MultiPass Detailed ReviewRates, Fees, Limits, Safety and More

Last updated: November 06, 2023

What is MultiPass? An introduction

MultiPass is a UK-based challenger bank that offers corporate clients multi-currency virtual IBANs, local EU, UK and US accounts as well as a card to cover day-to-day business expenses.

MultiPass company information

Founded in 2017 as part of the Dyninno Group, MultiPass began its journey as an in-house cross-border payment solution catering to Dyninno's international travel conglomerate. The venture proved successful within its internal ecosystem, encouraging MultiPass to broaden its horizons and extend services to businesses across the UK, Europe and further.

With a mission to ease global transactions for small and medium-sized enterprises, MultiPass adheres to the motto, "Empowered by technology, delivered by people". This principle signifies a blend of robust technological frameworks with personalized human interaction, simplifying international financial management for SMEs.

MultiPass aims to provide businesses operating globally with a transparent and flexible alternative to cumbersome traditional banking, along with the high level of support they deserve.

By creating an environment for simple cross-border payment management, MultiPass is not just a financial service provider; it is a partner in for global growth, making the world a smaller place for SMEs, one transaction at a time.

MultiPass is an international payment ecosystem that enables businesses to send and receive payments in multiple global currencies via their multi-currency bank account.

MultiPass by the numbers

Here are some statistics that help provide an insight into the scale of MultiPass' global operations:

- 30+ currencies available to transfer to over 180 countries

- Local payouts in 20+ markets

- 5 offices globally: UK, Latvia, India, Moldova and the UAE

- Gross revenue growth: 2.6 times in 2022

- Over 120,000 worldwide transactions processed in 2022

- Annual transaction volume: over EUR 2 billion

What services does MultiPass provide?

MultiPass provide a single business account to bank overseas. Its features include:

- A dedicated multicurrency IBAN

- Local account details in UK, US & Europe

- Payments in 30+ currencies to/from 180+ countries

- A wide choice of local and global payment methods

- Live currency exchange at bank-beating rates

- Virtual and plastic corporate expense cards

- Dedicated relationship manager support

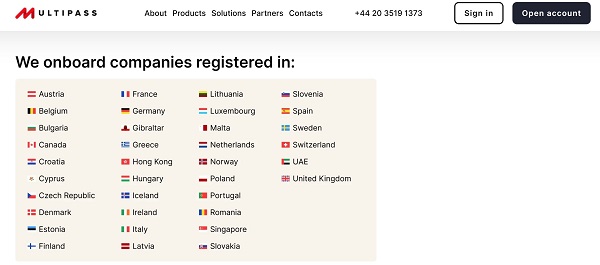

Which countries does MultiPass operate in?

MultiPass onboards businesses registered in the United Kingdom, European Union, UAE and a couple of other locations.

The below graphic captured the full list of countries you can register for MultiPass from.

Where can I send money from with MultiPass?

MultiPass multi-currency accounts can accept and hold over 30+ currencies from pretty much any part of the world (sanctioned countries excluded). MultiPass also provides domestic account details in the UK, US and EU to collect payments in these markets quicker and easier – just like local companies do.

Where can I send money to with MultiPass?

With MultiPass you can send over 30+ currencies globally (sanctioned countries excluded), and 17+ of them via local payment methods which is much cheaper and faster than traditional SWIFT payments.

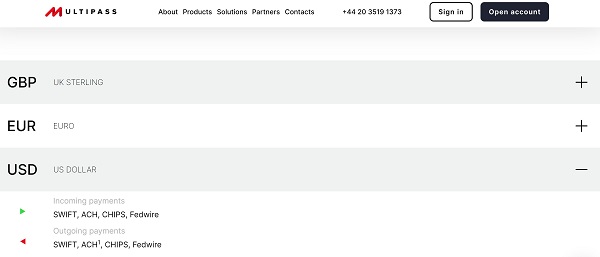

The below screenshot shows the supported currencies that you can send money to using MultiPass, along with incoming and outgoing payment methods.

The full list of available payment methods for all supported currencies can be found on the MultiPass website, so make sure to check it out.

You can register a MultiPass account from UK, Europe, UAE and a few more countries, and send payments globally in more than 30 currencies.

What are MultiPass' fees and exchange rates?

MultiPass has two standard pricing plans and also offers bespoke options. The fees start at 29 GBP a month and sending payments costs as little as GBP 0.50.

MultiPass accounts come up 2 possible plan types - Global and Pro. Check out their website for the latest pricing on the MultiPass Global and Pro account types.

Are MultiPass exchange rates good?

The exchange rates provided by MultiPass are typically more attractive compared to those offered by traditional banks, and may surpass some online foreign exchange services.

The FX markup can vary based on the conversion volumes per customer and is negotiated individually with each new customer. We have noticed the FX markup on MultiPass to range from as low as 0.2% to 2%.

MultiPass' FX markup ranges between 0.2% to 2%, depending on transfer amount and frequency and mutual negotiation.

To make sure you get the best possible deal on your international money transfers, we highly recommend that you compare exchange rates from various providers and see what other money transfer companies have to offer. By comparing exchange rates from many remittance companies side-by-side, you have all the information you need to pick the best option for your unique needs. The more informed you are, the better choices you can make.

Tracking ever-changing exchange rates manually can be challenging. To make this simple, you can use RemitFinder's online money transfer comparison engine. We keep you updated with the latest exchange rates and deals from umpteen money transfer providers so you can decide which option nets you the maximum return on your international remittances.

Is MultiPass a cheap way to send money overseas?

Yes, MultiPass can save a lot of funds for businesses with international partners, suppliers or contractors. The main savings come from accessing better exchange rates than ones offered by traditional banks as well as low fees for local payments in foreign markets.

Additional savings come from the opportunity to hold 30+ currencies in the account and have local account details in the UK, US and EU. This allows companies to operate globally without the need to open and keep several bank accounts in every market of interest.

You can benefit from MultiPass' competitive exchange rates and low fees on local payment methods to keep the cost of sending money abroad low.

How do I avoid MultiPass fees?

If your company is from the Wholesale trade, E-commerce & IT industries, it can benefit from the tailored pricing plan with reduced monthly maintenance fee and low-cost cross-border payments starting just from GBP 0.50 for GBP, EUR, USD and other currencies.

How much money can I send with MultiPass?

MultiPass sets no minimum or maximum payment limits as well as no minimum balance requirements.

That said, you may want to check any government or other financial limits in place for the country you are sending money to.

There is no limit to the amount of money you can send overseas with MultiPass.

How long does it take for MultiPass to send money overseas?

The speed of the payment depends on the payment method chosen. Payments sent via local networks (e.g., payments within the UK, US, EU and other locations) are executed instantly or within hours while global payments via SWIFT can take a couple of days to clear.

For example, a UK-based company can cover local expenses in GBP, collect payments from their US-based customers in USD, and pay their globally-based contractors in EUR, PLN, INR, or other currencies – all within a matter of minutes or hours and at low fees.

MultiPass can move money overseas within minutes or hours for local payment methods, or couple of days for SWIFT funded transfers.

How can I pay for my MultiPass money transfer?

A payment method is defined as the method you choose to fund your money transfer. MultiPass supports several payment methods like ACH debit, wire transfers as well as local payment methods in many countries.

The outgoing payment fees are deducted from the business account balance automatically after the payment is made. You always see the cost of the payment prior to making it.

How can my recipient get paid with MultiPass?

When you send your money transfer internationally, you will need to choose a delivery option for your recipient. A delivery option, also called a delivery method, is how you decide for your recipient to access the funds. Examples include bank deposit, cash pickup and many others.

MultiPass supports bank deposit as their standard delivery method. The recipient will receive money in their bank account, just like with any bank or payment institution.

Are there any MultiPass coupon codes or promotions I can use?

There are no coupon codes available, however, if your business is based in the UK or EU and operates in the Wholesale trade, E-commerce & IT industries, you could be eligible for a special low-cost pricing plan Global.

In case MultiPass adds any offers or promotions for RemitFinder users, we will add them on this in-depth review page. To make sure you do not miss out on any future MultiPass deals and discounts, check back here periodically.

To save time and avoid looking for MultiPass deals and offers manually, a convenient option is to sign up for the RemitFinder daily FX rate alert. The rate alert is totally free of cost. RemitFinder will keep you updated about the latest exchange rates and deals from many money transfer operators so you have all the information you need to make informed decisions.

How can I find MultiPass near me?

MultiPass is a fully digital service that you can access online, 24/7 from any world location. There are no physical locations or offices to go to; this saves you time and money by avoiding traffic and standing in lines.

MultiPass is fully online and available 24x7 via their website.

What is the best way to find an MultiPass Sending Location near me?

There is no need for that! MultiPass is an electronic money institution and has no branches. You can send money online via MultiPass 24/7 from any world location.

Is MultiPass a safe way to send money abroad?

MultiPass is a Financial Conduct Authority (FCA) registered and regulated entity, and thus meets strict security and compliance rules and regulations enforced by the FCA.

MultiPass Platforms Limited is an Electronic Money Institution (EMI) regulated by the FCA under the Electronic Money Regulations 2011 (with FRN Number 900840) for the issuing of electronic money.

Additionally, money held by MultiPass in customer accounts is protected by a process called safeguarding. MultiPass' adherence to the best practice of safeguarding ensures that customer funds are held in accounts that are fully segregated from those where MultiPass' own money is held.

MultiPass implements safeguarding to keep customer funds separate from their own, and are an EMI regulated by the FCA.

Can I trust MultiPass?

MultiPass is a UK-based company, regulated by the FCA under the Electronic Money Regulations 2011 (FRN 900840) for the issuing of electronic money.

Further, MultiPass is also a part of Dyninno – an international conglomerate with over 20 years of experience, operating across 50+ markets. The group has a diverse portfolio encompassing sectors like travel, finance, entertainment, and technology.

Due to its FCA regulation and implementation of various security regulations and best practices, your money and information should be safe with MultiPass.

How good is MultiPass' service?

MultiPass is an excellent choice for businesses with multi-currency payment flows. The international payments market is a complex and highly regulated landscape; therefore, having access to human support is crucial for businesses.

Unlike many big names in the cross-border payment sector, MultiPass takes pride in offering a private-banking-like service, providing personal support for all their customers, regardless of business size.

That said, one good way to check if MultiPass' service is good or not is to see what customers have to say about it. Let us do this in the next section below.

What do users have to say about MultiPass?

Below, we present information about MultiPass' ratings and reviews^ on popular app stores and review platforms to see what their customers mention about their products and services.

- MultiPass has a Great rating of 4.2/5.0 on Trustpilot with 62 reviews.

- MultiPass has an Excellent rating of 4.43/5.0 on thebanks.eu.

- MultiPass is currently not rated on RemitFinder.

When checking the reviews customer leave for MultiPass, it seems like business customers usually appreciate the fully remote onboarding, attention to detail to each individual business case and personal manager support.

On the product side, the most praised features are FX rates, and a wide range of local payment methods in over 20 countries (primarily local payments in GBP, USD and EUR but other global currencies too).

^Ratings on various platforms as on October 31, 2023

MultiPass has very good ratings and reviews on TrustPilot and other platforms, and customers seem to like their service.

Have you created and used a MultiPass account yet? If so, please consider reviewing MultiPass on RemitFinder. Your valuable experience and thoughts will help others gain from your usage of their product.

Is MultiPass the best choice for me?

MultiPass is the right choice for you if your company has suppliers, clients or workforce abroad and a need to make or collect payments in more than one currency.

Key advantages of using MultiPass include multi-currency account to easily manage payments and FX in major popular global currencies, no minimum account balances, no minimum or maximum sending or payment limits, flexible payment methods including local payment methods, quick local transfers that often finish within minutes, peace of mind knowing that your money and information is secure, and great feedback from customers.

RemitFinder likes MultiPass for providing a seamless multi-currency account to manage payments in 30+ currencies, no sending limits, quick transfers and flexible payment methods including local ones in many countries.

You can benefit from MultiPass services the most, if your company is registered in the United Kingdom, European Union or UAE.

What are the best reasons to use MultiPass?

MultiPass helps companies save on international payments by allowing better control over the currency exchange process.

Many companies worldwide see a significant portion of their profits eroded daily due to high FX rates and international payment charges by traditional banks. Moreover, they often experience slow payment processing, and inadequate support from banks when payments get stalled or rejected.

If these challenges resonate with you, MultiPass could be a viable solution for your business. It is a good fit whether you already deal in foreign currencies or are looking to expand into new markets.

For instance, if you aim to engage with customers in the US or EU, or have suppliers in India or China, MultiPass streamlines the financial interactions, making global operations smoother and more accessible by providing local payment methods in these and other markets.

Here are a few illustrative examples of businesses that could greatly benefit from choosing MultiPass:

- A UAE-based wholesale trade company with suppliers in India and customers in the UK and Germany.

- A UK-based software development company with teams in Eastern Europe and customers in the United States, United Kingdom, and Germany.

- A Dutch e-commerce store sourcing printed garments from China and Hong Kong, delivering to customers across Europe.

MultiPass is a great fit for many cross-border business payments involving foreign exchange and global markets.

What type of transfers can I make with MultiPass?

You can make the following 2 types of money transfers and payments with MultiPass:

- Local transfers in GBP (Faster Payments, CHAPS), EUR (SEPA Instant, Target2), USD (ACH, Fedwire), and many other currencies such as CAD, CZK, DKK, HKD, HUF, IDR, INR, MYR, NOK, PHP, PLN, RON, SEK, SGD and more.

- Global transfers in 30+ currencies using SWIFT bank transfers.

You can use MultiPass to make local transfers using many local payment methods as well as global payments using SWIFT in more than 30 currencies.

What are various ways to send money with MultiPass?

With MultiPass, you can make wire transfers as well as use payment cards for corporate expenses. Wire transfers are usually handled via the SWIFT payment network while local transfers can benefit from country-specific local payment methods.

For example, you can rely on Faster Payments and CHAPS in the UK, while ACH and Fedwire can be used in the US.

How to send and receive money with MultiPass?

Sending and receiving money with MultiPass is very easy, and takes only a few clicks.

For sending money with MultiPass, log into your profile, navigate to the "Send money" section and make a new payment.

For receiving money into your MultiPass account, share your MultiPass account details with your clients or business partners. You can find the details in the "Account details" section of your profile.

In the next section, we will look at the exact steps you can undertake to send money overseas with MultiPass.

Step-by-step guide to send money with MultiPass

Sending money with MultiPass is easy, convenient and quick. The whole process should take only a few minutes with the below simple steps.

- Step 1: Figure out if you want to use MultiPass to send money abroad. With numerous money transfer operators available, it may seem hard at first to decide who to go with. There are so many variations and flavors of remittance services that it could be overwhelming to decide who to choose. An easy way to solve this problem is to rely on RemitFinder's money transfer comparison platform that compares many companies side-by-side. This will help you find the best exchange rates and deals so you can decide which provider fulfills your specific needs the best.

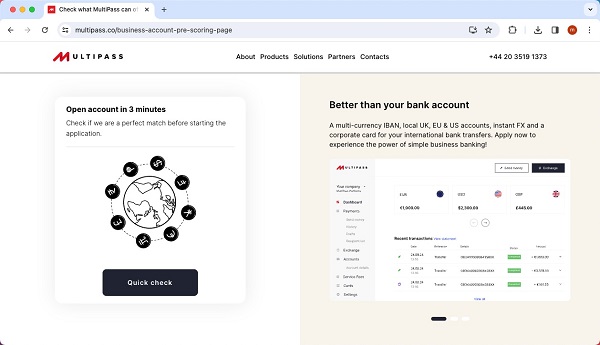

- Step 2: Execute MultiPass' business account pre-check. Determine if MultiPass suits your business by visiting their quick business account pre-check page. This check will ensure that your business is a good fit with the product and services that MultiPass provides.

- Step 3: Register your new account and verify your email. After completing the pre-check, register and verify your new account by providing your email address and through the link sent to your email by MultiPass.

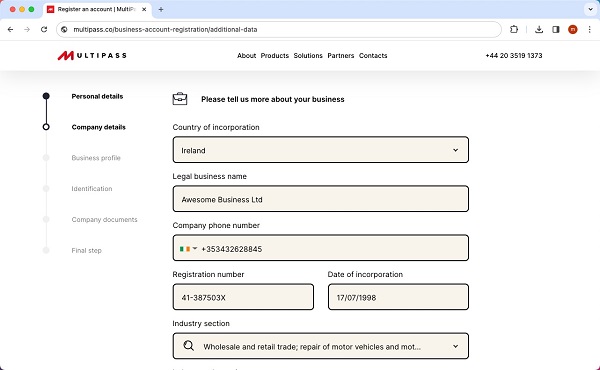

- Step 4: Complete the online application form and upload the required company documents. The form should take around 10 minutes to complete and will require you to take a selfie and a photo of your ID during the process. MultiPass provides a list of necessary company documents to help you with this step.

- Step 5: A MultiPass manager will contact you to complete the onboarding process. Once you complete your business account profile, a MultiPass account manager will reach out to you to fully setup your account. Stay in touch to ensure a speedy completion.

- Step 6: Send money and make payments with your MultiPass account. Once your account is active, log in, and receive your first incoming payment to top it up. With a positive balance, you can go to the "Send money" section to make an outgoing payment or initiate currency exchange first, if you wish to make a foreign payment.

Setting up a new MultiPass account and sending money is quick and easy. The whole process takes only a few minutes.

Finally, if you need assistance on any step in the process, MultiPass provides detailed guides on making payments (including drafts and repeated payments). You can refer to these helpful documents as needed.

How can MultiPass help me send money?

MultiPass makes it easy for businesses to send money to their overseas business partners, suppliers, or workforce residing globally. Money arrives quickly and at better rates compared to using traditional banks for international payments.

Do I need a MultiPass account to receive money?

You do not need a MultiPass account to receive money. All outgoing payments from MultiPass are directed to the recipient's bank account, regardless of whether the recipient has a MultiPass account. Payments can be sent to both traditional and digital bank account holders.

The overseas recipient of a MultiPass international money transfer or payment does not need a MultiPass account to access the funds.

Does MultiPass have a mobile app?

MultiPass has not released a mobile app as of now, but they do offer a mobile-optimized version of their platform.

How do I track my MultiPass transfer?

You can check the status of a payment made through MultiPass within your profile. If you have any questions, you can easily contact your personal manager or the support team to inquire about the status of your payment.

MultiPass will also keep you updated as your international money transfer payment proceeds forward to next steps.

Can I use MultiPass for international bank transfers?

Yes, that is precisely what MultiPass is designed for. With MultiPass businesses can manage over 30 currencies in a single account, convert them at bank-beating rates and send and receive payments globally in the local currencies of their partners, clients and suppliers.

Simply fund your MultiPass transfer via a bank transfer and similarly choose bank deposit at the delivery option for your overseas recipient. This way, you achieve an international bank transfer with MultiPass but with much better rates and lower fees as compared to banks.

Is MultiPass online better than sending money in-person in stores?

Generally, online payments are much more convenient for businesses as they rarely deal with cash. MultiPass offers convenient account statements where all transactions can be traced, which makes reconciliation easier for the accounting team.

Moreover, the MultiPass online platform provides a handy multi-user management feature. It allows to set different roles for team members and separate the tasks. For example, accountants can draft payments while business owners just need to approve them.

MultiPass is an online company with no physical offices to go to. This makes transfers faster, cheaper, easier and available 24x7.

Additionally, employees can manage or block their corporate cards online without requiring the business owner's direct involvement.

Does MultiPass have a rewards program?

There is no rewards program at MultiPass as the time of this writing. If MultiPass introduces a rewards program in the future, we will update this review with that information.

What customer support options are available with MultiPass?

MultiPass is known for being a 'fintech with a human face'. The team commits to providing a private-banking level of support and being accessible for guidance and support.

They offer Personal Manager support for their clientele as well as a Support Team that is on standby to assist both existing customers and address general inquiries.

There are several ways you can reach MultiPass; these include the following:

- Start an Online chat via the MultiPass website

- Connect via Instant Messengers (WhatsApp, Telegram)

- Email MultiPass support team at support@multipass.co

- Call MultiPass support team at +44 20 3519 1373

- Fill up a web form on the Contact Us page on the MultiPass website

There are several quick and easy ways to get in touch with MultiPass customer support team in case you need assistance or have questions.

Can I cancel my MultiPass transfer?

To cancel a MultiPass transfer, reach out to your personal manager or support team with your transaction ID as soon as possible.

Note that depending on the status of your transfer, it may or may not be possible to cancel it. It is, therefore, recommended that you reach out to MultiPass asap if you need to cancel a transaction.

How do I delete my MultiPass account?

To delete your MultiPass account, reach out to your personal manager or support team and they will guide you on the funds withdrawal and account closure process.

Also, make sure to keep a backup copy of all your transfers and other important information in case you need to refer it later. Once your account is deleted, you will lose all access to historical transfers.

Can I use MultiPass' multi-currency card overseas?

Yes, MultiPass cards are a good fit for business travel, online subscriptions and other expenses overseas with a low markup of 1.5% for foreign currency transactions.

Payments in main card balances (GBP and EUR for UK-based businesses and EUR for most other locations) come with no fees.

Additional Information

Legal and Regulatory Compliance

The MultiPass account is an e-money account provided by MultiPass Platforms Limited, an electronic money institution (EMI) regulated by the FCA under the Electronic Money Regulations 2011 (FRN 900840) for the issuing of electronic money. Registered office: 87-89 Baker Street, London W1U 6RJ, United Kingdom.

Helpful Links

- RemitFinder blog on how MultiPass enables seamless B2B international payments

Awards, Prizes and News

- FX Innovation of the year at Payments Awards 2022

- Business Banking category winner at FF Awards 2022

- Excellence in Innovation – Payment Platform UK 2022 by Global Banking and Finance Review

Memberships

MultiPass is a participating member of various payments industry associations, some of which are listed below.

- MultiPass is a member of The Payments Association

- MultiPass is a member of Innovate Finance