Viamericas Detailed ReviewRates, Fees, Limits, Safety and More

Last updated: August 08, 2022

What is Viamericas? An introduction

Viamericas company information

Viamericas was founded in 2000, and is headquartered in Bethesda, Maryland, USA, specializing primarily in money transfers and remittances from (and only from) the United States to Latin America, the Philippines, Africa and India.

The company has grown exponentially since its inception and currently not only offers various direct services to its customers, but also a series of products that can be contracted by other companies.

Viamericas was ranked #1 in the years 2012 and 2016 as the best among 30 remittance companies in the surveys carried out by InterAmerican Dialogue, where aspects such as the speed and security of the service were consulted; also, fees, rates, geographic distribution, shipping and payment points.

Viamericas also offers check processing, long distance calls, and mobile recharges through thousands of authorized agents within the United States (the company is licensed in all 50 states and DC). From each of them you can send remittances to more than 100,000 pick-up points in more than 50 countries, according to the company's website. Although we only managed to certify operations in 27 countries.

Viamericas has more than 20 years' experience in the financial services industry, and provides numerous solutions that include money transfers, mobile recharges and check processing.

Viamericas by the numbers

Below are some statistics that help highlight the global scale of Viamericas' business and operations.

- More than 100,000 payment locations internationally

- Operations in more than 50 countries

- 22 years and counting in the financial services industry

- Licensed to operate in all 50 US States

- Send money 24 hours a day, 7 days a week

What services does Viamericas provide?

Viamericas offers a series of financial services and products that range from being used within the United States, to the main services for which the company is internationally known, such as sending money or remittances.

At any of the authorized agents within the United States, Viamericas offers you the possibility of making long distance calls, mobile top-ups, bill payment and B2B check processing.

In addition, Viamericas offers a series of products available to clients and other companies that need to contract services or those that wish to be part of the network of authorized agents within the United States.

These are the mainstream products and services offered by Viamericas:

Vianex

Vianex is the digital remittance platform backed by Viamericas, created to facilitate the process of sending money from the United States to different countries around the world. With Vianex, Viamericas wanted to create a specialized, secure and efficient channel that would only be dedicated to sending remittances and is a fundamental part of the company's ecosystem. Plus, it blends nicely with the other products to create an optimal customer experience.

ViaConnect

ViaConnect is the Application Programming Interface (API) that unites the different services offered by Viamericas. It is an integrated system that interconnects with Vianex. ViaConnect is the API that works for the initial process of receiving money for any of the services (bill payment, long distance calls, remittances, etc.).

ViaPay

ViaPay is another Application Programming Interface designed for the payment and delivery of remittances sent from the United States and other types of payments. It is a system with which those who are interested in becoming Viamericas payment agents can easily integrate and become part of the company.

ViaCash

ViaCash is an interface designed for Viamericas authorized agents. ViaCash brings together all the products and services offered by the company and that may now be available to your customers. With a friendly and easily accessible interface, your customers can access remittances, mobile top-ups, bill payments, etc. And this is a product that is also combined with ViaCheck.

ViaCheck

ViaCheck is a hardware device used for you to deposit your checks without going to the bank. You simply need to locate a Viamericas point and there you can deposit your check safely. Your check is instantly scanned and verified.

As a tool it is of great help to avoid trips to the bank; it is fast, safe and offers advantages both for the client who deposits his check, as well as for the associate with Viamericas, who can offer this service to his clients with total security.

ViaCheck uses the software network that connects Viamericas with the rest of the products and services.

ViaSafe

ViaSafe is a security device that works like a mobile safe that serves both customers who wish to make their deposits in cash, without having to go personally to the bank but to a nearby Viamericas agent.

But this device can also be used by the owners and the staff of the store or authorized agent to safeguard the cash payments they receive.

The mechanism is easy to use: the money is introduced and the client obtains a receipt that is documented and has the support and security of Viamericas. The money is immediately deposited into the account of your choice within the United States.

While the ViaSafe device is removed and handled by security personnel and transferred in an armored truck.

ViaModal

In 2017, Viamericas partnered with Union Plus, the service founded by the AFL-CIO, which since 1986 has offered a variety of financial services to more than 12 million union members, to launch a new service called ViaModal.

ViaModal provides the remittance and money transfer service exclusively for union members. It is not a service open to the public.

Viamericas provides numerous services that include money transfers, mobile recharges, check processing and others, and can be your one stop solution for all financial services needs.

In the following sections, we will provide a detailed analysis of Vianex, which is the primary money transfer business operated by Viamericas. The following detailed review of Vianex will touch upon numerous aspects of international money transfers that you may find beneficial.

What is Vianex? An introduction

Vianex is a digital platform created and managed by Viamericas to handle money transfers, check processing (within the United States) and the entire remittance system that has been Viamericas' main service since it was founded.

You can send remittances from the United States to 28 countries. Although the corporate website of the parent company, Viamericas, mentions 50 countries, we could only verify the possibility of sending money to 28 countries, distributed in Latin America and Asia.

Vianex has been an ambitious project for Viamericas and in 2016 the company dedicated all its efforts to create a platform that offered via web, app and different APIs (application programming interface). As explained on the Viamericas corporate website, Vianex is "a trade name for Viamericas Corporation, Viamericas Financial Services Corporation, Viamericas New York Corporation, and Viamericas Money Services Corporation, as applicable".

In this way, Vianex became the axis of the Viamericas remittance system and its technological, security and efficiency advances were recognized by Digital Edge 50, thanks to the creation of the new Vianex digital brand.

Vianex's parent company, Viamericas, claims on its website to have exceeded "USD 31 billion in successful international money transfers". And since its launch, Vianex has centralized the Viamericas remittance channel, facilitating and streamlining the processes of sending money to different countries.

Vianex is the primary international money transfer business operated and owned by Viamericas.

Which countries do Vianex and Viamericas operate in?

Vianex has operations in 28 countries throughout Latin America and Asia, as well as in Australia and Canada.

With a very extensive network of more than 100,000 payment points where you can pick up cash from remittances. But additionally, in all these countries, Vianex has B2B shipping services available in thousands of associated banks.

All this is apart from the services and products we mentioned above and that are only available within the United States.

Where can I send money from with Vianex and Viamericas?

If you want to send money to any of the 28 Vianex remittance receiving countries, you can only do so if you are within the United States (either from your bank account, in cash, or using debit or credit cards).

Remittances cannot be sent through Vianex from any other country.

Where can I send money to with Vianex and Viamericas?

Vianex's market coverage is vast and the company ensures that you can send remittances from the United States to 28 countries across Latin America and Asia, plus Australia and Canada. Below is the list of supported countries you can send money to with Vianex:

- Latin America: Mexico, Argentina, Colombia, Bolivia, Brazil, Peru, Chile, Haiti, Costa Rica, Uruguay, El Salvador, Dominican Republic, Ecuador, Honduras, Guatemala and Nicaragua.

- Asia: Bangladesh, Indonesia, Philippines, Vietnam, South Korea, Malaysia, Hong Kong, People's Republic of China, India and Nepal.

- Other: Australia and Canada.

As you can see from the above list, Vianex covers almost all Latin American countries, as well as several Asian countries.

With Vianex, you can send money from the US to 28 countries across Latin America and Asia, as well as to Australia and Canada.

It is very easy to know exactly which countries you can send money to: by accessing either the Vianex app or its website. It is worth clarifying that although Vianex mentions that money can be sent to 28 countries, when we did the rigorous tests, only 26 countries are shown in the company's search engine.

In addition, you can check the rates and Exchange Rate and compare directly with the offers of other remittance companies from the APP or the Vianex website. There you will find the commissions that you must pay and depending on the money that you will send from the United States, how much the recipient will receive in the selected country.

What are Vianex's and Viamericas' fees and exchange rates?

Vianex tends to provide competitive exchange rates for the markets they operate their money transfer business in. But let's put this to the test by examining their exchanges rates.

Below, we will check Vianex's exchange rates to send money from the US to a few countries. We will use USD 1,000 as our transfer amount, and assume we are doing a bank transfer to pay for our money transfer. We will also run some calculations that will help us see if Vianex exchange rates are good or not.

| Country Pair | Transfer Amount | Exchange Rate* | Fees* | Payout | Mid-Market Rate** | FX Markup |

|---|---|---|---|---|---|---|

| USA to India | USD 1,000 | 1 USD = 78.8000 INR | USD 9.99 | 78,012.7880 INR | 1 USD = 79.4085 INR | 1.76% |

| USA to Mexico | USD 1,000 | 1 USD = 20.2800 MXN | USD 2.99 | 20,219.3628 MXN | 1 USD = 20.4384 MXN | 1.07% |

| USA to Brazil | USD 1,000 | 1 USD = 5.1100 BRL | USD 2.99 | 5,094.7211 BRL | 1 USD = 5.1660 BRL | 1.38% |

| USA to Dominican Republic | USD 1,000 | 1 USD = 53.7200 DOP | USD 19.50 | 52,672.4600 DOP | 1 USD = 54.7798 DOP | 3.85% |

| USA to Philippines | USD 1,000 | 1 USD = 54.9400 PHP | USD 2.99 | 54,775.7294 PHP | 1 USD = 55.5975 PHP | 1.48% |

*Exchange rates and fees as on August 07, 2022

**Mid-Market Rate from XE.com

See how we calculate FX Markup

To get a real time exchange rate quote from Vianex, simply go to their website or app, and punch in your target country and transfer amount. Then choose target currency, and how you want to send the money (bank deposit or cash pickup). Based on your input entries, Vianex will present a real time quote for the exchange rate for your chosen country combination.

When it comes to money transfer fees charged by Vianex, below is a summary of fees for a USD 1,000 transfer for some of the above corridors broken down up payment method.

| Country Pair | Payment Method | Transfer Fees^ |

|---|---|---|

| USA to India | Bank Account | USD 9.99 |

| USA to India | Debit Card | USD 34.99 |

| USA to India | Credit Card | USD 34.99 |

| USA to Mexico | Bank Account | USD 2.99 |

| USA to Mexico | Debit Card | USD 27.99 |

| USA to Mexico | Credit Card | USD 27.99 |

| USA to Brazil | Bank Account | USD 2.99 |

| USA to Brazil | Debit Card | USD 27.99 |

| USA to Brazil | Credit Card | USD 27.99 |

^Fees as on August 07, 2022

As you can see from the above table, the fees can be really high if you choose Debit and Credit card to fund your Vianex money transfer.

Vianex and Viamericas exchange rates tend to be competitive, but transfer fees can be high especially if you pay by cards.

Are Vianex and Viamericas exchange rates good?

Vianex and Viamericas tend to provide fairly competitive exchange rates in the 28 markets that you can send money to with them. If you are ready to send money and want to get a quote, use the real time calculator on their website to get the current exchange rate for that day.

Based on our case studies above, there does seem to be a variation in the exchange rates provided by Vianex and Viamericas based on the chosen destination country. Vianex tends to charge an FX markup from as low as 1.07% to as much as 3.85% depending on where you send money to.

Given this, we recommend you always do your due diligence before you send money home. Comparing various money transfer companies with Vianex and Viamericas will arm you with the knowledge to make better decisions.

An easy and convenient way to accomplish this goal is by relying on our real time money transfer comparison platform to easily compare many money transfer companies in a single, easy to understand view.

Are Vianex and Viamericas a cheap way to send money overseas?

Based on our analysis, Vianex and Viamericas are not always the cheapest ways to send money internationally.

Vianex fees tend to be pretty high, especially if you choose to pay for your money transfer with them using a Debit Card or Credit Card. Bank account transfer fees tend to be lower, so you should choose that option if you can.

We recommend you pay for your Vianex money transfer with a bank account so you pay lower fees. Avoid card payments as they have very high fees.

How do I avoid Vianex and Viamericas fees?

There is no way to avoid Vianex transfer fees in general. However, there could be seasonal promotions from time to time using which you can send money with lower or sometimes 0 fees.

How much money can I send with Vianex and Viamericas?

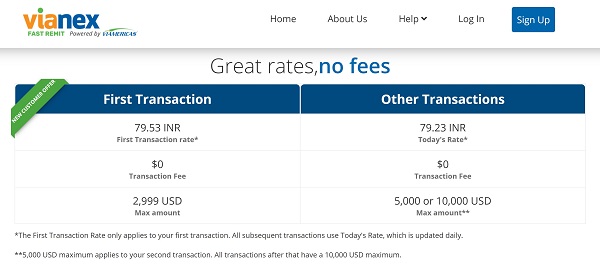

The amount of money available to send from the United States depends on each destination country. For example, Vianex's general upper limit for the first transaction is USD 2,999. For the second transaction, you can send a maximum of USD 5,000 and the transactions that are generated after the second one have a maximum sending limit of USD 10,000.

The minimum sending amount varies by target country. For example, if you are sending to Mexico, the minimum amount is USD 180. And for India, the minimum transfer amount is only USD 10.

How long does it take for Vianex and Viamericas to send money overseas?

Vianex has a fast service so that your recipient receives the remittances sent in a quick and safe way. Transfer speed depends on the way you sent the funds (cash, credit/debit card or bank account) to Vianex, when Vianex has the confirmed funds and the delivery method you chose (either cash pick up or direct bank transfer).

Many Vianex money transfers finish within minutes. The rest can take up to a maximum of 3 days.

Vianex is a fast way to send money abroad with many money transfers finishing within minutes.

How can I pay for my Vianex and Viamericas money transfer?

With Vianex and Viamericas, you can pay for your money transfer in a variety of flexible ways. These include the below:

- Pay with cash by going to one of the agents associated with Vianex in the 50 states of the United States.

- Pay with your US bank account by making a bank transfer to Vianex.

- Pay with a Debit card.

- Pay with a Credit card.

How can my recipient get paid with Vianex and Viamericas?

In the remittance industry, the term delivery method implies the manner in which you want to pay your overseas recipient. In any of the more than two dozen countries where Vianex offers international money transfer services, the recipient can receive their money in one of the following ways:

- Get money directly into their bank account

- Go to a payout agent where they will pick up the funds in cash

Are there any Vianex and Viamericas coupon codes or promotions I can use?

Vianex usually offers different promotions in many of the countries that are part of its network.

For example, if you send money to India with Vianex, you get a higher promotional exchange rate with no transfer fee for the first transaction of up to maximum USD 2,999. Subsequent transactions will be sent at the regular, non-promotional exchange rate.

Below is a screenshot of the aforementioned promotional exchange rate to India offer from Vianex.

How can I find Vianex and Viamericas near me?

A convenient way to send and receive your money transfers with Vianex and Viamericas is by going into their physical office or agent location. Before we look into how to locate a Vianex or Viamericas location near you, you should be aware that there are 2 types of branches available; these are as below:

- Agent locations in the US: You can use these to go into an office and work with staff to start your money transfer in person, including paying with cash for your transaction.

- International pickup location: Your recipient overseas can go into an overseas branch or agent office to pick up cash for the money you send to them using Vianex.

Vianex offers easy ways to find an agent near you. You can find your nearest Vianex using their mobile app or the website, and also by calling toll free at (800) 401-7626 at the following times: 8:00 a.m. to 10:30 a.m. Monday-Saturday, and Sunday: 9:00 a.m. to 10:30 p.m. (Eastern Time). An operator will assist you located the nearest Vianex.

What is the best way to find Vianex and Viamericas Sending Locations near me?

Vianex has numerous locations within the US to help you send money in person at a branch or office. To find a nearby Vianex or Viamericas office, simply go to the Vianex website and click on the locations tab.

Currently, Texas locations are listed online. For Vianex offices near you in other states, you can call their customer support.

Why should I go to a Vianex and Viamericas Sending Location to send money in person?

Going into a Vianex branch or location to send money has the following advantages:

- If you want to pay for your money transfer via Cash, you can do so in a Vianex agent location.

- If you need help with your money transfer, you can walk into a nearby Viamericas branch and someone will assist you.

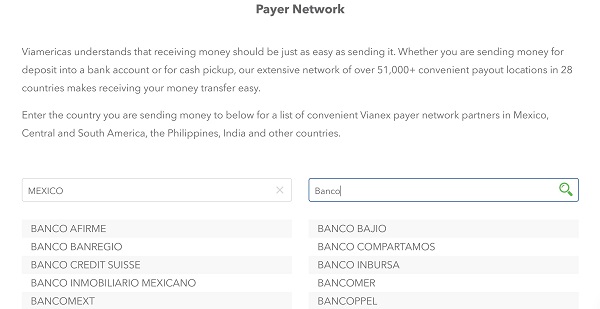

What is the best way to find a Vianex and Viamericas Payment Location overseas?

The easiest way to locate a Vianex international pickup location is by using their app or website to do so. Alternatively, you can also call their customer support and they will help you with your request.

To find the nearest Vianex payment location overseas, simply enter your country on the Locations page on the Vianex website, and filter from available locations. See the below screenshot for how this looks like when searching for locations in Mexico.

Are Vianex and Viamericas a safe way to send money abroad?

As money transfer companies that have been in business for more than 2 decades, Viamericas and Vianex have put in various measures in place to ensure the safety and security of their customers' money and information. Some of these measures include:

- Focusing on anti-money laundering (AML) and anti-terrorism funding activities by creating programs to prevent misuse of Vianex money transfers for such nefarious purposes.

- Taking compliance and security seriously, and constantly monitoring systems to detect and prevent unauthorized access.

- Continuously inspecting the transactions that happen using the Vianex systems.

- Scrutinizing and training agents and partners who are part of the Vianex and Viamericas overall network.

- Investing in ongoing training of staff to ensure they are updated with latest security policies, and are adept at spotting potentially fraudulent activities.

- Ensuring annual reviews happen to keep security policy and compliance up to date at all times.

Can I trust Vianex and Viamericas?

Vianex, and Viamericas, are fully licensed and regulated to operate as money transfer businesses in numerous US states. Additionally, Vianex meets all the security statuses required by the U.S. Department of Treasury's Financial Crimes Enforcement Network (FinCen), in addition to being backed by SecureTrust's Trusted Commerce, which governs data security systems in the credit card industry (PCI DSS).

Vianex and Viamericas implement many security best practices, and are registered with and authorized by many US states to send money.

Make sure to check Vianex's and Viamericas' licensing information for your state before you send money with them; such information is readily available on their website.

How good is Vianex's and Viamericas' service?

In general, the services and products offered by Vianex and its parent company Viamericas seem very good and cover a wide range both for residents of the United States and the exclusive remittance service from the United States to Latin American and Asian countries. In addition, they seem to offer very competitive rates and promotions in the industry.

What do users have to say about Vianex and Viamericas?

A good indicator of how good a product or service is to check reviews from other customers like you who have used the said service in the past. However, we could not find any ratings and reviews for Vianex and Viamericas online on Trustpilot, a popular online platform for business ratings and reviews.

Are Vianex and Viamericas the best choice for me?

Vianex and Viamericas can be a decent choice, especially when sending money to Latin America, a market that they have tried to specialize in. Having been in the financial services industry and the money transfer business for decades, you should definitely check their service out as a potential good option.

However, it is always a great idea to see what other options you have before you decide which company to send money with.

What are the best reasons to use Vianex and Viamericas?

Vianex and Viamericas has become a viable option to send money overseas, especially to Latin American countries. Here are some reasons why you could potentially choose them for your next international money transfer:

- Deep industry experience: Viamericas has been around since 2000, and has more than 22 years' experience in the financial services industry. Vianex has also been around for more than a decade and specializes in international money transfers.

- Competitive exchange rates: Vianex and Viamericas offer competitive exchange rates. That said, watch out for fees that can be very high, especially if you pay for your money transfer with a debit or credit card.

- Flexible payment methods: You can pay for your money transfer with bank account transfer, or debit and credit cards. Additionally, you can walk into a Vianex agent office and pay with cash as well.

- Wide network of pickup locations: Vianex and Viamericas have more than 51,000 agent locations across 28 countries worldwide. This makes it very easy and convenient for your overseas recipients to go to a nearby Vianex location and pickup cash.

- Safe and secure: Vianex and Viamericas seem to take the security of your funds and information seriously. They are also licensed and regulated money transfer companies within most US States.

- Robust customer support options: There are numerous ways to contact Vianex customer support team if you need to; these include phone, email, fax, filling an online form or even sending mail to their address.

We always recommend that you do more research and look at other money transfer companies as well before you make your final decision. The more knowledge you have, the better decisions you can make.

What type of transfers can I make with Vianex and Viamericas?

Using Vianex and Viamericas, you can make 2 main types of money transfers. These are bank account transfers and cash pickup. Depending on the preferences or situation of your recipient, you can choose one or the other.

Sometimes, for example, your recipient may not have a bank account. In such scenarios, Vianex and Viamericas can be a good choice as they have an extensive payout network with more than 51,000 cash pickup locations across 28 countries. The chances of your overseas recipient finding a close by Vianex location are, therefore, pretty high.

What are various ways to send money with Vianex and Viamericas?

You can send money internationally with Vianex and Viamericas in any of the following ways:

- Using the Vianex website

- Using the Vianex mobile app

- Going into a Vianex agent location to send money in person

Generally, we recommend online money transfers as they are quick, convenient and easy to use from the comfort of your home or office, but one scenario where you may want to send money in person at a Vianex agent location would be if you wanted to pay for your money transfer with cash. In that case, you could find a nearby Vianex location and work with an employee to make your international money transfer.

How to send and receive money with Vianex and Viamericas?

Vianex's technology makes the process of sending money transfers quick and easy. We suggest you download the app, either for Android or IOS, register (you must reside in the United States and be over 18 years of age), find out if the country where you want to send the money is available and then enter the data of the receiver of the money and select the payment method you will use.

How can Vianex and Viamericas help me send money?

Vianex has helpful resources available on their website that can help you get started in sending money with them. There is also a useful Frequently Asked Questions (FAQ) section available that should answer some of your initial questions.

If you need further assistance, you can get in touch with Vianex's customer support team, and they will help you with your questions.

Do I need a Vianex or Viamericas account to receive money?

No, you do not need to open a Vianex account to withdraw money in your country, as you will only have access to the Vianex platform if you reside within the United States. Just present your identification document and the identification number of the transfer that will be sent to you via email. This, in case of a cash pick up.

If the transfer has been made to your bank, you will receive the money directly to your account.

Your recipient does not need a Vianex or Viamericas account to receive money overseas.

Do Vianex and Viamericas have a mobile app?

Vianex has an app that has been awarded in 2017 by Digital Edge 50.

The Vianex app offers direct access to all its products and services and is the easiest way to manage your remittances from the United States.

How do I track my Vianex and Viamericas transfer?

You can easily track your money transfers with Vianex using their website or mobile app. Simply go to your transaction history to see the latest status of your transaction.

Vianex and Viamericas will also keep you posted anytime your money transfer changes status.

Can I use Vianex and Viamericas for international bank transfers?

You can effectively simulate an international bank transfer when you send money with Vianex and Viamericas. To do this, simply choose both your payment and delivery options as bank transfers.

In this way, money comes out of your US bank account since you pay Vianex with that. Similarly, your recipient receives the funds in their overseas bank account.

Compared to traditional bank transfers, you may actually get a better exchange rate and pay lower fees with Vianex and Viamericas.

Are Vianex and Viamericas online better than sending money in-person in stores?

Vianex and Viamericas online services are a quick and convenient way to send money overseas to your loved ones. This is because not only online is always available 24x7, but also since you can make online transactions from your home or office without standing in lines.

The only reasons to go into a Vianex or Viamericas agent location or office would be if you wanted to pay for your money transfer with cash, and if you feel more comfortable sending money in person with someone assisting you. If you prefer that, there are plenty of nearby Vianex and Viamericas agent locations that you could go to.

Do Vianex and Viamericas have a rewards program?

Vianex offers rewards programs and promotions exclusively for Union Plus members (only in the United States), with a 10% discount on remittance services and fees around $4.99 for money transfers abroad.

What customer support options are available with Vianex and Viamericas?

In case you run into any problems with your money transfer, or simply have any questions to ask, it is quite simple to get hold of someone at Vianex and Viamericas to assist you. Use any of the below options to contact the Vianex customer support team:

- Phone: (800) 401-7626. Call during any of the following hours - Monday-Saturday: 8:00 AM to 10:30 PM, and Sunday: 9:00 AM to 10:30 PM (Eastern Time).

- Email: customerservice@viamericas.com

- Fax: (866) 842-6374

- Mailing Address: 7910 Woodmont Avenue, Suite 220, Bethesda, MD 20814

- Website: You can fill up a form on the Vianex website on their Contact Us page.

Can I cancel my Vianex and Viamericas transfer?

You can cancel your transfer made with Vianex, as long as the money has not already been deposited in another account or the funds withdrawn by the recipient. To cancel your transaction, you must contact customer service, calling 800-401-7626 and notifying your Pickup Number.

How do I delete my Vianex and Viamericas account?

If you wish to delete your Vianex or Viamericas account, simply get in touch with their Customer Support team, and someone will assist you with your request.

Note that account deletion will mean losing access, so make sure to back up your transaction history before you make your account deletion request.

Additional Information

Legal and Regulatory Compliance

- Licensed and regulated to operate as money transfer businesses in numerous US states.

- Compliant with the U.S. Department of Treasury's Financial Crimes Enforcement Network (FinCen) regulations.

- Backed by SecureTrust's Trusted Commerce, which governs data security systems in the credit card industry (PCI DSS)

Awards, Prizes and News

- Vianex technological, security and efficiency advances recognized by Digital Edge 50 in 2017.

- Viamericas was ranked #1 remittance company in 2012 and 2016 by InterAmerican Dialogue