What Is Faster Payments?

Table of Contents

- What Is Faster Payments? An Overview

- Who Owns Faster Payments?

- How Does Faster Payments Work?

- What Types Of Payments Are Possible With Faster Payments?

- How Can I Make A Payment With Faster Payments?

- What Is The Transaction Limit For Faster Payments?

- What Are The Fees For Using Faster Payments?

- How Fast Is Faster Payments?

- Is Faster Payments Safe?

- What Are The Advantages Of Faster Payments?

- Which UK Banks Support Faster Payments?

- Is Faster Payments The Same As A Bank Transfer?

- What Are The Alternatives To Faster Payments?

- Conclusion

In today's fast-paced world, we all want our money to move as quickly as possible. Gone are the days of waiting days or weeks for a payment to clear. The ability to transfer funds instantly has become a popular choice for personal and business transactions throughout the world.

The same is true for the UK. And this is where Faster Payments, UK's instant payment service that aims to streamline how people and businesses transfer money. Faster Payments is a secure, efficient, and convenient solution for sending and receiving money quickly.

Whether you are paying bills, sending money to friends and family, or making an urgent payment, Faster Payments provides a hassle-free experience that saves time and effort.

Faster Payments, along with BACS and CHAPS is a foundational piece in UK's online banking and payments ecosystem.

In this article, we will explore what Faster Payments is, how it works, and why it has become a game-changer in the world of financial transactions within the UK.

What Is Faster Payments? An Overview

Faster Payments, also called Faster Payments Service (FPS), is a real-time payment system in the UK that allows individuals and businesses to transfer money instantly and securely from one bank account to another.

Faster Payments was launched in 2008 to provide a fast, efficient, and convenient payment solution for UK consumers and businesses. The system is available 24/7, 365 days a year, and makes real-time payments, with funds credited to the recipient's account within 2 hours, and often instantly.

Faster Payments is a real-time payment system in the UK that facilitates secure and quick bank transfers and payments.

The real-time settlement capabilities of Faster Payments make it ideal for a wide range of transactions, including bill payments, salary transfers, and personal payments.

To use Faster Payments, customers simply need to have an account with a participating bank and access to online or mobile banking. The system operates under strict security standards established in the UK to ensure that all transactions are safe and secure.

To give you an idea of the scale of transactions and money that Faster Payments processes, consider the below stats for 2021 whereby the system processed:

- 4 billion transactions

- GBP 2.6 trillion worth of payments

These numbers represented a 20% increase YoY in the number of payments processed and 24% increase in the amount of money handled by Faster Payments.

Every year, Faster Payments processes billions of transactions worth trillion of pounds.

Who Owns Faster Payments?

Faster Payments is owned and operated by Pay.UK, which is UK's regulatory and standards body and operator for all of the country's interbank payment systems.

Pay.UK provides the payment gateways and the backbone that is used by UK's banks, financial institutions and other businesses to make safe and secure payments every day.

In addition to Faster Payments, Pay.UK also owns and operates the BACS Payment System as well as the Image Clearing System.

Pay.UK is supervised by the Bank of England's Financial Market Infrastructure Directorate (FMID) and regulated by the Payment Systems Regulator (PSR).

How Does Faster Payments Work?

Faster Payments helps to interconnect banks and financial institutions in the UK via its real-time payment network to facilitate quick transfers within the country.

In cases when both the sending and receiving financial institutions or banks are directly connected to the Faster Payments System network, the transaction can clear very fast, sometimes instantly. In the worst case, it can take 2 hours to process the transfer.

For scenarios where participant banks are not Faster Payment members, funds will still arrive within the same day. This is as per the Payment Services Directive (PSD) regulations that apply to all financial institutions within the UK.

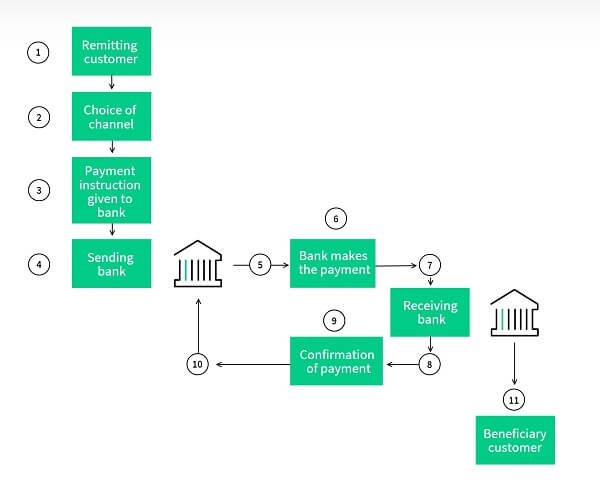

The below diagram from Pay.UK shows how the Faster Payments system works1.

Pay.UK also provides a Confirmation of Payee service that helps any participating organization to validate transaction processing within the Faster Payments system. This helps reconcile transactions properly as well as in combating fraud.

What Types Of Payments Are Possible With Faster Payments?

There are several payment operations permissible within the Faster Payments system. These are listed as below:

- Single Immediate Payments: UK bank account holders can initiate one-time payments using their bank's online banking portal, mobile app, phone banking or by visiting their bank's branch. The Faster Payments system works 24x7 and usually processes these payments within 2 hours, often instantly in real-time.

- Forward Dated Payments: These are very similar to single immediate payments described above, with the caveat that you can set these up for payment at a future date. Forward dated payments are a great way to pay recurring bills.

- Standing Orders: These are fixed amount payments paid out to the same individual or organization. Faster Payments standing orders work Monday through Friday, and if the payment falls over a weekend, it gets processed on the next business day.

- Direct Corporate Access Payments: These are bulk payments available to businesses to send numerous transfers to multiple recipients as a batch. As an example, an employer may use this payment type to send salaries into the bank accounts of hundreds of its employees. Direct corporate access payments work via secure file uploads to the Faster Payments system.

Faster Payments provides many useful payment types that drive both personal as well as corporate financial use cases forward.

As you can imagine, the above listed payment types available in the Faster Payments Service can enable a wide range of quick and easy payments. Below, we present some examples where you can use the power of Faster Payments.

- Personal Payments: You can use Faster Payments to transfer money to friends and family, make rent or utility payments, or pay bills. The service is available 24/7, so you can initiate a payment anytime, day or night.

- Business Payments: Faster Payments can be used by businesses of all sizes to make payments to suppliers, employees, and contractors. Real-time processing means funds are available almost immediately, reducing the risk of late payment fees and improving cash flow.

- Direct Debits: Faster Payments can also be used to set up and manage direct debits, making it easier to keep on top of recurring payments, such as utility bills and gym memberships.

- Salaries: Faster Payments can be used by employers to pay employee salaries, providing a fast and efficient solution for payroll processing.

- Refunds: If you need to issue a refund to a customer, Faster Payments can help you do it quickly and easily, reducing the risk of customer dissatisfaction.

These are just a few example. There are many other scenarios where Faster Payments can come in handy for moving money within the UK.

How Can I Make A Payment With Faster Payments?

Given that a ton of banks and financial companies that operate in the UK participate in Faster Payments, the chances that your bank supports sending money with Faster Payments are pretty high.

If you bank does participate in Faster Payments, you can make a payment or send money with it in any of the follow ways:

- Using your bank's online banking portal

- Using your bank's mobile application

- Using your bank's phone banking service

- By going to your bank's branch

Whichever method you choose, simply choose a payee and the transfer amount, and your bank will do the rest.

Is Faster Payments available over the weekend?

As a payment system, yes, Faster Payments is available over the weekend. In fact, the Faster Payments Service works 24x7 and 365 days a year including weekends and bank holidays.

That said, since you will use your bank to send a Faster Payments transfer, you are limited by your bank's service availability over the weekend.

If you use your bank's online banking or mobile banking facility, you should be able to send a Faster Payments transfer over the weekend.

On the other hand, phone banking and visiting a branch may not be possible if you want to use those facilities to initiate a payment using Faster Payments.

Make sure to check with your bank for weekend availability of their services before you plan to use Faster Payments to make a transfer.

What Is The Transaction Limit For Faster Payments?

Based on Pay.UK's guidelines, you can send up to GBP 1 million using Faster Payments.

That said, this high limit is usually not available to customers as various banks impose their own limits to how much money you can send with Faster Payments.

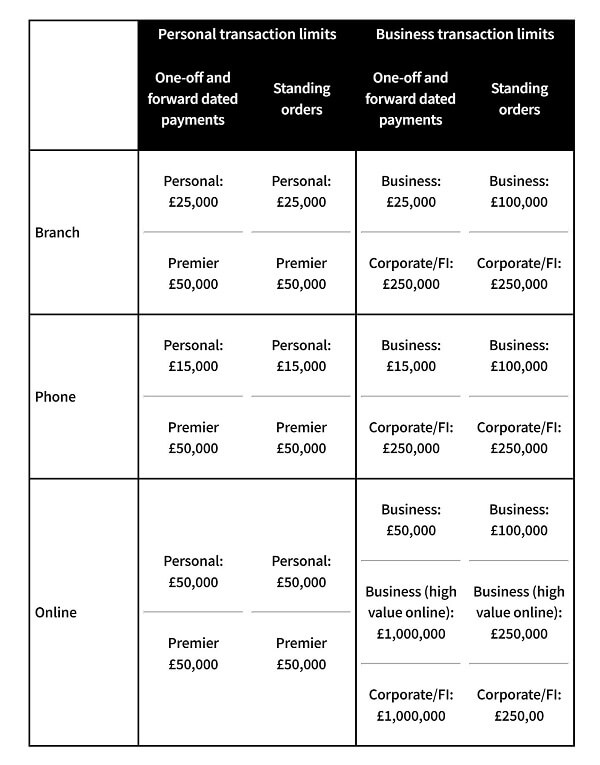

In fact, the Pay.UK website lists out the transactions limits2 imposed by various UK banks for Faster Payment transfers.

As an example, the below table shows Barclays Bank's limits for Faster Payments.

If your bank is not listed on Pay.UK's website, make sure to reach out to them and check what are your limits for sending Faster Payment transfers.

What Are The Fees For Using Faster Payments?

Faster Payments is free of cost and there are no fees and charges to use it to make payments or send money to others in the UK.

That said, you may have to pay fees if you exceed the daily transactions limits setup by your bank. Make sure to check with your bank on what your limits and fees may be when using Faster Payments.

How Fast Is Faster Payments?

Faster Payments are designed to be processed and credited to the recipient's account in real-time.

This means that funds are usually available within a matter of seconds after the payment has been initiated. In some cases, it can take up to 2 hours for the funds to arrive in the destination account.

Funds sent via Faster Payments often arrive instantly, else in up to 2 hours.

This is a significant improvement over other payment methods, such as wire transfers, which can take several hours or even days to complete.

It is important to note that the exact speed of a Faster Payments transaction may vary depending on a number of factors, such as the participating bank or type of transaction, and the time of day that the payment is initiated.

However, in general, Faster Payments is one of the fastest payment methods available in the UK, providing a quick and convenient solution for those who need to transfer funds quickly.

It is also worth mentioning that Faster Payments operates 24/7, 365 days a year, making it a reliable solution for those who need to make a payment outside of traditional banking hours. Whether you need to make a payment in the middle of the night or on a weekend, Faster Payments provides a fast and convenient solution that saves you time and effort.

Is Faster Payments Safe?

When you send money or make a payment with Faster Payments, you should be in safe hands given the below safety procedures:

- Your bank will identify you before allowing you to make a transaction. Whether you use online banking, mobile banking, phone banking or visit your bank's branch, you will need to authenticate yourself. Many banks also have 2-factor authentication (2FA) in place to ensure additional safety of your funds and information.

- Your bank will transmit information to the Faster Payments system in a secure manner.

- The Faster Payments system will also properly authenticate your bank or financial institution and allow funds transfer only if the requesting business is properly registered with it.

- Faster Payments system itself complies with Pay.UK's security and safety guidelines, and handles transactions in a secure manner.

- The receiving bank or financial institution can further validate the authenticity of the received payment by using the Faster Payments system's Confirmation of Payee service. This also helps prevent fraud.

Faster Payments is a safe and secure way to make payments and send money within the UK.

That said, you also play an important part in the overall security of payments made via Faster Payments. Make sure to keep your account safe at all times, and if you suspect any unauthorized access or fraudulent activity, reach out to your bank immediately.

What Are The Advantages Of Faster Payments?

There are several advantages to using Faster Payments; some of these include the below:

- Fast Transfer Speed: One of the biggest advantages of Faster Payments is the speed of the transactions. Payments are processed and credited to the recipient's account in real-time, making funds available almost immediately.

- Convenience: Faster Payments can be initiated from the comfort of your home, via online or mobile banking. This makes it a convenient solution for those who need to make a payment quickly and easily.

- Safety and Security: Faster Payments operates under strict security standards to protect both the sender and recipient of the payment. This includes encryption and two-factor authentication to ensure only authorized users can access and initiate payments.

- Wide Availability: Faster Payments is available 24/7, 365 days a year, and can be used by individuals and businesses with a participating bank or building society account.

- Increased Efficiency: By eliminating the need for manual intervention, Faster Payments can help businesses and individuals save time and increase efficiency. Payments can be scheduled in advance, reducing the need for manual input and reducing the risk of errors.

- Cost-Effective: Faster Payments can be more cost-effective than other payment methods, especially for small transactions. Many banks and building societies do not charge a fee for Faster Payments transactions, making it a cost-effective option for those who need to transfer funds quickly.

Faster Payments is a fast, secure, convenient and cheap way to make payments and move money within the UK.

Which UK Banks Support Faster Payments?

Given numerous advantages that the Faster Payments system provides, it is no surprise that it enjoy widespread adoption by banks and financial institutions in the UK. Most major banks and payment companies with the UK support Faster Payments.

In fact, Pay.UK maintains a list of various UK banks and financial institutions that participate in Faster Payments3; these are listed as below:

- Atom bank

- Banking Circle

- Barclays Bank

- Barclays Bank UK

- Cashplus Bank

- Citibank NA

- ClearBank

- Clydesdale Bank

- CreDec

- Ebury

- Evalon

- Equals Money

- Goldman Sachs

- HSBC Bank

- HSBC UK Bank

- iFast Global Bank Limited

- JPMorgan Chase & Co

- LHV

- Lloyds Bank

- Metro Bank

- Mettle

- Modulr

- Monzo Bank

- Nationwide Building Society

- NatWest

- Northern Bank

- PayrNet

- PPS

- Prepaid Financial Services

- Revolut Limited

- Santander

- Square

- Starling Bank

- Tesco Bank

- The Access Bank UK

- The Bank of London

- The Co-operative Bank

- TSB

- Turkish Bank UK

- Virgin Money

- Wise

This list can change over time so if your bank is not listed above, make sure to check with your bank to see if they participate in Faster Payments.

Is Faster Payments The Same As A Bank Transfer?

Faster Payments and bank transfers are similar in nature as the Faster Payments system moves money from one bank to another.

The term bank transfers is generally used as an umbrella term and there are many types of payments and transfers that fall under this bucket. For example, domestic and international wire transfers, BACS payments and CHAPS are also bank transfers in the UK.

To summarize, there are many types of bank transfers, and Faster Payments is one of them.

What Are The Alternatives To Faster Payments?

In addition to Faster Payments, BACS (Bankers Automated Clearing Service) and CHAPS (Clearing House Automated Payment System) are additional payment systems available in the UK. Each of these has its own unique features and advantages.

BACS payments are typically used for recurring payments and are processed in batches few times a week. They are a cost-effective solution for businesses and consumers, but the processing time can take 3 business days, meaning that funds may not be available immediately.

CHAPS is a same-day payment service in the UK and is typically used for large value, time-sensitive payments, such as property purchases.

CHAPS payments are processed on the same day if initiated before a certain cut-off time, but they are more expensive than other payment methods and can only be initiated during banking hours.

In contrast, Faster Payments are processed and credited to the recipient's account in real-time, with funds usually available within seconds.

Faster Payments are available 24/7, 365 days a year, and can be initiated from the comfort of your own home via online or mobile banking. This makes it a convenient and fast solution for a wide range of personal and business-related transactions.

Conclusion

Faster Payments is a real-time payment system that enables individuals and businesses to transfer funds quickly and securely. With processing times of just a few seconds, Faster Payments provides a fast and convenient solution for many transactions, including personal payments, business payments, direct debits, salaries, and refunds.

To use Faster Payments, you must have an account with a participating bank or building society and access to online or mobile banking.

With its fast processing times, 24/7 availability, and user-friendly interface, Faster Payments is an essential tool for anyone who needs to transfer funds quickly and easily in the UK.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. How Faster Payments works

2. Faster Payments transaction limits

3. UK Banks that participate in Faster Payments

Categories

Similar Articles

CNAPS Codes Unraveled: Navigating China's Banking Landscape

Discover CNAPS Codes: China’s unique bank identifier for fast, secure transactions. Learn how CNAPS Codes simplify payments across China's banking system.

ABA Routing Numbers In The US: A Comprehensive Guide

Discover what ABA Routing Numbers are, how they work and their importance in US banking transactions like direct deposits, online transactions and wire transfers.

What Is A NUBAN Number And What Is It Used For?

Discover what NUBAN Numbers are and how they streamline bank account identification in Nigeria. Do not miss this essential guide if you transact in any way with the Nigerian banking system.