What Is A CHAPS Payment?

Table of Contents

- What Is CHAPS?

- Who Owns CHAPS?

- Who Uses CHAPS?

- How Does A CHAPS Payment Work?

- Are There Any Fees For Making CHAPS Payments?

- How Long Do CHAPS Payments Take?

- What Are The Operating Hours Of CHAPS?

- What Are The Transaction Limits For CHAPS?

- What Are The Benefits Of CHAPS?

- Is CHAPS Safe?

- Is A CHAPS Payment The Same As A Bank Transfer?

- What Are The Alternatives To CHAPS?

- Conclusion

CHAPS stands for Clearing House Automated Payment System, and is a high-value payment system used in the United Kingdom to transfer large sums of money between banks.

CHAPS is a fast and highly secure way to transfer funds, with payments guaranteed to reach their destination on the same day. With its reliability and speed, CHAPS is an essential tool for businesses, individuals, and financial institutions that need to transfer large sums of money quickly and securely.

In combination with Faster Payments and BACS, CHAPS covers the full gamut of UK's payment solutions. Together, the 3 systems handle a bulk of the country's online money transfers and payments.

In this article, we will look closely at CHAPS payments, including how they work, the benefits of using CHAPS, and when to use this payment system.

Whether you are a business owner or financial professional or just need to transfer funds quickly and securely, this guide will give you a comprehensive understanding of CHAPS payments and how to make the most of this payment system.

What Is CHAPS?

CHAPS (Clearing House Automated Payment System) is a same-day payment and settlement system used in the United Kingdom for mostly high-value transactions.

CHAPS is most used to transfer large sums of money between banks and is considered one of the fastest and most secure payment systems available. CHAPS is designed for transactions where speed and certainty of payment is of the utmost importance, such as the payment of a large purchase or the transfer of funds between banks.

CHAPS is one of UK's safest same-day payment systems and is used for large value transfers due to its safety and guaranteed delivery.

CHAPS payments are settled on the day they are initiated, meaning the recipient's bank account is credited on the same day. This contrasts with other payment methods, such as BACS, which can take 3 working days to complete.

CHAPS is also a guaranteed payment system that ensures without doubt that the payment will reach its destination on the same day, even if the recipient's bank account is with a different financial institution.

CHAPS by the numbers - Key CHAPS statistics

To appreciate the scope and impact of CHAPS, consider the below statistics:

- CHAPS processed 9 million transactions in 2022, representing a 6.1% YoY growth. If we average this out to daily transactions handled by CHAPS, the number comes out to 203,538 CHAPS payments per day.

- CHAPS handled payments worth GBP 98.6 trillion in 2022 - an average of GBP 394.6 billion per day. Fund handled by CHAPS in 2022 also grew by 14.3% on a YoY basis.

- Just in April 2023, CHAPS handled 3.9 million payments worth GBP 7.1 trillion.

- Maximum daily transaction on any day in CHAPS history were 325,160 on 30 September, 2022, which was a Friday and the last day of Q3 2022.

- Maximum daily transfer amount on any day in CHAPS history was GBP 642.7 billion on October 3, 2022, which was a Monday and the first day of Q4 2022.

- CHAPS handles only 5% of UK payments in volume, but 93% of GBP amount. In fact, CHAPS processes money worth the GDP of the UK every 5 business days!

- CHAPS has over 30 direct participants. Additionally, more than 5,000 financial institutions rely on the direct participants to make CHAPS transfers.

CHAPS processes millions of transfers worth trillions of pounds every year. CHAPS handles 93% of the GBP amount of all UK transactions, and handled UK's GDP worth of transfers in just 5 working days.

Given that CHAPS handles 93% of the transaction amount of UK transfers, but only 0.5% volume of transactions, it is clear to see that CHAPS transfers tend to be of very high amounts.

Who Owns CHAPS?

CHAPS is owned and operated by the Bank of England since November 2017.

Historically, CHAPS was created in 1984 by the Bankers Clearing House in London. Just a year later in 1985, the system was moved to the CHAPS and Town Clearing Company Limited.

During those times, CHAPS was primarily used to clear cheques between banks on the same day. Interestingly, this service was called town-clearing - the name coming from the fact that the system cleared cheques between bank branches located in town, i.e., central London.

Town-clearing was stopped in 1995, after which, the owning company was renamed to the CHAPS Clearing Company Limited. It stayed that way until 2017 when the responsibility of CHAPS was taken over by the Bank of England.

Who Uses CHAPS?

There are 2 types of banking and financial institutions who use CHAPS as below:

- CHAPS Direct Participants: These are some of the UK's major high-street banks as well as many major international and custody banks. Currently, there are 30 direct participants in the CHAPS ecosystem.

- CHAPS Agency or Correspondent Banks: These are financial institutions that are not direct participants in CHAPS, but rely on the direct participants to make their CHAPS payments and transfers. In this way, these agency or correspondent banks access CHAPS indirectly. Currently, there are more than 5,000 such financial institutions that use CHAPS by relying on the 30 direct participants.

CHAPS is used by 30 direct participants and more than 5,000 agency or correspondent banks.

As per the CHAPS website1, below is the list of the 30 CHAPS direct participants:

- Banco Santander, S.A. (London branch)

- Bank of America N.A. (London branch)

- Bank of China Limited (London branch)

- Bank of England

- Bank of New York Mellon (London branch)

- Bank of Scotland plc (part of the Lloyds Banking Group)

- Barclays International (a trading name of Barclays Bank plc, part of the Barclays Group)

- Barclays UK (a trading name of Barclays Bank UK plc, part of the Barclays Group)

- BNP Paribas SA (London branch)

- Citibank N.A. (London branch)

- ClearBank Limited

- CLS Bank International (an Edge Act Bank based in New York)

- Clydesdale (a trading name of Clydesdale Bank plc, part of the Virgin Money UK PLC Group)

- Danske Bank (a trading name of Northern Bank Limited, part of the Danske Bank Group)

- Deutsche Bank AG (London branch)

- Elavon Financial Services DAC (UK branch)

- Euroclear Bank SA/NV (Brussels Head Office)

- Goldman Sachs Bank USA (London branch)

- Handelsbanken plc (a UK subsidiary of Svenska Handelsbanken AB)

- HSBC Bank plc (part of the HSBC Group)

- HSBC UK Bank plc (part of the HSBC Group)

- iFAST Global Bank Limited

- ING Bank N.V. (Amsterdam Head Office)

- P. Morgan Chase Bank N.A. (London branch)

- LCH Limited

- Lloyds Bank plc (part of the Lloyds Banking Group)

- National Westminster Bank plc (part of the NatWest Group)

- Northern Trust Company (London branch)

- Royal Bank of Scotland plc (part of the NatWest Group)

- Santander UK plc (part of the Banco Santander Group)

- Societe Generale (Paris Head Office)

- Standard Chartered Bank plc

- State Street Bank and Trust Company (London branch)

- The Co-operative Bank plc

- TSB Bank plc

- UBS AG (London branch)

- Virgin Money (a trading name of Clydesdale Bank plc, part of the Virgin Money UK PLC Group)

Given this, the chances that your bank directly or indirectly uses CHAPS are pretty high. If in doubt, check with your bank to see if they are able to make a CHAPS transfer for you.

How Does A CHAPS Payment Work?

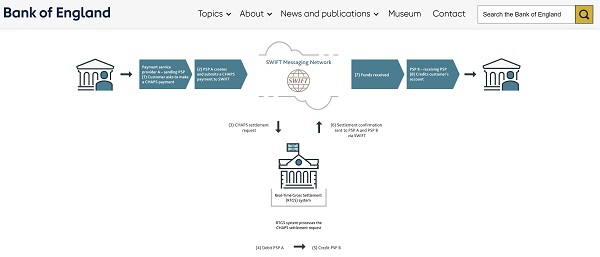

At the heart of it, CHAPS relies on the SWIFT Network to make inter-bank transfers.

SWIFT stands for the Society for Worldwide Interbank Financial Telecommunication, and is a payments network that facilitates global as well as domestic money transfers between banks.

CHAPS relies on the SWIFT network to route money from one bank to another.

Below is a step-by-step breakdown of how a CHAPS payment works:

- Step 1: Customer initiates a CHAPS transfer request with their bank or financial institution.

- Step 2: The bank submits a CHAPS payment request to the SWIFT payment network.

- Step 3: The SWIFT network routes the CHAPS settlement request to its Real-Time Gross Settlement (RTGS) system.

- Step 4: SWIFT's RTGS system debits the requested transfer amount from the initiating bank's customer account.

- Step 5: SWIFT's RTGS system credits the funds to the recipient bank account of the person or entity receiving the money.

- Step 6: SWIFT sends payment confirmation to both the sender as well as recipient banks to confirm that the transaction was successful.

- Step 7: The receiving bank gets the funds from the SWIFT payment system.

- Step 8: The receiving bank credits the final recipient customer bank account with the transfer amount.

The whole end-to-end CHAPS payment flow1 is nicely captured by a diagram available on the CHAPS page hosted by the Bank of England site, and is reproduced below for quick reference.

CHAPS payments examples and use cases

Given that CHAPS lends itself really nicely to high value payments and transfers, below are some examples where CHAPS could be a great fit:

- Big banks settling high value money market and FX transactions.

- Businesses paying time sensitive payments to vendors and suppliers, as well as making tax payments.

- Banks fulfilling loans and mortgages, and solicitors and financers making payments for housing and other real estate transactions.

- Individual customers making large value purchases like a house or car.

- Government agencies making large value transfers like pension funds or insurance payments.

This is just a small sample; CHAPS can handle any large value transfer that needs to finish within the same day.

How Can I Make A CHAPS payment?

To make a CHAPS payment, you must provide the recipient's bank details, including their account number and the Sort Code of the destination bank, and specify the amount you want to transfer.

You will also need to pay a fee for using the CHAPS service, which can vary from bank to bank. Check with your bank to see what their fees are for sending CHAPS payments.

Also, double-check the recipient's bank account and other details before sending the payment to avoid errors.

Are There Any Fees For Making CHAPS Payments?

Yes, there are fees and charges involved in making CHAPS payments.

If you are a consumer who sends a CHAPS payment via a Direct Participant or an Agency or Correspondent Bank, you can expect to pay anywhere between GBP 25 and GBP 30 for each CHAPS transaction.

Behind the scenes, your bank will also pay fees as below:

- Agency or Correspondent Banks have to usually pay Direct Participants anywhere between GBP 2 and GBP 3 per CHAPS payment.

- Direct Participants have to pay around GBP 0.31 to CHAPS for each CHAPS transaction.

Finally, note that Direct Participants also need to pay around GBP 30,000 in annual fees to CHAPS.

Consumers, agency or correspondent banks as well as direct participants all have to pay fees for using CHAPS.

As a consumer, make sure to check with your bank how much fee you will be charged for making a CHAPS payment.

How Long Do CHAPS Payments Take?

CHAPS payments get processed within the same business day as long as they are initiated before a cut-off time, which varies from bank to bank.

Even though the CHAPS system is functional till 6 pm, every bank or financial institution imposes a different cut-off time to accept CHAPS payments.

In case you initiate your CHAPS payment after your bank's cut-off time, it will get processed on the next business day.

Note that CHAPS is not available on weekend or bank holidays, so if you submit your payment after the cut-off time on a Friday, it will be handled by your bank and CHAPS on Monday, or the next working day if Monday is a bank holiday.

What Are The Operating Hours Of CHAPS?

The CHAPS payment system functions from 6 am to 6 pm every day on weekdays, i.e., Monday through Friday. CHAPS is, thus, not available during the weekends.

CHAPS is also not functional on bank holidays in the UK.

CHAPS is available on weekdays from 6 am to 6 pm (excluding bank holidays).

Is CHAPS available over the weekend?

No, the CHAPS payment system is neither operational over the weekends, nor on public and bank holidays.

CHAPS only works on business days from 6 am to 6 pm.

If you need to send money over the weekend, you may have to explore other options.

What Are The Transaction Limits For CHAPS?

The CHAPS payments system itself does not enforce any minimum or maximum limits on the amount you can send in a single CHAPS transaction.

However, most banks and financial institutions set their own transaction limits, and it is important to check with your bank to determine the specific limit for your CHAPS payment.

Typically, CHAPS maximum limits are quite high, as CHAPS is designed for large, high-value transfers. For example, some banks may have a maximum limit of GBP 10 million for a single CHAPS payment.

CHAPS transaction limits are typically very high, but vary from bank to bank. Check with your bank to find your CHAPS payment limits.

However, it is important to note that CHAPS maximum limits may be lower for some types of customers, such as individuals or small businesses. If you need to make a larger payment, you may need to split the payment into multiple transactions, or you may need to use another payment method, such as a wire transfer.

In any case, it is always best to check with your bank to find out what your CHAPS payment limits are.

What Are The Benefits Of CHAPS?

The biggest benefits of CHAPS are as below:

- Safe and secure payment network: CHAPS provides a very safe and time-tested financial ecosystem to make same-day payments. This is important as CHAPS is generally used for high value transfers where safety and security are of paramount importance.

- No transaction limits: There are no minimum or maximum transfer amounts enforced by the CHAPS payment system. This makes it ideal to execute high value and ultra-high value payments and money transfers.

- Fast processing times: CHAPS payments are processed on the same business day as long as the transaction gets initiated before the cut-off time. Otherwise, the payment will be processed on the next day.

- Guaranteed delivery: Since CHAPS relies on the SWIFT network as its underlying money transfer mechanism, CHAPS payments are reliable and resilient due to the stability of the SWIFT payment system.

- Easy to use: CHAPS payments can be triggered very easily and quickly by relying on the 30 direct participants or more than 5,000 agency or correspondent banks.

CHAPS provides a safe and secure environment for high value payments and transfers, guaranteeing delivery within the same business day.

Are there any disadvantages of CHAPS?

CHAPS is a fast and secure payment method, but like any payment system, it has some drawbacks. Some disadvantages of CHAPS payments include:

- High transfer cost: CHAPS payments are more expensive than other payment methods, such as BACS transfers or online bank transfers. Most banks charge anywhere from GBP 25 to GBP 30 for sending a CHAPS payment.

- Limited availability: CHAPS is only available to banks and financial institutions, so individuals cannot use the service directly. This can make it difficult for some customers to access CHAPS payments, especially if they do not have an account with a participating bank.

- Processing time: CHAPS payments finish within the same business day if they are sent before a specified cut-off time, else they finish on the next working day. This can make CHAPS a less preferred choice if you need to send money instantly for urgent needs.

- Operation on business days only: CHAPS works only on business days, i.e., Monday through Friday excluding public and bank holidays.

- Long lead time to join CHAPS: Banks or financial institutions who want to become Direct Participants in CHAPS have to wait anywhere from 12 to 18 months to be approved.

- High fees for direct participants: Banks or financial institutions that wish to become Direct Participants need to pay up to GBP 30,000 annual fees as well as up to GBP 0.31 per transfer sent via CHAPS. This may discourage many smaller banks and financial institutions from becoming a Direct Participant in CHAPS.

- UK only: CHAPS is only available in the United Kingdom, so it may not be an option for international transfers. If you wish to send money internationally, you can check out many great money transfer companies that can help you send money overseas at great exchange rates and low cost.

Is CHAPS Safe?

CHAPS is considered a very safe and secure payment system due to several factors:

- Participating banks' security: CHAPS payments can only be made through participating banks and building societies, which are required to meet strict security and privacy standards. This ensures that payments submitted to CHAPS are already vetted by banks.

- No direct access: Since customers have to use their bank to start CHAPS payments and cannot submit payments directly to the CHAPS ecosystem, the chances of fraud and unauthorized access to CHAPS are reduced. Only registered and vetted Direct Participants can submit CHAPS payments. Agency or correspondent banks also need to access CHAPS via a CHAPS direct participant bank.

- Reliance on the SWIFT Network: CHAPS uses SWIFT as its underlying funds transfer payment network. SWIFT is secure and safe, and has been in use for decades as a global standard moving large sums of money both internationally as well as domestically.

- Encryption and security measures: CHAPS uses encryption and other security measures to protect sensitive financial information during the payment process. This helps to prevent unauthorized access to payment information and reduces the risk of fraud.

- Regulation: CHAPS is a regulated financial and payment ecosystem under the purview of the Financial Services Banking Reform Act (FSBRA), a 2013 UK regulation that provides guidelines for payment systems within the country.

CHAPS is a regulated and secure payment system. No consumer direct access and reliance on the SWIFT network for transfers further enhance the safety of CHAPS.

Is A CHAPS Payment The Same As A Bank Transfer?

Anytime money moves from one bank account to another, such a movement of funds is called a bank transfer.

In that sense, CHAPS payments are also bank transfers as funds get debited from the sending bank account and get credited to the receiving bank account.

Other examples of bank transfers include Faster Payments, domestic and international wire transfers and BACS payments.

What Are The Alternatives To CHAPS?

There are several alternatives to CHAPS if you need to send payments and money within the UK. Below are some payment systems that you could consider if CHAPS does not work for your needs.

BACS (Bankers Automated Clearing Service) payments are a cheap and secure way for businesses as well as individual consumers to send money within the UK. However, BACS payments take 3 days to finish. If you need to send money sooner, you may have to look for other options as compared to using BACS.

Another great option to send money is Faster Payments, which is free of cost, secure and available via most banks. Other advantages of this payment system include 24x7 access 365 days a year, and real-time payments that mostly finish instantly, otherwise in 2 hours.

Finally, there is the option to use domestic wire transfers, but since they also rely on the underlying SWIFT payment network, they behave very similarly to CHAPS payments.

Conclusion

CHAPS plays a vital role in facilitating large value payments and supporting the UK's financial system. With wide adoption from 30 direct participant banks and more than 5,000 agency and correspondent banks, CHAPS is available for anyone.

CHAPS also handles 93% of the UK's direct payments every year. That is the equivalent of the country's GDP amount handled every 5 business days.

However, before using CHAPS for a transaction, it is important to consider the cost and whether the added speed and certainty are absolutely necessary for your situation.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. How does a CHAPS payment work

Categories

Similar Articles

CNAPS Codes Unraveled: Navigating China's Banking Landscape

Discover CNAPS Codes: China’s unique bank identifier for fast, secure transactions. Learn how CNAPS Codes simplify payments across China's banking system.

ABA Routing Numbers In The US: A Comprehensive Guide

Discover what ABA Routing Numbers are, how they work and their importance in US banking transactions like direct deposits, online transactions and wire transfers.

What Is A NUBAN Number And What Is It Used For?

Discover what NUBAN Numbers are and how they streamline bank account identification in Nigeria. Do not miss this essential guide if you transact in any way with the Nigerian banking system.