Sendwave Detailed ReviewRates, Fees, Limits, Safety and More

Last updated: December 22, 2023

What is Sendwave? An introduction

Sendwave company information

Sendwave is a digital money transfer service that allows users to send money internationally from the United States, Canada, the UK, and the EU to various countries in Africa, Asia, and Latin America. Known for its ease of use and mobile app, it offers competitive exchange rates and fast transfer times.

Sendwave is a safe and secure way to send money internationally and uses industry-standard security measures to protect its users' data.

Sendwave by the numbers

Here are some stats to put Sendwave's money transfer operation in perspective from a scale and impact standpoint.

- 2.6 million app downloads annually

- More than 20 destinations supported across Asia, Africa and Latin America

- Almost 10 years' experience in international money transfer space

Sendwave is an electronic money transfer service that allows users to send money internationally from US, Canada, UK and EU to many countries in Asia, Africa and Latin America.

What services does Sendwave provide?

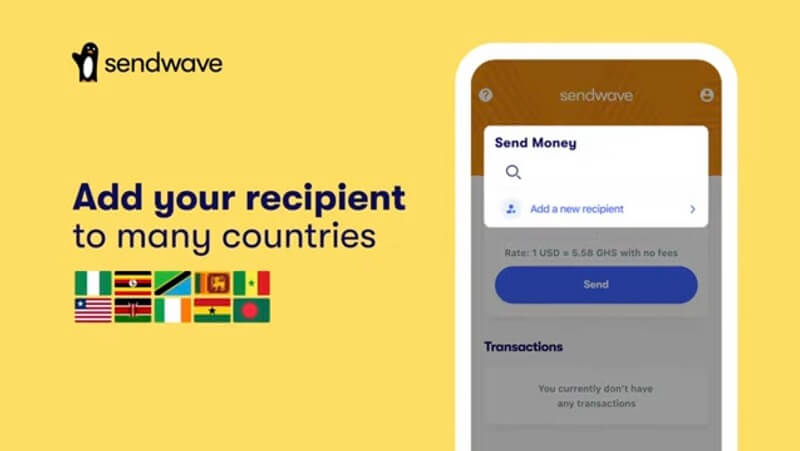

Sendwave allows you to make fast, affordable money transfers from countries in North America and Europe (USA, UK, Canada, France, Italy, Spain, and Ireland) to countries in Africa, Asia and Latin America.

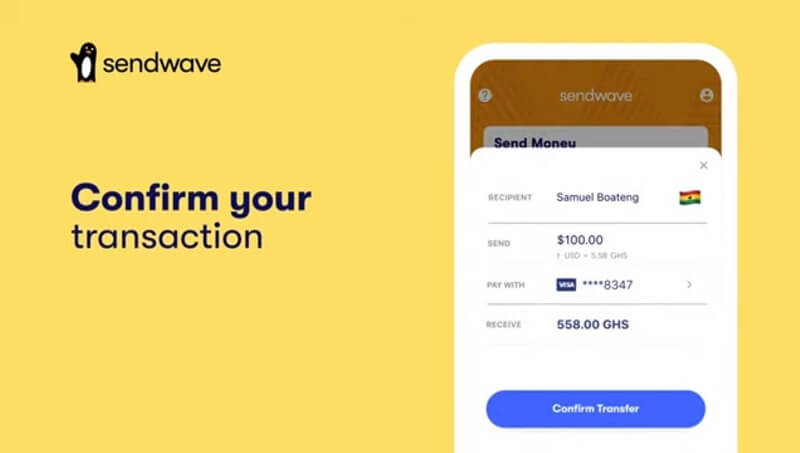

Using the Sendwave app, you can quickly send funds from Visa or MasterCard debit cards and PostePay cards in Italy and Correos cards in Spain. Sendwave also enables you to send to mobile wallets and bank accounts in multiple countries; more information can be found on country pages on the Sendwave website.

Sendwave enables international remittances to many countries in Asia, Africa and Latam. Using Sendwave, you can send and receive money using many flexible payment and delivery options.

Which countries does Sendwave operate in?

At this time, Sendwave allows sending international remittances from the United States, Canada, United Kingdom and several European countries to many global destinations across Asia, Latin America and Africa. Let us look into Sendwave's full country coverage below.

Where can I send money from with Sendwave?

You can send money with Sendwave from US, UK, Canada and a few European countries. The full list of active Sendwave sending countries is as below:

- Belgium

- Canada

- France

- Germany

- Ireland

- Italy

- Spain

- United Kingdom

- United States

This means that you can send money from the above countries in 4 currencies as listed below:

- British Pound (GBP)

- Canadian Dollar (CAD)

- Euro (EUR)

- US Dollar (USD)

Where can I send money to with Sendwave?

When it comes to destination countries that you can send money to Sendwave with, the good news is that you have several popular choices available across Asia, Africa and Latin America.

With Sendwave, you can send money to the following countries:

- Bangladesh

- Brazil

- Cameroon

- Colombia

- Congo DRC

- Congo-Brazzaville

- Côte d'Ivoire

- Dominican Republic

- Gambia

- Ghana

- Guatemala

- Haiti

- Indonesia

- Kenya

- Lebanon

- Liberia

- Madagascar

- Mali

- Morocco

- Nigeria

- Peru

- Philippines

- Senegal

- Sri Lanka

- Tanzania

- Thailand

- Uganda

- Vietnam

When it comes to supported destination currencies, below is the full list of Sendwave's target currency coverage:

- Bangladeshi Taka (BDT)

- Brazilian Real (BRL)

- Central African CFA Franc (XAF)

- Colombian Peso (COP)

- CFA Franc BCEAO (XOF)

- Dominican Peso (DOP)

- Gambian Dalasi (GMD)

- Ghana Cedi (GHS)

- Guatemalan Quetzal (GTQ)

- Haitian Gourde (HTG)

- Indonesian Rupiah (IDR)

- Kenyan Shilling (KES)

- Malagasy Ariary (MGA)

- Moroccan Dirham (MAD)

- Nigerian Naira (NGN)

- Philippine Peso (PHP)

- Sri Lankan Rupee (LKR)

- Tanzanian Shilling (TZS)

- Thai Baht (THB)

- Ugandan Shilling (UGX)

- Vietnamese Dong (VND)

- US Dollar (USD)

As you can see, Sendwave country and currency matrix allows you to send money from and receive funds globally in numerous countries and currencies.

Sendwave supports sending money between more than 250 country combinations and a matrix of about 88 currency combinations.

What are Sendwave's fees and exchange rates?

Sendwave generally provides competitive exchange rates and low fees in comparison to other global money transfer companies.

A great way to validate the above viewpoint is to actually look at some of Sendwave's money transfer exchange rates.

Let us embark on some case studies to see if Sendwave's exchange rates are good or not. Along the way, we will also do some helpful calculations to easily compare rates and fees.

Below is a summary of Sendwave's exchange rates and transfer fees for sending 1000 units of currency for some popular global remittance destinations.

| Country Pair | Transfer Amount | Exchange Rate* | Fees* | Payout | Mid-Market Rate** | FX Markup |

|---|---|---|---|---|---|---|

| USA to Brazil | USD 1,000 | 1 USD = 4.8400 BRL | USD 0.0 | 4,840.00 BRL | 1 USD = 4.9266 BRL | 1.76% |

| UK to Ghana | GBP 1,000 | 1 GBP = 14.7700 GHS | GBP 0.0 | 14,770.00 GHS | 1 GBP = 15.0237 GHS | 1.69% |

| Canada to Philippines | CAD 1,000 | 1 CAD = 39.4400 PHP | CAD 0.0 | 39,440.00 PHP | 1 CAD = 40.8061 PHP | 3.35% |

| Germany to Vietnam | EUR 1,000 | 1 EUR = 25,669.4500 VND | EUR 0.0 | 25,669,450.00 VND | 1 EUR = 26,101.2460 VND | 1.65% |

| Italy to Indonesia | EUR 1,000 | 1 EUR = 16,461.6000 IDR | EUR 0.0 | 16,461,600.00 IDR | 1 EUR = 16,734.7080 IDR | 1.63% |

*Exchange rates and fees as on December 09, 2023

**Mid-Market Rate from XE.com

See how we calculate FX Markup

Before you send money with Sendwave, you can check the exchange rate you will get by looking at the real-time online currency calculator on their site or in the app. This will help you estimate the funds your overseas recipient will get with your intended money transfer.

Are Sendwave exchange rates good?

For countries where there is no fee, like Ghana, Kenya, Tanzania, Uganda, and Bangladesh, Sendwave just makes a small percentage on the exchange rate that you see on the main page of the app. For countries where there is a fee, like Liberia, Sendwave aims to keep rates low and ensure sending remains affordable.

That said, as demonstrated by our case studies above for the corridors we sampled, Sendwave's exchange rate markup is generally around 1.5% or a little higher. To see the exact exchange rate that you will get, make sure to check their website or app.

Given the highly fluctuating nature of exchange rates, we recommend to our readers that they always do their full due diligence before sending their next money transfer. This means that you should always compare money transfer companies to ensure that you can make the most of your international remittances.

A very easy way to do this is by utilizing RemitFinder's real time money transfer comparison engine to easily compare numerous remittance service providers side-by-side.

Is Sendwave a cheap way to send money overseas?

Yes, Sendwave is certainly a very cost-effective way to send money overseas. This is because Sendwave charges no or low fees in all markets it serves, saving you tons of money each time you send.

Sendwave charges no fees in most markets they operate in. Where fees are charged, they are generally very low.

How do I avoid Sendwave fees?

Sendwave has little to no fees to begin with so there is not much extra that you need to do when you send money with them.

How much money can I send with Sendwave?

Every sender has maximum limits on how much they can send per day and per month. These are called sending limits.

You can view your Sendwave daily and monthly sending limits, as well as your usage, by going to the Menu and tapping on My Limits. If you are a sender in the US, UK or EU, you do not need to take any action to raise your sending limits. Your sending limits will be automatically raised as soon as you are eligible.

If you are a sender in Canada, once you are eligible to request higher sending limits, you can make a request through your My Limits page. The Sendwave team will review your request and get back to you as soon as possible.

It is also important to note that certain countries may impose their own restrictions on how much money you can send to them. For example, Thailand's domestic regulations enforce that you can only send up to THB 50,000 at a time in one transfer.

How long does it take for Sendwave to send money overseas?

Sendwave is able to move your money overseas fairly quickly, and the transfer speed depends on the delivery method you choose for your overseas recipient.

Here are Sendwave's transfer speeds for various delivery options:

- Mobile wallets: Usually within minutes, especially in Africa.

- Bank accounts: 1-3 business days, depending on the recipient's bank.

- Cash pickup: Within minutes once the recipient receives the voucher code.

Sendwave money transfers process very quickly. Mobile wallet transfers and cash pickups finish within minutes, and bank transfers within 1-3 business days.

How can I pay for my Sendwave money transfer?

When you send money abroad with a money transfer company, you have to fund your money transfer with them by paying for it. The methodology you use to pay for your money transfer is called a payment method.

Currently, Sendwave only accepts debit cards as a payment method for international money transfers.

You can use any Visa or MasterCard debit cards to send money with Sendwave. Often, local card providers are also supported such as PostePay cards in Italy and Correos cards in Spain.

Which payment method should I use to pay for my Sendwave money transfer?

At this time, Sendwave only accepts a debit card payment to fund your money transfer with them.

How can my recipient get paid with Sendwave?

A delivery method is the way you choose to pay your overseas recipient in their country.

Sendwave supports the following 3 delivery methods:

- Mobile wallet transfers in Kenya, Uganda, Tanzania, Ghana, Senegal, and Bangladesh.

- Bank account deposits in Kenya, Uganda, Nigeria, Bangladesh, and Sri Lanka.

- Cash pickups in Senegal at various Wave cash pick-up locations.

With Sendwave, you can pay your overseas recipients via mobile wallet transfers, bank deposits or cash pickups.

Which delivery method should I use for my Sendwave money transfer?

The choice of the best delivery method depends on your and your recipient's preferences and situation. For example, if your recipient does not have a bank account or does not want to share that information with you, you can choose mobile wallet transfer or cash pickup.

Similarly, if your recipient primarily uses their bank account for managing their money, you can deposit the funds directly in their bank account.

It is generally a good idea to discuss the best delivery option with your recipient so you both can pick what is best. With Sendwave, you have 3 popular delivery options to pick from - mobile wallets, bank deposits and cash pickups.

Are there any Sendwave coupon codes or promotions I can use?

Currently, there are no Sendwave coupon codes or deals available. If that changes, we will update our Sendwave review to add that information, so check back periodically.

Instead of checking for Sendwave deals and promotions manually, you can also sign up for the RemitFinder daily exchange rate alert. It is totally free to do so, and we will keep you updated with the latest promotions offered by money transfer companies.

How can I find Sendwave near me?

Sendwave is an online only money transfer company, so there are no office locations or branches to go to. You can simply download the Sendwave app, and start sending money right away.

Sendwave is a completely online money transfer service. There is no need to visit physical offices or branch locations to send money with Sendwave.

What is the best way to find an Sendwave Sending Location near me?

As Sendwave is an online business, you do not need to search for any branches or offices near you. Sendwave is always available on your phone whenever you need to send money!

What is the best way to find an Sendwave Payment Location overseas?

Sendwave moves money overseas electronically as well as via cash pickups. For electronic delivery - which includes mobile wallets and bank accounts - there is no need for your recipient to go to a physical location to pick up the funds.

For cash pickup transfers sent via Sendwave, you can pick a location convenient to your overseas recipient in the Sendwave app when you initiate your money transfer. The recipient can then go to the specific location with their ID and pick up the money you send to them.

Is Sendwave a safe way to send money abroad?

Sendwave seems to put strong focus on the security and safety of your funds and private information. Below, we share some ways that Sendwave ensures that it is safe for their customers to send money via their service:

- Sendwave does Know Your Customer (KYC) verification on new accounts to ensure that you opened your account yourself and not someone else. This may entail that you are required to share your government issued photo ID with Sendwave to prove your identity.

- Sendwave uses 256-bit encryption technology to handle and process every bit of data that you enter on their app. Any data you enter into the app is also encrypted on your mobile phone.

- Sendwave relies on technology solutions and services to proactively scan their systems for unauthorized access and fraudulent transactions. Keeping an eye on scams and suspicious activity enabled them to keep your account safe.

- Sendwave gives you the option to enable Two-Factor Authentication (2FA) to further secure your account. If you choose to, you can setup an SMS authentication mechanism in addition to your login credentials. This will make your account safer as you will need to enter an SMS for logging in and transacting.

- Sendwave provides dedicated support phone numbers and email addresses so you can contact them in case you notice or suspect any suspicious activity on your account. This enabled their security team to thoroughly check your account to ensure your safety.

- Sendwave and its affiliate companies are registered and regulated in every single country of operation. This helps ensure that Sendwave complies with local legal, regulatory and compliance requirements.

Sendwave implements a number of security best practices and related methods to keep your money and information secure.

Can I trust Sendwave?

In the last section, we inspected some ways in which Sendwave tries to create a secure environment for customers to transaction on their platform.

Another important aspect of you being able to trust a company is to ensure if they are properly registered and authorized to provide their services. This cannot be more important in the financial services sector where your hard-earned money is at stake.

Below, we provide information about Sendwave's legal and regulatory status for various countries they operate in:

- United States: Sendwave is registered as a Money Services Business in the US with the Financial Crimes Enforcement Network (FinCEN) and has licenses in pretty much all US states.

- United Kingdom: Sendwave is authorized as a payment institution in the UK by the Financial Conduct Authority (FCA).

- Canada: Sendwave is registered with and regulated in Canada by the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

- Europe: For its EU operations, Sendwave is licensed and regulated by the National Bank of Belgium (NBB) and has EU license passporting.

As a regulated money transfer business, Sendwave undergo frequent audits by regulatory organizations, financial watchdog institutions and independent reviewers in various countries of operation.

Additionally, Sendwave complies with General Data Protection Regulation (GDPR) and ensures the security of their users' data. The Sendwave mobile app is also Payment Card Industry Data Security Standard (PCI DSS) certified.

Finally, Sendwave is part of the Zepz Group which is a well-established international digital money transfer and remittance business.

Zepz is headquartered in London, UK and has regional offices in Australia, Belgium, Canada, Ethiopia, Japan, Kenya, Malaysia, Philippines, Poland, Rwanda, Singapore, Somaliland, South Africa, Tanzania, Uganda and the United States.

The Zepz Group enables customers located in more than 50 countries to send money to recipients in over 145 countries.

Sendwave is authorized, licensed and regulated in every country they operate in. Their services are regularly audited by regulatory bodies and independent reviewers.

How good is Sendwave's service?

An effective way to validate if a product or service is good or not is to see what existing customers have to say about it. We will do precisely this to see if customers like Sendwave or not.

What do users have to say about Sendwave?

Let us check Sendwave's ratings and reviews^ on popular review platforms as well as app stores to see what current customers think about their service.

- On the Google Play Store, Sendwave has a 4.8/5.0 rating with about 71,000 reviews and more than 1 million downloads

- Sendwave's iOS app is rated 4.7/5.0 on the App Store with about 31,000 ratings

- Sendwave has an excellent rating of 4.5/5.0 on Trustpilot with almost 13,000 reviews

^Ratings on various platforms as on December 14, 2023

Sendwave has excellent ratings on Trustpilot as well as Google Play Store and iOS App Store. Customers seem to like Sendwave's international money transfer service.

Have you used Sendwave yet? If so, please consider leaving a review on RemitFinder so other users can benefit from your expertise and experience.

Is Sendwave the best choice for me?

Based on our detailed inspection and analysis of Sendwave's international money transfer service, we find it advantageous in many areas. Here are some key strengths of Sendwave:

- Competitive exchange rates: Sendwave consistently offers some of the most competitive exchange rates in the money transfer industry. This means you get more foreign currency for your money, which is especially beneficial for larger transfers.

- Fast transfer times: Transfers with Sendwave are typically processed within minutes or hours, depending on the destination country. This is significantly faster than traditional methods like bank transfers, which can take days or even weeks.

- Low fees: Sendwave's fees are transparent and usually lower than traditional money transfer services. They also do not charge hidden fees or additional costs, making it a cost-effective way to send money abroad.

- Convenience: You can send money with Sendwave anytime, anywhere, using your phone or computer. This eliminates the need to visit a physical location or wait in line, saving you time and effort.

- Wide range of sending and receiving options: Sendwave allows you to send money to bank accounts, mobile wallets, and cash pickup locations in over 60 countries. This flexibility ensures your recipient can access the funds in a way that is convenient for them.

- Security: Sendwave uses bank-level security measures to protect your money and personal information. They are also a licensed and regulated financial institution, giving you peace of mind when transferring funds.

- Mobile app: Sendwave has a user-friendly app that makes it easy to manage your transfers on the go. You can track the status of your transfers, view your history, and add new recipients, all from your phone.

- Customer support: Sendwave offers 24/7 customer support through phone, email, and live chat. This ensures you can get help quickly and easily if you have any questions or issues.

RemitFinder likes Sendwave for providing customers with competitive rates, very low fees, flexible delivery methods, extremely fast money transfers and a secure way to send money.

What are the best reasons to use Sendwave?

Sendwave's strengths presented in the prior section render it a useful choice for quite a few international money transfer scenarios. Based on our detailed review of Sendwave's remittance services, we find it to be a good fit for many international remittance scenarios.

Here are a few scenarios where Sendwave may prove to be a good partner for your next international remittance.

- If your overseas recipient lives in some popular destinations across Asia, Africa and Latin America, Sendwave may be a good choice given their extensive coverage for many countries in those regions. See our earlier section about exact country and currency support to see if your destination is supported.

- We all want to send money overseas in a cost effective way, and if that is what you prefer, Sendwave can help as their transfer fees are either 0 or very low. This helps put more money in your overseas recipient's pocket.

- Sometimes you may need to rush money overseas for urgencies. If you are up against time, Sendwave can come to the rescue as their mobile wallet and cash pickup transfers finish within minutes. This means your recipient abroad can access the funds almost instantly.

- Sendwave helps you send money overseas using a multitude of delivery methods that include mobile wallet, bank deposit and cash pickup. This gives you and your recipient a lot of choice so you can both pick the best option based on your preferences.

- Since Sendwave is a fully online service, you do not need to go to any offices or locations. This means there is no need to deal with traffic or stand in lines. If you are a busy person with scarce time, Sendwave is a good choice as its always available on your mobile phone.

Sendwave's key strengths make it a potentially strong choice for many international money transfer use cases.

What type of transfers can I make with Sendwave?

You can use Sendwave to make international money transfers from US, UK, Canada and several European countries to many popular destinations across Africa, Latin America and Asia.

Sendwave transfers are lightning fast with mobile wallet and cash pickup transactions finishing within minutes, and bank deposits completing within 1-3 business days.

What are various ways to send money with Sendwave?

Sendwave offers a variety of ways to send money internationally, catering to different needs and preferences. Here is an overview of the types of transfers you can make with Sendwave based on supported delivery methods:

- Mobile Money: Send money directly to the recipient's mobile money wallet for instant access.

- Bank Account Deposit: Transfer funds to the recipient's bank account, usually within 1-3 business days.

- Cash Pickup: Send cash that your recipient can collect at a designated agent location with a voucher code.

How to send and receive money with Sendwave?

Sending money overseas using Sendwave is very simple, quick and easy. The whole process of sending money internationally can be completed in just a few minutes using Sendwave's mobile app. Check out the section below for exact steps to send an international remittance with Sendwave.

Step by step guide to send money with Sendwave

Here is how to send money internationally using the Sendwave app in a few simple steps:

- Step 1: Determine if you are ready to send money overseas with Sendwave. The first and most important step in sending an international money transfer is to decide which provider you want to go with. This can seem daunting especially due to the explosion of available choices for sending money abroad. A good answer to this problem is to compare various remittance service providers using RemitFinder's online money transfer comparison platform. RemitFinder does all the heavy lifting and helps you compare many money transfer companies side by side. This can help you fine tune your search based on your preferences and assist you in deciding which company to go with.

- Step 2: Download and install the Sendwave mobile app. Once you have chosen Sendwave as your preferred money transfer company, head to your phone's app store (Google Play or App Store for Android or iOS devices, respectively) and search for "Sendwave". Download and install the app.

- Step 3: Create a new Sendwave account. Open the Sendwave app and tap "Sign Up". Then, enter your phone number and choose a strong password. You will receive a verification code via SMS. Enter it to verify your account.

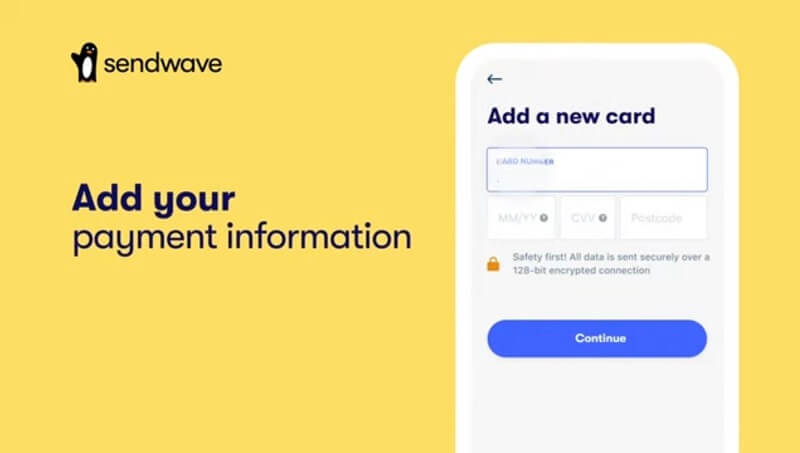

- Step 4: Link your debit card to your Sendwave account. Tap "Add Payment Method" and select "Debit Card". Enter your debit card details (name, number, expiry date and CVV). Sendwave will charge a small temporary amount (refunded later) to verify your card.

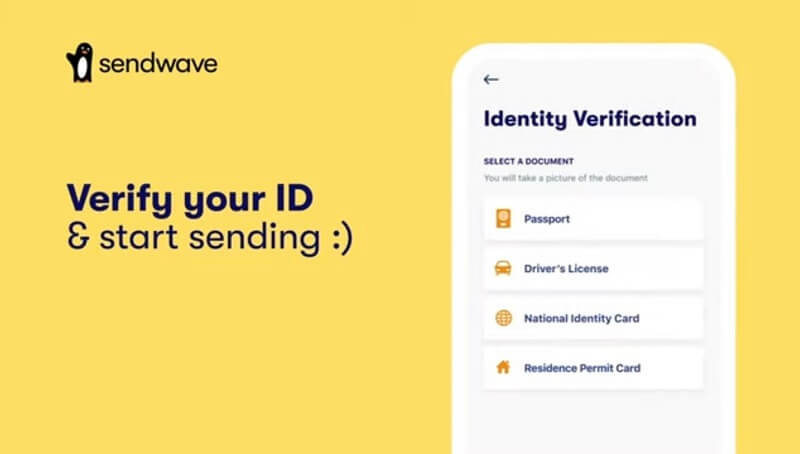

- Step 5: Verify your identity. For security reasons, Sendwave needs to verify your identity. Tap "Verify Identity" and choose your preferred method. For the ID Scan method, take clear pictures of your government-issued ID (passport, driver's license, etc.). For the Live Selfie method, take a real-time selfie with your ID held next to your face.

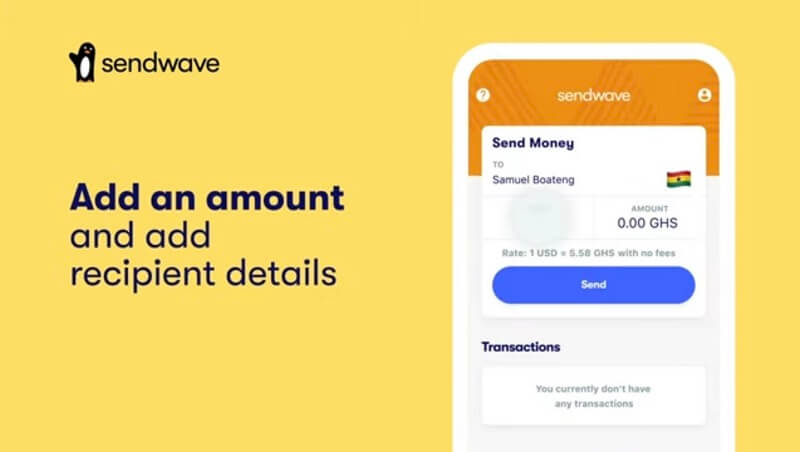

- Step 6: Add your overseas recipient details. Tap "Add Recipient" and enter the details: Recipient's full name, Country, Phone number (optional for some countries), Bank account details (for bank deposits) or mobile money details (for mobile wallets).

- Step 7: Start your new money transfer. Select the recipient you want to send to. Enter the amount you want to send (minimums and maximums may apply). Review the fees and exchange rate. Once you are satisfied with all the presented information, tap "Send" and confirm the transfer.

- Step 8: Track your money transfer. You will receive updates on the transfer status via SMS and the app. The recipient will also be notified as the transfer progresses.

From this point on, you are done. If all goes smoothly, Sendwave will process your money transfer and credit the funds to your chosen overseas recipient.

Guide to receive money with Sendwave

Receiving money with Sendwave depends on the chosen delivery method. Here is all you need to know if you are the recipient of a Sendwave international money transfer:

- Cash Pickup: If your sender sent you money using the Cash Pickup delivery method, you will receive a unique voucher code and a one-time password via SMS. Once you have that information, visit a designated cash pickup location (e.g., partner agent, bank branch, etc.). You will need to present the voucher code, password, and a valid ID to claim the money.

- Mobile Money: If you are receiving money sent via a Sendwave transfer directly to your mobile phone, the money is directly deposited into your mobile money wallet. You will receive an SMS notification and can access the funds instantly.

- Bank Deposit: For money transfers sent via a Bank Deposit delivery method, you will receive the money directly into your bank account. The transfer typically takes 1-3 business days, depending on the bank. You will receive a notification from your bank when the money arrives.

You can send and receive money internationally using the Sendwave mobile app quickly and easily with a simple and streamlined money transfer flow.

How can Sendwave help me send money?

Sendwave has several helpful resources to get you started on your first money transfer with them. The most useful of these are their country-specific pages that you can use to learn more about specific remittance corridors supported by Sendwave.

Do I need a Sendwave account to receive money?

If you are the recipient of an international Sendwave money transfer, you do not need a Sendwave account to receive the money sent to you.

This is because none of Sendwave's delivery methods - mobile wallet, bank deposit or cash pickup - necessitate you to have a Sendwave account.

The overseas recipient of a Sendwave international money transfer does not need to have a Sendwave account to access the funds sent to them.

Does Sendwave have a mobile app?

Sendwave is primarily accessible via their mobile app to send money overseas. The app is available on both the Google Play Store for Android devices as well as the iOS App Store for iOS devices.

Sendwave does have a website as well, but currently it is not possible to create an account and send money via it. That said, you can use the website to get a real time exchange rate quote and browse various helpful content.

How do I track my Sendwave transfer?

You will receive updates on the transfer status via SMS and the app. The recipient will also be notified as the transaction progresses forward.

Can I use Sendwave for international bank transfers?

Yes, you can use Sendwave for international bank transfers. Sendwave allows you to send money from your bank account in the US, Canada, UK, and EU to bank accounts in over 60 countries across Africa, Asia, and Latin America.

To realize an international bank transfer with Sendwave, simply pay for your transfer via your debit card linked to your bank account and choose bank deposit as the delivery method for your overseas recipient.

In this way, the funds move from your local bank account in your country of residence to the international bank account of your recipient in their country. The advantage, though, is that you avoid bad exchange rates and high fees charged by banks, and avail Sendwave's competitive exchange rates and low fees instead.

Is Sendwave online better than sending money in-person in stores?

Yes, sending money online with Sendwave is much better than cash transfers at stores, and here is why:

- Convenience: Send money anytime, anywhere with just your phone or computer.

- Competitive exchange rates: Often better rates than traditional money transfer services or in-person stores.

- Faster transfer times: Money can reach the recipient within minutes, depending on the country.

- Lower fees: Sendwave's fees are generally transparent and lower than many in-person options.

- Security: Sendwave uses bank-level security to protect your information and money.

- Track transfers: Monitor the status of your transfer in real-time through the app.

- More sending and receiving options: Send to bank accounts, mobile wallets, and cash pickup locations in many countries.

Sending money digitally via Sendwave mobile app is faster, cheaper and more convenient than cash transfers done at stores.

Does Sendwave have a rewards program?

Currently, Sendwave does not have a rewards or loyalty program. If that changes, we will update this detailed review of Sendwave's international money transfer service.

What customer support options are available with Sendwave?

Sendwave offers several customer support options to ensure you have assistance whenever you need it. Below, we provide a rundown of various choices at your disposal to get help when you are stuck or have questions.

Phone Support

Sendwave's phone support is available 24x7, and you can reach a live representative any day, any time for immediate help. Sendwave provides dedicated phone numbers for USA/Canada, UK, Italy, Ireland, and Spain. Additionally, there are also toll-free numbers available so you can make support calls for free within respective countries.

Here are Sendwave's country-specific customer support phone numbers:

- US and Canada: +1 888 966 8603

- Portuguese speakers in US and Canada: +1-877-585-0803

- UK: +44 113 320 7935

- Italy: +39 02 3057 8468

- Ireland: +353 1800 949 226

- Spain: +34 900 998 284

- France: +33 5 19 74 15 37

- Belgium: +32 78 07 92 65

- Germany: +49 800 181 2030

Email Support

If you wish to reach out to Sendwave customer support team via email, you can reach out to them anytime and someone will get back to you.

The primary Sendwave email address available for various support requests is help@sendwave.com.

Mobile App Support

Sendwave also provides support within their mobile app. This is a very convenient feature since you send money abroad using Sendwave's mobile app. Here are your options to get in-app support:

- Live Chat: Access real-time assistance directly within the Sendwave app.

- In-app FAQs: Find quick answers to common questions without leaving the app.

Contact Us Form

Another convenient way to get in touch with Sendwave's customer support team is by filling up a web form on their website. You can list your issue, add your transaction number and even add attachments to the support form.

Sendwave Help Center

Finally, there is also a detailed help center available on the Sendwave website. Using the Help Center, you can browse through comprehensive articles and FAQs covering various topics.

Sendwave provides a variety of ways to get in touch with their customer support team. Options include 24x7 phone support, in-app support, email and web form.

Can I cancel my Sendwave transfer?

You can cancel your Sendwave money transfer, but only before the transaction is settled and final. The latest stage to cancel is usually after fraud checks, etc. have been conducted, after which, it might be too late.

If you have made a transfer in error and need to cancel, make sure to reach out to Sendwave customer support team immediately.

How do I delete my Sendwave account?

You can easily delete your Sendwave account from within the app. Simply visit your profile section in the app to request account deletion.

Note that you will lose access to your account after its deleted, so make sure to make a copy of your transaction history for future reference.

Additional Information

Legal and Regulatory Compliance

Sendwave is legally authorized to operate in every country they are in. Below is pertinent licensing and regulatory information for various countries:

- Sendwave is licensed in most US states and is registered as a Money Services Business in the US with the Financial Crimes Enforcement Network (FinCEN).

- In the UK, Sendwave is an authorized payment institution registered with the Financial Conduct Authority (FCA).

- Sendwave is regulated in Canada by the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

- Sendwave is licensed by the National Bank of Belgium (NBB) for its European business operations and has EU license passporting.

Sendwave also complies with General Data Protection Regulation (GDPR) and their mobile app is Payment Card Industry Data Security Standard (PCI DSS) certified.

Along with WorldRemit, Sendwave is part of the Zepz Group which is headquartered in London, UK and has regional offices in Australia, Belgium, Canada, Ethiopia, Japan, Kenya, Malaysia, Philippines, Poland, Rwanda, Singapore, Somaliland, South Africa, Tanzania, Uganda and the United States.

Reviews

Why are you deceiving us here when the exchange rate on your app is far lower? We used to trust you. You should work hard to keep that trust.