Intermex Detailed ReviewRates, Fees, Limits, Safety and More

Last updated: July 17, 2022

What is Intermex? An introduction

Intermex company information

When we talk about remittance services operating from the United States, it is impossible not to mention Intermex (short for International Money Express), a company that ever since its foundation, back in 1994 has striven to become a leader in the segment of remittances to Latin America, guaranteeing seriousness, speed and excellent customer service.

After its inception in 1994, Intermex began operations in the states of Washington and Oregon. In 1996 the company expanded operations to Florida, opening their corporate headquarters in Miami. By 2014 Intermex was licensed to operate in over 49 states consolidating its position as one of the leading money transfer companies to Latin America, continuously outpacing the market growth.

Today, Intermex operates in the 50 states of the United States, plus Washington DC and Puerto Rico and offers the security and prestige of being a public company listed on Nasdaq under the symbol IMXI.

Intermex's global operations offer remittances from the United States to Latin America, the Caribbean and Africa, and currently covers 22 global destinations with a network of more than 100,000 payout locations worldwide. In addition, Intermex has also been perfecting a series of very useful additional services that expand their offer as a company.

If you are in the United States and need to send remittances to Latin America or Africa with total security, transparency and efficiency, Intermex is definitely a strong contender you should look at.

Intermex is a well-established remittance company servicing 22 Latin American and African countries.

Intermex by the numbers

Below are some interesting statistics that help portray Intermex's operations across various global regions.

- Available in all 50 US states as well as Washington DC and Puerto Rico

- Helps send money from US to 22 Latin American and African countries

- Has an extensive network of more than 100,000 payout locations internationally

- 6,000 authorized locations within the US to send money in person

- Been in the currency exchange business since 1994

What services does Intermex provide?

One of the most important characteristics of Intermex is its versatility in terms of the services it offers to its clients, and it goes far beyond sending remittances. Intermex solves many financial needs you may have, and may be a one stop shop for many payments related requirements you may have.

The services offered by Intermex include:

Remittances

If you are in the United States and need to send money to one of the 22 Latin American or African countries affiliated with Intermex, you have following two options to do so:

- The first is the online transfer, which you can carry out comfortably and easily through the Intermex digital platform, sending money to the country of your choice, either directly to a bank in the region (using your credit card, debit card, or bank account).

- The second option is that the recipient collects the funds in person at any of the more than 100,000 commercial points associated with Intermex.

If you prefer to send money in person, you can also go to one of the 6,000 authorized points within the United States and carry out your transaction via the Cash Direct system, which ensures that in approximately one hour the recipient will be able to withdraw the money.

Prepaid Debit Cards

A very practical service that Intermex offers is the prepaid debit card, which can be used to make all kinds of purchases. You can purchase it at Intermex offices and have a payment method at your fingertips without having to have a bank account.

Check Processing

Many of Intermex's 6,000 physical branches also provide Check Processing empowered by their CheckDirect system. By taking advantage of this innovative service, you can process your check to send a wire transfer. This will help save your precious time and money.

Bill Payments

You can also streamline your bill pay by using Intermex. Whatever service you have to pay for: gas, water, telephone, cell phone, cell phone, electricity, cable TV among others, it is now possible to do so through Intermex in a fast and secure way.

Money Orders

The traditional system of sending money in person via money order has been one of Intermex's emblems since the beginning of the company, with the advantage of being able to make transfers of up to USD 500 in a single money order.

Telewire Services

If you prefer to send your money through the help of an Intermex telephone operator, you only have to call the call center between the hours of 7:00 am and 1:00 am. EST, where you will be attended by highly qualified personnel.

Intermex provides a wide variety of financial products and services that help make them a one stop shop for many of your money related needs.

Which countries does Intermex operate in?

When looking for a remittance provider, one of the most important aspects is the scope it has in terms of the countries in which the company offers its services. This of course gives an idea of the security and spectrum that it has.

Let us see where you can send money from and which countries you can receive funds in using Intermex.

Where can I send money from with Intermex?

With Intermex, you can send money from the US. All 50 states in the United States, as well as Washington DC and Puerto Rico are covered as part of international money transfer services that Intermex provides.

Where can I send money to with Intermex?

Intermex is a leading money transfer company offering remittances to the following 22 Latin American and African countries:

- Argentina

- Bolivia

- Brazil

- Chile

- Colombia

- Costa Rica

- Ecuador

- El Salvador

- Guatemala

- Honduras

- Mexico

- Nicaragua

- Panama

- Paraguay

- Peru

- Dominican Republic

- Uruguay

- Kenya

- Nigeria

- Ghana

- Ethiopia

- Senegal

Intermex, thus, covers almost all of Latin America as well as a few important destinations in Africa.

With Intermex, you can send money from anywhere within the US to 22 Latin American and African countries.

What are Intermex's fees and exchange rates?

Intermex tends to provide fairly competitive exchange rates and fees when compared to other money transfer companies.

To determine how good Intermex's exchange rates are, we will look at a few case studies. We will also do some helpful calculations which will help us evaluate if the rates and fees provided by Intermex are good or not.

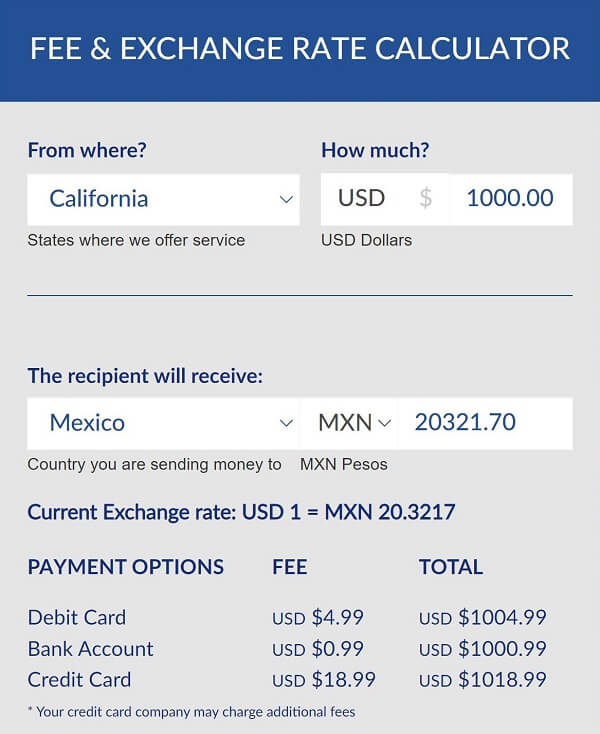

The below table captures a few international money transfer scenarios for sending USD 1000 from USA to Mexico with Intermex with the payment options that they support.

| Transfer Amount | Exchange Rate* | Payment Method | Fees* | Payout | Mid-Market Rate** | FX Markup |

|---|---|---|---|---|---|---|

| USD 1,000 | 1 USD = 20.3217 MXN | Bank Account | USD 0.99 | 20,301.58 MXN | 1 USD = 20.5494 MXN | 1.21% |

| USD 1,000 | 1 USD = 20.3217 MXN | Debit Card | USD 4.99 | 20,220.29 MXN | 1 USD = 20.5494 MXN | 1.60% |

| USD 1,000 | 1 USD = 20.3217 MXN | Credit Card | USD 18.99 | 19,935.79 MXN | 1 USD = 20.5494 MXN | 2.99% |

*Exchange rates and fees as on July 16, 2022

**Mid-Market Rate from XE.com

See how we calculate FX Markup

Below is a screenshot of Intermex's online exchange rate and fee calculator that you can use anytime to get a quote on your intended money transfer. Simply choose your US state, pick your destination country and the amount you want to send, and Intermex will provide you with a real time quote on those money transfer input parameters.

Intermex's payout has a wide variation depending on how you pay for your transfer. Get a real time quote before you decide to send money with them.

Are Intermex exchange rates good?

The exchange rate itself that Intermex offers is not bad at all. As we saw in the case study above, Intermex's exchange rate is not too far off from the interbank exchange rate (also called the mid-market exchange rate). This makes Intermex a competitive money transfer company when it comes to exchange rates.

Is Intermex a cheap way to send money overseas?

Not necessarily - Intermex fees can stack up quickly depending on how you choose to pay for your money transfer with them. For example, the fee to pay for your transfer goes up from USD 0.99 if you pay with your bank account to a whopping USD 18.99 if you pay with a credit card.

In parallel, the FX Margin also varies. In our example above, the FX Margin goes up from 1.21% for a bank account transfer to almost 3% for a similar transfer paid by a credit card.

Watch out for fees depending on the payment method you use to pay for your money transfer with Intermex.

How do I avoid Intermex fees?

It is not possible to entirely avoid Intermex fees. However, you can reduce the impact that transfer fees have on your recipient's payout by choosing to fund your transfer via a Bank Account transfer. The fee to send USD 1,000 from USA to Mexico using a bank transfer is only USD 0.99.

Pay for your transfer via your bank account to minimize Intermex transfer fees.

You should definitely compare Intermex with other money transfer companies to ensure you are getting the best deal. One easy way to do this is by utilizing RemitFinder's money transfer comparison platform. RemitFinder will help you save time and money by comparing many remittance companies in a simple and easy to understand view.

Once you compare money transfer companies, you get to understand their relative strengths and weaknesses. This will help you make better and more informed decisions when sending money internationally. RemitFinder also keeps you aware of ongoing promotions and deals that can be another way to save even more on your international money transfers.

How much money can I send with Intermex?

Intermex allows you to send USD 2,999 for every money transfer you make with them.

If you need to send amounts higher than that limit, Intermex requires that you visit one of their agent locations or branch offices and provide additional documentation. Intermex will then validate your documentation, and upon successful verification, you will be allowed to send higher amounts.

How long does it take for Intermex to send money overseas?

Most money transfers with Intermex finish within minutes, especially wire transfers as well as transfers where your recipient will pick up the funds as cash at an agent location. Intermex tries to finish rest of the transfers as soon as possible.

To avoid any delays from your side, make sure to provide full and detailed information so your transfer does not get flagged for a security review, which will introduce delays to the overall process.

Most Intermex money transfers are completed within minutes.

How can I pay for my Intermex money transfer?

In the money transfer business, how you pay for your money transfer is called a payment method. Intermex supports the following payment methods:

- Bank Account Transfer

- Debit Card

- Credit Card

Paying for your transfer with your bank account is the cheapest - Intermex usually charges only USD 0.99 if you do so.

We recommend that you do not pay for your transfer with a credit card as the fee is USD 18.99. Additionally, your credit card company may also charge a cash advance fee. All this will significantly lower the money your recipient gets overseas.

To save on fees, try to pay for your Intermex transfers via your bank account. Avoid credit card payments due to high fees.

How can my recipient get paid with Intermex?

A delivery method is defined as the manner in which you want to get your recipient paid overseas. With Intermex, you can use any of the following 2 delivery methods:

- Cash Pickup

- Bank Deposit

If you need to send money overseas faster, choose Cash Pickup as your recipient can pick up the money within minutes of your order completing.

Are there any Intermex coupon codes or promotions I can use?

At this time, there are no active Intermex promotions or coupon codes that you can use. We will keep this page updated if we become aware of any Intermex deals that you can take advantage of, so check back periodically.

Instead of checking manually, you can also automate this by registering for the RemitFinder exchange rate alert. Our daily rate alert is totally free of cost, you can rely on it to stay updated with the latest exchange rates and deals from Intermex as well as numerous other providers.

How can I find Intermex near me?

Since Intermex has a wide network of partners and coverage in thousands of locations, it is very likely that you will be able to find an Intermex location near you somewhere.

Before we delve into how you can find a nearby Intermex branch or location, let us see what kinds of services are available at these offices.

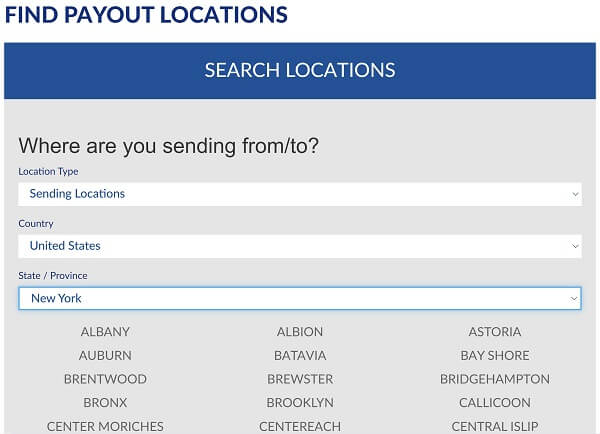

Intermex branch locations can be of 2 types - Sending Locations or Payment Locations. Both of these branch types have different services that they provide. See below for the purposes of these locations.

- Intermex Sending Locations - Sending Locations are Intermex branches where you go to send money from. Since Intermex lets you send money from the United States, these are spread throughout the US and are available in every state and pretty much all major cities.

- Intermex Payment Locations - Payment Locations are Intermex branch or agent offices where your recipient can collect money. These are, therefore, located overseas in the 22 countries where Intermex lets you send money to.

What is the best way to find an Intermex Sending Location near me?

Intermex has a wide network of over 6,000 Sending Locations spread throughout the United States. These are convenient branch offices where you can go to send money via Intermex in person.

Follow the steps below to find an Intermex Sending Location close to you.

- On the Intermex find locations page, choose "Sending Locations" in the Location Type dropdown.

- Then choose the Country as United States.

- Select your province or state, for example, California.

You will see a list of cities that have Sending Locations available. You can call Intermex customer support team at 1-800-670-8611 for more information for the branch in your city.

As an example, below is a screenshot of Intermex Sending Locations in the state of New York.

How to find the nearest Intermex Sending Location

Why should I go to an Intermex Sending Location to send money in person?

With Intermex, you have the convenience of sending money online 24x7 from the comfort of your home or office. So, you may wonder why would you ever need to walk into an Intermex sending location to send money. One important reason for this is if you need to send more than the default amount of USD 2,999.

If you need to send higher amounts with Intermex, you need to go to a sending location near you, and submit additional documentation. Intermex will then verify your information. Once everything has been successfully validated, you will be able to send higher amounts via Intermex.

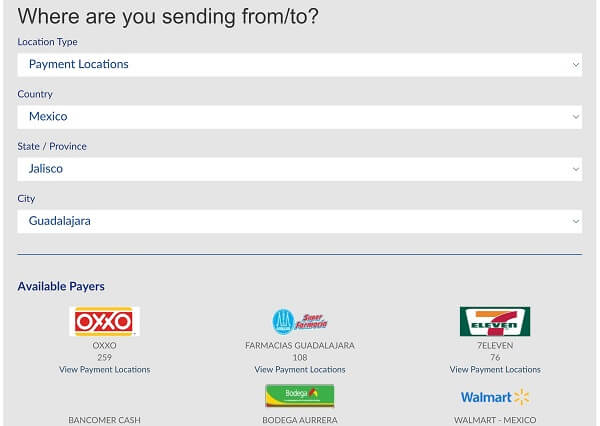

What is the best way to find an Intermex Payment Location overseas?

In addition to having thousands of sending locations throughout the US, Intermex also has a huge network of more than 100,000 Payment Locations worldwide. These are spread across all the 22 destination countries that Intermex service.

Your recipient overseas can go to an Intermex Payment Location that is close to them and collect money that you send to them via Intermex. Follow the below simple steps to find a convenient Payment Location.

- On the Intermex find locations page, choose "Payment Locations" in the Location Type dropdown.

- Then choose the Country your recipient lives in.

- Select your province or state, followed by city.

You will see a list of available payment locations in the chosen city. Your recipient can also search this by themselves to see which location is near them to collect funds without going far.

Below is a screenshot of a search for Intermex Sending Locations in the Mexican city of Guadalajara in the state of Jalisco.

How to find the nearest Intermex Payment Location overseas

For each of the specified partner branch locations in your chosen city, you can further click on "View Payment Locations" to get a list of addresses with their working hours. See below for a screenshot of this for OXXO branches in Guadalajara, Jalisco, Mexico.

How to find the nearest Intermex Payment Location addresses and working hours overseas

As you can see from the above analysis, it is really easy to find Intermex locations near you. Take advantage of this to save on your travel cost and time by going to the nearest Intermex branches in your area.

It is quick and easy to find Intermex Sending and Payment locations using their Location Finder.

Is Intermex a safe way to send money abroad?

Safety is a key element in Intermex's company policy. As a result, Intermex implements numerous security best practices to protect your money and information. We present some examples below:

- Intermex does customer verification based on the identification you provide and as part of Know Your Customer (KYC) compliance.

- Intermex invests in fraud detection and prevention to keep you safe.

- Intermex system does real time validation of your transaction and flags them for security review if anything seems suspicious.

- Both you as well as your recipient have to be at least 18 years older to send and receive money via Intermex.

- For cash pickup, your recipient's ID must match the name you provide for them.

Can I trust Intermex?

Intermex is a licensed and authorized money transfer company in the US with Nationwide Multistate Licensing System (NMLS) registration numbers 897906, 1024984 and 1024987. As part of obtaining and complying with the NMLS requirements, Intermex ensures that they implement the needed security protocols.

Intermex implements numerous security best practices and is licensed to operate in the US. Your money and information should be safe with them.

How good is Intermex's service?

Intermex is a popular choice to send money from the US, especially to Latin America. With their heavy focus on Latin American destinations, customers tend to use their service for their remittance needs. To see how good Intermex's service is, we will check feedback that remitters like you have given them.

What do users have to say about Intermex?

Below, we look at the user feedback that Intermex has received from their customers on some popular rating and review^ platforms.

- On Trustpilot, Intermex is rated Average with a 3.1/5.0 rating with 136 reviews

- On the Google Play Store, Intermex has a 2.6/5.0 rating with 366 reviews and more than 50 thousand downloads

- On the Apple App Store, Intermex is rated 2.7/5.0 with 30 ratings

^Ratings on various platforms as on July 17, 2022

Intermex ratings are average on various popular review platforms. Users seem to face some issues. Consider going to a Sending Location if you hit snags.

Is Intermex the best choice for me for sending money to Latin America?

Intermex is a company that will provide you with all the services for sending money from (and only) the United States with its extensive network of more than 6,000 points within the country. You can send money to more than 100,000 money reception points in Latin America (as well as few African countries) in a safe and fast way.

Intermex also offers you a series of additional services like wire transfers, money orders, bill pay and check processing. In that sense, Intermex can be your one stop joint for many financial services you may need.

RemitFinder likes Intermex for supporting most of Latin America, moving money overseas quickly and having a huge network of both sending and payment locations.

We strongly recommend that before you decide to send money with Intermex, you should compare them with other money transfer companies. The more research you do, the higher the chances that you get a better deal amongst available options.

What are the best reasons to use Intermex?

Intermex not only has a solid, successful and verified track record, but also has the support of being a public company listed on Nasdaq, guaranteeing that your remittances from the United States to Latin America or Africa are in the hands of the best professionals.

In April 2016, the Remittance Industry Observatory published a report that included a survey conducted by the Inter-American Dialogue where Intermex received the highest rating for customer service in the remittance industry.

What type of transfers can I make with Intermex?

With Intermex you can make 2 types of money transfers - wire transfers and international remittances.

Additionally, you can also send money overseas to your recipient by either a Bank Account Transfer or using a Cash Pickup at an Intermex payment location in your recipient's country overseas.

What are various ways to send money with Intermex?

There are several ways to send money internationally with Intermex; we list them below.

- Using the Intermex website - the website is available 24x7 and from anywhere

- Via the Intermex mobile app - available for both Android as well as iOS devices

- By going to an Intermex sending location - Intermex has more than 6,000 sending locations spread throughout the United States. If you want to send more than the usual transfer limit of USD 2,999, you must go to a sending location branch office to get your transfer limit raised.

How to send and receive money with Intermex?

Both sending and receiving money using Intermex is very simple. Follow the below step by step guide to easily send money with Intermex is a few simple steps.

Step by step guide to send money with Intermex

Follow the few steps outlined below to quickly send money with Intermex. It's very simple, and you should be able to send money within just a few minutes.

- Step 1 - Determine if Intermex is your chosen money transfer company. A convenient way to decide this is by comparing many remittances companies using RemitFinder's online money transfer comparison tool. RemitFinder compares various providers and shows you the results in a single easy to digest view. This will help you compare pros and cons of various companies and decide who is best served to help you with your next money transfer.

- Step 2 - Register an account with Intermex. If you do not have an Intermex account, you will first need to register with them. It's pretty quick, and once you have established an account, login into your Intermex account to proceed to next steps. Or if you prefer to send money in person, visit one of the Intermex offices near you.

- Step 3 - Fill out the recipient form. Next, completely fill out the recipient form to tell Intermex about your intended money transfer. Here you will provide the following details: country where the money will be sent, recipient information and finally your payment details (debit or credit card or bank account).

- Step 4 - Confirm your money transfer. After you have double checked everything for accuracy, simply submit your transfer, and Intermex will then process your transaction.

- Step 5 - Track the progress of your money transfer. Once your transfer is accepted by Intermex, you have no other action items. Simply track the progress of your transaction as it proceeds. Intermex will also keep you notified as it progresses forward.

- Step 6 - Your recipient gets the funds overseas. To withdraw the money, the recipient can personally go to an Intermex payment location to withdraw the cash sent, and for this the recipient only has to show the money transfer control number (MTCN). Alternatively, the recipient can also receive the funds directly in their bank account.

It is quick and easy to send money overseas with Intermex using their website or mobile apps.

How can Intermex help me send money?

Intermex has several helpful guides and articles on their website to help you get started with them to send money internationally. Their product is also pretty easy and simple to use, so may just want to get started and resort to the guides in case you get stuck.

Finally, the Intermex customer support team is available 7 days a week to help answer questions in case you need assistance with your transfer.

Do I need an Intermex account to receive money?

Your recipient does not need an Intermex account to receive the money you sent with them overseas. You can pay your recipient via either a bank deposit or cash pickup, and neither of them necessitate your recipient to have an Intermex account of their own.

Your recipient does not need an Intermex account to receive money you send to them.

Does Intermex have a mobile app?

Intermex mobile app is available for both Android and IOS, through which you have access to all the company's services in a very practical way and with a friendly interface that will help you send your remittances or answer any questions you may have.

How do I track my Intermex transfer?

You can check the status of your transactions by logging into your Intermex account any time. Simply go to your transaction history and look for your pending transfer.

Intermex will also keep you updated on your transfer progress via both SMS and email notifications. You will be notified whenever your money transfer progresses to any of the below statuses:

- Transaction Sent: As soon as your money transfer order request has been successfully processed.

- Order Sent for Review: In case your transfer gets flagged for review due to security, legal or other compliance related reasons.

- Order Cancellation: If your order gets canceled for any reason - whether you cancel it or some system action triggers a cancellation.

- Transaction Paid: Once you recipient gets the money - either via Cash Pickup at an Intermex payment location overseas, or via a Bank Deposit.

Can I use Intermex for international bank transfers?

You have 2 options to use Intermex for international bank transfers; we list them below.

- You can send a wire transfer via Intermex. This is similar to doing an international bank transfer.

- You can also send remittance via Intermex, and choose Bank Transfer as both your payment as well as delivery method. This way, money will come straight from your bank account, and will get credited directly into your recipient's overseas bank account.

Is Intermex online better than sending money in-person in stores?

In general, sending online money transfers with Intermex is quick and convenient as the online service is available 24x7 and you can use it from anywhere as long as you have a smartphone, tablet or computer and an internet connection.

One reason why going into an Intermex physical branch or location is if you want to send more than USD 2,999 which is the online money transfer limit. For sending higher amounts, you need to provide additional documentation that can only be done in person at an Intermex Sending Location.

Does Intermex have a rewards program?

At this time, Intermex does not seem to have a rewards program. We will keep this page updated if that changes, so make sure to check back once in a while.

What customer support options are available with Intermex?

There are many ways to contact Intermex customer support team in case you run into any problems using their service, or have any questions you need to ask. You can contact Intermex's support team in any of the following ways:

- By sending an email: You can reach out to Intermex support team by sending an email to webcs@intermexusa.com. If your email is sent between 7 AM to 1 AM EST, you should get a response within the same business day, else the next day.

- By calling via phone: If you wish to speak with someone at Intermex, you can call 1-866-999-1282 between 7 AM to 1 AM EST any day of the week.

- By chat: You can also contact Intermex support team via online chat by using the Chat feature on their Contact Us page.

- By filling a form on website: Yet another option to contact Intermex

There are several easy ways to contact Intermex customer support.

Can I cancel my Intermex transfer?

You can cancel your Intermex money transfer as long as the funds have not been received by the recipient. To cancel your transaction, simply login into your account and go to your transaction history. Then look for the transfer you want to cancel, and click on the "Cancel Transaction" button.

If Intermex is able to cancel your transfer, your funds will be refunded to you within 3-10 business days.

How do I delete my Intermex account?

If you need to delete your Intermex account, get in touch with their Customer Support team and they will assist you with your request. Prior to account deletion, make sure to make a copy of your transaction history as you will lose access after your account has been deleted.

Additional Information

Legal and Regulatory Compliance

Intermex is license and authorized to operate in the United States as a money transmitter by the Nationwide Multistate Licensing System (NMLS). Their registration numbers with NMLS are 897906, 1024984 and 1024987.