Best Banks In The US For Expats And Foreigners

Table of Contents

- Can A Foreigner Open A Bank Account In The US?

- What Criteria Should I Consider When Choosing A Bank In The US?

- Top US Banks for Expats and Foreigners

- 1. Charles Schwab: Great option if you can establish US residency

- 2. Chase Bank: Good overall bank but most accounts have monthly fees

- 3. Citibank: Global banking that makes it easy to move money internationally

- 4. HSBC Bank USA: Umpteen choices for the global citizen

- 5. Bank Of America: Big US bank with thousands of branches and ATMs

- 6. Capital One: No fees, no minimums, no hassle

- Conclusion: Choosing The Best Bank In The US For Foreigners And Expats

Moving to a new country can be a daunting experience, especially when it comes to managing your finances. As an expat or foreigner in the United States, finding the right bank can be crucial for your financial stability and peace of mind.

Whether you need to send money back home, access your funds from anywhere in the world, or simply manage your daily expenses, choosing the right bank can make a significant difference.

In this article, we explore the best banks in the US for expats and foreigners, considering their services, fees and overall customer experience. This will help you establish a better understanding of the options available to you and assist in making an informed decision about which bank best suits your needs.

Can A Foreigner Open A Bank Account In The US?

Most traditional banks in the US will ask you to provide a US-issued identification like either the Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) for opening a bank account with them.

If you are a foreigner or expat in the US, your banking options depend a lot on your residency status. If you are able to establish US residency, you may be able to apply for your SSN. Otherwise, you may need to obtain an ITIN to be able to open a bank account. Note that temporary visa holder are not eligible to apply for ITIN.

If you are ineligible to obtain either an SSN or an ITIN, your best bet may be fintech companies like Revolut and Wise (formerly TransferWise) as they allow residents of other countries to use their services in the US. However, note that these companies are not banks; you can, however, avail most bank-like features by using their services.

US Banks need either an SSN or an ITIN to open a bank account. If you have neither, fintech companies like Revolut and Wise may be good alternative options.

What Criteria Should I Consider When Choosing A Bank In The US?

If you are an expat or foreigner in the US, choosing the right bank requires careful consideration of various factors.

Here are some key criteria to keep in mind when evaluating your options:

- International Services: Look for banks that offer international services such as foreign currency exchange, international wire transfers and ATM access in other countries. These services can be essential for managing your finances as an expat or foreigner.

- Fees and Charges: Consider the fees the bank charges for their services, including ATM fees, monthly account maintenance fees and international transaction fees. Some banks may offer fee waivers or discounts for certain accounts or transactions, so reading the fine print is important.

- Accessibility: Look for banks that offer online and mobile banking services, thereby making it easier to manage your accounts anywhere. Some banks may also offer in-person services, so consider the bank's branch and ATM network and whether they are in the areas you will be living or traveling to.

- Customer Support: Consider the level of customer support the bank offers, including availability, responsiveness and language support. As an expat or foreigner, you may have unique needs or questions, so choosing a bank that can provide the assistance you need is essential.

By evaluating banks based on these criteria, you can narrow your options and choose a bank that best fits your needs and situation.

Below is our take on the best US banks for expats and foreigners. They all have their pros and cons, so read on to learn more about each bank's offering.

Top US Banks for Expats and Foreigners

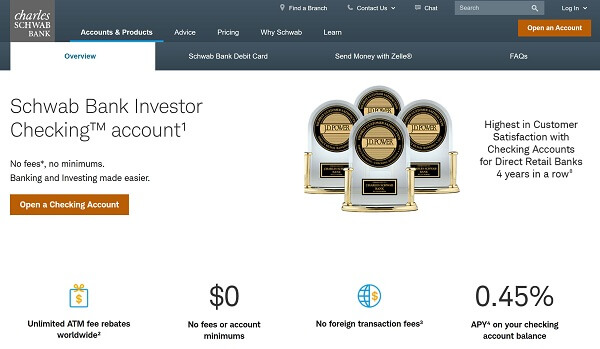

1. Charles Schwab: Great option if you can establish US residency

If you are able to establish resident status in the US, and thereby procure your SSN, Charles Schwab is one of the best options to consider.

This is because Charles Schwab excels in providing its customers with online and mobile banking services, has a friendly fee structure and offers many useful features for international travelers.

Below are the topmost reasons why Charles Schwab should be on your radar as one of the best choices for a bank that is friendly to expats and foreigners in the US:

- No ATM Fees + Fee Reimbursement: One of the best expat-friendly features of Charles Schwab is that it does not charge any ATM usage fees. It gets even better as you will also get reimbursed for all ATM fees charged by other banks for international usage. This is an excellent feature if you travel overseas frequently - getting cash when you need it without having to worry about fees can be a big relief.

- No Fees for Foreign Transactions: With Charles Schwab you will not need to pay any fees for foreign transactions, including purchases and ATM withdrawals. Once again, this can be a major benefit if you frequently travel abroad and make purchases and payments in various currencies.

- High-Yield Checking Account: If you have any savings or extra money, you can grow it with Charles Schwab by utilizing their high-yield checking account that pays interest on deposits. Plus, there are no minimum balances to maintain or monthly charges to pay. This is a great option to let your money grow when you do not need to use it.

- 24x7 Mobile Access: Charles Schwab has a feature rich mobile app that enables customers to manage their accounts and do many actions like transfer funds, and deposit checks remotely. This is another great option as you can do banking on the fly without having to step into a physical branch.

If you value convenience, flexibility and low fees, Charles Schwab can be a great option for your banking needs. With Its focus on digital banking and travel-friendly features, Charles Schwab is certainly a worthy choice for expats and foreigners in the US.

RemitFinder likes Charles Schwab for charging 0 fees for their ATMs, reimbursing ATM fees from other banks, charging no monthly account fees and providing interest on savings as well as robust online and mobile banking facilities.

The only downside of Charles Schwab is that you do need to be a US resident for tax purposes to be able to open this account. In case you are overseas a lot, it may not be that easy to meet the minimum stay residency requirements every year.

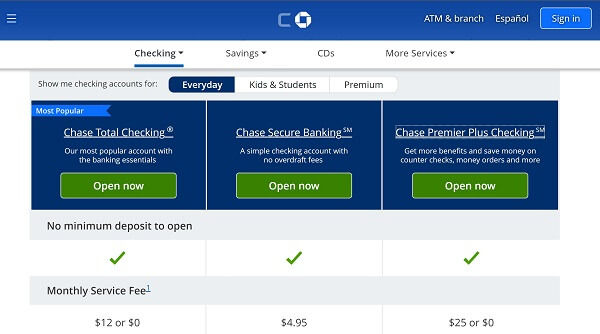

2. Chase Bank: Good overall bank but most accounts have monthly fees

Chase Bank is a popular choice for expats and foreigners in the US, offering a wide range of banking services and international features.

You can choose from any of the following checking accounts:

- Chase Total Checking - Monthly fee USD 12

- Chase Secure Banking - Monthly fee USD 4.95

- Chase Premier Plus Checking - Monthly fee USD 25

Below are some advantages of using Chase:

- There are no minimum deposits to open these accounts and you get access to more than 15,000 ATMs and round the clock online and mobile banking.

- Another key features of Chase includes international wire transfers, which can be convenient for expats and foreigners who need to send money back home or to other countries.

- Another plus is that Chase offers foreign currency exchange services, which can be helpful for expats and foreigners who need to exchange money into different currencies.

- Chase offers a robust online and mobile banking platform, making it easier to manage your accounts from anywhere in the world. Chase also has a large ATM network, which can be useful for accessing your funds while traveling in the US or abroad.

RemitFinder likes Chase for providing online and mobile banking and a widespread ATM network. International wires and currency exchange solutions further help expats move money internationally.

It is worth noting that Chase does charge fees for many of its services, such as foreign currency exchange and international wire transfers. Additionally, the bank's fees for international transactions can be high, so it is important to read the fine print and compare fees with other banks.

If you want to use your bank for sending money abroad, note that banks are generally notorious about providing bad exchange rates on international currency exchange, with markups as high as 3-4% sometimes. This can put a dent on the money you send overseas.

Given this, we always recommend looking closely at money transfer companies that usually charge low fees, provide competitive exchange rates and move money overseas fast.

Overall, Chase Bank is known for providing expats and foreigners with convenience, accessibility and a wide range of services. However, make sure to evaluate fees and compare them with other options to ensure you are getting the best deal.

3. Citibank: Global banking that makes it easy to move money internationally

Citibank is one of the best banks for expats and foreigners who are looking to manage their finances in the United States.

With a wide range of financial products and services and a strong global presence, Citibank is well-positioned to serve the needs of individuals new to the country or looking to expand their financial footprint.

Below are various checking accounts you can apply for in the US with Citibank:

- Access Account Package

- Basic Banking Package

- The Citibank Account Package

- Citi Priority Account Package

- Citigold Account Package

- Citigold Private Client

Excepting the first 2 accounts above, the others come with waived ATM fees for non-Citibank ATMs. You will have to pay fees for most of these accounts though unless you maintain minimum balance thresholds that vary from account to account.

Below are the various advantages of going with Citibank:

- One of the key advantages of banking with Citibank as an expat or foreigner is the bank's global reach. With operations in over 160 countries worldwide, Citibank offers a range of international banking services that can help expats and foreigners manage their finances across borders.

- Citibank products include international accounts, global transfers and foreign exchange services that can help individuals manage their finances seamlessly, no matter where they are in the world. Keep an eye on exchange rates though to ensure you are getting the best deal for international money transfers.

- Another advantage of banking with Citibank is its commitment to providing personalized service and support to its customers. As an expat or foreigner, navigating the complexities of the US financial system can be challenging, but Citibank's team of experts can provide guidance and advice on everything from opening a new account to managing your credit history.

- In addition to its global reach and personalized service, Citibank also offers dedicated checking and savings accounts tailored to the needs of individuals new to the country, as well as credit cards and personal loans that can help expats and foreigners build their credit history.

RemitFinder likes Citibank for its global presence, personalized solutions and dedicated support teams to help expats and foreigners in the United States.

Overall, Citibank is one of the best banks for expats and foreigners looking for a comprehensive financial partner.

With its global reach, personalized service, and specialized products and services, Citibank is well-equipped to help individuals manage their finances and achieve their financial goals, no matter where they are.

4. HSBC Bank USA: Umpteen choices for the global citizen

HSBC Bank USA is one of the best banks for expats and foreigners looking to manage their finances in the United States.

HSBC offers a wide variety of international banking solutions, including the flexibility to open a US account even if you are not a US resident. Regardless of whether you are an overseas HSBC customer or entirely new to HSBC, you can take advantage of this benefit.

The most popular HSBC account for foreigners and expats is the HSBC Premier checking account with the below advantages:

- No fees on everyday transactions; there is a USD 50 monthly account maintenance fee but that can be avoided if certain criteria are met.

- Access to a HSBC Premier Debit World Mastercard card for spending and purchases; overseas transactions are fee free with this card.

- Priority services and global support available across the world, including access to preferential savings interest rates.

- Access to Premier services for up to 4 family members.

- Easy transfer of money across your global HSBC accounts located in various countries.

And here is the best part - you do not need to be a US resident to open your HSBC Premier checking account. HSBC accepts applicants from numerous countries that include Argentina, Armenia, Australia, Belgium, Bermuda, Brazil, Canada, Chile, China, Egypt, France, Germany, Greece, Guernsey, Hong Kong, India, Indonesia, Isle of Man, Israel, Japan, Jersey, Kenya, Kuwait, Lebanon, Macau, Malaysia, Mexico, Netherlands, Norway, Philippines, Poland, Portugal, Russia, Singapore, South Africa, Spain, Sweden, Switzerland, Taiwan, Thailand, Turkey, United Arab Emirates (UAE), United Kingdom (UK), United States (U.S.), Uruguay and Venezuela.

You can open an HSBC account in the US even if you are not a resident of the US. Currently, residents of more than 45 countries can open a US bank account with HSBC.

Yet another highly attractive offering is the HSBC Global Money Account, which is a multi-currency account by HSBC; key benefits include:

- You are eligible for an HSBC Global Money Account as long as you have an HSBC checking or savings account.

- You do not need to be a US resident to open this account - since non-residents can open an HSBC Premier checking account, they are also eligible to open the HSBC Global Money Account. Note that you must have a US address to be able to open this account.

- You can hold funds in 8 currencies in this account - these include AUD (Australian Dollar), CAD (Canadian Dollar), EUR (Euro), GBP (Pound Sterling), HKD (Hong Kong Dollar), NZD (New Zealand Dollar), SGD (Singapore Dollar) and USD (US Dollar).

- You get access to highly competitive FX rates to interconvert funds between supported currencies.

- You can send instant money transfers to another HSBC customer without paying any fees.

If you opt to bank with HSBC and open an HSBC Premier checking account, we definitely suggest looking at the companion HSBC Global Money Account as well to manage your money in many currencies.

RemitFinder likes HSBC Bank USA for making it easy for non-US residents to open a US bank account as well as providing multi-currency options to facilitate international transactions with good FX rates and no fees.

Another major advantage of HSBC is that since their banking services are global in nature, you can continue banking with them even if you leave the US. Most HSBC bank customers can continue to bank with them as long as HSBC has presence in the destination country.

5. Bank Of America: Big US bank with thousands of branches and ATMs

Bank of America is 2nd largest bank in the United States and is part of the Big Four banks in the US that also include JPMorgan Chase, Citigroup and Wells Fargo.

With a wide range of financial products and services, Bank of America is a popular choice for individuals and businesses.

While Bank of America is not specifically designed for expats and foreigners, the bank offers a range of services that can be useful for those who are new to the country or looking to expand their financial footprint. This does mean, though, that you have to be a US resident to open an account with Bank of America.

When it comes to checking accounts, Bank of America has a flagship Advantage Banking checking account with the below 3 available flavors:

- SafeBalance option for students that comes without checks for up to USD 4.95 monthly fee

- Advantage Plus option that is ideal for everyday banking for up to USD 12 monthly fee

- Advantage Relationship option that has perks like fee waivers and higher interest rates for up to USD 25 monthly fee

Note that the monthly fee can be waived if certain qualifying criteria are met.

One of the key advantages of banking with Bank of America is the bank's extensive network of branches and ATMs. With over 4,000 branches and 17,000 ATMs nationwide, Bank of America offers convenient access to financial services for individuals and businesses in nearly every corner of the United States.

This can be particularly useful for expats and foreigners looking to establish a local presence and build relationships within their communities.

Another advantage is access to mobile banking and online account management. With these tools, Bank of America makes it easy for customers to manage their finances anytime and from anywhere.

In addition to its extensive network and digital capabilities, Bank of America also offers a range of financial products and services designed to meet the needs of individuals and businesses of all sizes. This includes checking and savings accounts, credit cards, loans, mortgages, and investment and wealth management services.

RemitFinder likes Bank of America for providing a vast network of branches and ATMs across the United States as well as mobile and online banking. This makes easy for customers to access their money and manage their finances.

Overall, Bank of America is a solid choice for individuals and businesses looking for a comprehensive financial partner.

While the bank may not have the specialized services for expats and foreigners that other banks offer, Bank of America's extensive network, digital capabilities, and range of financial products and services make it a popular choice for those looking for a one-stop shop for their financial needs.

6. Capital One: No fees, no minimums, no hassle

Capital One is one of the best banks for expats and foreigners looking to manage their finances in the United States.

With a range of financial products and services designed specifically for international customers, Capital One is well-positioned to serve the needs of individuals new to the country or looking to expand their financial footprint.

Here are the key advantages of the Capital One 360 Checking account:

- No monthly account fees or no minimum balance requirements.

- Perfect for everyday use and comes with the Capital One mobile banking app.

- Access to more than 70,000 ATMs nationwide without paying any withdrawal fees.

- Facility to use Capital One Cafe's for banking and coffee - available in select locations only.

- Debit card that can be locked and unlocked seamlessly using online banking or the mobile app.

Capital One also prides in opening your account within just 5 minutes whether you want to do it online or in a branch.

The Capital One 360 Checking account comes with 0 fees and minimums, and is a great choice for anyone looking to do secure yet seamless everyday banking.

In addition to the popular 360 Checking account, Capital One also offers the below additional products and services:

- Capital One 360 Performance Savings account with highly competitive savings interest rates.

- Capital One 360 CDs with various terms and interest rate options.

- Capital One Money Teen Checking account for teenagers.

- Capital One Kids Savings account for children.

With its focus on low fees and great usability, you cannot go wrong with Capital One.

RemitFinder likes Capital One for providing highly streamlined account opening process as well as 0 fees and no minimum balances. You can also take advantage of high-yield savings accounts as well as open fixed deposits.

Capital One is one of the best banks for expats and foreigners looking for a personalized and technology-driven financial partner.

With its dedicated international customer service teams, specialized products and services, and innovative digital capabilities, Capital One is well-equipped to help individuals manage their finances and achieve their financial goals in the United States.

Conclusion: Choosing The Best Bank In The US For Foreigners And Expats

For many expats and foreigners living in the United States, choosing the right bank can be daunting. With so many different banks and financial institutions, it can take time to know which will best meet your needs.

But with the right research and understanding of your financial needs, you can decide which bank is right for you.

The banks mentioned in this article offer a wide range of products and services, charge varying fees, and provide different levels of customer service, so it is important to weigh your options carefully.

Once you determine your financial needs, you can use the information in this article to decide which bank is right for you. Whether you are looking for convenient mobile banking options, low fees, or easy access to international transfers, there are various banks that can meet your needs.

By choosing the best bank for you, you can focus on building your new life in the US with confidence and financial stability.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

Categories

Similar Articles

CNAPS Codes Unraveled: Navigating China's Banking Landscape

Discover CNAPS Codes: China’s unique bank identifier for fast, secure transactions. Learn how CNAPS Codes simplify payments across China's banking system.

ABA Routing Numbers In The US: A Comprehensive Guide

Discover what ABA Routing Numbers are, how they work and their importance in US banking transactions like direct deposits, online transactions and wire transfers.

What Is A NUBAN Number And What Is It Used For?

Discover what NUBAN Numbers are and how they streamline bank account identification in Nigeria. Do not miss this essential guide if you transact in any way with the Nigerian banking system.