What Is BHIM UPI And What Is It Used For?

Table of Contents

- What Is BHIM UPI?

- How Does BHIM UPI Work?

- What Are The Advantages Of Using BHIM UPI?

- Is BHIM UPI Safe?

- BHIM UPI VS Other Payment Methods: What Sets BHIM UPI Apart?

- What Are The Limitations Of BHIM UPI?

- Frequently Asked Questions About BHIM UPI

- What is BHIM?

- What types of payments can I make with BHIM UPI?

- Where can I pay with BHIM UPI?

- Is BHIM UPI a mobile or digital wallet?

- How many languages is BHIM UPI available in?

- Can I use BHIM UPI outside of India?

- Are there any fees or charges for using BHIM UPI?

- Can BHIM UPI be used without an internet connection?

- Can I use BHIM UPI if my bank does not support UPI?

- What are the requirements to register for BHIM UPI?

- What are various ways to send money with BHIM UPI?

- What are the transaction limits for BHIM UPI?

- Is BHIM UPI available over weekends?

- Which Indian banks support BHIM UPI?

- Conclusion: RemitFinder's Take On The Future Of BHIM UPI

BHIM, short for Bharat Interface for Money, is a digital payment system introduced by the National Payments Corporation of India (NPCI) in December 2016. It is a simple and secure way of instantly transferring money from one bank account to another.

BHIM is based on the Unified Payments Interface (UPI) technology, which enables users to send and receive money using a Virtual Payment Address (VPA) linked to their bank account.

Similar to RuPay Cards, BHIM UPI has gained widespread popularity in India due to its ease of use, security, and accessibility.

In this article, we explore the features of BHIM UPI, its benefits, and how it has revolutionized the digital payments landscape in India.

What Is BHIM UPI?

BHIM (Bharat Interface for Money) is a payment and money transfer mobile app used in India for making digital purchases and payments in a seamless, secure and reliable manner.

BHIM is built upon the UPI (Unified Payments Interface) as the underlying payment technology. With the power of UPI as its backbone, BHIM facilitates instant online payments via more than 170 banks in India that are connected to the UPI ecosystem.

BHIM uses the UPI payment network for its payments and money transfers. This amplifies the reach of BHIM UPI since there are umpteen banks and financial institutions connected to the UPI ecosystem.

Since BHIM uses UPI under the hood, it is also commonly referred to as BHIM UPI.

BHIM has been conceptualized and developed by the National Payments Corporation of India (NPCI), which is a leading government body that oversees various payment specifications and systems in India.

BHIP UPI Adoption - Some Statistics

When BHIM UPI was launched back in December 2016, there were more than 10 million downloads of the BHIM Android App from the Google Play Store in just the first 10 days following the launch. During the same time period, BHIM processed over 2 million transactions via the UPI platform.

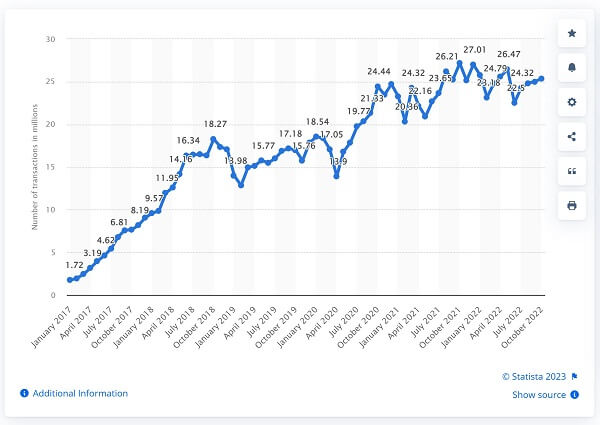

Since then, BHIM UPI has been growing its user base and adoption rapidly over the last few years. As an example, notice the below graph from Statista that shows the growth of transactions through the BHIM ecosystem from January 2017 to October 20221.

Another key indicator of BHIM UPI's amazing adoption journey are statistics from the mobile app stores^ as below:

- On the Google Play Store, BHIM's Android App has more than 50 million downloads and an average rating of 4.4 with 1.64 million reviews.

- On the Apple App Store, BHIM's iOS App has an average rating of 4.5 with 103 thousand ratings.

^ Stats as of June 10, 2023

These statistics are a testament to the continued popularity of BHIM UPI mobile app in India.

How Does BHIM UPI Work?

BHIM UPI is a simple, user-friendly payment system that lets users send and receive money instantly.

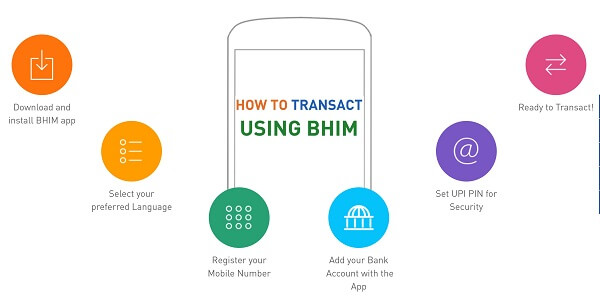

Here is a step-by-step guide on how BHIM UPI works:

- Step 1: Download And Install BHIM UPI App. The first step is to download and install the BHIM UPI app on your smartphone from the Google Play Store or Apple App Store.

- Step 2: Select your preferred language. BHIM app currently supports 20 languages that include English, Hindi, Marathi, Tamil, Telugu, Malayalam, Oriya, Punjabi, Gujarati, Marwari, Haryanvi, Bhojpuri, Urdu, Konkani, Manipuri, Mizo, Khasi, Kannada, Bengali and Assamese.

- Step 3: Select SIM with bank registered mobile number. Make sure to select the SIM card that is tied to the mobile number that you use to register with your bank. This is especially relevant if you have a dual-SIM mobile phone.

- Step 4: Set your app passcode. BHIM app needs a passcode to login into; set yours in this step.

- Step 5: Link Your Bank Account: Next, you need to link your bank account with BHIM UPI. Choose the bank account option and provide your bank account details.

- Step 6: Set up your UPI PIN. After linking your bank account, you need to set a UPI PIN, which is a 4-6 digit code that will be used for all transactions. This PIN is required every time you make a transaction using BHIM UPI. You can do this by providing the last 6 digits and the expiration date on your debit card that is tied to your bank account.

At this point, you are all set to make UPI transactions using the BHIM UPI app.

The below image from the BHIM website encapsulates the above steps2 in a pictographic format.

Now that your BHIM UPI app is setup and configured for use, it is very quick and easy to send and receive money with it.

How can I send money with BHIM UPI?

To send money using BHIM UPI, you can enter the recipient's UPI ID, the amount to transfer, and your UPI PIN. You also have the option to scan the QR Code of the person you want to pay. The money is transferred instantly from your bank account to the recipient's bank account.

How can I request money with BHIM UPI?

To request money using BHIM UPI, you can enter the recipient's UPI ID and the amount to be requested. The recipient will receive a notification on their BHIM UPI app to approve the transaction, and the requested amount will be transferred to your bank account once the transaction is approved.

At any time, you can also check your transaction history on the BHIM UPI app, which provides details of all the transactions made using BHIM UPI.

It is quick and easy to set up the BHIM UPI app as well as send and receive money using it.

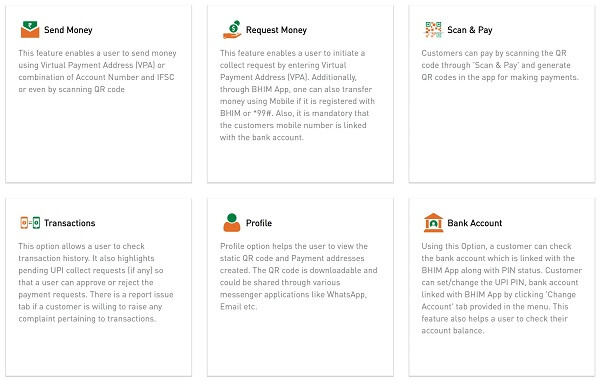

The below infographic from the BHIM website nicely captures everything you can do with your BHIM UPI app3.

BHIM UPI is a safe and secure payment system that uses two-factor authentication and encryption to protect your transactions. It has made digital payments easy and accessible to all, revolutionizing how money is transferred in India.

What Are The Advantages Of Using BHIM UPI?

BHIM UPI is a digital payment system that enables users to transfer funds from one bank account to another instantly using a mobile application. It is a government-initiated digital payments platform that offers several advantages for making payments.

Here are some of the advantages of using BHIM UPI for payments:

- Instant Money Transfer: BHIM UPI offers instant money transfer, which means you can send and receive money instantly, 24x7. You do not have to wait hours or days for the money to get credited to your bank account. This feature is particularly useful when you need to make urgent payments.

- Easy To Use: BHIM UPI is a user-friendly platform that is easy to use. You do not need to be a tech-savvy person to use the platform. You only need a mobile phone and an internet connection to use the BHIM UPI app. It is a simple and convenient way to make payments.

- Secure Payments: BHIM UPI is a secure platform that ensures safe and secure transactions. It uses a two-factor authentication (2FA) system, meaning you must enter your PIN and fingerprint to complete the transaction. This ensures that only the authorized user can make the transaction.

- No Need For Bank Details: With BHIM UPI, you do not need to share your bank account details to make a transaction. All you need is the UPI ID of the recipient, which is a virtual address that is linked to their bank account. This makes the transaction process more secure, as you do not need to share sensitive information.

- Wide Acceptance: BHIM UPI is widely accepted by merchants and vendors across India. You can use BHIM UPI to make payments at retail stores, restaurants, petrol pumps, and other places that accept digital payments. This makes it a convenient option for making payments.

- Not Dependent On Internet Connectivity: One of the biggest advantages of BHIM UPI is that you are not dependent on an internet connection to use it! This is very unique when it comes to digital payments. If you do not have internet coverage, you can simply dial *99# from your phone and all the features of BHIM as you would on the mobile app. In fact, you can also register for BHIM using *99# .

BHIM UPI offers several advantages for making payments. It is a secure, easy-to-use, and convenient way to transfer money instantly.

With the wide acceptance of BHIM UPI, it is a great platform to make digital payments and move towards a cashless economy in India.

Is BHIM UPI Safe?

BHIM UPI is a digital payment system that has gained immense popularity in India due to its ease of use and convenience. However, the platform's success also lies in its robust security features that ensure safe and secure transactions.

One of the key security features of BHIM UPI is the two-factor authentication (2FA) system. To complete a transaction, the user must enter their UPI PIN and provide their fingerprint or biometric data, which ensures that only the authorized user can access the account and make transactions.

BHIM UPI has also implemented encryption and secure socket layer (SSL) technology to protect sensitive user information during the transaction process.

The platform also has strict rules for setting up UPI IDs and requires users to register their mobile numbers with their bank accounts to prevent fraud.

BHIM UPI's security features ensure that users can make transactions with confidence, knowing that their sensitive information and funds are well-protected.

BHIM UPI VS Other Payment Methods: What Sets BHIM UPI Apart?

In India, digital payment methods are becoming increasingly popular, and among these payment methods, BHIM UPI stands out as a unique option.

One primary factor that sets BHIM UPI apart from other payment methods is its ease of use. Unlike other payment methods requiring users to provide extensive personal information or create an account, BHIM UPI only requires a mobile number and a bank account.

Additionally, BHIM UPI enjoys widespread adoption with more than 170 Indian banks and numerous other non-banking financial institutions on it. What makes BHIM UPI even more powerful is its massive footprint when it comes to merchants, shops and stores. You can generally use BHIM UPI anywhere in India where digital payments are accepted.

All this means that BHIM UPI can be used across different banks and payment providers, making it a convenient option for users with multiple accounts or using different payment providers.

Another significant advantage of BHIM UPI is its ability to transfer funds instantly. Unlike other payment methods that may take several hours or days to complete a transaction, BHIM UPI enables instant fund transfer, particularly useful for urgent payments.

Additionally, BHIM UPI offers robust security features such as two-factor authentication, encryption, and SSL technology to ensure that transactions are safe and secure.

Last but not the least, you can even use BHIM UPI without an internet connection. This is super convenient if you do not have internet or are in an area with weak signal. Simply dial *99# and use all the standard features of BHIM UPI.

RemitFinder likes BHIM UPI app for providing full functionality even when there is no internet access. This makes BHIM a very unique app for making digital payments even without the internet.

In conclusion, BHIM UPI's ease of use, interoperability, instant transactions, security features, and wide acceptance sets it apart from other payment methods in India and has played a significant role in the country's push towards a cashless economy.

What Are The Limitations Of BHIM UPI?

BHIM UPI is a popular digital payment system in India that offers several advantages, such as ease of use, interoperability, and instant transactions.

However, it also has some limitations that you should be aware of. Here are some of the key limitations of BHIM UPI:

- Transaction Limits: BHIM UPI has set transaction limits, which may vary depending on the bank and the type of account. For example, some banks may have a daily transaction limit of Rs. 1 lakh (INR 1,00,000), while others may have a higher limit. Additionally, there may also be a limit on the number of transactions that can be made in a day.

- Availability: While merchants and vendors across India widely accept BHIM UPI, it may not be available at all locations. Some merchants may still prefer cash payments or may not have the necessary infrastructure to accept digital payments.

- Bank account requirement: To use BHIM UPI, you must have a bank account with a participating bank. If you do not have a bank account or if your bank is not a participant in the BHIM UPI network, you will not be able to use this payment method.

- Security Concerns: While BHIM UPI offers robust security features, there is always a risk of fraud or unauthorized access to your account. It is important to be vigilant while making transactions and to ensure that you do not share your UPI PIN or other sensitive information with anyone.

Despite these limitations, BHIM UPI sees widespread adoption and popularity in India, and continues to spur the country towards a progressive digital and cashless economy.

Frequently Asked Questions About BHIM UPI

Below are some Frequently Asked Questions (FAQs) about BHIM UPI.

What is BHIM?

BHIM (Bharat Interface for Money) is an instant digital payment solution popular in India. It is based on UPI (Unified Payments Interface) which is the enabler of online, digital and mobile payments and money transfers within India. For this reason, BHIM is also commonly called BHIM UPI.

What types of payments can I make with BHIM UPI?

With BHIM UPI, you can send and receive money to anyone with a UPI ID. You can also make purchases and payments to UPI enabled merchants and stores. Other common uses include paying by scanning a QR Code and sending money using IFSC Code and bank account number.

Where can I pay with BHIM UPI?

You can use BHIM UPI at numerous banks and merchants physically as well as online. In general, any financial institution or business that accepts UPI payments should be able to accept BHIM UPI payments.

Is BHIM UPI a mobile or digital wallet?

No, BHIM UPI is not the same as a mobile wallet. It is a way to make instant payments and transfers via linked bank accounts. In that sense, there is no money that gets stored within your BHIM UPI account.

How many languages is BHIM UPI available in?

Currently, BHIM UPI supports 20 languages, i.e., English, Hindi, Marathi, Tamil, Telugu, Malayalam, Oriya, Punjabi, Gujarati, Marwari, Haryanvi, Bhojpuri, Urdu, Konkani, Manipuri, Mizo, Khasi, Kannada, Bengali, Assamese.

Can I use BHIM UPI outside of India?

You can use BHIM UPI outside India, but only to send and receive payments for your Indian bank accounts. Also, it may be possible to link NRE/NRO accounts with BHIM UPI as long as your bank allows doing so.

Given this, you cannot make international payments or send money internationally using BHIM UPI. If you need to send money internationally, there are numerous good options like money transfer companies to consider.

Are there any fees or charges for using BHIM UPI?

The BHIM system does not charge users any fees or charges for using the BHIM UPI payment method. However, it is possible that various banks may impose their own fees. Check with your bank to see if they have any fees when it comes to making BHIM UPI payments.

Can BHIM UPI be used without an internet connection?

Yes! BHIM UPI can be used without internet as well. Simply dial *99# from your mobile phone to use BHIM UPI without being online. In this way, BHIM UPI is very unique as it can work in an offline mode too.

Can I use BHIM UPI if my bank does not support UPI?

Since BHIM UPI uses UPI as the underlying payments network, your bank needs to be on UPI for you to be able to use BHIM UPI. If your bank does not support UPI payments, you cannot use BHIM UPI with your bank account.

What are the requirements to register for BHIM UPI?

To be able to register for BHIM UPI, you must have a mobile number and a bank account. Also, your bank must support UPI payments otherwise you will not be able to use BHIM UPI with your bank.

What are various ways to send money with BHIM UPI?

You can send money using BHIM UPI with any of the following methods:

- By using the recipient's UPI ID

- Via their UPI registered mobile number

- By using their IFSC Code and bank account number

What are the transaction limits for BHIM UPI?

With BHIM UPI, you can send up to Rs. 100,000 per transaction; the same limit applies to daily transfers via a linked bank account. Note that the INR 100,000 limit is per bank account - if you have multiple bank accounts linked to BHIM UPI, you can send the maximum limit with each account.

Is BHIM UPI available over weekends?

BHIM UPI is available 24x7 and 365 days a year. This is great as you do not have to wait for bank operating hours or working days to send and receive digital payments.

Which Indian banks support BHIM UPI?

Any Indian bank or financial institution that supports the UPI payments ecosystem generally works with BHIM UPI. If in doubt, contact your bank to see if they are on UPI and hence can participate in BHIM UPI payments.

Conclusion: RemitFinder's Take On The Future Of BHIM UPI

The rise of digital payments in India has been unprecedented, and BHIM UPI has played a crucial role in this transformation. As more people become comfortable using digital payment methods, BHIM UPI will likely continue to grow in popularity.

The government's push towards a cashless economy and the increasing adoption of smartphones and internet connectivity are also expected to drive the growth of digital payments in India.

The future of BHIM UPI and digital payments looks promising, with several new features and improvements being introduced regularly to enhance the user experience.

For example, the introduction of BHIM 2.0 enabled users to link their overdraft accounts, make recurring payments, and use QR Codes for transactions. Expanding BHIM UPI to international markets and integrating new technologies such as blockchain and AI could further enhance its capabilities.

In conclusion, the future of BHIM UPI and digital payments in India is bright, and we will likely see more innovative and user-friendly payment options in the years to come.

As the country continues to move towards a cashless economy, BHIM UPI is expected to remain at the forefront of this transformation, providing users with a fast, secure, and convenient way to make digital payments.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. Statista data on BHIM transaction volume from January 2017 to October 2022

2. How to setup your BHIM UPI app

3. Everything you can do with your BHIM UPI app

Categories

Similar Articles

Popular Mobile Wallets Across The World

Discover the top mobile wallets transforming how we pay globally. Explore the world of convenient and secure digital transactions. Do not miss this ultimate guide to the most popular mobile wallets across the world!

What Is PayID And How Does It Work?

If you send or receive money in Australia, say goodbye to complex bank details. Use PayID and experience hassle-free payments. PayID has revolutionized the payment experience in Australia – learn all about it.

Complete Guide To Cash App Limits

Cash App is convenient and easy to use, but there are limits you should be aware of. Our comprehensive guide to Cash App limits has all you need to know to maximize the value of your account.