Complete Guide to Send Money Online

Table of Contents

- All you need to know about the online money transfer process

- Everything we do today in online

- What are different ways to send money online?

- How to transfer money from one bank to another online?

- How to send money online using debit card?

- How to send money online with credit card?

- How to send money online with cash?

- How to send money online?

- Factors influencing online money transfers

- Exchange Rate

- Fixed vs Indicative Rate

- Transfer Fees

- Transfer Limits

- Payment and Delivery Methods

- Transfer Time

- Deals and Promotions

- How to choose the best way to send money online?

All you need to know about the online money transfer process

In a prior blog post, we talked about the best way to send money overseas. We touched upon some of the recent migration and remittance trends, and discussed how international money transfers are becoming increasingly important, frequent and a major factor in the global economy.

Specifically, we discussed the below options to realize overseas money transfers.

- Carrying Cash during overseas travel

- Carrying Travelers Checks during overseas travel

- Transfer Money through a money transfer agency

- Wire Transfer

We presented some of the pros and cons of the aforementioned choices and then mentioned how the internet explosion is fueling online money transfer as a very popular method today.

In this blog post, we will describe how to do an international money transfer online, and discuss various factors influencing the yield realized on such transfers. We will also talk about the best way to send money online, and present some best practices to maximize the value realized by sending money online.

Everything we do today in online

With the popularity of the internet and the rapid growth of the Information Technology (IT) industry, the world around us is changing fast. IT is transforming everything we do and how we do it. From online banking to bill pay, from booking travel to purchasing groceries, from paying taxes to other bills, from taking online educational courses to healthcare - we do everything online! In fact, searching any word on the internet (or on mobile App Stores like Google Play Store and Apple iTunes Store) quickly reveals multiple websites and mobile applications catering to whatever term was searched for.

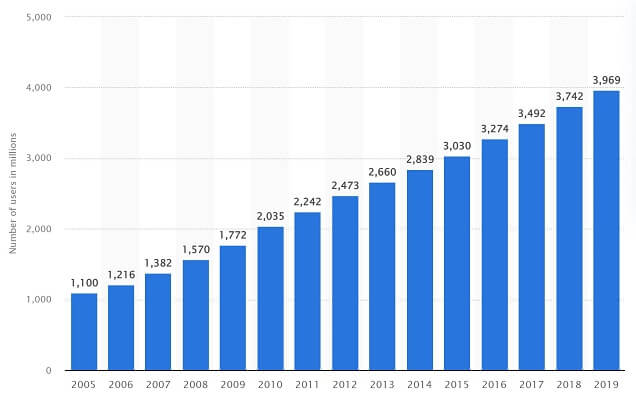

The following graph shows the growth of internet usage globally from 2005 till 2017.

Given this, it is no surprise that sending money online has also become a very popular choice in the global remittance ecosystem.

What are different ways to send money online?

There are many ways to send money online, and below we touch upon some of them. They all have subtle differences amongst themselves so read on to learn more.

How to transfer money from one bank to another online?

When you want to send money online using bank account, the best possible way is to do an ACH money transfer online. ACH transfers are direct bank to bank transfers, secure and generally very fast.

An ACH transfer is also a great answer to how to transfer money online without debit card. If you do not want to deal with debit or credit cards, transfer money from bank to bank online.

How to send money online using debit card?

If you want to send money online with debit card, you simply have to fund your remittance transaction with a debit card. This means providing the money transfer company with your debit card information so they could deduct the funds from your account.

An online money transfer from debit card is a pretty good option as the money still comes from your bank account. Due to this, fees on debit card transfers are generally lower than those on credit card transfers.

How to send money online with credit card?

Much like funding your transfer with a debit card, you could also use a credit card to pay for your money transfer. Just be aware that the associated fees might be much higher.

How to send money online with cash?

Paying your online money transfer with cash would require you to go to a provider's office or agent location to hand over the cash. Many companies will allow you to start your money transfer process online, and then go into their office to fund the transfer.

There are numerous ways to pay for online money transfers including bank transfers, debit cards, credit cards and even cash.

How to send money online?

The process of an online remittance typically involves setting up 2 specific payment instruments - a sending or funding or paying account, and a receiving or delivery or payout account.

You have to set up an online account with a Money Transfer Operator (MTO) that supports online remittance, and link the funding and delivery accounts to the same. This way, the money transfer operator knows which account to get incoming funds from and which account to remit outgoing funds to.

Once you, as a remitter, wants to initiate a transfer, the MTO site or platform will provide you with a quote that includes the provided exchange rates, associated fees and the time taken to transfer the funds. Once the transfer is initiated, the MTO deducts incoming funds from the funding account and provides a timeline when the funds will be available in the delivery account.

The MTO will then rely on interbank networks, or peer to peer transfer methods, or equivalent methodologies to execute the transfer. All this time, the sender can track the progress of the online transfer, which tends to be fairly accurate as everything is predictable and online.

That's a very high level overview of how the process works, but there are tons of details! We will discuss some of the influencing factors associated with online remittances in the remainder of this article.

Factors influencing online money transfers

When it comes to sending money online, there are numerous factors that come in play when making an informed choice. These factors will have a direct impact on the final amount the recipient gets, and may have a significant impact on the transfer agency or operator chosen as well as the best time to do the transfer. Specifically, we will discuss the following aspects that have a material impact on the aforementioned angles of the money transfer process.

- Exchange Rate

- Fixed vs Indicative Rate

- Transfer Fees

- Transfer Limits

- Payment and Delivery Methods

- Transfer Time

- Deals and Promotions

Below, we discuss each of these in more detail.

Exchange Rate

The online remittance industry is a highly competitive marketplace, and money transfer operators are fiercely competing to gain more business. That, coupled with the already highly dynamic nature of currency exchange rates that fluctuate virtually every second, makes it a very interesting playing ground where companies are vying for business by finding ways to provide the best exchange rate that they possibly can.

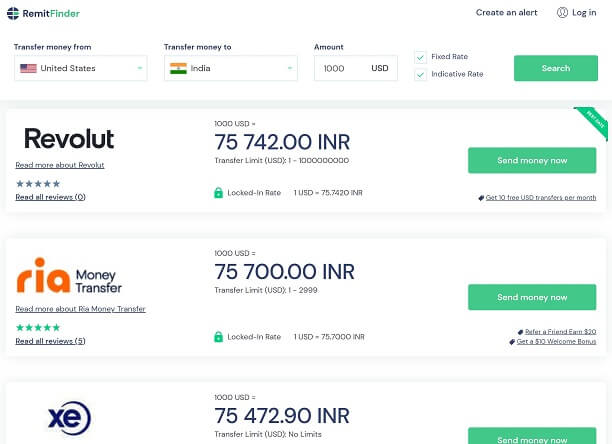

To illustrate this point, check out the below comparison table to send money from USA to India.

There is only a difference of 0.27 INR between top 3 providers!

Obviously, the realized exchange rate on a transfer will have a major impact on how much money the recipient gets. But exchange rate is not all. Keep reading!

Fixed vs Indicative Rate

Exchange rates offered by MTOs come in 2 flavors - fixed (also called guaranteed or locked-in) and indicative (also called non-fixed). Below, we explain the differences between both of these.

Fixed (or Guaranteed or Locked In) Exchange Rate

A fixed rate means that the exchange rate quoted by the MTO at the time of transfer is exactly the rate that is applied when the actual transaction happens. In other words, what you see is what you get! Since exchange rates fluctuate rapidly, this type of offering insulates the risk of actual exchange rate at transaction time being low due to market changes.

Indicative (or Non-Fixed) Exchange Rate

As the opposite concept of the fixed rate, an indicative or non-fixed rate means that the exchange rate quoted at the time of transaction initiation will be different from the actual exchange rate realized at transaction clearing time. In other words, market swings may have an impact on yield, and rates going up or down will influence the final rate.

Given this, you may wonder why ever go with an Indicative Exchange Rate? The reason is that exchange rate is not the only factor influencing the final payout amount that the recipient gets. Also, usually the Indicative Rate is much closer to the interbank or mid-market rate and is thus higher than the Fixed Rate. So even though an Indicative Rate may change, but if the transfer is realized with low or no fees, the final payout might be better vs a fixed rate transaction with another provider. The time taken for the transfer will also play an important role in the whole process.

Transfer Fees

Another important factor in the online money transfer process is the fee involved in the remittance transaction.

Various MTOs have different fee structures. Some charge a flat fee, others a percentage, and still others charge a tiered fee that generally decreases as the transfer amount increases. Fees also vary by payment and delivery methods - you will generally see very low or even 0 fees for bank to bank transfers. On the opposite spectrum, paying with a credit card will usually involve a higher fee plus additional charges from the credit card processor as well.

While fees are an important component of the transaction, they should be taken into account with other factors before making a decision.

For example, for low transfer amounts, a percentage based fee may be tolerable. But the same will become prohibitive for a larger amount - 1% fee on transfer amounts of 100, 1,000 and 10,000 is 1, 10 and 100 respectively.

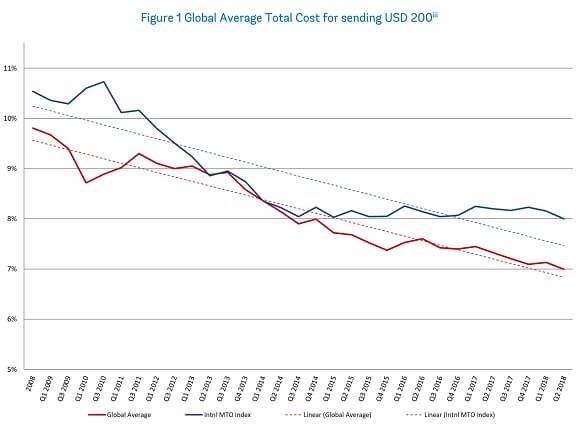

According to data published by the World Bank, the average remittance fee in Q2 2018 was 6.99%. The following graph shows the trend in remittance fee from 2008 through 2018.

Money transfer rates and fees are the biggest factors that impact the final amount your recipient will get.

Transfer Limits

Most MTOs and providers enforce limits on transaction amounts - these may vary from single transaction limits to 24 hour aggregate transaction limits to 30/60/90 day limits, etc. In addition, in certain cases, there may also be legal or governmental controls in the source or destination country which further inform the limits on transaction amount. Depending on the size of the transaction, you may have to either choose providers that fit the need, or perhaps split the amount to execute few smaller transactions.

Payment and Delivery Methods

A payment method is how the transaction is funded by the requester. There are numerous ways to do this, and as we mentioned before, they may come with different fee structures.

Similarly, a delivery method is how the recipient receives the funds. There are several choices available here as well, which also have an impact on transaction fee. Additionally, payment and delivery methods will also have an impact on transfer speed - for example, bank to bank transfers would add the time taken by both the sending and receiving banks to clear the transactions.

Transfer Time

The time taken to transfer money will depend on many factors - payment and delivery methods, provider integrations with major international banks and other partners, and days and times of the week as weekends and holidays may influence the transfer time. Suffice it to say, you should keep the transfer time in mind before initiating the transaction and make choices depending on the urgency needed.

Online money transfer does come with a lot more accurate predictability of the time taken till the recipient gets the funds. Generally, most MTOs will provide online tracking and updates about transfer progress.

Deals and Promotions

Finally, deals and promotions could make a major impact on the value realized from a transaction. Many providers run various promotions that could be seasonal (during holidays, or New Year's, etc.) or ongoing. Additionally, since the online money transfer industry is highly competitive with so many players fighting for market share, it is common for MTOs to run targeted promotions by geographical regions or corridors.

Below is an example of a promotion from WorldRemit.

How to choose the best way to send money online?

The answer to this question is - it depends. As we have explained in prior sections, there are a lot of factors to consider to decide which money transfer option to take. It will all come down to an individual's needs around the urgency and timing of transfer, transaction amount involved, appetite for some risk with changing rates, etc.

With so many online money transfer services available, relying on an automated money transfer comparison platform can help you save a lot of time and money.

For example, there are many online money transfer services in USA to choose from. Similarly, if you want to send money to Philippines online, there are an equally good number of providers available.

Most of these providers are industry leaders and domain experts in the international money transfer space. Below, we list just a few so you can get an idea of options available to you.

- Western Union send money online

- Ria Money Transfer online services

- Instarem online money transfer

- Wise (formerly TransferWise) to send money online

- Revolut online money transfer options

- MoneyGram send money online

- Walmart send money online

Most modern money transfer operators also have an online money transfer app so you can send money through your mobile phone as well. Mobile access will allow you to send money online instantly thereby minimizing wait time.

There are numerous good choices to send money online. Be sure to research them before deciding who you go with.

We hope you have enjoying reading this post, and are now aware of various factors that may have an important influence on the online money transfer process. Happy remitting!

Categories

Similar Articles

US Big Beautiful Bill's Impact On Remittances

The Big Beautiful Bill has been passed in the US, and remittances are impacted. Learn how the Bill impacts remittances and what to do if you are affected by the new law.

Bangladesh Remittance Cash Incentive: All You Need To Know

Are you an overseas Bangladeshi resident who sends money home to your loved ones? Read on to learn how to earn an additional 2.5% cash on your international remittances sent to Bangladesh.

How Fintech Is Pushing Banks Out Of The Remittance Business

The fintech revolution is disrupting the international remittance business. Discover how innovative startups are reshaping the international money transfer industry and challenging traditional banks.