What Is RuPay And How Does It Work?

Table of Contents

- What Is RuPay? A Brief Overview Of Its Origin And Purpose

- How Does RuPay Work? The Building Blocks Of RuPay

- What Are The Benefits Of RuPay?

- What Types Of RuPay Cards Are Available?

- Which Banks In India Offer RuPay Cards?

- Can RuPay Card Be Used For International Transactions?

- What Are RuPay Card Limits?

- RuPay Vs. Other Payment Systems: A Comparative Analysis

- RuPay's Impact On India's Economy: Driving Digital Transactions

- RemitFinder's Take On The Future Of RuPay

Understanding the various payment systems available in various countries of the world is crucial in today's rapidly evolving global economy driven by digital transactions.

While global giants like Visa and Mastercard have long dominated the financial landscape, a homegrown alternative has emerged in India that aims to revolutionize how Indians make payments. Enter RuPay, the indigenous payment network that has gained significant traction in recent years.

RuPay, often dubbed as the "Indian card scheme", has been making waves across the nation as it strives to establish itself as a viable alternative to international payment networks. Launched in March 2012 by the National Payments Corporation of India (NPCI), RuPay has witnessed a remarkable rise, capturing a substantial share of the Indian payment market.

Given that India is home to some really advanced indigenous payment systems like UPI (Unified Payments Interface) and BHIM (Bharat Interface for Money), it is no surprise that yet another system like RuPay has evolved.

In this article, we explore RuPay's origins, features and how it works. We will uncover the distinctive aspects of RuPay that set it apart from its global counterparts and discuss its impact on the Indian economy and financial ecosystem.

Whether you are an Indian consumer looking to understand the benefits of RuPay or an international observer curious about the rise of this indigenous payment system, this article will provide you with valuable insights into the world of RuPay.

What Is RuPay? A Brief Overview Of Its Origin And Purpose

RuPay, India's very own payment network, has emerged as a formidable player in the financial realm, revolutionizing how transactions are conducted within the country.

Launched in 2012 by the National Payments Corporation of India (NPCI), RuPay was created to provide a domestic alternative to international payment systems like Visa and Mastercard.

The brand name RuPay has been derived from the words "Rupee", the name for the Indian currency, and "Payment". This highlights the fact that RuPay is India's own payment system.

The origin of RuPay can be traced back to the Indian government's vision of establishing a self-reliant and inclusive financial ecosystem. Focusing on financial inclusion and affordability, RuPay aims to provide a secure, cost-effective, and convenient payment option for the vast population of India.

By offering services tailored to the specific needs of the Indian market, RuPay aims to reduce the dependence on foreign payment networks and keeps transaction costs low whilst keeping funds as well as their handling completely within the country.

RuPay was launched in March 2012 by the National Payments Corporation of India (NPCI) to fulfil the Indian government's vision of creating a secure, cost-effective and inclusive homegrown modern payment system.

RuPay's purpose extends beyond just being a payment network. It significantly promotes financial inclusion by facilitating transactions for society's unbanked and underbanked segments. By providing a domestic payment system, RuPay has made banking services accessible to millions of Indians who were previously excluded from the formal financial sector.

Moreover, RuPay has supported government initiatives such as Direct Benefit Transfer (DBT) programs, enabling seamless and secure disbursement of welfare payments to beneficiaries nationwide digitally.

As RuPay gained traction, it expanded its offerings beyond traditional debit and credit cards. It introduced prepaid cards, contactless payments, and e-commerce solutions, catering to the evolving needs of consumers and businesses.

RuPay offers various types of credit and debit cards, and is a reliable and secure vehicle for digital disbursement of funds from various Indian government welfare schemes.

RuPay's interoperability with other payment systems has further enhanced its utility, allowing users to transact across various platforms and merchants.

RuPay Statistics

To appreciate the impact and popularity of RuPay, let us look at some statistical information around its usage and related data.

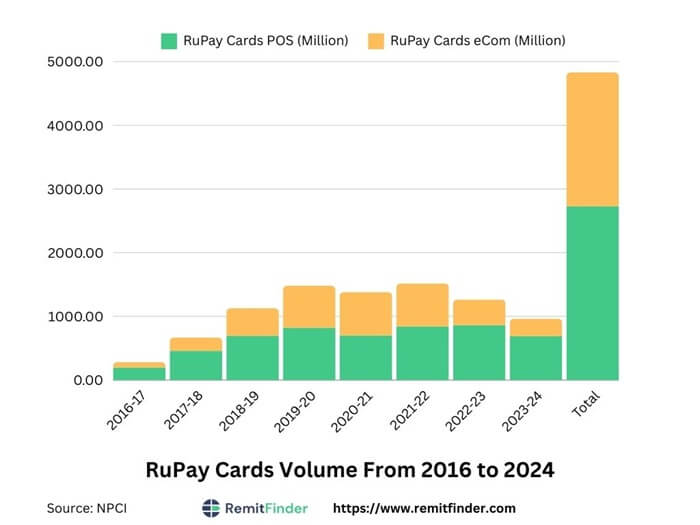

Based on data released by the NPCI, the number of RuPay Cards in use increased from 282.78 million in FY 2016-2017 to 964.25 million in FY 2023-2024. These numbers include both POS and eCommerce RuPay Cards and together represent a 240% increase.

The below graph shows the growth of RuPay Cards from 2016 through 2024 in millions.

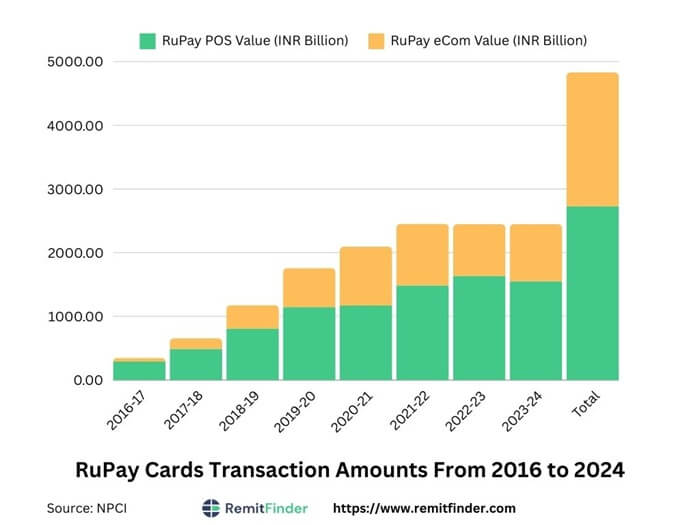

If we look at the monetary value of RuPay Cards used from 2016 to 2024, we see tremendous growth as well.

Based on NPCI data, the value of RuPay Cards issued increased from INR 349.29 billion in FY 2016-2017 to INR 2447.30 billion in FY 2023-2024. These numbers include both POS and eCommerce RuPay Card values and together represent a whopping 600% increase!

The below graph shows the increase in the value of RuPay Cards in billions of Indian Rupees from 2016 through 2024.

RuPay Cards have seen tremendous growth and adoption since launch. From 2016 to 2024, there has been 240% increase in the number of RuPay Cards and 600% increase in their monetary value.

It is also noteworthy that a lot of Indian government welfare schemes use RuPay Cards to disburse funds to recipients. This not only spurs the digital, cashless economy in India forward, but also means that RuPay will continue to be a popular payment method in the country.

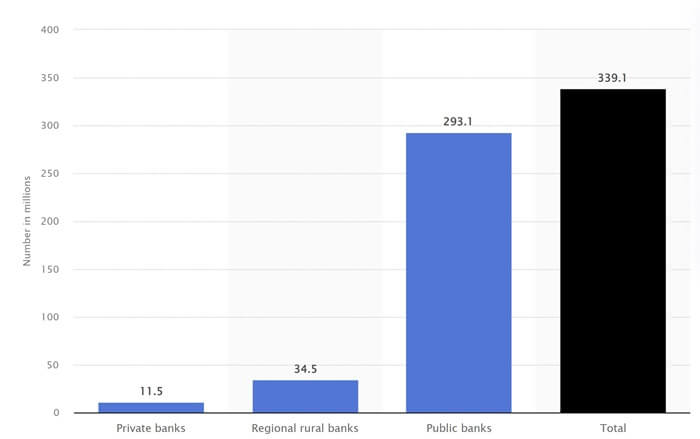

Based on data from Statista, there were 339 million RuPay Debit Cards issued in India in 2023 as part of the Pradhan Mantri Jan-Dhan Yojana. Of these, 293 million RuPay Debit Cards were issued by public sector banks and another 11 million by private sector banks.

Source statista.com

Based on all these data points, it is clear to see that RuPay has gained a lot of traction in India and will continue to be a major force helping shape India's cashless digital payment landscape.

How Does RuPay Work? The Building Blocks Of RuPay

RuPay operates through a series of interconnected processes that enable seamless and secure user transactions. Here are the key aspects that drive the operations of RuPay.

- Card Issuance: A foundational piece of the RuPay payment system involves the issuing of RuPay Cards by partner banks. RuPay Cards can be in the form of debit, credit or prepaid cards. Individuals and businesses can obtain RuPay Cards linked to their bank accounts from participating banks.

- Payment Infrastructure: RuPay leverages a robust payment infrastructure that includes point-of-sale (POS) terminals, ATMs and online payment gateways. These payment channels are equipped with the necessary technology to process RuPay Card transactions securely.

- Transaction Authorization: When a RuPay cardholder initiates a payment, the transaction data is securely transmitted to the acquiring bank (merchant's bank) via the payment infrastructure. The acquiring bank then sends the authorization request to the cardholder's issuing bank for approval.

- Authentication: To ensure the security of transactions, RuPay employs various authentication methods such as personal identification numbers (PINs), two-factor authentication and secure verification protocols. These measures authenticate the cardholder's identity and authorize the transaction.

- Clearing And Settlement: Once the transaction is authorized, the clearing and settlement process begins. The transaction details are sent to the NPCI's National Financial Switch (NFS) for clearing. The NFS facilitates the exchange of transaction information between participating banks, ensuring accurate and timely settlement.

- Interoperability: RuPay has achieved interoperability with other payment systems, enabling cardholders to use RuPay cards on domestic and international platforms. This interoperability expands the reach of RuPay, allowing users to make transactions at a wide range of merchants, online retailers and service providers.

- Security Measures: RuPay prioritizes the security of its payment system. It incorporates advanced security features such as encryption, tokenization and fraud detection systems to safeguard cardholder information and prevent unauthorized access.

- Innovation And Expansion: RuPay continually strives to enhance its services and keep pace with evolving consumer needs. It has introduced innovative solutions like contactless payments, mobile wallets and e-commerce integration, providing users with a comprehensive range of payment options.

As of this writing, various types of RuPay Cards are issued by more than 1100 banks in India. These banks include Public Sector Banks, Private Sector Banks, Regional Rural Banks and Co-Operative Banks.

More than 1100 banks in India issue various types of RuPay Cards. Issuing banks span public, private regional as well as co-operative banks

From card issuance to transaction authorization, clearing, and settlement, RuPay's infrastructure ensures secure and efficient payments.

With its focus on innovation and interoperability, RuPay continues to play a pivotal role in transforming India's payment landscape and promoting financial inclusion across the nation.

What Are The Benefits Of RuPay?

RuPay offers a range of benefits and is designed to cater to the specific needs of the Indian market. It is, thus, no surprise that RuPay has gained significant traction and emerged as a preferred payment system for millions of users in India.

Here are the key benefits that set RuPay apart from other payment networks.

- Cost-Effectiveness: One of the key benefits of RuPay is its cost-effectiveness. Compared to other international payment networks, RuPay offers lower transaction fees, making it an attractive option for individuals and businesses.

- Wide Acceptance: RuPay has witnessed widespread acceptance across various payment channels, including point-of-sale (POS) terminals, ATMs and e-commerce platforms. This wide acceptance ensures that users can make payments using RuPay Cards at a vast network of merchants and service providers within India and internationally.

- Financial Inclusion: RuPay has been instrumental in promoting financial inclusion in India. With a focus on reaching the unbanked and underbanked population, RuPay has facilitated access to banking services through its affordable payment solutions. This has empowered millions of previously excluded individuals to access modern, digital financial payments.

- Government Support: RuPay has received strong backing from the Indian government, leading to its integration with various government programs and initiatives. It has played a crucial role in facilitating Direct Benefit Transfer (DBT) programs, enabling the efficient and transparent disbursement of subsidies, welfare payments and other government benefits to eligible individuals.

- Enhanced Security: RuPay highly emphasizes security measures to safeguard its users' transactions and personal information. It incorporates robust security protocols, including encryption, tokenization, and two-factor authentication, to protect against fraud and unauthorized access.

- Interoperability: RuPay has achieved interoperability with other payment systems, allowing users to transact across various platforms and merchants. This interoperability expands RuPay's utility by enabling seamless domestic and international transactions.

- Tailored Services: The RuPay team understands the unique requirements of the Indian market and offers tailored services to cater to them. It has introduced innovative solutions such as contactless payments, prepaid cards and mobile wallets, aligning with users' changing preferences and lifestyles.

- Promoting Self-Reliance: RuPay's development as a domestic payment network aligns with the Indian government's vision of promoting self-reliance in the financial sector. RuPay contributes to the country's economic independence and sovereignty by reducing dependence on international payment networks.

RemitFinder likes RuPay for its cost-effectiveness, security and widespread acceptance. The Government of India also uses RuPay Cards as the preferred method of disbursing financial benefits to Indian citizens.

What Types Of RuPay Cards Are Available?

RuPay offers a diverse range of card types to cater to its users' varied needs and preferences. Here are the different RuPay card options available:

- RuPay Debit Card: The RuPay Debit Card allows users to access funds directly from their linked bank accounts. It provides a convenient and secure way to make payments, withdraw cash from ATMs and perform online transactions. RuPay Debit Cards are widely accepted across a vast network of merchants and payment platforms.

- RuPay Classic Debit Card

- RuPay Platinum Debit Card

- RuPay Select Debit Card

- SBI RuPay Debit Card

- HDFC RuPay Debit Card

- BoB (Bank of Baroda) RuPay Debit Card

- PNB (Punjab National Bank) RuPay Debit Card

- Canara Bank RuPay Debit Card

- ICICI Bank RuPay Debit Card

- Indian Bank RuPay Debit Card

- Axis Bank RuPay Debit Card

- BOI (Bank of India) RuPay Debit Card

- Union Bank RuPay Debit Card

- RuPay Credit Card: RuPay Credit Cards enable users to make purchases on credit and repay the amount at a later date. With attractive rewards programs, discounts and offers, RuPay Credit Cards provide users with additional benefits and privileges. They are accepted both domestically and internationally, expanding the purchasing power of cardholders.

- RuPay Classic Credit Card

- RuPay Platinum Credit Card

- RuPay Select Credit Card

- RuPay MSME Credit Card

- SBI RuPay Credit Card

- HDFC RuPay Credit Card

- ICICI Bank RuPay Credit Card

- IndusInd Bank RuPay Credit Card

- Axis Bank RuPay Credit Card

- Tata Neu RuPay Credit Card

- BoB (Bank of Baroda) RuPay Credit Card

- RuPay Prepaid Card: RuPay Prepaid Cards are reloadable cards that can be loaded with a specific amount of money. They offer a convenient and secure alternative to carrying cash and provide a controlled spending limit. RuPay prepaid cards are particularly beneficial for individuals who do not have a traditional bank account or prefer to manage their expenses with a predetermined budget.

- RuPay Classic Prepaid Card

- RuPay Corporate Prepaid Card

- RuPay Platinum Prepaid Card

- RuPay Contactless Card: RuPay Contactless Cards incorporate Near Field Communication (NFC) technology, allowing users to make quick and convenient "tap-and-go" payments at enabled payment terminals. These cards eliminate the need for physical contact or swiping, providing a faster and more efficient payment experience.

- RuPay Government Scheme Card: RuPay is the Indian Government's chosen payment method to disburse funds digitally for various welfare schemes that Indian citizens qualify for. RuPay payments have eliminated fraud and helped tremendously with financial inclusion by inducting the unbanked and underbanked directly into India's thriving digital economy.

- RuPay Pradhan Mantri Jan-Dhan Yojana Card (RuPay PMJDY Card)

- RuPay Mudra Card

- RuPay Pungrain Card

- RuPay Kisan Credit Card

- RuPay International Card: RuPay International Cards are designed for users who frequently travel abroad. They allow seamless transactions and cash withdrawals at international merchants and ATMs that accept international payment networks.

RuPay Debit Cards come in 3 popular flavors as below:

Some really popular RuPay Debit Cards from some of India's most popular banks include:

RuPay Credit Cards come in various flavors that include:

Some really popular RuPay Credit Cards from some of India's most popular banks include:

RuPay Prepaid Cards come in the following flavors:

RuPay Government Scheme Cards that include the below:

These RuPay cards help qualifying Indian citizens receive funds pertaining to specific welfare schemes. For example, the RuPay Kisan card is a specialized card targeting farmers in India. It provides access to agricultural credit and government subsidies, enabling farmers to receive payments and access financial services conveniently.

In case you need to move money internationally, you can also use international money transfer specialists to send and receive money abroad. A great way to find the best remittance service provider is to compare exchange rates from many companies to find the best option.

Launched in July 2019 in partnership with CB International Co. Ltd., the RuPay JCB Global Card supports international use. The RuPay Global Card comes in Classic, Platinum and Select flavors, and is accepted at over 42.4 million POS locations and over 1.9 million ATM locations in 200+ countries across the world.

From Debit Cards to Credit Cards to International Cards, RuPay has something to offer for all common payment scenarios. All RuPay Cards come in various flavors so you can pick and choose the best one for your needs. Additionally, RuPay Cards are the preferred payment method for the Government of India to disburse funds under various welfare schemes.

These are just a few examples of available RuPay Card types. RuPay's diverse card options caters to various user requirements, from everyday transactions to premium privileges and specialized needs.

With its comprehensive card portfolio, RuPay continues to offer inclusive and innovative solutions to meet the evolving payment preferences of its users.

Which Banks In India Offer RuPay Cards?

Currently, more than 1100 banks - including Public Sector Banks, Private Sector Banks, Regional Rural Banks and Co-Operative Banks - issue various types of RuPay Cards all across India.

RuPay Cards are issued by more than 1100 banks in India. Participating bank types include public sector, private sector, regional rural as well as co-operative banks.

With such wide coverage, the chances that your bank issues RuPay Cards are fairly high. If in doubt, check with your bank to see if they are able to issue a RuPay Card for your needs.

In addition, the following 10 banks are core promoters of the RuPay payment system:

- State Bank of India

- Punjab National Bank

- Canara Bank

- Bank of Baroda

- Union Bank of India

- Bank of India

- ICICI Bank

- HDFC Bank

- Citibank N. A.

- HSBC

Finally, 56 banks are share-holders of NPCI and therefore, strong supporters of RuPay payments.

Can RuPay Card Be Used For International Transactions?

If you are wondering if RuPay is internationally accepted, then the answer is yes.

The RuPay JCB Global Card is RuPay's international card that works at over 42.4 million POS locations and over 1.9 million ATM locations in 200+ countries across the world. You can choose between Classic, Platinum and Select flavors of the RuPay Global Card based on your needs and preferences.

What Are RuPay Card Limits?

RuPay Cards come with limits that determine how much money you can spend, withdraw or use for various purposes.

RuPay Card limits are managed by issuing banks and vary from bank to bank. Due to a large number of banks and various RuPay Card types, it is not possible to list such limits.

For example, here are SBI RuPay Debit Card limits:

- Minimum transaction limit: INR 100

- Maximum transaction limit at domestic ATMs: INR 40,000

- Maximum transaction limit at points of sale (POS): INR 75,000

If you wish to find your RuPay Card limits, check your bank's website or mobile app, or connect with them to find your RuPay transaction limits.

RuPay Vs. Other Payment Systems: A Comparative Analysis

When comparing RuPay with other payment systems, we consider several factors like cost, acceptance, government adoption and sponsorship, and interoperability.

RuPay holds a distinct advantage in terms of cost-effectiveness. Its transaction fees are typically lower compared to international payment networks. Fee comparisons of RuPay vs Visa or RuPay vs Mastercard almost always reveal RuPay as the more cost-effective option. This make RuPay an attractive choice for individuals and businesses, particularly in price-sensitive markets like India.

In terms of acceptance and coverage, RuPay has made significant strides in expanding its network. It is widely accepted within India and is increasingly gaining recognition internationally, making it a viable payment option for both domestic and cross-border transactions.

Another significant differentiator is RuPay's commitment to financial inclusion. With a strong focus on reaching the unbanked and underbanked, RuPay has played a pivotal role in extending banking services to previously excluded individuals. This sets it apart from other international payment systems like Visa and Mastercard that may not prioritize inclusivity to the same extent.

RuPay enjoys robust support and encouragement from the Government of India. It is the chosen method for the Direct Benefit Transfer (DBT) program whereby funds from various welfare schemes are disbursed exclusively via RuPay Cards. This has further amplified RuPay's credibility and reach.

Interoperability is another key factor where RuPay is making major strides. Whilst global payment networks like Visa and Mastercard have good interoperability, RuPay's growing network and partnerships are expanding its interoperability capabilities quickly.

Finally, RuPay offers tailored services and solutions designed to meet the unique requirements of the Indian market, introducing innovations aligned with evolving consumer needs. As a contrast, international payment systems may not be keen to develop solutions specific to the Indian payment landscape.

RuPay's Impact On India's Economy: Driving Digital Transactions

As India's indigenous payment network, RuPay has profoundly impacted the country's economy by driving the widespread adoption of digital transactions. Through its emphasis on affordability, accessibility and inclusivity, RuPay has played a vital role in promoting a cashless economy and transforming the way financial transactions are conducted in India.

By offering cost-effective alternatives to traditional payment methods, RuPay has encouraged individuals and businesses to embrace digital payments, leading to greater transparency, efficiency, and accountability in financial transactions.

Moreover, RuPay's focus on financial inclusion has empowered millions of previously unbanked individuals to access formal banking services and participate in the digital economy.

RuPay's low transaction fees and extensive acceptance across both physical and digital channels have also benefited small businesses, enabling them to accept digital payments and contribute to the growth of India's cashless economy.

RuPay has been instrumental in driving the digital transformation of India's economy and paving the way for a more inclusive and robust financial ecosystem.

RemitFinder's Take On The Future Of RuPay

RuPay has gained tremendous popularity and adoption in India, and we believe that it will continue to grow in market share. Already a tremendous success, we feel that the future of RuPay looks promising due to many of the below factors.

Thus far, RuPay has kept a strong focus on technology adoption and innovation. Looking ahead, we believe that RuPay will continue to do well in this area. Here are some interesting thoughts:

- RuPay may aim to leverage artificial intelligence (AI) to automate its workflows and make its operations more efficient.

- RuPay could potentially benefit from blockchain adoption as it may help make the platform even more cost-effective.

- Biometrics is another useful technology that RuPay could benefit from as it will help enhance security and provide users with a seamless payment experience.

By staying at the forefront of technology, RuPay can continually improve its services and meet the evolving needs of its users.

Furthermore, we strongly believe that RuPay will continue to expand its reach both within India and internationally. Growth within India will continue to be indigenous whilst international expansion will be driven by forging strategic partnerships with global payment networks.

Both at home and internationally, increased collaboration and partnerships with banks, financial institutions and fintech companies will be a key focus area for RuPay to drive innovation and broaden its range of services.

We also foresee RuPay continuing to introduce more innovative products and services, such as contactless payments, mobile wallets and QR code-based transactions. These will help provide greater convenience and utility to its users.

Last but not the least, the Government of India will continue to adopt, foster and grow RuPay in more creative ways. This will continue to promote financial inclusion and maximize RuPay's outreach to financially underserved population segments by enabling digital payments for individuals in remote areas.

Due to all the abovementioned reasons, we firmly believe that RuPay is well-positioned to continue to shape the future of digital payments in India and beyond.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

Categories

Similar Articles

CNAPS Codes Unraveled: Navigating China's Banking Landscape

Discover CNAPS Codes: China’s unique bank identifier for fast, secure transactions. Learn how CNAPS Codes simplify payments across China's banking system.

ABA Routing Numbers In The US: A Comprehensive Guide

Discover what ABA Routing Numbers are, how they work and their importance in US banking transactions like direct deposits, online transactions and wire transfers.

What Is A NUBAN Number And What Is It Used For?

Discover what NUBAN Numbers are and how they streamline bank account identification in Nigeria. Do not miss this essential guide if you transact in any way with the Nigerian banking system.