What Is a Remittance and How Does It Work?

Table of Contents

- Remittance Definition – What does remittance mean?

- Why do people use remittances?

- Who is a remitter?

- Why are remittances important?

- Who benefits from a remittance?

- How does a remittance work?

- Sender's or remitter's experience

- Recipient's or beneficiary's experience

- Money transfer operator's experience

- Chains of institutions could be involved

- What are various ways to send a remittance?

- Wire transfer via Banks

- Wire transfer at stores

- Transfer cash via an Agent

- Online money transfer

- Multi-currency bank accounts

- Remittances and Cryptocurrency

- Conclusion

In this comprehensive guide on remittances, we cover all aspects on this topic ranging from remittance meaning, usage, how remittances work, who sends remittances, and most importantly, what are some ways to remit money internationally.

Money (both physical and digital currency) changes hands through the modern, global economy. There are types of money, such as wooden nickels, that were created long ago and are no longer in production, and there are more recent innovations in play today, such as digital wallets.

Money changes in terms of value from area to area. This sometimes means that individuals work in one country, and send money across international borders to support their families in another country. This is the process commonly associated with the term "remittance."

Remittance Definition – What does remittance mean?

Dictionary.com defines a remittance as below:

remittance [ ri-mit-ns ]

noun

the sending of money, checks, etc., to a recipient at a distance.

money or its equivalent sent from one place to another.

A remittance is, thus, money sent to someone generally farther away. The key distinction between a remittance and a regular money transfer is the distance aspect - also called out in the definition above with the suffix "to a recipient at a distance". The last part - the distance - is, therefore, an important distinguishing factor in the definition of a remittance.

In today's world, the word remittance has become synonymous with international money transfer - again notice that we highlight the term "international" to signify that the money being sent is to a faraway destination.

Let's also see what Wikipedia has to say on the term remittance.

A remittance is a transfer of money, often by a foreign worker to an individual in their home country. Money sent home by migrants competes with international aid as one of the largest financial inflows to developing countries. Workers' remittances are a significant part of international capital flows, especially with regard to labor-exporting countries.

Again, this further validates our earlier discussion of the definition of the term remittance as a payment that involves cross border money transfers.

To summarize, a remittance is a form of payment sent from one party to another. A remittance can take several forms, from personal transfers and supplier invoices, to business payments. While most commonly associated with foreign workers sending money to their families in their country of origin, remittances are technically any type of payment.

For example, payment for a product to be shipped overseas is a remittance, and so is paying for overseas services. Similarly, these payments can also take the form of a remittance advice, which is an acknowledgement from the payor to the payee that an invoice has been paid.

Why do people use remittances?

One of the most frequent uses of a remittance payment is to send money earned from a job in one country back to family in another country. According to Pew Research Center, in 2017 the United States sent almost $150 billion in remittance transfers to other countries. In another case, Mexico's bank has officially reported that nearly $25 billion was sent back to Mexican families via international workers. This surpassed oil revenues for a source of foreign income for the first time in Mexico's history. The same article by NBC News goes on to say that "there is an advance in the recovery of the U.S. economy that has a very high correlation to jobs available for immigrants."

There are other reasons for remittances such as:

- Investments

- Small Entrepreneurships

- Loan Payment

- Foreign Purchase of a Product/Service

- Restoring Credit

This leads us to define who is a remitter, categorize various people and groups who need to send remittance of funds and touch some scenarios that benefit from such remittances.

Who is a remitter?

What are some scenarios when remittances are useful and who sends an international remittance?

Anyone, an individual or a business, who has a need to send money overseas and is, therefore, remitting funds from one place to another, is a remitter. The notion of a remittance, by definition, involves transfer of money from a sender to a recipient.

We live in a world that is increasingly getting smaller both from a physical perspective whereby international travel is becoming easier, shorter and cheaper, as well as technologically whereby the power of the internet continues to bring people together.

Consequently, the need for moving money around emerges as money has to follow people who are moving around in today's connected, global world.

Whether it is studying or working abroad, starting a global business with partners and customers in other countries, or settling down overseas temporarily or permanently, anyone who engages in any type of activity in another nation has a need to execute international money transfers.

Let's look at some frequent users of global remittances in today's connected world.

Immigrants

Immigrants are people who have temporarily or permanently settled in a country that is different from their home country.

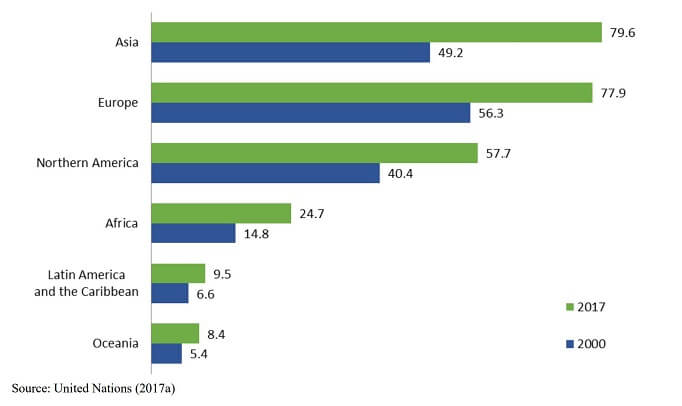

According to the United Nations International Migration Report 2017:-

"The number of international migrants worldwide has continued to grow rapidly in recent years, reaching 258

million in 2017, up from 220 million in 2010 and 173 million in 2000."

"...two thirds (67 per cent) of all international migrants were living in just twenty countries. The largest

number of international migrants (50 million) resided in the United States of America. Saudi Arabia, Germany and the Russian Federation hosted the second, third and fourth largest numbers of migrants worldwide (around 12

million each), followed by the United Kingdom of Great Britain and Northern Ireland (nearly 9 million)."

The below graph represents the growth in numbers of international migrants from 2000 to 2017 by regions of the world.

Immigrants are one of the top most senders of remittances since they usually have families back home to sustain and support.

Additionally, many immigrants eventually return to their home nation, so they like to park their savings in their home country for future use.

Temporary workers

Temporary workers are generally work visa holders with authorization to work in a foreign country. They include skilled as well as unskilled workers who may be employed in their visiting country for various durations ranging from weeks to years.

Temporary workers almost always send money back to their home country since they return back to their nation after their work assignment is complete. They are, thus, also a top consumer of remittance services.

Businesses

Businesses in today's connected economy have various inter-dependencies in a chain of service providers whereby a business can be both a consumer as well as producer of services. In such an ecosystem, it is increasingly the case that customers, partners, suppliers or vendors of a business operate in another country, thereby necessitating the need for international invoicing and payments.

That is where remittances come in.

Business remittances also generally tend to be higher in amount and more frequent as compared to personal money transfers.

Students

International study is a big business nowadays, and there are a large number of students who go abroad for studies. This could include full time degrees and courses, as well as exchange programs whereby students spend a semester or two overseas in an affiliated or partner educational institution.

Needless to say, whether the stay is short or long, international stay will need money transfers. Whilst it is not rare for the concerned educational institutions to supply partial funding via scholarships, loans or other assistance, it is expected that students will have to supplement expenses with their own funding; remittances are a common vehicle for international students to do so.

According to iie.org, "the number of US students who studied abroad for academic credit in 2017/18 was 341,751, and the number of international students who were in the US in 2018/2019, including those in academic programs and Optional Practical Training (OPT) was 1,095,299."

Tourists and other short term visitors

In addition to the aforementioned travelers, there are obviously tourists and other short term visitors who have needs for international travel. Leisure, tourism, sports, conferences, short business trips, medical tourism, etc. are few scenarios where people need to travel abroad. There are, therefore, also cases where people rely on remittances to fulfill the financial obligations of their trip abroad.

Why are remittances important?

In today's highly connected global economy, remittances are an essential vehicle of moving money from one place to another.

According to a report by the World Bank:-

"Remittance flows to low- and middle-income countries (LMICs) are expected to reach $551 billion in 2019, up by 4.7 percent compared to 2018. Remittances have exceeded official aid – by a factor of three – since the mid-1990s. This year, they are on track to overtake foreign direct investment (FDI) flows to LMICs.

In 2019, in current U.S. dollar terms, the top five remittance recipient countries are projected to be India, China, Mexico, the Philippines, and Egypt (figure 2). As a share of gross domestic product (GDP) for 2019, the top five recipients would be smaller economies: Tonga, Haiti, Nepal, Tajikistan, and the Kyrgyz Republic."

In the prior section, we touched upon some frequent users of international money transfers. Now we will discuss some of the primary reasons why immigrants, overseas workers, international students, global travelers, and other related people have a need to move money.

What are the reasons to send a remittance?

Family maintenance

Family maintenance is one of the top most reasons to send a remittance.

For numerous immigrants as well as international workers, taking care of their families back home is of paramount importance.

Even in cases where an atomic family unit has settled overseas, there is often an extended family (parents, siblings, relatives, etc.) who depend on the migrated family members for financial support. Especially for people who are working abroad on short/medium term assignments, there are families back home to maintain and support.

Savings

Another top most reason for sending money home is putting it in savings for future use. Once family maintenance commitments are fulfilled, it is highly useful to park the leftover additional funds into some savings vehicle.

Many migrants either have concrete plans to return to their home countries at some future time, or minimally have enough emotional attachment and financial affinity to their home country - hence this is a pretty high frequency use cases for remittances.

Additionally, immigrants often continue to have strong cultural and emotional bonds with their home nations, and contributing to the economy of their place of birth makes them feel that they are contributing back into the ecosystem that nurtured them to maturity. Once the funds are moved to the home country, there are generally numerous investment options available to grow them.

Purchase a property

Similar to the above point, investing in immovable physical property is another attractive choice for people who are settled abroad or working overseas. With medical science extending life expectancy life never before, population pressures are continuing to bump up property prices higher - this makes property purchase an attractive mid to long term investment.

If the property is sold at a later time for a profit, there may be capital gains that may be subject to tax treatment. For example, non-residents selling property in India have to pay taxes on capital gains realized from the sale.

Pay bills or loans

Remitters also use remittances to pay bills and loans back home. This is especially applicable to migrants and workers who have families to maintain in their home nation. Education or mortgage loans are also often seen as major commitments that people settled overseas continue to take care of despite changing the country in which they live in.

Pay for education

Another major reason for sending remittances is paying for education. This could be education meant for siblings and other family members in the home country, as well as educational loans that the migrating individual took to fund their own education.

Who benefits from a remittance?

Remittances have been gaining a lot of traction in recent years and have established themselves as a key mechanism of moving money abroad. Let's explore who all gains from international money transfers.

Sender

The obvious first party who benefits from sending a remittance is the person or institution that sends the money - the sender (also called the remitter) - as this fulfils a clear intent to use the money for some specific purpose. The goals to execute a money transfer are many, and vary from individual to individual, and from business to business; we discussed some of the primary ones in a prior section.

Recipient

The next obvious party who benefits from a remittance is the receiver or the recipient (also called the beneficiary). For individual money transfers, the recipient achieves a direct financial benefit and can use the incoming funds for family maintenance, paying bills, etc.

For money sent to businesses, remittances usually take the form of payments for goods and services rendered to the sender, and therefore, are a fundamental vehicle for the receiving business to get paid and make a significant contribution to their bottom line.

Economy of the receiving country

Another huge beneficiary of global remittances is the economy of the country the recipient lives in. At face value, this may not stand out as a big benefit, but once the global scale of remittances is taken into account, the importance of this becomes evident.

According to data published by the World Bank, the contribution of remittances to GDP of receiving countries is significant.

Overall, the global share of remittances as a percentage of global GDP grew from 0.31 in 1977 to 0.746 in 2018. For many countries, incoming remittances are a major chunk of their GDP.

The below table shows the top 9 countries that realized more than 20% of their GDP from incoming remittances.

Source: World Bank data on remittances

How does a remittance work?

There are a variety of ways that an individual can transfer a remittance. Most types of remittances require a few key things:

- Recipient bank name

- Recipient account number

- Recipient routing number

- Wire transfer form

Different methods have specific requirements as to how much money can be transferred, the currency exchange rate, and the fees charged, so it becomes important to look at all options before sending a remittance. Although fees associated with specific money transfer limits vary based on a number of factors, typically they follow as such:

- Transfer history

- Location of the individual wiring money

- Location of the individual being wired money

- Exchange service

- Agent location limits

- Country receive limits

- Payment method

Let's look into how remittances actually work; we will inspect this from 2 standpoints - the perspective of the sender/recipient pair and the viewpoint of the remittance provider.

Sender's or remitter's experience

From a remitter's viewpoint, the process of sending a remittance basically entails registering with a money transfer operator (MTO) or a remittance service provider, and executing the money transfer by funding it with their money.

Below we highlight some of the steps a sender will undertake to execute a money transfer transaction:-

- Research service providers of interest and decide the institution to send money with.

- Register and create an account with the chosen money transfer operator. This step will also involve providing identifying information like photo IDs, residence proof, and other necessary KYC (know your customer) documentation. These are important for fraud prevention, protection of all parties involved as well as AML (anti-money laundering).

- Follow the provider's steps to execute a remittance.

- Fund the money transfer with money - typically, the remitter can use credit/debit cards, bank account transfer or sometimes even cash to do so. The choice of payment methods varies from provider to provider.

- Track the transfer - most providers will provide email/text updates as well as show remittance status tracking on their website/app.

Recipient's or beneficiary's experience

The recipient will generally not have to deal much with the remittance service provider unless the delivery method is cash - in which case the recipient will have to go to the provider's registered office with an identification proof to collect the funds.

In case the remitter chose direct bank transfer as the delivery method, the recipient will simply get the funds directly in their account, and would not have to do anything on the remittance company's platform or website.

Money transfer operator's experience

The service provider or the money transfer operator (MTO) - sometimes also called the remittance company or provider - provides the engine which executes the money transfer.

Since remittances involve cross border movement of money, MTOs are usually registered financial institutions in both the sending and the receiving countries - for example, Western Union that has global offices allowing remitters and beneficiaries to visit their office to send and receive funds, respectively.

It is also very common for MTOs to have financial partnerships with banks and other institutions in the receiving country - this allows direct money transfers into the beneficiary's bank account.

To be compliant with strict global and national financial laws, regulations and anti-money laundering requirements, the MTO will need to collect the rightful details, identifications and proofs thereof; this ensures the protection of not just the remitter and the beneficiary, but also the MTO itself in case government or regulatory authorities need to investigate a remittance.

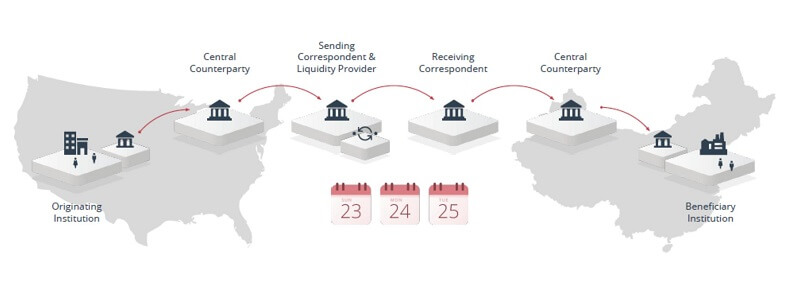

Chains of institutions could be involved

Another important aspect of remittances is that the remittance provider may not be a single institution that will execute the money transfer from end to end. It is not uncommon to have chains of financial institutions involved in the middle to be able to successfully execute an international money transfer.

For example, if the sender is dealing with a local, regional or even national bank, such an institution will likely not have direct overseas presence unlike global financial institutions that operate in numerous countries. In this case, the remitter's bank will rely on another institution that will allow funds to move overseas. It is possible that the partner financial institution uses yet another company or service to actually execute the money transfer!

Similarly, if the recipient does not directly deal with a global institution, funds will again have to be moved from the last global institution in the chain that finally moved the money to the destination country to the recipient's local bank or financial institution.

The below graphic illustrates the potential chain of providers that could be involved in sending a global remittance.

To summarize, remittance providers often rely on global and regional partnerships to increase their network, and this results in networks and chains of institutions involved in global remittances.

What are various ways to send a remittance?

Given the massive amounts of money sent via remittances, the remittance ecosystem has seen tremendous growth and investment.

From banks to private companies to fintech startups, there has been a spurt of technological and business growth in the space, resulting in a wide variety of modes of operation.

This is really good for remitters as well since they have more choices in deciding what vehicle to choose and which service providers to go with. Below we describe some of the popular ways in which you can send a remittance.

Wire transfer via Banks

A wire transfer is a bank to bank transfer, and is one of the most traditionally established and known ways to send money overseas. In this way, a wire transfer is similar to an online remittance payment, but there are also numerous differences between bank transfers and remittances.

Wire transfers have existed for a long time, and continue to be a fairly popular choice when moving money internationally. One of the biggest advantages of a wire transfer is the ease of operation - all you need is a pair of bank accounts - one for the sender and another for the recipient.

The procedure is fairly simple as the sending bank needs the details of the receiving bank account, and executes the transfer. Usually, the sending bank is the bank where the sender already has an account. The necessary details needed for the recipient account are generally international Swift codes for the receiving bank, recipient's account number and identifying information.

Also note that there could be chains of banks involved in the middle. Depending on the size and global reach (or lack thereof) of the sending and receiving banks, there could be one or more bigger national or global banks involved in the middle to facilitate the movement of funds.

Obviously, each institution involved will add to the time it takes to clear the funds, as well as increase the fees associated with the transfer. This brings us to the 2 topmost disadvantages or cons of wire transfers - speed and fees. It can sometimes take up to 2 weeks for a wire transfer to clear out, and the fees are generally pretty high as well. Also noteworthy is the fact that the FX rate on wire transfers is generally not the best deal you can get.

But the key advantages of wire transfers still continue to make them a solid choice for international money transfers; some of these are:-

- Security - the transaction is fully secure as it is backed up banking systems, and wire transfers invoke a natural trust in consumers.

- Ease of use - generally the sender already has an account at the sending bank, and just needs to provide basic information about the recipient and their bank account.

- Practically no or very high limits on transfer amounts - this helps the global citizen to move large sums of money relatively quickly and easily. Given this, wire transfers continue to be a popular choice for overseas immigration, property purchase, savings, etc.

Wire transfer at stores

Companies such as Western Union have physical locations all over the country where you can send money abroad in-person. In 2017, Western Union helped small businesses, global corporations and families around the world send 800+ million dollars in international money transactions. Western Union can send money to over 200 countries as well as payout in 130 different currencies. With Western Union, users can send money in-person, online, and with the Western Union app. Also, when you sign up for My WU membership you can earn rewards on qualifying transfers.

Wire transfers are not immediate — they take time. Western Union has a transfer speed of 3-5 days, which is how long it will take for the wire transfer to leave the sender's account and enter the receiver's account.

Transfer cash via an Agent

Another traditionally popular remittance choice is cash-to-cash transfer via a money transfer agent; companies like Western Union and MoneyGram have facilitated this mode of money transfers effectively since many years.

In this model, the sender typically goes into the money transfer agent's office and funds their money transfer with cash. The agent executes the transfer, and the recipient collects the funds (generally cash as well) from the agent's office in their own country.

Both the sender and the recipient have to submit identifying information to establish legal identity and ensure compliance with regulation and anti-money laundering rules.

Some other key points about this mode of remittances:-

- Generally used for low value transfers with amounts in the hundreds and low thousands given cash dealing.

- Fairly easy to use - walk into an agent office and finish the transaction quickly.

- Rates may not be competitive, although they might be a bit better than wire transfer rates.

- Almost instantaneous speed of transfer - this makes this method very attractive for money transfers that need to get to the recipient asap, for example in cases of emergencies or for urgent needs.

- Wide network of agent locations - it is very typical for the money transfer agent to have umpteen local offices in both the sending as well as receiving countries. Most companies that operate in this space tie up with vendors like grocery stores, convenience stores, locations in malls, etc. to provide easy access points for people who want to use cash transfers.

Online money transfer

With the explosion of technology and the internet in the last few years, it is no surprise that online remittances are one of the top most channels for sending money globally. Almost every money transfer operator - even if they started with traditional brick and mortar money transfer agent business - has an online money transfer facility.

Banks who have traditionally excelled at wire transfers also have opened up their services via the internet to facilitate online money transfers.

The online money transfer works pretty much similar to other modes of remitting money with the added convenience of being able to do everything online - either through a website or mobile apps. This is, therefore, one of the most popular modern way of sending money as you do not have to go into any office or location, and can execute a transfer 24 x 7 from the convenience of their home or office.

Some key points about online money transfers:-

- Extremely easy to use - most companies have excellent user experience driven websites and mobile apps that allow executing transfers in just a few clicks.

- Better rates - since the cost to operate a digital business is less than the cost to operate a brick and mortar business, providers are able to offer better rates on online money transfers.

- Highly competitive space - given that everything is online these days, and given the high adoption of the digital economy by consumers, the online money transfer space is highly competitive. This is great for remitters as when businesses compete for their business, consumers gain.

- Faster transfer times - given the inherent digital connectivity that come with the internet, online money transfer companies are able to move money faster, thereby providing faster transfer times.

Multi-currency bank accounts

Multi-currency bank accounts are a new and innovative way to access funds in multiple currencies.

In this model, the service provider allows its consumers to maintain accounts in multiple currencies and link them together - often, this could be a single account with funds available in multiple currencies! Whilst technically multi-currency accounts are not a remittance vehicle in the strict sense that money is not “moving” from one country to another, they achieve the same effect.

In fact, the provider may be actually moving money from one location to another - it's just the consumer who has transparent and immediate access to their money in multiple currencies.

The bank providing multi-currency accounts generally charges some fee for maintaining and operating these accounts for their consumers.

Similar to online money transfers, it is the highly connected modern digital economy that makes multi-currency bank accounts feasible and easy to operate and maintain. Such accounts are highly popular with people who travel frequently - business travelers, musicians and artists who tour other countries frequently, international vacationers, etc.

Key points about multi-currency bank accounts:-

- Great for anyone who travels internationally frequently

- Instant access to your money in multiple currencies

- Generally, very competitive FX rates

- Generally, come with an ongoing account fee to cover operational expenses

Remittances and Cryptocurrency

Cryptocurrencies are new digital currencies that do not have a physical currency equivalent, and are fully online and digital in nature.

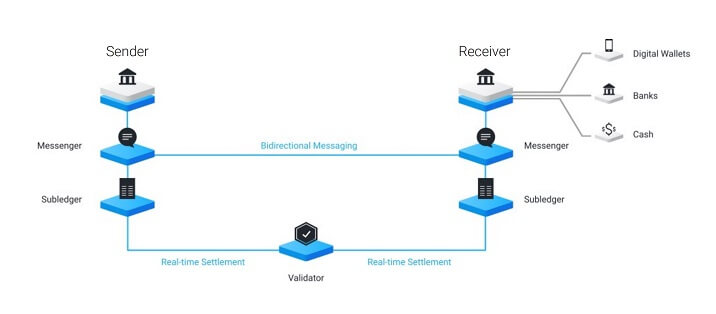

Whilst cryptocurrencies themselves are not a remittance vehicle, they are becoming a potential technology backbone to international money transfers due to the quick times in which crypto transactions execute.

As an example, Ripple (symbol XRP) has been working on providing a digital money transfer service network based on the movement of XRP. According to the Ripple website, more than 300 financial institutions across 40+ countries are using the Ripple global payments network; customers cited on their site include MoneyGram, PNC, SBI Remit, Instarem, and others.

The below graphic shows how RippleNet facilitates global movement of money.

Conclusion

With so many options, how do you decide what is the best way to do a remittance?

The first thing you would want to do is to understand various factors that may help you to maximize the yield on your remittance. This is important as it will arm you with the right knowledge base to be able to efficiently compare various money transfer companies so you can choose the best one for your needs.

Next, given the wide range of choices at your disposal, you would want an efficient and trustworthy way to compare money transfer providers, and get access to latest exchange rates from these companies. RemitFinder has a global platform covering 35,000+ remittance corridors, hundreds of banks, remittance service providers and money transfer companies, and with active users in more than 150 countries. For example, for both USA to India, and UK to India money transfers, we have more than a dozen money transfer companies that you can compare and choose from.

Let us help you choose your next money transfer!

Categories

Similar Articles

US Big Beautiful Bill's Impact On Remittances

The Big Beautiful Bill has been passed in the US, and remittances are impacted. Learn how the Bill impacts remittances and what to do if you are affected by the new law.

Bangladesh Remittance Cash Incentive: All You Need To Know

Are you an overseas Bangladeshi resident who sends money home to your loved ones? Read on to learn how to earn an additional 2.5% cash on your international remittances sent to Bangladesh.

How Fintech Is Pushing Banks Out Of The Remittance Business

The fintech revolution is disrupting the international remittance business. Discover how innovative startups are reshaping the international money transfer industry and challenging traditional banks.