Pomelo Detailed ReviewRates, Fees, Limits, Safety and More

Last updated: November 15, 2024

What is Pomelo? An introduction

Pomelo is an international money transfer service that is not only easy, fast and secure, but also provides customers the ability to send on credit with the Pomelo Mastercard®, to build credit with the Pomelo Secured Mastercard®, or to send from their debit card, all without transfer fees or interest charges.

Pomelo is available for transfers from the United States to the Philippines to either GCash wallets or bank accounts.

Pomelo Mastercard® holders can use their card to send money from the app or for purchases anywhere Mastercard® is accepted and pay it back next month.

Pomelo Secured Mastercard® holders can build their credit not only from what they spend, but from what they send back home.

Pomelo does not charge fees for customers in good standing. External charges may apply for 3rd party services. Pomelo earns FX gains.

Pomelo is an international money transfer company that lets you send money using the Pomelo Mastercard using your credit. This way, you can send money now and pay later.

Pomelo company information

Pomelo launched in 2022, two years after CEO Eric Velasquez Frenkiel recognized that sending money to his family in the Philippines was a totally broken system, rife with high fees and predatory practices.

To fix this, he founded Pomelo to fulfil the dire need for support in the immigrant communities that power much of the western economy.

What services does Pomelo provide?

Pomelo is an international money transfer service, currently focused on serving customers sending money from the United States to the Philippines.

Here are some key services that Pomelo provides to its customers:

- Pomelo Mastercard®: Pomelo offers the Pomelo Mastercard® which is a line of credit for customers to use when sending money or spending here in the United States, with the ability to pay next month.

- Pomelo Secured Mastercard®: Pomelo also offers the Pomelo Secured Mastercard® for those users who are still building their credit, whereby they can build their credit every time they pay off their bill on time.

- Send money with Debit Card: Pomelo account holders can also send from their existing debit cards.

- Send to GCash as well as banks: Pomelo allows transfers to GCash wallets and dozens of Philippine banks.

Pomelo helps you send money overseas using their credit card or any debit card. You can also build your credit using Pomelo whereby you can send via credit and pay your bill on time to build your credit history.

Which countries does Pomelo operate in?

Pomelo offers transfers from the United States to the Philippines.

Where can I send money from with Pomelo?

Once you have a Pomelo account, you are able to send money from the US to the Philippines.

Where can I send money to with Pomelo?

Currently, you can send money to the Philippines using Pomelo.

With Pomelo, you can send money from the US to the Philippines.

It is possible that Pomelo will add support for more countries in the future. If this happens, we will update this detailed review with that information.

What are Pomelo's fees and exchange rates?

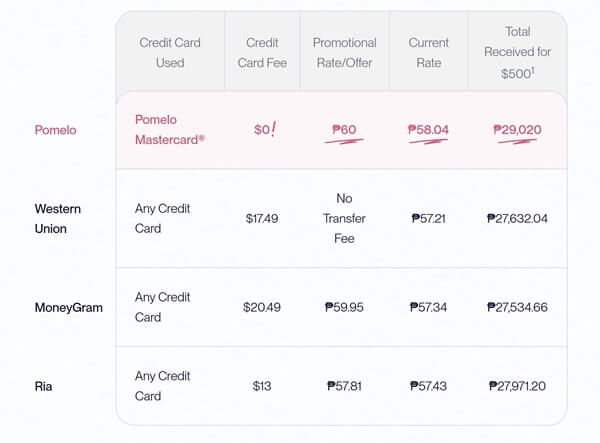

Pomelo tends to provide highly competitive exchange rates for international money transfers. Based on data published by Pomelo on their own website, here is a summary of their fees and exchange rates as compared to some of their competitors.

Credit card transfer fee when sending USD 500 to a bank account.

Pomelo earns FX gains.

Rate checked as of 11/04/2024 1 PM PDT.

1. Total amount remitter spends (i.e. USD 500 spent including fees).

Pomelo also provides RemitFinder customers a promotional, first-time exchange rate of USD 1 → PHP 60 for up the first USD 500 of the transfer amount.

When it comes to fees, here are some pertinent details about Pomelo's fees:

- Pomelo has no transfer or credit card fees.

- If you do not make your payment when it is due (no earlier than 25 days after you send), you may owe a late fee of up to USD 39.

Are Pomelo exchange rates good?

Pomelo offers competitive exchange rates, which they update daily to ensure you are always getting a strong and fair exchange rate. In general, Pomelo makes less than 1% on FX gains.

That said, we always suggest to our readers to always shop around and see what other remittance service providers are offering. More information will help you best choose a partner to send money with. When you compare money transfer providers, the chances of your getting the most benefit on your international money transfers increase significantly.

Whilst you can compare remittance companies manually, a quick and convenient way to do so is to rely on RemitFinder's online money transfer comparison engine. RemitFinder compares umpteen providers side-by-side to give you accurate and updated information about exchange rates and deals.

Is Pomelo a cheap way to send money overseas?

Yes, Pomelo can be a very cost-effective way to send money abroad.

By avoiding any transfer or credit card fees and having a very competitive exchange rate, Pomelo can be a cheap way to send money from the US to the Philippines.

How do I avoid Pomelo fees?

The best way to avoid any Pomelo fees is to pay off your Pomelo credit card bill on time.

We recommend that you setup auto pay from your bank account or just pay your Pomelo statement balance when it is due, no sooner than 25 days after you send.

How much money can I send with Pomelo?

For customers that accept the Pomelo Pay Later Plan, you will have a credit limit of up to a USD 1,000 for you to:

- Send money to your recipient's GCash Wallet or bank account.

- Spend money in the US or anywhere with your Pomelo Mastercard®.

For customers that accept the Pomelo with Credit Builder Plan, you may set your credit limit between USD 50 and USD 1000 and activate it by making a security deposit in the same amount. After a sufficient number of positive payments, Pomelo may graduate you to our Pay Later Plan and refund your original security deposit.

Once you pay off your credit limit, it resets to its full amount, and you are able to send the equivalent of your limit once again.

You can also use your debit card within the application to send more once your credit limit is reached.

Below is a table with the total amount limits for one day, one week, and one month.

Pomelo's transfer limits depend on your Pomelo plan. In general, you can keep sending up to your credit limit and pay off your card to send the same amount again. Additionally, you can send more money overseas by using a debit card even if your credit limit has been reached.

How long does it take for Pomelo to send money overseas?

Pomelo tends to move money overseas very quickly. The speed of your transfer depends on how you wish to pay your overseas recipient, and is as below:

- GCash Wallets: Within a few minutes

- Bank Accounts: For most transfers, within 5 minutes

Pomelo is an extremely fast way to move money overseas. For transfers to the Philippines, most transactions clear within a few minutes - this includes both GCash wallets as well as bank accounts.

How can I pay for my Pomelo money transfer?

To be able to complete an international money transfer, you first need to send your funds in local currency to the money transfer company you choose. The mechanism to pay for your remittance transaction is called a payment method.

Pomelo supports the following 2 payment methods:

- Pomelo Credit Card: You can pay for your money transfer within 25 days, using your bank account. You can connect your bank account to your Pomelo account directly on the Pomelo app.

- Debit Card: You can also use your debit card to send directly to your recipient.

Pomelo allows you to pay for your international money transfer using either the Pomelo Credit Card or a Debit Card.

Which payment method should I use to pay for my Pomelo money transfer?

We always recommend paying for your money transfers with the cheapest possible method.

In Pomelo's case, you have the option to pay for your money transfer with a Debit Card. This is free most of the time and you will save money.

If you do use your Pomelo Credit Card to pay for your transfer, make sure to pay off your credit card bill on or before time to avoid card fees.

How can my recipient get paid with Pomelo?

The method you choose to credit your overseas receiver is generally called a delivery method. Pomelo supports the following delivery methods:

- GCash Wallet

- Bank Account

If you send an international money transfer to the Philippines using Pomelo, you have the choice to pay your recipient directly into either their GCash wallet or their bank account.

Which delivery method should I use for my Pomelo money transfer?

For recipients of Pomelo international money transfer in the Philippines, paying into their GCash wallet might be a great option since GCash is widely used and accepted in the country for various types of spending and purchases.

That said, most GCash wallet users have a linked bank account, so paying into their bank account is almost equivalent. This way, they can load the money into their GCash wallet if they want or use it in other ways from their bank account.

We recommend that you discuss the preferred delivery method with your recipient before you send your international money transfer with Pomelo.

Are there any Pomelo coupon codes or promotions I can use?

Pomelo is offering new RemitFinder users a first-time promotional exchange rate of USD 1 → PHP 60 for up to USD 500. Regular exchange rate applies above USD 500.

This is a great way to save money on your first international money transfer with Pomelo!

If Pomelo runs any offers or promotions in the future, we will add them on this page. Check this Pomelo review periodically to ensure that you do not miss out on any future deals.

Whilst you can check for Pomelo deals and discounts manually, doing so is time consuming. A better way is to sign up for the RemitFinder daily exchange rate alert. Our daily alert is totally free of cost; we will keep you posted on exchange rates and latest offers from many money transfer companies.

How can I find Pomelo near me?

Pomelo is a fully digital service. Pomelo does not have physical stores or ATMs - instead, customers are able to use the app to send money directly to their loved one's bank account or GCash wallet.

What is the best way to find a Pomelo Sending Location near me?

Pomelo does not have any sending locations. You can send money anywhere using the Pomelo app on your phone.

Why should I go to a Pomelo Sending Location to send money in person?

You will not need to go to a specific sending location to use Pomelo. Pomelo is very convenient in that you can always send money directly from your phone, so you do not have to go somewhere and waste valuable time.

What is the best way to find a Pomelo Payment Location overseas?

You do not need to find a payment location as your loved one can receive the money directly in their GCash wallet or bank account. Currently, Pomelo does not offer a cash pick-up option.

Is Pomelo a safe way to send money abroad?

Pomelo has many measures in place to ensure the safety and security of their customers' funds and personal information. Below, we present some of these.

- Pomelo implements KYC (Know Your Customer) specifications for new recipient identity verification using Veriff. This ensures that your identity is verified and Pomelo knows you are acting on your own behalf vs a fraudster opening an account in your name.

- Pomelo does new recipient bank account verification using Microdeposits. This ensures that you have access to your account and enhances the security of your funds and information.

- Pomelo uses sender to recipient direct link; this helps to add another layer of security to your money transfer sent to your overseas recipient.

- When you create your international money transfer with Pomelo, you will be asked to provide recipient bank account information. This improves the overall security of the transaction and prevents sending money to wrongful or unauthorized recipients.

- Pomelo implements collection of purpose of transfer. This helps ensure compliance with legal and regulatory requirements like AML (anti money laundering).

- Pomelo also relies on the collection of relationship to recipient information; this is also helpful for auditing and compliance purposes.

- When you send a new money transfer with Pomelo, you will be asked to verify your transfer via a sender email verification. This adds another layer of security to your money transfer.

- Pomelo has support for biometrics, but this is limited to card details at this time.

- Pomelo also collects SSN (Social Security Number) from all US senders. This validates the authenticity of the sender and enhances overall security and safety.

Pomelo implements numerous types of security measures in an effort to keep your money and information safe. As a result, you can be confident that Pomelo is a safe and risk-free way to send money overseas to your loved ones.

Can I trust Pomelo?

A major aspect of trusting a financial institution entails inspecting their legal and regulatory status in the countries of their operation. When it comes to Pomelo, we notice the below pertinent information:

- Pomelo is a licensed money transfer operator in both the United States of America as well as the Philippines.

- Pomelo follows all legal and regulatory requirements in both the United States and the Philippines.

- Pomelo is partnered with Coastal Community Bank, which is FDIC-Insured; the Pomelo Card is issued by Coastal Community Bank pursuant to a license from Mastercard International.

Pomelo is a licensed money transfer company in both the US as well as the Philippines. Additionally, the Pomelo Card is issued by Coastal Community Bank (which is FDIC-Insured) pursuant to a license from Mastercard International.

How good is Pomelo's service?

One of the most reliable ways to check if a service is good or not is to see what other customers have to say about it. We will do the same to see if Pomelo's customers are happy with their service or not.

What do users have to say about Pomelo?

In this section, we look into Pomelo's ratings and reviews^ on popular review platforms and major mobile app stores to see what users think about their service.

- On Trustpilot, Pomelo is rated Excellent with a 4.8/5.0 rating and 929 reviews

- On the Google Play Store, Pomelo is rated 4.7/5.0 with 533 reviews and more than 10K downloads

- On the Apple App Store, Pomelo is rated 4.9/5.0 with 1.9K ratings

^Ratings on various platforms as on November 15, 2024

Pomelo has excellent ratings and reviews on Trustpilot as well as Android and iOS app stores. Customers seem to like their international money transfer service.

Have you used Pomelo yet? If so, please consider leaving a review on RemitFinder so other users can benefit from your expertise and experience.

Is Pomelo the best choice for me?

Given our detailed analysis of Pomelo international money transfer service and related aspects, it is clear that Pomelo has many strengths. Here are some areas where we find Pomelo standing tall in the international remittance use case:

- Innovative send now, pay later model: If you need to send money overseas to your loved ones but do not have the funds yet, you can still execute your money transfers using the Pomelo Card. This way, your overseas recipient can have the funds whilst you have time to pay for your credit card before you incur charges.

- Build credit history: Pomelo offers their Secured Mastercard which is ideal for anyone who needs to build their credit history in the United States.

- Competitive exchange rates and low fees: Pomelo offers highly competitive exchange rates and low fees which amplify the reach of your hard-earned money by putting more money into your overseas recipient's pocket.

- Special promotional FX rate for RemitFinder users: Pomelo is offering a special promotion for new RemitFinder users whereby you get a welcome exchange rate of USD 1 → PHP 60 for up the first USD 500 of the transfer amount. Take advantage of this to save a lot more on your first international Pomelo money transfer.

- Extremely quick money transfers: Pomelo money transfers finish within minutes. This includes both GCash wallet credits as well as bank deposits. This makes Pomelo a quick way to send money overseas.

- Flexible payment and delivery methods: You can pay for your Pomelo money transfer using your Pomelo Card or a debit card. Similarly, you can choose to send to funds to your overseas recipient's GCash wallet or bank account.

- Focus on safety and security: Pomelo implements numerous safety and security protocols to try to keep your information as well as money safe. In addition, Pomelo is a licensed and regulated money transfer company.

RemitFinder likes Pomelo for providing an innovative send now, pay later service, credit building ability with its Secured Mastercard, highly competitive exchange rates including a special, welcome exchange rate for RemitFinder users, quick transfers, flexible payment and delivery methods and a secure platform.

This makes Pomelo a good fit for many international money transfer needs, some of which we will discuss next.

What are the best reasons to use Pomelo?

Pomelo's key advantages make it a very good choice for quite a few international money transfer use cases. Based on the in-depth analysis that we have conducted on Pomelo's remittance service in prior sections of this review, we notice that it can be a great fit for many international money transfer scenarios.

Here are some examples where Pomelo can prove to be a reliable partner for your next overseas money transfer.

- If you do not have money right now but need to send it overseas to your loved-ones, Pomelo can be a great fit given its Send Now, Pay Later model. Using your Pomelo Card, you can send money to your overseas recipients now, and pay for it later with your credit card bill payment.

- If you are new to the financial ecosystem of the US and need to build your credit history, you can rely on the Pomelo Secured Mastercard which will assist you in building your credit over time. Simply pay for your money transfers using the card as well as make purchases - as long as you pay your bill on time, you will build much-needed credit history.

- With Pomelo, you can maximize the reach of your money by taking advantage of highly competitive exchange rates. To make it even better, Pomelo is offering new RemitFinder users a special exchange rate of USD 1 → PHP 60 for up the first USD 500 on their first international remittance.

- Sometimes money needs to be sent overseas urgently. If you find yourself in this situation, Pomelo can be a great partner as Pomelo international money transfers finish within minutes.

- If you wish to use flexible payment and delivery methods for your transfers, Pomelo can be a good option as it supports Pomelo Card and debit card as payment options, and GCash wallet and bank deposit as delivery options for your overseas recipient.

- If you want to have peace of mind that your private and confidential information is safe and your money is not lost, Pomelo can be a reliable partner as it implements many security protocols and best practices.

Pomelo's strengths and advantages make it a very good choice for many money transfer scenarios for remitting money from one country to another.

What type of transfers can I make with Pomelo?

You can send money to a GCash wallet or to a bank account from your Pomelo Mastercard or through your debit card.

What are various ways to send money with Pomelo?

Currently, you can send money with Pomelo on the Pomelo app directly on your phone.

How to send and receive money with Pomelo?

It is quick and easy to send money internationally with Pomelo. In fact, the whole flow from start to finish can be completed on any of Pomelo's channels to send money with in just a few minutes. Check out the section below for the exact steps needed to do an overseas money transfer with Pomelo.

Step by step guide to send money with Pomelo

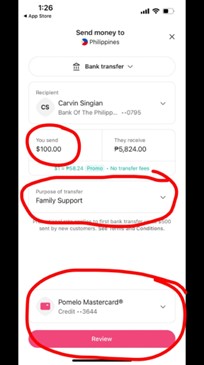

With Pomelo, sending money overseas takes only a few clicks. Here are the steps you need to undertake to finish an end-to-end money transfer with Pomelo:

- Step 1: Decide Pomelo is your chosen partner for your next money transfer. With the recent explosion of money transfer operators, it may seem difficult to decide who to go with. One helpful way to reach a decision is to compare various money transfer companies using RemitFinder's real-time money transfer comparison platform. RemitFinder does all the heavy lifting to assist you to easily compare the relative strengths and weaknesses of many remittance companies side by side. This can really help you to narrow down the choices that meet your selection criteria and therefore, help you to select who to go with.

- Step 2: Create a new Pomelo account. Once you have decided that you wish to use Pomelo for your next international money transfer, sign-up for a Pomelo account. Fill out all the required information and provide proper identification to get verified. Then accept your Pomelo plan and download the Pomelo mobile app on your smartphone.

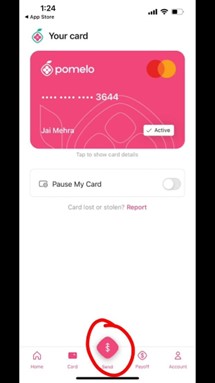

- Step 3: Click on Send on the bottom menu. Once you have the Pomelo app on your phone, login into your account and click on Send on the bottom menu.

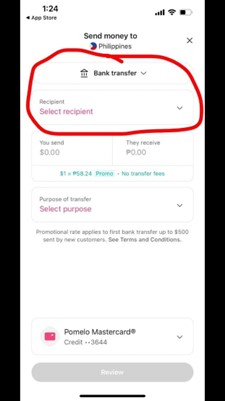

- Step 4: Select transfer type and recipient. In the next step, select your Pomelo money transfer type; options include Bank transfer or GCash. Also choose your overseas recipient from the list if you have previously sent money to this recipient (otherwise, you will add a recipient in the next step).

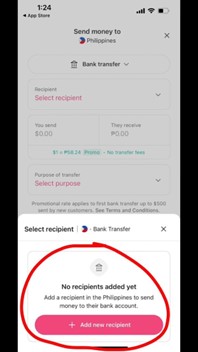

- Step 5: Add new recipient if sending money to someone for the first time. If you are sending money to someone for the first time, you will need to add them as a recipient. Make sure to provide all the information required about your receiver.

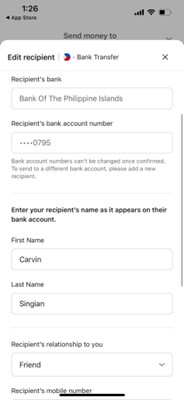

- Step 6: Add new recipient details for selected transfer type. Make sure to provide all the information required about your receiver - this varies depending on the transfer type that you selected earlier.

For bank transfers, the following information is required:

- Recipient's bank name

- Recipient's bank account number

- Recipient's first and last name

- Recipient's phone number

- Recipient's relationship to you

For GCash wallet transfers, the following information is required:

- Recipient's first and last name

- Recipient's phone number that is associated with their GCash Wallet

- Step 7: Enter transfer amount, select purpose and review transaction. Once your new recipient has been added, enter the amount you want to send as well as the purpose of transfer. Next, click Review on the bottom of the screen to verify all entered information about the transfer.

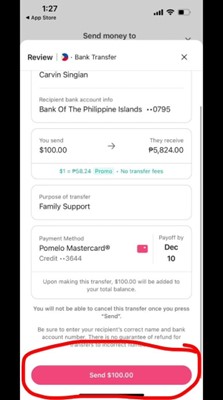

- Step 8: Verify information and send your transfer. In this step, you are presented with a summary of your transfer. In case any information is not correct, go back to fix the same. Once you have verified all information for accuracy, click Send on the bottom of the screen.

That is it. Pomelo will work on your transaction and your money should be delivered to your recipient within a few minutes.

It is quick and easy to send money overseas with Pomelo. You can finish the whole money transfer flow using the Pomelo mobile app within just a few minutes.

How can Pomelo help me send money?

You can use the above step-by-step guide to sign up and execute your first transaction with Pomelo - its quick and easy to do so with the steps we have outlined above.

Additionally, Pomelo has many helpful resources on their website to help you get started with your first money transfer with them.

Finally, if you need assistance, you can contact the Pomelo customer support team (pertinent information is listed in a following section).

Do I need a Pomelo account to receive money?

No, you do not need a Pomelo account to receive money sent to you by someone using Pomelo. Only the sender needs a Pomelo account.

The recipient can receive the money directly in their GCash wallet or bank account, without signing up for Pomelo.

Does Pomelo have a mobile app?

Yes, it does. You can download Pomelo's mobile app on either the IOS App store or the Google Play App Store to send money on the go.

How do I track my Pomelo transfer?

You will receive SMS and emails related to the status of your transfer. Additionally, you can see the status of your transfer on the Pomelo app.

Can I use Pomelo for international bank transfers?

Yes, you can use Pomelo for international bank transfers. To do this, pay for your Pomelo money transfer with your debit card (linked to your bank account) and choose bank deposit as the delivery option to pay your overseas recipient.

By doing this, money will flow directly from your local bank account to your recipient's overseas bank account, thereby executing an international bank transfer.

The major advantage of this, though, is that instead of getting bad exchange rates and paying high wire transfer fees to banks, you get the benefit of Pomelo's competitive exchange rates and low fees.

Is Pomelo online better than sending money in-person in stores?

Absolutely! Not only does sending money through Pomelo’s application save you time, it is also more secure and safer.

Using Pomelo's mobile app to send money overseas is easy, convenient and secure.

Does Pomelo have a rewards program?

Pomelo does not have a rewards program at this time. If that changes, we will update this detailed Pomelo review.

What customer support options are available with Pomelo?

In case you need any help with your Pomelo money transfer, or have any other general questions, you can contact the Pomelo customer support team.

There are many easy ways to get in touch with Pomelo customer support as below:

- You can email Pomelo support team at support@pomelo.com.

- You can call Pomelo support on this number: +1 (888) 404-2729.

- You can use in-app support from within the Pomelo mobile app.

Pomelo's customer support team is available every day from 9:00 AM ET to 11:59 PM ET.

Pomelo's customer support team can be reached via email, phone or from within the mobile app, and is available every day from 9:00 AM ET to 11:59 PM ET.

Can I cancel my Pomelo transfer?

You can cancel your bank account transfer as long as the funds have not been deposited into the recipient's account yet. Also, if a bank account does not exist with the information you provided, then the transfer will be canceled automatically and your balance will be adjusted.

Note that you cannot cancel a GCash transfer. This is because GCash wallet deposits are almost instant and there is no way to recover the funds. We, therefore, suggest that you check all information very carefully when you create a transfer.

GCash transfers sent with Pomelo cannot be canceled. Bank transfers can be canceled before transaction completion. Make sure to double check all info when you create a transfer to avoid issues.

How do I delete my Pomelo account?

If you wish to delete your Pomelo account, you will need to settle your outstanding balance before your account can be closed. Once you have settled your balance, contact Pomelo customer support team to request account deletion.

You can expect your request to be completed in 7-10 business days from receipt of your request.

We recommend that you make a copy of your transaction history for future references. Once your account is deleted, you will lose all access to historical information.

Can I use Pomelo's multi-currency card overseas?

Yes, you can use your Pomelo Mastercard anywhere that Mastercard is accepted. This makes the Pomelo Card ideal for international use.

Can I use Pomelo's application when traveling internationally?

Yes, you can use the Pomelo mobile app to transfer money to the Philippines across the world as your travel from one place to another.

Additional Information

Legal and Regulatory Compliance

Pomelo is partnered with Coastal Community Bank, which is an FDIC-Insured institution. The Pomelo Card is issued by Coastal Community Bank pursuant to a license from Mastercard International.

Awards, Prizes and News

- Yahoo Finance story on Pomelo and Thunes partnership.

- TechCrunch article on Pomelo's Series A funding round.

- Pomelo's launch announcement from its CEO, Eric Velasquez Frenkiel.