XE Money Transfer Detailed ReviewRates, Fees, Limits, Safety and More

Last updated: January 20, 2026

What is XE Money Exchange? An introduction

XE Money Exchange company information

XE Money Exchange, also called XE Money Transfer, was founded in 1993 and is part of Euronet Worldwide (EWI), a Nasdaq-listed global provider (NASDAQ: EEFT) of electronic and transaction processing solutions.

XE Money Exchange provides a comprehensive range of currency services and products, including:

- Quick, easy and secure money transfers for individuals and businesses

- Live currency transfer rates through the XE Currency Converter

- Market Analysis

- Currency Data API

XE Money Exchange leverages technology to deliver these services through their website and mobile app, and also offers dedicated phone service from their team of currency experts.

XE Money Exchange by the numbers

XE Money Exchange operates worldwide at a massive scale; below numbers help put XE's global footprint in perspective.

- 285+ million site visitors a year

- 60+ million XE app downloads

- 100,000+ customers

- 20,000+ business clients in 100 industry sectors

- 98+ currencies available via XE international money transfer to 130+ countries

- 25+ years in the currency business

- Initiate international transfers 24 hours a day, 7 days a week

XE has a massive global footprint and has more than 25 years' experience in the currency business.

Whatever your reason for sending money overseas, finding a secure, knowledgeable money transfer provider like XE Money Exchange can make a huge difference in how much your international money transfer costs, how quickly it arrives, and how convenient the process is on your end.

XE Money Exchange provides individuals and businesses around the world with low-cost, quick and secure international money transfers, along with other foreign currency tools. Let's take a closer look at what makes XE the world's trusted currency authority.

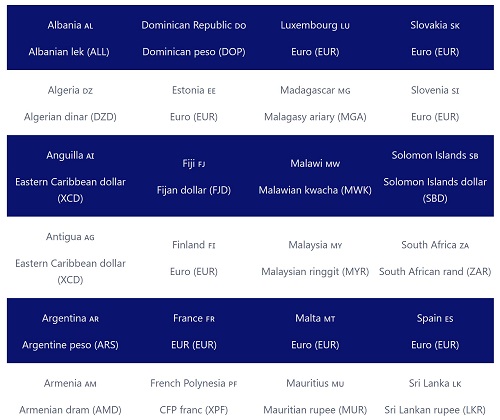

Which countries does XE Money Exchange operate in?

XE Money Exchange is a veteran in the currency exchange and international money transfer business, and allows you to send money in more than 98 global currencies to more than 130 countries worldwide.

Where can I send money from with XE Money Exchange?

With XE Money Exchange, you can send money from any of the following countries.

- North America - United States, Canada

- Europe - United Kingdom, Austria, Belgium, Denmark, Finland, France, Germany, Guernsey, Ireland, Isle of Man, Italy, Jersey, Luxembourg, Netherlands, Norway, Portugal, Spain, Sweden

- Asia Pacific - Australia, New Zealand

As an example, you can easily send dollars from USA to India using XE Money Exchange.

XE Money Exchange is always working to expand their network of supported countries and currencies, so be sure to check their latest supported sending countries periodically.

Where can I send money to with XE?

Once you create an account with XE Money Transfer, you can send money to more than 130 countries. These include all major countries across the globe.

Before you send money abroad with XE, you can check whether your recipient's country is supported or not by seeing the full list of countries where you can send money to with XE.

Another useful resource is the corresponding list of all supported currencies that you can send via XE.

With XE, you can send money overseas in more than 98 global currencies to more than 130 countries.

What are XE's fees and currency transfer rates?

XE money rates tends to be very competitive when compared with other global remittance service providers.

What better way to validate the above than actually seeing some of XE money rates!

Let us do some comparisons and calculations to see how good are XE's currency transfer rates. We will inspect XE money rates for sending 1000 units of currency for some country/currency pairs below.

| Country Pair | Transfer Amount | Exchange Rate* | Fees* | Payout | Mid-Market Rate** | FX Markup |

|---|---|---|---|---|---|---|

| Canada to Philippines | CAD 1,000 | 1 CAD = 41.4894 PHP | CAD 0.0 | 41,489.40 PHP | 1 CAD = 41.6994 PHP | 0.50% |

| UK to Pakistan | GBP 1,000 | 1 GBP = 237.9204 PKR | GBP 0.0 | 237,920.40 PKR | 1 GBP = 241.6490 PKR | 1.54% |

| USA to Mexico | USD 1,000 | 1 USD = 20.2084 MXN | USD 0.0 | 20,208.40 MXN | 1 USD = 20.2841 MXN | 0.37% |

| Australia to India | AUD 1,000 | 1 AUD = 56.8086 INR | AUD 0.0 | 56,808.60 INR | 1 AUD = 56.9002 INR | 0.16% |

| France to Thailand | EUR 1,000 | 1 EUR = 36.7135 THB | EUR 0.0 | 36,713.50 THB | 1 EUR = 36.9949 THB | 0.76% |

*currency transfer rates and fees as on March 23, 2022

**Mid-Market Rate from XE.com

See how we calculate FX Markup

When it comes to money exchange rate, XE offers competitive money transfer rates.

You can use XE's online currency calculator (located at xe com currencyconverter) to estimate how much money your recipient will get for your intended XE international money transfer. Simply punch in the amount you want to send, and choose your source and destination currencies to get a quick and easy quote.

When it comes to XE international money transfer fees, you can mostly send money overseas with 0 fee if you send above a minimum threshold. If you do send smaller amounts, the fee charged is fairly nominal.

The below table^ shows XE international money transfer fees at this time.

^Fees as on March 23, 2022

XE money rates tend to be fairly competitive. Send above minimum thresholds to avoid paying any transfer fees.

Are XE money transfer rates good?

XE has very competitive currency transfer rates across all global country and currency combinations they support. You can use their real time currency calculator to get an instant quote for your XE international money transfer.

That said, as demonstrated by our case studies above, there can be huge variations in XE Money Exchange rates across corridors. XE seems to charge an FX markup from as low as 0.16% to as much as 1.54%.

It is, therefore, always important to do your full due diligence before you send your next international transfer. You should always compare money transfer companies to ensure that you are getting the best return on your transfer.

One way you can do this is by relying on RemitFinder's real time money transfer comparison engine to easily compare numerous remittance service providers.

Even though we provide you very detailed information as part of our XE Money Transfer review, it is still recommended that you compare XE Money Exchange with other money transfer operators.

Is XE a cheap way to send money overseas?

XE is definitely a cost effective way to send money overseas given their focus on very low, and often 0, XE international money transfer fees. As noted earlier, if you send above minimum thresholds, you do not pay any fees.

Another cost that is part of international money transfers is poor exchange rate. XE money transfer rates are very competitive, but depending on your currency pair, there could be an FX markup you have to pay.

How do I avoid XE fees?

XE is great at low or 0 fees, and one the ways you can avoid paying any fees with XE is by ensuring you send above the minimum threshold amount. For example, if you are sending money from the United States, try to send at least USD 500 to qualify for 0 fees.

At this time, below are the minimum sending thresholds to avoid XE fees.

- Australia - 500 AUD (AUD 4 fee for 0-499 AUD)

- Canada - 500 CAD (CAD 3 fee for 0-499 CAD)

- European Union - 250 EUR (EUR 2 fee for 0-249 EUR)

- New Zealand - 500 NZD (NZD 4 fee for 0-499 NZD)

- United Kingdom - 250 GBP (GBP 2 fee for 0-249 GBP)

- United States of America - 500 USD (USD 3 fee for 0-499 USD)

Send above minimum threshold amounts to send money with XE with absolutely 0 fees!

Additionally, avoid paying for your XE money transfer with credit cards or wire transfers as they come with fees. Such fees are not XE's fees, but charged by your credit card company or banks.

Its best to pay for your XE remittance with an XE bank transfer to avoid any indirect fees from your bank or financial institution.

How much money can I send with XE?

When you send money with XE, there is no minimum transfer amount threshold. Additionally, XE allows you to send maximum USD 500,000 (or equivalent in other currencies) for online transfers.

If you need to send even larger amounts (over USD 500,000), XE can assist you with such large transfers over the phone.

With XE, there are no limits to how much money you can send overseas.

How long does it take for XE to send money overseas?

XE specializes in moving your money overseas fast. Your XE transfers are typically completed in 1-4 business days, though most complete within 24 hours.

XE is always working to move your money even faster, and some currencies are transferred within minutes. At this time, you can take advantage of super quick transfers in minutes for the below countries.

- Colombia

- Ghana

- Guatemala

- Guyana

- Honduras

- India

- Indonesia

- Mexico

- Pakistan

- The Philippines

- Turkey

XE helps move your money quickly overseas - within minutes for some countries, and in up to 1-4 business days for others.

How can I pay for my XE money transfer?

XE allows you to pay for your money transfer in a variety of flexible ways.

XE's supported payment methods vary by region, and currently are as below.

- UK & Europe - XE Bank transfer, Wire transfer, Debit Card, Credit Card

- United States - XE Bank transfer, Wire transfer, ACH Bank debit, Debit Card, Credit Card

- Canada - XE Bank transfer, Wire transfer, EFT Bank debit, Debit Card, Credit Card, Interac E-transfer, Bill payment (some banks only)

- Australia & New Zealand - XE Bank transfer, Wire transfer, Debit Card, Credit Card, BPAY (AU only), Osko (AU only)

XE supports a wide variety of payment methods (including some local ones) to help you fund your money transfer.

Which payment method should I use to pay for my XE money transfer?

If you are not sure how to pay for your XE money transfer, read their helpful article breaking down the differences between various payment methods.

XE recommends the below best practices to fund your money transfer with them.

- Use direct debit if you want to pay no extra fees to your bank or financial institution

- Use wire transfer or card payment for very quick transaction processing

- Use wire transfer if you are transferring a very large amount

- XE bank transfer is always a great default option that comes with no extra fees

How can my recipient get paid with XE?

The manner in which your recipient gets paid is called a delivery method. XE supports the below 2 delivery methods.

- Bank transfer

- Cash pickup (available only on app)

XE recently added support for cash pickup as a way to pay your overseas recipients. This is a very convenient option if your recipient does not have a bank account as sending cash is now feasible with XE.

XE currently supports 500,000 locations worldwide for money transfer recipients to pick up cash from. There are 2 ways you can look up the most convenient cash pickup location for your receiver:-

- Use the Location Finder on the XE mobile app

- Use the Location Finder on the XE website

However, cash pickup is currently only available on the XE app. So, if you want to take advantage of cash pickup, make sure to send money via the XE mobile app.

XE recently added support for sending cash whereby you can choose from 500,000 convenient worldwide locations for your recipient to pick funds transfers from.

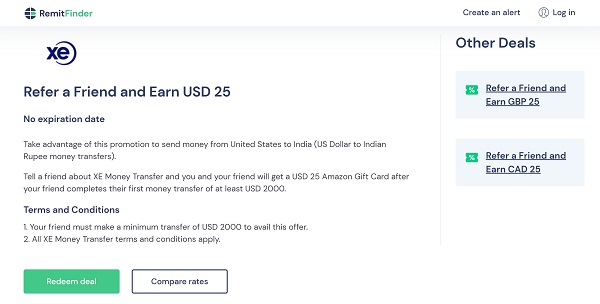

Are there any XE remit promo codes or offers I can use?

With a strong focus on very competitive currency transfer rates, and very low (often 0) fees, XE generally does not offer many cash back or related remit promo codes.

That said, there are still some good XE offers you can take advantage of. For example:-

- In the US, you can refer a friend and earn USD 25

- In the UK, you can refer a friend and earn GBP 25

- In Canada, you can refer a friend and earn CAD 25

Below is a screenshot of the US Refer a Friend XE offer that you can take advantage of to earn USD 25 for each referral in the United States.

XE promotion in the US to refer a friend and earn USD 25

Note that you do not need an XE promo code to take advantage of the above XE offer.

Be sure to check back on this XE Money Transfer review regularly for any future XE promo codes, offers and deals. You can also sign up for the RemitFinder free daily exchange rate alert, and we will keep you updated with the latest XE money transfer rates and deals right in your mailbox.

Is XE a safe way to send money abroad?

Transfers with XE are secure. XE takes the greatest care in ensuring the safety of their customers' money and information, employing bank-grade security measures.

XE follows numerous security best practices to ensure safety; these include the below.

- Verifying your identity using the accepted proof of identity (varies by country) to ensure that it is indeed you who is operating your account and not someone else

- Complying with KYC (know your customer) and AML (anti-money laundering) guidelines

- Investing in secure and modern infrastructure and managed services

- Ensuring fraud prevention, detection and remediation

- Developing a deep understanding and knowledge of international regulatory, legal and compliance requirements

- Understanding risk management and keeping track of global events that impact the ever changing valuations of currencies

- Adhering to data protection and data privacy guidelines

Additionally, XE invests in educating customers about fraud prevention by educating them how to protect themselves from fraud attacks and other related threat vectors and scams.

Can I trust XE?

XE has been in the currency business for over 25 years and ensuring the safety of your money and information is a top priority for them.

XE is regulated and governed by national and international secure guidelines in various countries they operate in. They also comply with many data protection guidelines such as:-

- GDPR (General Data Protection Regulation) in Europe

- Canada's Privacy Act in Canada

- The US Privacy Act in the United States

Additionally, XE is also regulated by numerous central banks and international financial regulatory agencies that include:-

- The Australian Securities and Investments Commission (ASIC)

- The New Zealand Financial Markets Association (NZFMA)

- The Financial Transactions and Reporting Analysis Centre of Canada (FinTRAC)

- l'Autorité des marchés financiers (AMF) in the Province of Quebec

- US Department of Treasury Financial Crimes Enforcement Network (FinCEN)

- The Financial Services Authority (FCA) in the UK

- European Securities and Markets Authority

Since XE implements numerous ways to protect your money and information, you can rest assured that you are in safe and reliable hands when you do business with them.

XE implements numerous security practices to ensure your money and information is safe at all times.

How good is XE's service?

XE has world class products that are used by millions of users worldwide. That said, one great way you can see how good XE's money transfer service is by checking reviews of XE Money Transfer by other remitters like you.

What do users have to say about XE?

Let us see how customers rate XE's money transfer product on some popular review^ platforms. Checking these reviews of XE Money Transfer will help us evaluate if customers like their money transfer service or not.

- XE is rated 4.4/5.0 on Trustpilot and has almost 51k reviews

- On the Google Play Store, XE has a 3.8/5.0 rating with more than 106k reviews

- XE's iOS app is rated 4.4/5.0 on the App Store with more than 5k ratings

^Ratings on various platforms as on March 23, 2022

XE has great ratings on Trustpilot and App Store. Users seem to like their service. Google Play store ratings are a bit lower though.

Is XE the best choice for me?

Based on our detailed analysis about XE's money transfer service, we find XE having key strengths in quite a few areas. Specifically, we find XE outstanding in the below areas.

- Very competitive exchange rates - XE offers very good and competitive exchange rates for numerous markets they operate in. We generally see them in the top few choices when it comes to excellent exchange rates.

- Very low, often 0, fees - Low fees is an area where XE really shines. If you meet minimum sending thresholds, you pay 0 fees. For example, in the US, if you send more than USD 500, you pay no fee!

- Deep experience and knowledge - XE has been in the currency business for over 25 years, and has a very deep understanding of the currency domain and money transfers.

- Robust country and currency support - With XE, you can send money overseas in more than 98 global currencies to more than 130 countries.

- No sending limits - There is no limit to the amount of money you can send with XE. This is ideal if you need to send large amounts overseas.

- Fast transfer speeds - XE sends your money overseas in 1-4 business days, and within minutes to many countries.

RemitFinder likes XE for providing competitive exchange rates with low (often 0) fees, robust currency support, no sending limits and moving money overseas quickly.

What are the best reasons to use XE?

Given the key strengths of XE's money transfer service we discussed above, there are many scenarios which make XE a great choice for your next remittance transaction. Below, we exemplify some cases where XE may be a great fit.

- If you want to get good rates with low fees, XE is a great choice to send money abroad. You can easily get 0 fees by meeting low minimum sending amount requirements; this further improves your payout and makes XE an even more cost effective option.

- If you need to move a large amount of money abroad, XE can help. XE has no limit to the amount of money you can send with them. This is great for scenarios like overseas property purchase, paying off a loan, etc.

- Sometimes we all need to rush funds overseas quickly in emergency situations. If you ever find yourself in such circumstances, XE can help you send money overseas in minutes (not available in all countries).

- XE recently added cash pickup as a delivery method. Sending cash is now quick and easy with XE. This is great in case your recipient does not have a bank account. With more than 500,000 worldwide cash pickup locations supported, XE is a great option if your recipient can only accept cash payments.

- Last but not the least, depending on where you live and where you need to send money to, XE can assist you transfer funds internationally given their robust country and currency support.

XE is a great choice for numerous money transfer needs you may have.

What type of transfers can I make with XE?

What kinds of money transfers does XE offer?

Every XE international money transfer is different. In order to suit the variety of needs you may have, XE offers the following types of transfers.

- Spot transfers - Transfer immediately at the current rate

- Forward contracts - Lock in today's rate and set a future date for your transfer to be sent

- Market orders – Identify a 'target' exchange rate, and the order will transact once that rate has been reached

If you do not have a need to transfer money just yet, XE also allows you to set up Rate Alerts. Select your chosen currencies and set your ideal rate, and XE will watch the markets for you and notify you once that rate has been reached.

What are various ways to send money with XE?

There are many convenient and easy to use ways in which you can use XE money transfer to send money overseas. Depending on your need, you can use any of the following options to send money with XE.

- Online via XE's website

- Using the XE mobile app - When sending cash, please use XE's app as cash pickups are currently only supported on the app

- Calling an XE agent on the phone - This is useful in case you need to send more than USD 500,000 (or equivalent in other currencies

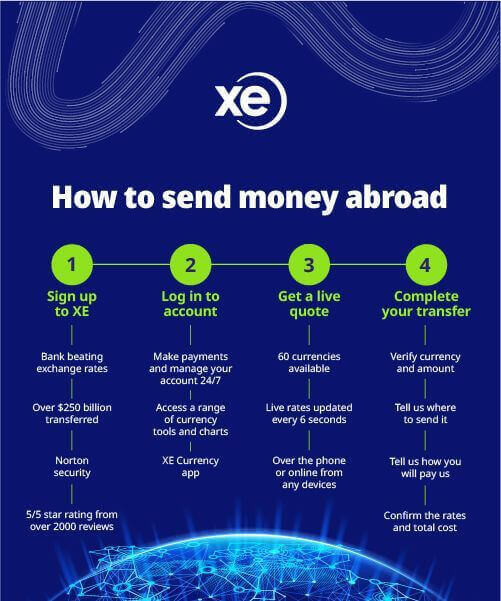

How to send and receive money with XE?

Sending money overseas with XE is quick and simple, and should only take you a couple of minutes. If you need further assistance, you can contact the XE team.

Below we present a step by step guide on how to send money with XE.

Step by step guide to send money with XE

Follow the below simple and easy steps to send money with XE within just a few minutes.

- Step 1 - Decide if you are ready to send money with XE money transfer. One simple and easy way you can do so is by comparing various money transfer companies using RemitFinder's remittance comparison engine. This allows you to compare providers side by side, and easily pick the best one for your remittance needs.

- Step 2 - Sign up with XE. Set up your XE account online or over the phone. It's quick, free and easy.

- Step 3 - Get a quote for your money transfer. Enter how much you're transferring, which currencies and who to send it to. You will need your recipient's name and banking information.

- Step 4 - Confirm and send money. Once you've agreed on a transaction, either online or over the phone, simply send XE the money (by bank transfer, card payment or direct debit) and they'll do the rest.

- Step 5 - Track your transaction. Keep up to date with the progress of your transaction online or in the app 24 hours a day, 7 days a week. XE also sends notifications via email every step of the way as your transfer progresses.

It is quick and easy to send money with XE online or via the phone.

How can XE help me send money?

XE has plenty of helpful resources to help you send money overseas.

You could send money with XE for any of the following reasons.

- Sending money to friends or family abroad

- Paying overseas suppliers or invoices

- Transferring money to or from your own account in another country

- Purchase real estate or make investments overseas

- Making payments for tuition, bills, debts, medical costs, or other overseas expenses

- And more...

Whatever your reason for sending money overseas, finding a secure, knowledgeable money transfer provider can make a huge difference in how much your money transfer costs, how quickly it arrives, and how convenient the process is on your end.

XE provides individuals and businesses around the world with low-cost, quick and secure international money transfers, along with other foreign currency tools.

You can visit their send money page to get started - it's simple and easy to send money with XE. Additionally, XE provides helpful resources for each country to help you send money with them.

Be sure to check XE's helpful guide for your country before you send money with them.

Do I need an XE account to receive money?

You do not need an XE account to receive money. When you send money via XE, your recipient can receive the funds transfers directly into their account. Sending cash is also convenient as the recipient can pick up cash at an agent location.

Your recipient does not need an XE account to receive money you send with XE.

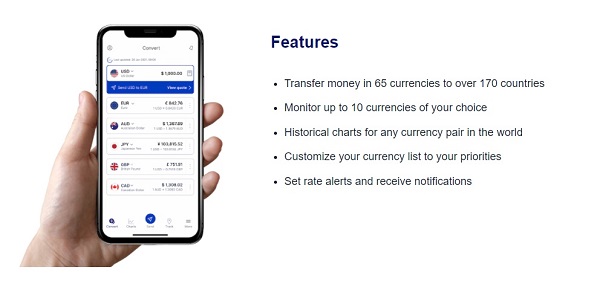

Does XE have a mobile app?

XE does have a mobile app that you can use to send money overseas from the comfort of your home or office. XE's mobile apps are available for download via both the Google Play Store as well as the Apple App Store.

Experience money transfer on the go with the XE mobile app.

You can transfer money internationally using the XE app. It's easy, secure, and there are very low (or sometimes 0) fees.

How do I track my XE transfer?

You can easily check the status of your XE money transfer transaction online or in the XE mobile app 24 hours a day, 7 days a week.

XE also sends you notifications via email every step of the way as your transaction proceeds to next steps.

Can I use XE for international bank transfers?

You can certainly make an international bank to bank transfer with XE. Simply choose bank account as both your payment as well as delivery method for your money transfer.

This way, money comes straight from your bank to fund your XE transfer, and gets deposited directly into your recipient's bank account overseas. In other words, you effectively made an international bank transfer with XE.

Is XE online better than sending money in-person in stores?

Sending money online with XE is fast & easy. You can make money transfers and manage your account online 24 hours a day, 7 days a week from any device.

Use XE website or mobile app to send online money transfers quickly and easily from the comfort of your home.

No need to go to the bank or wait for business hours, etc. All you need is an internet connection and you can send money with XE from the comfort of your home.

Does XE have a rewards program?

XE has a referral program whereby you can refer your friends to XE.

If your referred friend signs up with XE, and makes a qualifying transfer, both you and your friend will get a reward.

For example, you can refer a friend in the US, and earn USD 25 if your friend makes a qualifying transaction.

What XE customer service options are available?

In case you need to contact XE customer service, there are several ways to do so. These include:-

- Sending an email to XE customer service

- Live Chat with an XE customer service agent

- Make a phone call to speak with an XE support rep

Once you sign in into your XE account, you will see all the above support options available to contact XE customer service team.

XE also provides helpful online resources to address your issue and provide more options to contact their support team.

Can I cancel my XE transfer?

XE allows you to cancel your transfer as long as the funds have not reached the recipient. Otherwise, it is not possible for XE to cancel transfers.

If and how you can cancel your transfer also depends on the delivery method you chose when you initiated the transaction. XE publishes detailed guidelines on their transfer cancelation process.

For bank transfers and for sending cash, the following rules apply.

- Bank transfer deliveries can be easily canceled at quote stage. After that, fees and payments may be involved to cancel. Once the transfer is complete, it cannot be canceled.

- Cash pickup transfers can be canceled till the recipient picks up the funds at an agent location.

Be sure to review XE's policies for canceling transfers, and contact them immediately if you need to cancel your inflight transaction.

How do I delete my XE account?

If you wish to delete your XE account, log in into your account and use the Live Chat feature to request account deletion. An XE support agent will help you with your account deletion request.

Note that you will lose access to past transaction history if you delete your account.

Additional Information

Legal and Regulatory Compliance

XE is thoroughly regulated. XE Money Transfer has regulatory approval in every country that they operate in. Some of the global agencies that XE is regulated by include the below.

- The Australian Securities and Investments Commission (ASIC)

- The New Zealand Financial Markets Association (NZFMA)

- The Financial Transactions and Reporting Analysis Centre of Canada (FinTRAC)

- l'Autorité des marchés financiers (AMF) in the Province of Quebec

- US Department of Treasury Financial Crimes Enforcement Network (FinCEN)

- The Financial Services Authority (FCA) in the UK

- European Securities and Markets Authority

Helpful Links

- RemitFinder blog on top 7 best international money transfer apps

- RemitFinder blog on how XE Money Transfer works

- RemitFinder blog on why you should choose XE Money Transfer for your online money transfers

- RemitFinder blog on sending cash with XE Money Transfer

- RemitFinder blog on the best ways to send money from the United States

Awards, Prizes and News

XE recently won the 2021 Canstar International Money Transfers Outstanding Value Award.

Why XE won:

- good XE money transfer rates

- low to no fees

- save customers the most money

Canstar has recognized XE's value in offering features such as their transparent exchange rates, the number of facilities available to customers around the world, and the support XE gives to customers.

Reviews

Excellent provider - better than Remitly

Being long time customer but rectory had a bad experience with one transfer which took 5 days without any update from customer service