OFX Detailed ReviewRates, Fees, Limits, Safety and More

Last updated: October 07, 2022

What is OFX? An introduction

OFX company information

OFX was founded in 1998 originally as OzForex to make sending money from Australia cheaper and faster. Over time, the company expanded into numerous other countries and setup many local brands like UKForex, CanadianForex, NZForex, USForex, ClearFX and Tranzfers to provide local expertise in key regions of the world. Eventually, there was a major rebranding effort in 2015 whereby all the aforementioned brands were consolidated into a single, global company called OFX.

OFX is a public company trading with stock ticker OFX on the Australian Securities Exchange Ltd (ASX).

OFX grew from the idea that there had to be a better, fairer way to move money around the world. That was over 20 years ago, and since then over 1 million customers have trusted OFX with transfers in 50+ currencies to over 170 countries.

When it comes to moving money, peace of mind is important. OFX is monitored by over 50 regulators globally and work within a network of carefully selected banking partners. So, whether you are sending money to friends and family abroad, or doing business across borders, OFX can get your money where it needs to go. Fast, simple, secure.

OFX has more than 20 years of experience in the money transfer business, and has a strong global footprint. You can send money in more than 50 currencies to over 170 countries worldwide.

OFX by the numbers

As a global money transfer company, OFX has come a long way. We present some statistics and numbers below to put this in perspective.

- More than 2 decades of experience in the money transfer business

- Over 1 million customers

- Helped send more than AUD 150 billion

- Supports transfers in 50+ currencies

- Send money to over 170 countries

- Worldwide offices in 8 countries

- Regulated and monitored by over 50 global agencies

- Send money online 24 hours a day, 7 days a week

- Helpful phone agents available 24x7

OFX don't just offer great rates, they believe real help from real people counts. That's why their clients get the best of both worlds – a seamless digital platform, combined with 24/7 phone access to currency experts.

Which countries does OFX operate in?

OFX has 8 office locations globally in Australia, New Zealand, Ireland, United Kingdom, United States, Canada, Hong Kong, and Singapore. OFX is Australian Securities Exchange (ASX) listed and has over 20 years of foreign exchange experience. During this time, OFX has helped over 1 million customers transfer more than AUD 150 billion globally.

Where can I send money from with OFX?

With OFX, you can send money in 50+ currencies from numerous countries worldwide. OFX has 115 bank accounts in their global network to support these 50+ currencies, so the chances that you can send money with OFX from your country are pretty high.

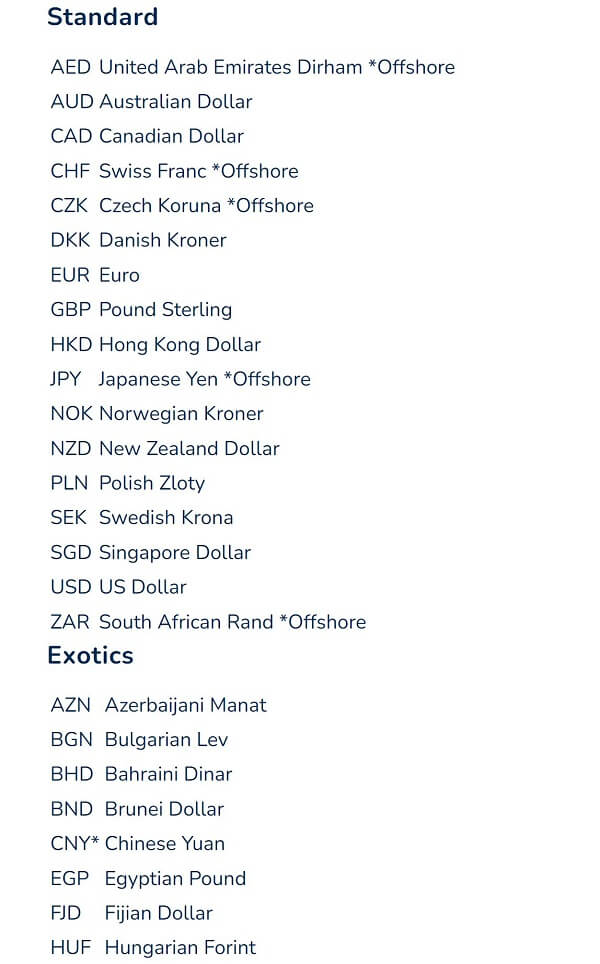

OFX partitions their supported currencies into standard and exotic. To check if your currency pairs are supported, simply check their online currency calculator and they will tell you if they can support your intended money transfer.

Below is a screenshot of OFX's supported currencies you can currently send money in. Note that the exotic list continues; please check the above link if you want to see the full list.

Where can I send money to with OFX?

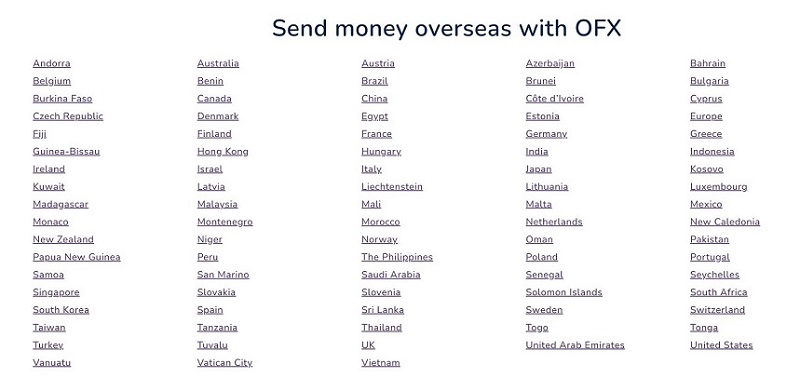

With OFX, you can send money to over 170 countries worldwide. Below is a screenshot of all supported countries where you can remit with OFX to.

OFX is always adding more currencies and countries, so make sure to check their site regularly to see if your country and currency gets added.

With OFX, you can send money overseas in more than 50 global currencies to more than 170 countries.

What are OFX's fees and exchange rates?

OFX generally offers highly competitive exchange rates and transfer fees when compared to other competing global money transfer companies. OFX's customer rate is the rate of exchange that they use to move your money from one currency to another. It includes a small (bank-beating) margin.

That said, a great way to validate the above is to actually look at some OFX rates across some popular country combinations.

Below, we present an analysis of OFX's rates and fees when sending 1000 units of currency for some country/currency pairs. We will also do calculations to see how good are OFX's exchange rates.

| Country Pair | Transfer Amount | Exchange Rate* | Fees* | Payout | Mid-Market Rate** | FX Markup |

|---|---|---|---|---|---|---|

| Australia to India | AUD 1,000 | 1 AUD = 53.8030 INR | AUD 15.0 | 52,995.9550 INR | 1 AUD = 54.2974 INR | 2.40% |

| Australia to Philippines | AUD 1,000 | 1 AUD = 37.5885 PHP | AUD 15.0 | 37,024.6725 PHP | 1 AUD = 38.0094 PHP | 2.59% |

| Australia to United States | AUD 1,000 | 1 AUD = 0.6899 USD | AUD 15.0 | 679.5515 USD | 1 AUD = 0.6923 USD | 1.84% |

| Australia to Germany | AUD 1,000 | 1 AUD = 0.6504 EUR | AUD 15.0 | 640.6440 EUR | 1 AUD = 0.6543 EUR | 2.09% |

*Exchange rates and fees as on June 27, 2022

**Mid-Market Rate from XE.com

See how we calculate FX Markup

A very important fact to be aware of is that OFX has a standard fee of AUD 15 for transfers under AUD 10,000. If you're transferring more than AUD 10,000, OFX won't charge you a transfer fee.

There are a few exceptions to OFX's pricing structure though; these are some special cases and are listed below.

- All OFX transfers to the Australian Taxation Office (ATO) are always fee free. In other words, it does not matter how much money you send to the ATO, or when; OFX will never charge a fee for making payments to the ATO.

- Similarly, all payments made via OFX to the Inland Revenue Department (IRD) of New Zealand are also free of cost.

- Payments from dividends earned within Australia via Link Market Services (LMS) and paid out to your non-Australian overseas bank account get charged a flat fee of AUD 5 for all transfers less than AUD 10,000. LMS transfers above AUD 10,000 are fee free.

If you send less than AUD 10,000 with OFX, you will have to pay a flat fee of AUD 15. Send more than AUD 10,000 to avoid the fee.

Given this, let's run the above comparison calculations again with a transfer amount of AUD 10,000 this time, and see the results.

| Country Pair | Transfer Amount | Exchange Rate* | Fees* | Payout | Mid-Market Rate** | FX Markup |

|---|---|---|---|---|---|---|

| Australia to India | AUD 10,000 | 1 AUD = 53.8030 INR | AUD 0.0 | 538,030.0000 INR | 1 AUD = 54.2974 INR | 0.91% |

| Australia to Philippines | AUD 10,000 | 1 AUD = 37.5885 PHP | AUD 0.0 | 375,885.0000 PHP | 1 AUD = 38.0094 PHP | 1.11% |

| Australia to United States | AUD 10,000 | 1 AUD = 0.6899 USD | AUD 0.0 | 6899.0000 USD | 1 AUD = 0.6923 USD | 0.35% |

| Australia to Germany | AUD 10,000 | 1 AUD = 0.6504 EUR | AUD 0.0 | 6504.0000 EUR | 1 AUD = 0.6543 EUR | 0.60% |

*Exchange rates and fees as on June 27, 2022

**Mid-Market Rate from XE.com

See how we calculate FX Markup

These are very interesting results! We have basically validated mathematically that if you can avoid the flat fee on your OFX money transfers, you get a higher payout for your hard earned money. This is further validated by the lower FX Markup that you have to pay.

The FX Markup charged by OFX drops significantly if you are able to avoid the flat fee charged for transfers less than AUD 10,000.

One final note on money transfer fees - occasionally, third-party banks may deduct a fee from your transfer before paying your recipient. This fee may vary, and OFX receives no portion of it. Check with your bank to see if such fees may be applicable in your case.

Are OFX exchange rates good?

OFX generally tends to have competitive exchange rates across all the markets that they operate in. If you are close to sending an international money transfer, and are considering to use OFX, you can get a real time quote from their online calculator to see what exchange rate you may get.

As noted in our case studies and based on the calculations we did, the FX Markup charged by OFX varies anywhere from as low as 0.35% to as high as 2.59%. Further note that:

- If you end up paying the AUD 15 flat fee (for transfers less than AUD 10,000), the FX Markup you will pay will generally be around 2%.

- If you are able to avoid the flat fee (see how to do this below), you will pay an FX Markup around 1% or lower, depending on your country combinations.

Clearly, it is a huge benefit to try to avoid the flat fee amount as you pay much lesser FX Markup and, therefore, save more money.

We recommend you always research your options in detail before you decide to send your next money transfer. Comparing money transfer companies will enable you to find the best provider for your need, and ensure you save the most money.

A really effective way to compare various money transfer companies is to use RemitFinder's comparison platform. By doing so, you can easily see the pros and cons of various providers and pick the one that suits your needs best.

Is OFX a cheap way to send money overseas?

The answer to this question is - it depends. If you are able to avoid the flat fee charged by OFX (AUD 15 for transfers under AUD 10,000), then yes, OFX is a cost effective way to send money overseas. However, if you are not able to avoid the fee, you may have to pay a higher FX Markup which may reduce your recipient's payout.

See the next section to understand how you can avoid paying OFX fees.

One very good thing about sending money with OFX is that there are no hidden fees. OFX clearly discloses the exchange rate and fees you will get, and there is no hidden charge beyond that.

How do I avoid OFX fees?

There are 2 ways you can avoid OFX fees, and save even more money on your international money transfers with them. These are as below:

- There are no OFX fees if you transfer over AUD 10,000. You pay the flat fee of AUD 15 only for transfers below AUD 10,000.

- Another way to avoid OFX fees is to take advantage of OFX promotion available for RemitFinder users whereby your first 10 OFX money transfers are fee free! All you have to do is to ensure that you send minimum AUD 250 (or equivalent in other currencies) and OFX will waive the transfer fee for your first 10 money transfers with them.

Use one of the following 2 ways to avoid OFX fees - send above AUD 10,000 or take advantage of 10 fee free transfers available to RemitFinder users.

Additionally, you also pay 0 fees for any payments you make using OFX to any of the below entities within Australia and New Zealand:

- The Australian Taxation Office (ATO)

- The Inland Revenue Department (IRD) in New Zealand

How much money can I send with OFX?

With many money transfer companies, there are generally limits to how much money you can send. For example, whilst major currencies like USD, GBP, EUR, CAD, AUD, etc. may be sent freely, some regulated currencies like CNY, KRW or ZAR may have strict transfer limits.

OFX does not enforce any limits on the amount of money you may want to transfer overseas. Whether you want to send 100s regularly for family maintenance, 1000s for paying an overseas business or millions to purchase a property overseas, OFX has you covered!

There are no limits to the amount of money you can send overseas with OFX.

How long does it take for OFX to send money overseas?

OFX's global network of banking partners enables them to move your money efficiently, through some of the fastest payment schemes available globally.

OFX processes most major currency transfers within 1-2 business days from the time funds are received. Exotic currencies may take a little longer (generally 3-5 business days).

OFX will keep you updated along the way with email notifications when funds are received and paid out to the recipient. You can also opt-in for SMS updates or even track your transfer with OFX by logging in online or on the OFX app.

OFX is able to move your money overseas quickly. Most transfers finish within 1-2 business days, and the rest within 3-5 days.

How can I pay for my OFX money transfer?

With OFX, you can fund your money transfer using quite a few payment methods.

You can almost always pay for your global money transfer with OFX via a direct bank transfer as well as a wire transfer.

In some cases, other payment options may be available. For example, within Australia, you can use BPAY which is an online bill pay management system linked to your bank account.

Please note that methods of payment vary based on the currency being sent to OFX. Once you lock your rate, OFX will inform you of available payment options.

OFX lets you pay for your money transfer via many ways, including local payment methods in some countries.

How can my recipient get paid with OFX?

In the international money transfer space, the term delivery method (also called delivery option) means how you choose to pay your recipient overseas. OFX only supports a single delivery method, and pays recipients directly into their bank account.

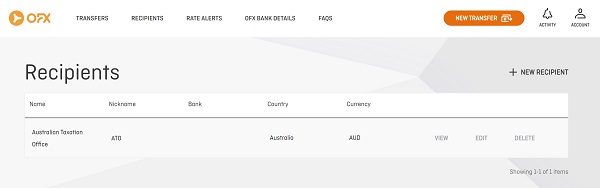

Another incredibly useful OFX feature is making tax payments from overseas directly to the Australian Taxation Office (ATO) as well as the Inland Revenue Department (IRD) in New Zealand.

This is highly convenient as you do not have to open bank accounts in Australia and New Zealand to make tax payments in those countries. Simply use your OFX account and add the 2 aforementioned entities as recipients, and OFX will send your money to them directly.

To make it even better, OFX does not charge any fees on international money transfers you make to send money to the ATO as well as the IRD. So, if you are an Australian or New Zealand resident living overseas, definitely check out this useful OFX service to save money on your tax payments for those countries.

With OFX, you can pay your recipient via a direct bank account transfer into their overseas bank account. Additionally, you can also make free tax payments to the ATO in Australia and the IRD in New Zealand.

If you need to send cash to your recipient, you may want to explore other options as OFX currently does not support cash pickups.

Are there any OFX coupon codes or promotions I can use?

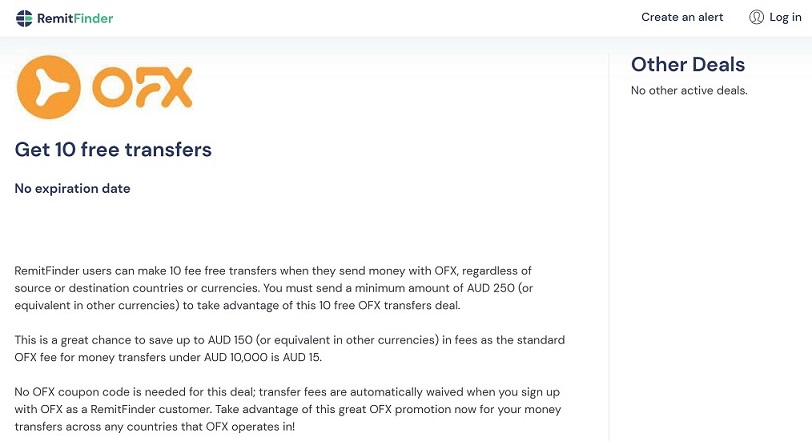

OFX has an exciting promotion ongoing for RemitFinder users whereby you can send your first 10 OFX money transfers for free. All you have to do is to ensure that each money transfer is worth at least AUD 250 (or equivalent in other currencies), and OFX will waive your fee for your first 10 money transfers.

This is an amazing opportunity to save up to AUD 150 (or equivalent in other currencies) in fees as the standard OFX fee for money transfers under AUD 10,000 is AUD 15. Take advantage now and save money when you send with OFX!

Below is a screenshot of this attractive OFX promotion for RemitFinder customers.

OFX promotion for RemitFinder users to earn 10 free money transfers

RemitFinder users can save up to AUD 150 in fees as their first 10 OFX transfers are fee free.

Additionally, as a RemitFinder user, you have access to all the below benefits with OFX:

- Great rates: Preferential exchange rates and 0 OFX fees on first 10 FX transfers

- OFXpert support: Talk to an OFXpert 24/7 day and night

- Global reach: Make transfers in 50+ currencies to over 170 countries

- Peace of mind: OFX is monitored by over 50 regulators globally

- Cashflow certainty: Fix FX rates for up to 12 months and transfer later

- Streamlined digital platform: Make and track your global money transfers online or with the OFX app

Register with OFX to access your member benefits and take advantage of a seasoned money transfer operation to send money overseas.

We will keep this page updated in case any new OFX promotions get added, so be sure to check back regularly. Another great way to stay updated is to create your free daily exchange rate alert with RemitFinder. We will make sure we keep you updated with the latest exchange rates and promotions from many providers right in your mailbox.

Is OFX a safe way to send money abroad?

As an experienced and reputable money transfer company that has been around for more than 2 decades, OFX takes the security and safety of both your money as well as personal information seriously.

To ensure this, OFX follows a series of safety guidelines and implements many security best practices; some of these are listed below.

- OFX enforces secure passwords, security questions, and automatic time-outs help to keep customers' identities and accounts protected from bad actors.

- OFX implements Secure Socket Layer (SSL) encryption to create a secure connection with customers' browsers to protect personal information from being intercepted.

- OFX's fraud system utilizes a multi-layered approach. It monitors registrations, logins, and transactions to identify any suspicious activity, and also detects and prevents fraudulent apps that can target the platform and customers.

- OFX invests in researching, developing and adopting leading digital security technologies to provide their clients with a safe and secure money transfer service.

- OFX implements various physical and organizational safeguards in their offices and locations to ensure overall safety standards are met.

- OFX publishes guides and informational resources to help educate customers about security guidelines and fraud detection and prevention.

OFX believes everyone deserves peace of mind when moving money globally, so maintaining and improving systems that help protect their clients' money is crucially important to them.

Can I trust OFX?

OFX is an Australian Securities Exchange (ASX) listed company and is regulated and monitored by over 50 regulators globally. This is important as compliance with regulations and monetary laws in various countries ensures that you can trust OFX to be safe when it comes to transacting with them.

Below, we present some information on OFX's registration and compliance with various international financial institutions worldwide.

- In Australia, OzForex Limited (trading as OFX) is regulated by the Australian Securities & Investments Commission (ASIC) with the license number ABN 65 092 375 703. OFX is also a member of the Australian Financial Complaints Authority (AFCA) with an AFS license number 226 484.

- In Europe, OFX Payments Ireland Limited trading as OFX is regulated by the Central Bank of Ireland (Firm Ref. No. C190174). OFX's registered office in Europe is at the following address - Fitzwilliam Court, 2 Leeson Close, Dublin 2, D02 YW24, Ireland.

- In Hong Kong, OzForex (HK) Limited trading as OFX is licensed as a Money Service Operator with the Customs and Excise Department Hong Kong with the license number 12-08-00582.

- In New Zealand, NZForex Limited trading as OFX (CN: 2514293) is registered as a financial service provider under the Financial Service Providers (Registration and Dispute Resolution) Act 2008. NZForex Limited is not currently regulated by the Financial Markets Authority as a Derivatives Issuer in New Zealand.

- In Singapore, OFX Singapore Pte. Limited (UEN: 201317103N) is regulated in Singapore by the Monetary Authority of Singapore under the Payment Services Act (License no. PS20200277). OFX is licensed by the Monetary Authority of Singapore to conduct the following payment services: Cross-border Money Transfer Service, Domestic Money Transfer Service, E-money Issuance Service and Account Issuance Service.

- In the UK, UKForex Limited (trading as OFX) is registered in England and Wales (Company No. 04631395). OFX is also authorized by the Financial Conduct Authority as an Electronic Money Institution (Firm Ref. No. 902028). OFX's UK registered office is at 4th Floor, The White Chapel Building, 10 Whitechapel High St, London E1 8QS.

- In the US, USForex Inc. dba OFX is a licensed money transmitter with NMLS #1021624. OFX is also registered as a Money Service Business at the federal level with the Financial Crimes Enforcement Network (FinCEN), which is a bureau of the United States Department of Treasury.

Within the US, OFX is also regulated by numerous US States. Below are a few examples of OFX's regulatory compliance in some key US states.

- Arizona - Money Transmitter License #MT-0923780 issued by the Arizona Department of Financial Institutions

- California - Money Transmitter License #2447 issued by the California Department of Financial Protection and Innovation

- Florida - Money Transmitter License #FT230000051 issued by the Florida Office of Financial Regulation

- Massachusetts - Foreign Transmittal Agency License #FT1021624 issued by the Massachusetts Division of Banking

- New Jersey - Money Transmitter License #L066157 issued by the New Jersey Department of Banking & Insurance

- New York - Money Transmitter License #102944 issued by the New York State Department of Financial Services

Make sure to look at the full list of OFX registration information with various US states to see if they are regulated in your state of residence.

Given OFX's strong focus on security and safety, as well as their thorough registration and compliance with numerous reputed financial organizations worldwide, your hard earned money and private information should be safe with them.

Your money and information should be safe with OFX given their thorough compliance with numerous security protocols and best practices.

How good is OFX's service?

OFX has serviced over 1 million customers for the last 2 decades, so we certainly expect their service to be of the highest quality. A good way to find that out is by seeing what other international money transfer customers like you think about their product and service quality.

What do users have to say about OFX?

In this section, we take a look at what remittance customers think about OFX money transfer services by looking at reviews and feedback on some popular review^ platforms.

- OFX is rated Great with a 4.0/5.0 rating on Trustpilot and has almost 5k reviews

- On the Google Play Store, OFX has a 4.5/5.0 rating with more than 3200 reviews

- OFX's iOS app is rated 4.8/5.0 on the App Store with about 3300 ratings

- OFX has a rating of 3.3/5.0 on RemitFinder

^Ratings on various platforms as on June 29, 2022

OFX has very high ratings for their Android and iOS mobile apps. Users seem to love their apps for sending money.

Is OFX the best choice for me?

As a seasoned global money transfer company that has been around for more than 20 years, OFX has many strengths when it comes to sending money overseas. Based on our detailed analysis, we find OFX to be strong in the below areas.

- Comprehensive country and currency support: With OFX, you can send money in more than 50 currencies to over 170 countries across the world. Depending on where you live, the chances that you can send money with OFX are pretty high.

- Deep experience in the money transfer industry: OFX has been around for more than 20 years, and have served more than a million customers so far. With that much deep expertise in international money transfers, you can rest assured you are transacting with a reputed and safe company.

- Competitive exchange rates: If you are able to avoid the AUD 15 fee (for transfers under AUD 10,000), you get a very competitive exchange rate that helps you save money. You can take advantage of exclusive OFX promotion for RemitFinder users whereby you can send money with 0 fees for your first 10 transfers with OFX.

- No transfer limits: OFX does not impose any limit on how much money you can send with them. This can be a great advantage if you need to send larger amounts of money overseas.

- Quick money transfers: OFX can usually send money overseas within 1-2 business days, and in some cases, within 3-5 business days. Your money will be available to your recipient fairly quickly if you send money with OFX.

- Variety of transfer options: As an OFX client, you can fix FX rates for up to 12 months and transfer later. You also have access to a range of other FX transfer options and risk management products.

- Free tax payments for Australia and New Zealand expats: With OFX, you can make totally free payments to the Australian Taxation Office (ATO) and the Inland Revenue Department (IRD) in New Zealand.

- 24/7 customer support: Talk to a real person at any time, day or night.

RemitFinder likes OFX for providing comprehensive corridor coverage, enforcing no transfer limits, sending money overseas quickly and having a variety of transfer options.

What are the best reasons to use OFX?

Whether you're relocating internationally, selling stocks, shares or equity or just sending money home, OFX can help. Depending on where you are sending money to or receiving money from, OFX could be your best FX service provider option.

Based on our detailed analysis of OFX's strengths and weaknesses, we present some scenarios in which OFX could be a strong fit with your money transfer needs.

- OFX is a great choice to send money overseas if you need to send larger sums because they don't have a maximum transfer limit. Sometimes you may need to send a big chunk of money overseas for cases like investment, business, real estate, etc., and with no transfer limits involved, OFX can help you move your money overseas in a single transaction.

- Depending on where you live and where you need to send money to, the chances that OFX has you covered are pretty high. This is due to their comprehensive support for umpteen global currencies and countries. Coupled with all the other advantages, you could use OFX for your money transfers for your desired destination.

- The exchange rate you get with OFX is pretty competitive. However, if you send below AUD 10,000 (or equivalent in other currencies), you will have to pay a flat fee of AUD 15. But the good news is that you can take advantage of exclusive OFX promotion for RemitFinder customers whereby your first 10 money transfers with OFX are fee free.

- In case you need to send money overseas quickly, OFX can be a good partner as most of their money transfers complete within 1-2 business days, with the remainder finishing in 3-5 business days.

- If you are an Australian or New Zealand resident living overseas, and owe any tax payments in those countries, you can use OFX to pay your taxes directly to the Australian Taxation Office (ATO) and the Inland Revenue Department (IRD) in New Zealand. OFX will directly credit the money into the relevant accounts for the ATO and the IRD. Plus, your money transfers for making tax payments to the ATO and the IRD are totally fee free.

- OFX also supports multiple payment methods to fund your money transfer with them. This includes local payment methods in some countries. Note that local payment methods tend to be cheaper and can save you some additional money on your remittances.

- OFX offers a range of FX risk management products such as Forward Contracts Limit Orders to help you meet your budget or simply gain more clarity over your future FX costs. Additionally, if you choose to transfer money with OFX, they offer 24/7 support from real people.

There are many money transfer scenarios in which OFX can be a very good choice.

What type of transfers can I make with OFX?

As an OFX client, you can send money from one country to another quickly in 50+ currencies to over 170 countries. OFX supports their clients to save time on regular overseas payments and streamline global business payments and receivables. OFX also offers products and 24/7 OFXpert support to help their clients plan ahead for future transfers.

Below is a complete list of various types of money transfers you can make with OFX.

- One time money transfers: Also called single transfers or spot deals, these are one time international money transfers you can send with OFX. Key advantages of this type of transfer include locked in exchange rates and quick transfer speed.

- Recurring money transfers: If you need to send money overseas regularly to make loan payments or handle school tuition fees, etc., recurring transfers could be a great fit. Key advantages of this transfer type include 0 fees and ability to fund your transfers with direct debit. Note that you have to make minimum 4 money transfers to avail the aforementioned benefits.

- Forward contracts: OFX also offers forward contracts whereby you can lock in your exchange rate and book your money transfers for the future. This helps protect you from currency exchange rate fluctuations. You can book OFX forward contracts between 2 days and 12 months from today. Key advantages of OFX forward contracts include locked in exchange rate and better management of your cash flow.

- Limit orders: With OFX limit orders, you can set a target exchange rate, and once that rate is reached, OFX will execute your money transfer. The biggest advantage of limit orders is that you do not have to watch exchange rates constantly. You decide what rate you want, and create your limit order. Your order will get executed only if the target exchange rate is reached. OFX limit orders are valid for up to 6 months from the date of creation.

- Tax payments for Australia and New Zealand: If you are an individual or a business who owes taxes to the Australian Taxation Office (ATO) or the Inland Revenue Department (IRD) in New Zealand, you can use your OFX account to make international payments to them directly from overseas. OFX will convert your foreign currency into local currencies, and make relevant tax payments to the ATO or the IRD. And the best part is that these tax payments to the ATO and the IRD are free of cost - OFX waives their transfer fee on these money transfers.

With OFX, you can choose between one time or recurring money transfers as well as forward contracts and limit orders.

How can I make ATO tax payments with OFX?

OFX has recently partnered with the Reserve Bank of Australia (RBA) to become a chosen provider for debt repayments and tax payments to the Australian Taxation Office (ATO). This is a tremendously convenient service for Australian's living overseas or anyone who owes money to the ATO.

The way this works is that you can send international payments via OFX like any other money transfers, but choosing the ATO as the recipient. OFX will do the currency conversion and pay the requisite amount to the ATO on your behalf. Plus, you do not pay any transfer fee; all ATO payments sent via OFX are totally fee free!

What types of debt and tax payments can I make to the ATO using OFX?

OFX money transfers sent to the ATO are useful for numerous types of scenarios for both individuals as well as businesses. Basically, anyone who owes any money to the ATO can take advantage of this service.

Below are various scenarios in which you can send money to the ATO from overseas using OFX.

Individuals

- Australians living in New Zealand who need to make Higher Education Contribution Scheme (HECS) HELP loan payments

- Overseas Australians who have property and assets in Australia that produce income and thus are subject to Capital Gains tax

- Australians living overseas with ordinary income sources in Australia that necessitates payment of income tax

- Child support in cases where one of the separated parents is Australian, and needs to pay or receive child support after separation

Businesses

- Overseas companies with financial assets within Australia that require payment of taxes and/or Goods and Services Tax (GST)

- Overseas businesses who have branches within Australia and need to expand their business and pay taxes on the income earned within Australia

What is the process of making payments to the ATO using OFX?

Once you are ready to take advantage of OFX's direct international money transfers to the ATO, follow the below steps to complete the process:

- Step 1: Ensure that ATO is setup as a recipient in your account. Existing OFX customers can reach out to OFX customer support to get this done. New OFX customers will automatically have the ATO added as a recipient in your account if you sign up with the link right after these steps. You should see ATO added in your account as per the below screenshot.

- Step 2: Select currency and payment amount. Now that ATO has been successfully setup as a recipient in your account, simply select your source currency and transfer amount.

- Step 3: Enter your Payment Reference Number (PRN). This is a very important step whereby you let OFX know your PRN. The PRN ensures that the funds are deposited by OFX into your account with the ATO correctly. If you do not have your PRN handy, you can find it on your ATO statement.

- Step 4: Pay for your transfer. The last step is to fund your money transfer. Once OFX receives your funds, they will work on the transfer to ATO.

As you can see, the process to send money to the ATO using OFX is really simple. And the best part is that money transfers sent via OFX to the ATO are completely free. You do not have to pay any fee on payments sent to the ATO. Take advantage of this convenient OFX service if you need to send money to the ATO.

Another huge advantage of using OFX to pay your dues to the ATO is that you no longer need to have a local bank account in Australia. Using OFX, simply make international payments directly to the ATO from overseas.

How can I make IRD tax payments with OFX?

Similar to the ATO partnership in Australia, OFX has also partnered with the Inland Revenue Department (IRD) in New Zealand to help you make tax payments directly to the IRD from overseas.

To send tax payments directly to the IRD with OFX, follow the below steps:

- Step 1: Add the IRD as a recipient. Before you can send a tax payment to the IRD from overseas using OFX, the first step is to add the IRD as a recipient within your OFX account. To do so, simply create a new OFX recipient with the following information:

- Account Name: Inland Revenue Department

- Branch No: 030049

- Account Number: 0001100

- Bank Address: Level 15, 318 Lambton Quay, Wellington, New Zealand

- Recipient Address: 55 Featherston Street, Wellington, New Zealand

- Step 2: Provide your IRD information to OFX. Next, you need to provide OFX with your IRD related information so the tax payment can be sent directly to your IRD account. To do this, enter the following information in the 'Reference' section:

- Your IRD Number

- IRD Tax Type

- Period End Date (either 31/3/20XX or 30/9/20XX)

- Step 3: Start your tax payment transaction with OFX. Select your source currency, transfer amount, and choose IRD as the recipient to start a new international money transfer with OFX.

- Step 4: Fund your OFX money transfer. Finally, pay for your IRD tax payment money transfer. Once OFX receives your payment, they will process the transaction and deposit the funds with the IRD directly.

Sending tax payments from overseas to the IRD is totally free; you do not have to pay any transfer fee to OFX for paying your taxes to the IRD in New Zealand. Additionally, the flexibility to make international payments straight to the IRD using OFX obviates the need to have a local bank account in New Zealand.

Making tax payments directly to the Australian Taxation Office (ATO) and the Inland Revenue Department (IRD) in New Zealand via OFX is free and convenient. Plus, you no longer need to maintain local bank accounts to pay taxes.

How can I receive Link dividends into my bank account with OFX?

To continue to provide value added services to its clients, OFX has also partnered with Link Market Services (LMS) to help customers receive Link dividends straight into their overseas bank accounts.

You can follow the below steps to set up Link dividend payments go to your bank account via OFX:

- Step 1: In the Link Investor Centre website, go to "Payments and Tax", and then select "Foreign Currency Payment" as your chosen payment method.

- Step 2: Authorize the Link system to interconnect your Link and OFX accounts with each other.

- Step 3: Add bank and account information for your bank account where you want your Link dividends to go.

- Step 4: Choose your preferred payout currency. Note that you cannot choose an Australian bank account to get AUD payouts; only a foreign currency bank account can be used with this service.

At this point, you are all set. OFX will receive your Link dividends in AUD and convert the same to your chosen foreign currency and credit the converted amount into your foreign bank account.

Please be aware that you will have to pay a flat fee of AUD 5 for all LMS dividend transfers under AUD 10,000; higher amounts get transferred at 0 fee.

Finally, the LMS integration is available to the following OFX customer types - individuals, corporations, trusts and joint shareholders.

What are various ways to send money with OFX?

There are a few quick and convenient ways to send money overseas with OFX. You can choose any of the below methods to complete your money transfers within minutes, all from the convenience of your home or office, and without going to any branches or standing in lines.

- Online via the OFX Website: The OFX website is your one stop center to manage your account, send money as well as read many helpful guides and articles.

- Using OFX mobile app: OFX has both an Android as well as iOS app available for download from the corresponding app stores.

- Using the OFX Global Currency Account: Note that the Global Currency Account is not available to all OFX clients. Eligibility for this account is assessed on a case by case basis upon registration.

How to send and receive money with OFX?

OFX money transfer is quick and easy to use, and as we saw in the customer ratings and review section earlier, users seem to really like OFX. Given that, it is no surprise that you can send money with OFX easily and in just a few minutes.

Below, we present a helpful step by step guide to send money with OFX.

Step by step guide to send money with OFX

Follow the below steps to send money internationally with OFX in just a few clicks. It's really easy to send money with OFX!

- Step 1 - Decide if you want to send money with OFX. First and foremost, you need to figure out if you will be using OFX for your next money transfer. An easy way to determine this is to compare OFX with their competitors. One way you can do this in a streamlined fashion is to compare numerous money transfer providers in a single place using RemitFinder. This will help you compare companies and decide who to go with.

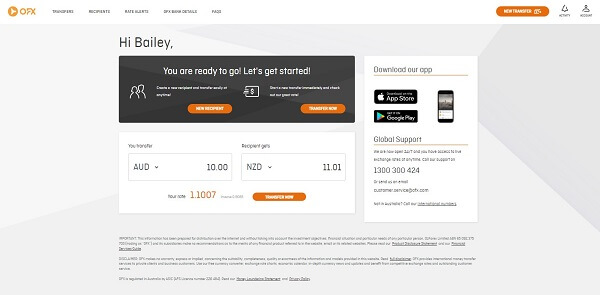

- Step 2 - Login into your OFX account, or register a new account. Login into your OFX account if you have one already. If you do not have an existing OFX account, register a new account by following OFX's simple new account registration flow.

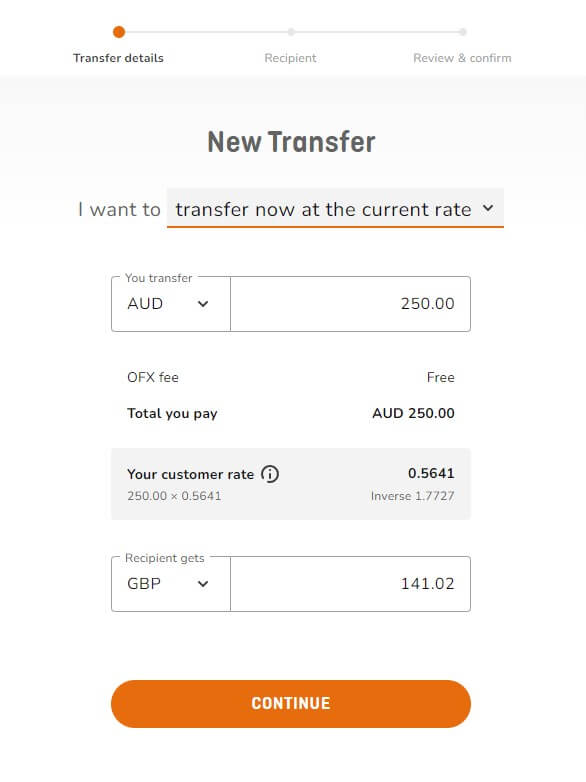

- Step 3 - Choose source and destination currencies. Once you are logged in into your OFX account, you can choose your source and destination currencies to begin your money transfer transaction.

- Step 4 - Select transfer type. Select the type of money transfer you want to do. OFX offers one time or recurring money transfers, as well as forward contracts and limit orders. Choose the transfer type that is applicable to your transfer requirements.

- Step 5 - Enter transfer amount. Now that you have selected the type of transfer you want to do, simply fill in your desired transfer amount in the field next to the source currency.

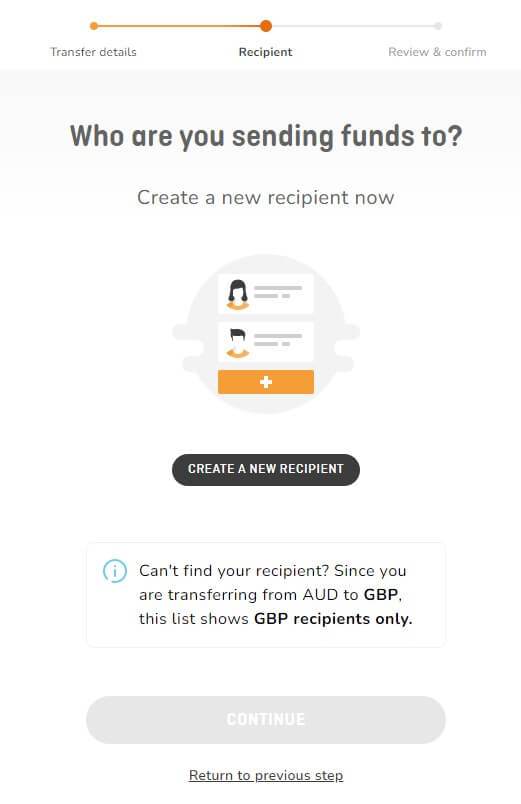

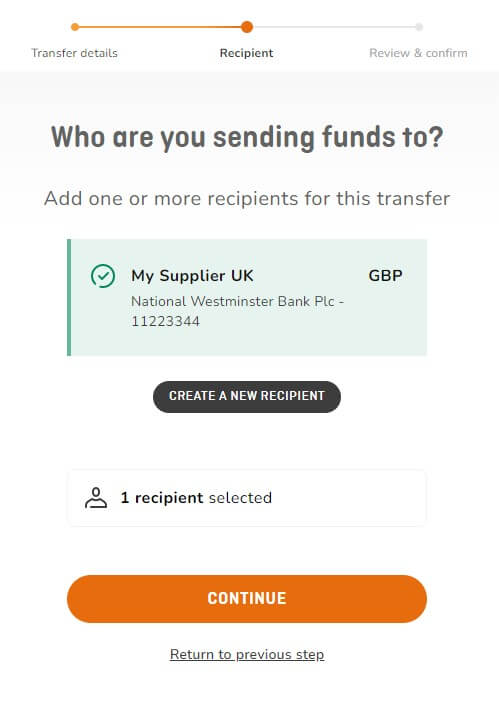

- Step 6 - Add or select recipient. The next step in your OFX money transfer process is to choose a recipient. If you have sent money before with OFX, and intend to choose an existing recipient, simply select them from the list. If you need to add a new recipient, do so and they are automatically selected for the current money transfer.

- Step 7 - Continue after entering recipient details. Once you have entered full recipient details (or selected an existing recipient from your saved recipient list), click continue to progress to the next step.

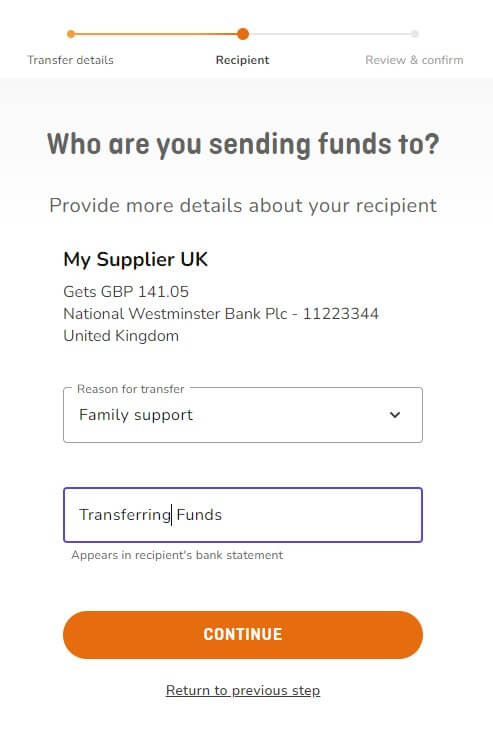

- Step 8 - Enter reason for transfer. In this step, select a reason why you are sending money overseas to your recipient. Note that the reason you choose will appear on the recipient's bank statement.

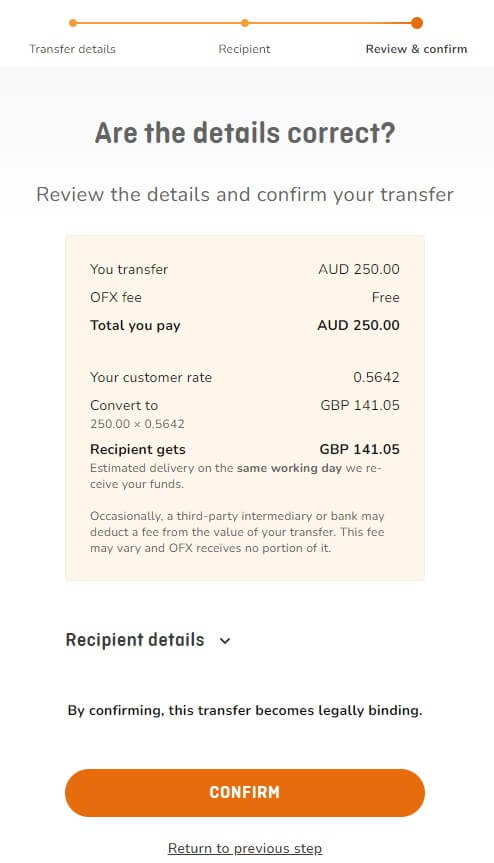

- Step 9 - Verify transfer details. Double check everything to ensure all entered information is correct. This is a critical step to ensure a smooth money transfer as any mistakes or typos will cause delays later in the process. Make sure to validate that all transaction information is accurate. Once you are satisfied with everything, click on the Confirm button.

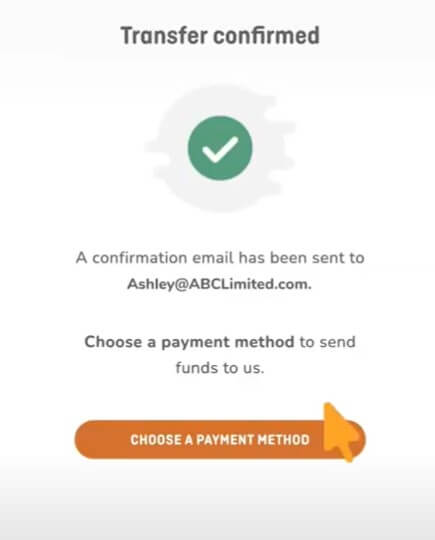

- Step 10 - Transaction accepted and confirmed. Once you verify that all transfer information is correct and confirm, OFX will accept your transaction and check everything. If all goes well, you will be presented with a confirmation screen. You will also get an email confirming that your transfer was accepted. After this, you can send your funds to OFX so they can process your transaction.

If you are more of a visual person, you can also watch OFX's video on how to make a money transfer.

You can send money with OFX in just a few minutes by following simple and easy to follow steps.

How can OFX help me send money?

Whether you're making a personal or business transfer, OFX has a transfer option to suit your needs.

Types of transfers you can make with OFX:

- If you want to make a one-off money transfer, OFX's Spot Transfer may be the perfect choice for you. If you'd like to make multiple transfers, perhaps for regular mortgage or business payments overseas, OFX's recurring transfers will allow you to set up an automated transfer schedule.

- Beyond OFX's rapid transfer options are Forward Exchange Contracts and Limit Orders which help manage your transfers in advance. These are suitable for larger transfer amounts and provide you with a degree of rate security with added flexibility to take advantage of the market.

For further reading on OFX transfer types, check out their detailed guide on various ways to send money with OFX.

Next, you can visit various country specific money transfer guides to get started - it's simple and easy to send money with OFX. These helpful resources for each country are tailored to that market, and further help you send money with OFX. Below are some examples for some popular destinations.

- Send money to China

- Send money to Egypt

- Send money to India

- Send money to Indonesia

- Send money to The Philippines

- Send money to Sri Lanka

- Send money to Thailand

- Send money to Vietnam

Make sure to go through OFX's helpful money transfer guide for your country before you decide send money internationally with them.

Do I need a OFX account to receive money?

Recipients of funds from OFX do not need an OFX account, the money sent from the OFX client will be delivered directly to the recipient's bank account.

You do not need an OFX account to receive money overseas.

Does OFX have a mobile app?

OFX does have a mobile app that is compatible with both Apple and Android phones. Make sure you download the correct app from the respective App Store.

Using the OFX app, you can:

- Login securely: Enable the latest security features and protect your account with fingerprint and FaceID on compatible devices.

- Check live market rates: View live rates and rate history for 50+ currencies. And OFX will save your currency preferences for a quick view each time you use the app.

- Transfer money globally: Send money with competitive exchange rates using OFX's secure platform. The apps also have a quicker, easier transfer experience.

- Track your transfers: Know where your money is every step of the way, and when it has been safely received by your recipient.

- Upload verification documents: Take photos of your verification documents with your phone, and upload them directly from the app.

- Add payment methods: Automatically connect your bank account within the app for faster, more streamlined transfers.

OFX mobile app is a convenient way to manage your account and send money on the go.

How do I track my OFX transfer?

You can track your transfer with OFX online or on the OFX app. OFX will also send you updates when they have confirmed your transfer, received your funds and made the payment to your recipient.

Can I use OFX for international bank transfers?

Yes. Just like a bank transfer, you will send funds from your own bank account, and the recipient will receive them in their account. In other words, if you use bank account as both the payment and delivery method for your money transfer, you end up achieving the same result as an international bank transfer.

The only difference is that OFX will act as an intermediary to help speed up and simplify the transfer process while keeping down the costs associated with moving money globally.

Is OFX online better than sending money in-person in stores?

Unlike an in-person store, OFX is always open, and ready to help. OFX clients can self-serve using their intuitive online platform, or pick up the phone and talk to a real person, anytime, day or night. When it's your money moving across the world, it's good to know you have 24/7 support in case any problems arise.

The OFX website or mobile apps let you execute online money transfers quickly and easily from the comfort of your home.

Does OFX have a rewards program?

OFX does not have a rewards program for individual customers, but they do have a partner referral program for businesses.

If you have a business and are looking to add more value for your customers and potentially earn a revenue share as a result, the OFX Referral Program could be a win-win for you and your clients.

What customer support options are available with OFX?

If you run into any issues or have questions, and need to contact the OFX customer support team, you have a couple of options; these are listed below.

- You can email OFX support team at customer.service@ofx.com.

- You can also make a phone call to speak with an OFX customer support rep. The phone numbers vary by country and are listed below for reference.

What is the OFX customer support phone number for my country?

Below, we list phone numbers to contact OFX support team for various countries they provide customer support in.

- Australia: 1300 300 424 (Local call) or +61 2 8667 8090 (International)

- New Zealand: 0800 161 868 (Free call)

- Hong Kong: (+852) 3008 5721

- Singapore: +65 6817 8747

- United States: 1-888-288-7354 (Local call) or +1-415-449-1379 (International)

- Canada: +1800 680 0750 (Free call)

- United Kingdom: +44 207 614 4194

- Ireland: 1-800-948-364

- Germany: 0800-181-7242

- Spain: 900-838628

- France: 0805-080584

For a full list of support options to contact OFX customer support team, you can visit their Contact Us page.

Can I cancel my OFX transfer?

Once a transfer is booked, it is binding. However, OFX understands that people make mistakes or situations change, so if you want to cancel an OFX transfer, you should contact the OFX Customer Service team as soon as possible. Note that cancellation costs may apply.

How do I delete my OFX account?

To close your OFX account, you need to contact the OFX Customer Service team, and someone will assist you with your request.

Note that if you delete your OFX account, you will lose all transaction history. So, it's a good idea to keep a backup of your old transactions if you wish you delete your account with OFX.

Can I use OFX when travelling internationally?

Yes, OFX can assist with your international transfers while you are travelling provided the funds are coming from an account in your own name. Below are some helpful tips to be aware of if you want to use OFX when traveling.

- Transfers to some regions are not supported by OFX, so please check before travelling or relocating.

- OFX monitors IP addresses when you make transfers to determine your location.

- A fixed physical address is required to create an OFX account (no postal office boxes).

Additional Information

Legal and Regulatory Compliance

OzForex Limited (ABN 65 092 375 703 ) (trading as OFX) has an Australian Financial Services License ("AFSL") issued by the Australian Securities and Investments Commission ("ASIC") to deal, make a market in and provide financial product advice in relation to foreign exchange contracts and derivatives. OFX's AFS License number is 226 484.

Additionally, OFX is regulated and monitored by over 50 global financial agencies. They are also registered and authorized to operate in numerous US states.

Helpful Links

- RemitFinder blog on top 7 best international money transfer apps

- RemitFinder blog on how to make ATO and IRD tax payments from overseas using OFX

- Simplify your payments to the Australian Taxation Office with OFX

- Learn about a new global payment solution from CargoWise and OFX

- How to send money overseas with OFX

- Stay up to date with currency movements

- Get personalized rate alerts straight to your inbox

- How OFX keeps your data and money secure

- How OFX is able to keep their prices low

- How to achieve a money transfer without fees

Awards, Prizes and News

- 2016: Canstar outstanding value award

- 2016: Digital Identity Excellence Award in Fraud Prevention

- 2006: UK Trade & Investment International Business Awards Finalist

- 2005: BRW list of Fast 100 companies

- Various: Deloitte list of fastest 500 Technology companies

Reviews

Worst experience ever, trying to threat customer with high cancellation fee for its own delay. Not recommended.

Would be great if rates were higher. Will use again.