e-Pocket Detailed ReviewRates, Fees, Limits, Safety and More

Last updated: May 02, 2023

What is e-Pocket? An introduction

e-Pocket company information

e-Pocket is a Melbourne based financial technology company established in 2017. e-Pocket has built an ecosystem of products that empower digital payments for everybody round the clock.

e-Pocket has been operational since launch in the cryptocurrency space, and has a digital wallet that is accessible over both Android and iOS smartphones. The e-Pocket mobile wallet is available for download via both the Google Play Store as well as the iOS App Store.

As part of its growth journey, e-Pocket has also started providing remittance services since October 2022. With e-Pocket's newly launched remittance program it is now possible for Australians to send money to Africa to their loved ones with zero fees and competitive rates.

Having broken into the remittance industry, e-Pocket aims to serve customers by offering the best possible value for their money as well as exceptional customer support. Currently, e-Pocket supports 16 African countries and hundreds of different payment methods.

e-Pocket is a mobile wallet using which you can send money to other e-Pocket users as well as send international remittances to various countries in Asia and Africa.

What services does e-Pocket provide?

e-Pocket is an Australian digital or mobile wallet which you can use to hold Australian Dollars (AUD) funds. You can then do a variety of actions with your money in your wallet, which include the below:

- Send money to other e-Pocket users using just their mobile number.

- Deposit more funds into your e-Pocket wallet via a variety of methods.

- Send international remittances to friends and family in over 17 countries in Africa and Asia.

- Withdraw funds from your mobile wallet into your bank account quickly and easily.

Which countries does e-Pocket operate in?

e-Pocket operates out of Australia, and currently supports sending money to various countries in Africa as well as Asia. We provide more details on e-Pocket's corridor coverage below.

Where can I send money from with e-Pocket?

Currently, you can send money overseas using e-Pocket from Australia in Australian Dollars (AUD).

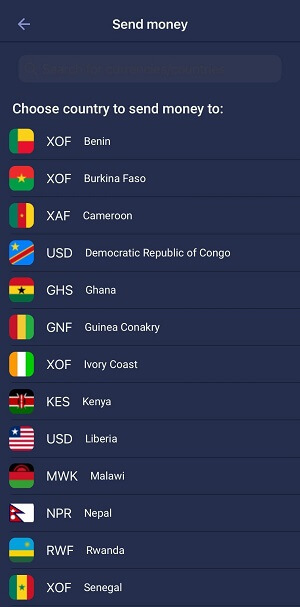

Where can I send money to with e-Pocket?

If you are in Australia, you can send money to over 17 countries in Africa and Asia using e-Pocket's international remittance services.

Below is a list of countries you can send money to with e-Pocket:

- Benin

- Burkina Faso

- Cameroon

- Democratic Republic of Congo

- Ghana

- Guinea Conakry

- India

- Ivory Coast

- Kenya

- Liberia

- Malawi

- Nepal

- Rwanda

- Senegal

- South Sudan

- Tanzania

- Uganda

- Zambia

You can send money with e-Pocket from Australia to more than 17 countries in Africa and Asia.

In case your country is not yet in the list, keep checking back as it is possible that e-Pocket supports more countries in the future.

What are e-Pocket's fees and exchange rates?

e-Pocket tends to have very competitive exchange rates across various countries that they support. To verify this, let's check their FX rates for some countries and see if their rates are really good or not.

Below, we have listed some comparisons we did for sending money from Australia with e-Pocket. We chose various countries to send AUD 1000 from Australia for our case studies below.

| Country Pair | Transfer Amount | Exchange Rate* | Fees* | Payout | Mid-Market Rate** | FX Markup |

|---|---|---|---|---|---|---|

| Australia to Ghana | AUD 1,000 | 1 AUD = 7.4340 GHS | AUD 0.0 | 74,340.00 GHS | 1 AUD = 7.8069 GHS | 4.78% |

| Australia to Guinea | AUD 1,000 | 1 AUD = 5568.0200 GNF | AUD 0.0 | 55,680,200.00 GNF | 1 AUD = 5612.9708 GNF | 0.80% |

| Australia to Kenya | AUD 1,000 | 1 AUD = 87.1350 KES | AUD 0.0 | 871,350.00 KES | 1 AUD = 87.6210 KES | 0.55% |

| Australia to Rwanda | AUD 1,000 | 1 AUD = 711.8320 RWF | AUD 0.0 | 7,118,320.00 RWF | 1 AUD = 738.0150 RWF | 3.55% |

| Australia to Tanzania | AUD 1,000 | 1 AUD = 1529.3880 TZS | AUD 0.0 | 15,293,880.00 TZS | 1 AUD = 1534.2745 TZS | 0.32% |

*Exchange rates and fees as on April 30, 2023

**Mid-Market Rate from XE.com

See how we calculate FX Markup

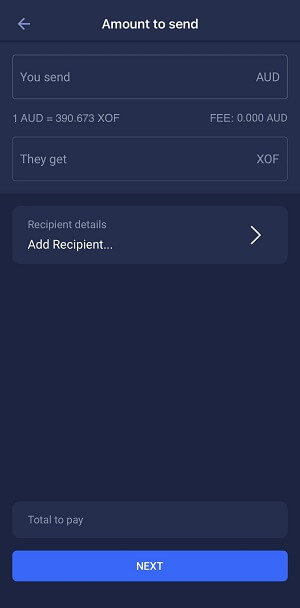

e-Pocket provides a real time online FX rate calculator on their site and mobile apps. This means you can always check their latest exchange rates anytime you are ready to send money overseas with them.

Simply choose the country you want to send money to and choose the amount you wish to send in AUD. e-Pocket will show you the exchange rate you can expect to get if you send money with them to your desired destination country.

e-Pocket's exchange rates tend to be fairly competitive across most of the markets they operate in. Currently, there are also no fees to send money with e-Pocket.

Are e-Pocket's exchange rates good?

e-Pocket does provide fairly competitive exchange rates in the markets that they currently operate. To get a real time quote before you send money with them, you can use their online FX calculator to get an idea of the rate you will get.

Based on our case studies presented above, e-Pocket tends to charge an FX Markup between 0.32% and 4.78% on top of the interbank exchange rate. This means that you will get a great rate most of the time, but for some corridors, you may not get a good rate for your international money transfers.

Hence, it is in your best financial interest to always compare various money transfer companies before you choose one to send money abroad. Doing this research will ensure that your hard earned money goes farther and your overseas recipient gets more bang for your buck.

A great way to compare money transfer options is to rely on RemitFinder's online remittance comparison platform. Leave the hard work to compare providers to experts, and rely on easy to read and understand results to see which provider is the best for you.

Is e-Pocket a cheap way to send money overseas?

There are usually 2 main ways money transfer companies make money off your international money transfers. These are bad exchange rates and transfer fees.

The good news is that RemitFinder users do not pay any transfer fees when they send money overseas from Australia with e-Pocket. Additionally, e-Pocket's exchange rates tend to be generally very competitive, so you can save on that front as compared to banks or other companies that charge a very high FX Markup.

With 0 fees and competitive exchange rates, e-Pocket is definitely not an expensive way to send money overseas from Australia.

How do I avoid e-Pocket fees?

RemitFinder users pay 0 fees on international money transfers from Australia with e-Pocket. So, the best way to avoid e-Pocket fees is to click through RemitFinder to e-Pocket and register your account to send money abroad.

How much money can I send with e-Pocket?

There is no limit to the amount of money you can send with e-Pocket. This makes e-Pocket a great option in case you need to send large amounts of money overseas from Australia.

There is no sending limit in place when you send money internationally with e-Pocket.

That said, there may be legal rules and regulations applicable in certain countries which may impose a limit on how much money you can send to such destinations. Check with an e-Pocket support rep to find out if any limits apply to your destination country.

How long does it take for e-Pocket to send money overseas?

With e-Pocket, how long your money will move overseas depends on how you choose to pay your overseas recipient for your remittance transaction with them. Below are e-Pocket's transfer speeds for various delivery methods:

- Mobile wallet deliveries usually arrive in seconds.

- Bank account transfers can take anywhere between seconds and 1-3 days since final delivery is up to the discretion of partner banks.

- For cash pickups, the recipient can typically receive the money within 24 hours.

e-Pocket is a quick way to send money abroad. Most transfers finish between seconds to 24 hours.

How can I pay for my e-Pocket money transfer?

When you send money abroad with e-Pocket, you have the option to pay for your money transfer in a few ways. How you pay for your remittance is called a payment method.

e-Pocket supports the below payment methods:

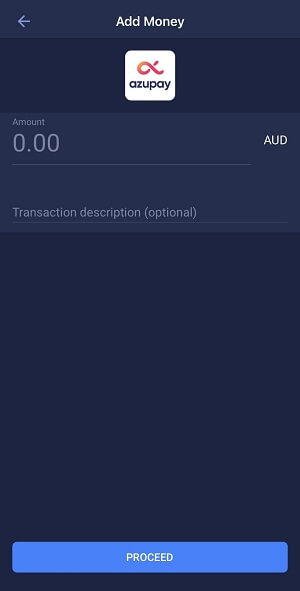

- PayID: PayID is a digital payment ecosystem prevalent within Australia. You can pay for your e-Pocket remittance transaction with PayID.

- Bank Transfer: You can also send money to e-Pocket via a direct bank transfer.

You can pay for your e-Pocket money transfer using PayID or a direct bank transfer.

Which payment method should I use to pay for my e-Pocket money transfer?

Both PayID and bank transfer are a secure and electronic way to pay for your money transfer. You can use either of the two without any risk.

Depending on your convenience or preference, you can use PayID or a bank transfer to send money to e-Pocket for your international remittance with them.

How can my recipient get paid with e-Pocket?

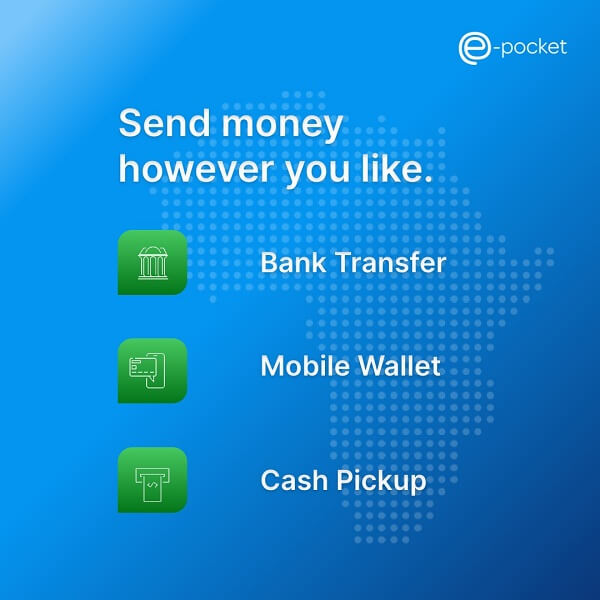

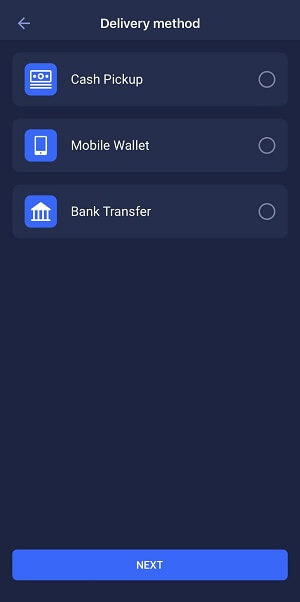

The manner in which you choose to pay your overseas recipient is called a delivery method. e-Pocket supports the following 3 delivery methods:

- Mobile Wallet Credit: In this case, e-Pocket will send the funds to your recipient's mobile wallet. Mobile wallet transfers with e-Pocket are generally very quick and finish within seconds.

- Bank Transfer: With a bank transfer, the funds get deposited into your recipient's overseas bank account. This may take 1-3 business days as it is dependent on the overseas bank speed, procedures and holidays.

- Cash Pickup: You can also pay your recipient vi cash pickup at thousands of convenient locations in their country. e-Pocket cash pickups are generally available within 24 hours of sending the funds from Australia.

Which delivery method should I use for my e-Pocket money transfer?

The delivery method you choose for sending money via e-Pocket depends on your and your recipient's preferences and needs.

For example, if you need to send money quickly, you can choose a mobile wallet transfer as the funds will arrive within seconds.

In case your recipient does not have a bank account or mobile wallet, you can send money via a cash pickup. Cash pickups can be risky though so we do not recommend sending large amounts via this mode.

Finally, for sending large amounts, it is always best to choose the bank transfer deliver method.

You can choose between bank transfer, cash pickup and mobile wallet credit when you send money overseas with e-Pocket.

Are there any e-Pocket coupon codes or promotions I can use?

Yes, there are currently 2 attractive deals available to RemitFinder users who choose to send money internationally with e-Pocket from Australia.

The 2 active e-Pocket promotions are as below:

- Get free transfers from Australia: RemitFinder users pay 0 fees on all money transfers (first as well as subsequent) sent from Australia via e-Pocket.

- Refer a friend to earn AUD 10: If you refer a friend to e-Pocket and they send at least AUD 50, both you and your friend will earn an AUD 10 reward. Note that you must also have sent at least AUD 50 to qualify for the reward amount.

Take advantage of attractive e-Pocket promotions to save more money on your international remittances from Australia.

If e-Pocket adds more deals and coupons, we will mention them on this page. Make sure you check back periodically to stay updated with new e-Pocket offers.

Another great way to stay updated and avoid checking for new deals and promotions manually is to sign up for the RemitFinder daily exchange rate alert. It's totally free, and you will get notified about the best exchange rates and deals from various money transfer companies.

How can I find e-Pocket near me?

The services offered by e-Pocket are exclusively available online via their website and mobile apps. As such, there are no physical stores or branches associated with e-Pocket.

You can access and utilize e-Pocket for your remittance needs from the comfort of your own devices without the need to visit a physical location.

e-Pocket is an online only remittance service provider without any physical locations or branches.

What is the best way to find an e-Pocket Sending Location near me?

With e-Pocket, you can send money from anywhere, anytime using the e-Pocket mobile apps. There is no need to visit a physical location as e-Pocket offers its services on their website and user-friendly mobile apps.

Why should I go to an e-Pocket Sending Location to send money in person?

You can access and utilize e-Pocket for your remittance needs from your own devices without the need to visit a physical location.

What is the best way to find an e-Pocket Payment Location overseas?

When you send money with e-Pocket and choose cash pickup as a delivery method, you will need to pick a cash pickup location in the country you are sending money to. Once you do this, your overseas recipient will receive a notification regarding the pickup location.

Is e-Pocket a safe way to send money abroad?

An important aspect of choosing a money transfer company is safety and security of your funds and private information. Let's see what safety practices does e-Pocket follow to keep your money and information safe at all times.

Based on our analysis, e-Pocket implements the below security guidelines and best practices:

- Complying with Know Your Customer (KYC) guidelines to ensure that customers are fully and properly identified. This also protects you from fraud by ensuring only you transact on your behalf and no one else.

- Using digital wallet technology which is inherently more secure as you transact via a mobile application which is installed on your device.

- Providing customers with an option to enable 2-factor authentication (2FA) to further enhance security.

According to the information available on the e-Pocket website, the e-Pocket team claims that they have never had any security breach or loss of funds since their inception.

Can I trust e-Pocket?

Another spectrum of security and trustworthiness is regulation and compliance. If a money transfer company is registered with the right financial authorities in the countries they operate in, you can rest more assured that they are likely safe.

Since 2018, e-Pocket has been compliant with the guidelines of the Australian Transaction Reports and Analysis Centre (AUSTRAC). Maintaining compliance with financial watchdog institutions ensures that registered companies maintain an acceptable level of security and safety for their operations.

Given e-Pocket's AUSTRAC registration and compliance, and security measures implemented by them, you can likely trust e-Pocket with your money and information.

How good is e-Pocket's service?

A good indicator of whether a service is good or not is to see what other customers have to say about it. While companies can produce marketing material to impress you, real feedback from other users is always something to look at.

What do users have to say about e-Pocket?

Let's see what e-Pocket's remittance customers have to say about their money transfer product. We checked e-Pocket's ratings and reviews on various popular platforms^ and found the below information:

- e-Pocket is rated Excellent on Trustpilot with a 4.4/5.0 rating and has 11 reviews

- On the Google Play Store, e-Pocket has a 5.0/5.0 rating with 33 reviews and more than 1,000 downloads

- e-Pocket's iOS app is rated 5.0/5.0 on the App Store with 2 ratings

^Ratings on various platforms as on May 01, 2023

e-Pocket has excellent ratings and reviews across the board. Number of reviews is still less though.

Have you used e-Pocket yet? If so, please consider leaving a review on RemitFinder so other users can benefit from your expertise and experience.

Is e-Pocket the best choice for me?

e-Pocket presents many key advantages when it comes to sending money internationally. Based on our detailed analysis of e-Pocket's remittance service, we find it to be beneficial in the following key areas:

- Highly competitive exchange rates: e-Pocket's FX margin tends to be low, which makes it a very good choice to get higher exchange rates on international money transfers.

- 0 fees on all transfers: e-Pocket is not charging any fee on money transfers; this includes your first as well as subsequent money transfers with them. This further lowers the cost of your remittance and puts more money into your overseas recipient's account.

- No sending limits: e-Pocket does not enforce any maximum sending limits. Be aware that there may be country-specific limits imposed by governments and/or financial regulators in certain countries.

- Flexible payment and delivery methods: With e-Pocket, you can pay for your transfers with PayID as well as a bank transfer. Similarly, you can have your recipient access funds via mobile wallet, bank transfer or cash pickup.

- Fast money transfers: e-Pocket moves money overseas quickly with digital wallet credits finishing in just a few seconds.

- Great customer feedback: Even though e-Pocket has only a handful of reviews on various platforms, the feedback on their remittance service from customers is outstanding. This is a great indicator that customers love their service.

RemitFinder likes e-Pocket for providing competitive exchange rates, charging 0 fees, providing flexible payment and delivery methods and moving money overseas very quickly.

e-Pocket is a digital platform that provides international money transfer services. It tends to be a fast, reliable and cost-effective service.

One of the key advantages of e-Pocket is its zero fee and transparent exchange rates, which are typically much lower than those charged by traditional banks and other money transfer providers.

e-Pocket also offers a user-friendly and easy-to-use platform, which allows customers to initiate transfers quickly and easily from their desktop or mobile device. e-Pocket allows users to send money over 17 different countries in Africa, and to make transfers between those currencies at competitive exchange rates, without any hidden fees or high markups.

Overall, e-Pocket is a reputable and reliable service that is widely trusted by users worldwide.

It is worth noting that e-Pocket quality of service remains consistent on any transfer corridor, currency, and amount involved.

What are the best reasons to use e-Pocket?

The advantages of e-Pocket make it suitable for many international money transfer scenarios. Based on our comprehensive inspection of e-Pocket's money transfer service, we find it to be a good fit for many remittance needs.

Below is an example of some common scenarios that are served well by e-Pocket's remittance product:

- If you need to send money to African countries often, e-Pocket may prove to be a great partner for your needs. With a special focus on the African continent, e-Pocket provides a very good option to send money to loved ones in Africa.

- If you need to send large sums on money abroad, e-Pocket can be a good fit as they do not enforce any sending limits. Make sure to check your destination country rules and regulations though as they may enforce limits that e-Pocket will have to comply with.

- If you need to rush money to your family members urgently, e-Pocket is a great choice as they can move money abroad rapidly. Mobile wallet transfers with e-Pocket, for example, finish within seconds. This will provide your overseas recipient instant access to funds.

- If you need flexibility with delivery options, e-Pocket may be your best bet. This is because e-Pocket support 3 delivery methods - bank transfers, mobile wallet credits and cash pickups. This makes it very convenient for you and your overseas recipient to decide which delivery option works the best for both of you.

- If you want to save on international money transfers, e-Pocket can be a good choice given their competitive exchange rates and 0 fees on all money transfers sent from Australia.

e-Pocket can be a great fit for many international money transfer needs.

What type of transfers can I make with e-Pocket?

With e-Pocket, you can make money transfers with 3 different delivery options to pay your overseas recipient. These are:

- Mobile Money Transfer

- Bank Transfer

- Cash Pickup

These options lend you and your overseas recipient with a lot of flexibility when it comes to planning your international money transfers from Australia.

What are various ways to send money with e-Pocket?

You can access and utilize e-Pocket for your remittance needs from the comfort of your home and using your own devices anytime. Since e-Pocket is an online only money transfer company, you do not need to visit a physical location.

With e-Pocket, you can send money in the following 2 ways:

- Via the e-Pocket website

- Via the e-Pocket mobile apps available on both Android and iOS

How to send and receive money with e-Pocket?

Sending money overseas using e-Pocket is simple, quick and easy, and the whole process can be completed in just a few minutes.

In the next section, we will present a step by step guide on how to send money abroad using e-Pocket.

Step by step guide to send money with e-Pocket

Follow the below steps to quickly and easily send money overseas using e-Pocket's remittance service:

- Step 1: Determine if you are ready to send money with e-Pocket. When you want to send money abroad, the first step is to figure out which money transfer provider you want to go with. To determine the best company for your needs, we strongly recommend you compare e-Pocket with other money transfer companies to inspect the pros and cons of each option. A great way to accomplish this is by using RemitFinder to compare money transfer companies. Simply search for your source and destination countries and compare various options presented easily.

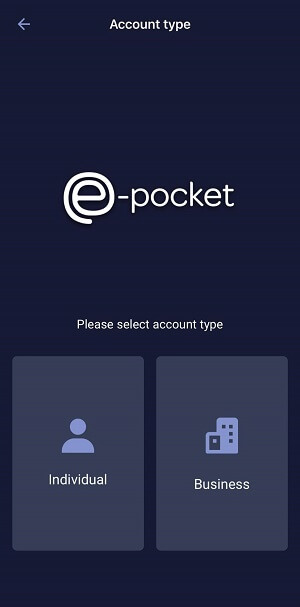

- Step 2: Sign up for an e-Pocket account. Once you have determined you are ready to send money with e-Pocket, you will need to create an account with them. To do this, go to the e-Pocket website or mobile app and click the Register button. You will be prompted to provide your information for verification and security purposes. Once you have completed the registration process, you will be able to log in to your e-Pocket account.

- Step 3: Deposit money into your e-Pocket wallet. Before you can send money abroad with e-Pocket, you will need to add funds to your e-Pocket wallet. One way to do this is by using PayID. Simply select PayID as your payment option, enter the amount you want to add, and follow the on-screen instructions to complete the transaction. Alternatively, you can also fund your e-Pocket wallet via a bank transfer.

- Step 4: Choose the destination country and currency. In this next step of your transfer process, selected the country you want to send to as well as the destination currency.

- Step 5: Select the delivery method for your transfer. Choose the delivery method that best suits your and your overseas recipient's needs. You can choose from 3 supported delivery methods that include bank transfer, mobile wallet transfer and cash pickup.

- Step 6: Enter transfer amount and add recipient details. The next step is to enter your transfer amount and add your recipient. Once you enter the amount you want to send, e-Pocket will automatically calculate the exchange rate and any fees associated with the transfer, so you will know exactly how much the recipient will receive. Also, you will need to enter the recipient's details. This includes their name, email address and bank account information or mobile number. Make sure to double-check all of the information to ensure it is correct. This will ensure that the transfer progresses smoothly without any problems.

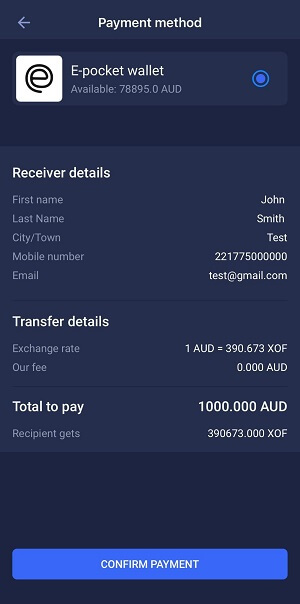

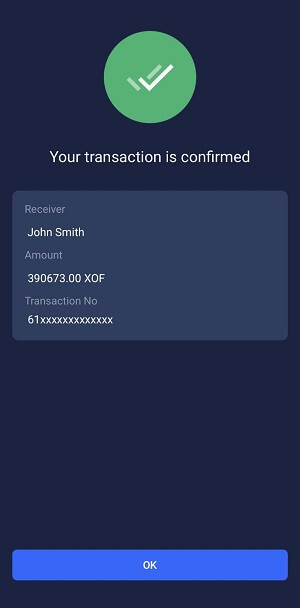

- Step 7: Review and confirm your money transfer. Before you finalize the transfer, it is important to review all of the details to ensure everything is correct. This is also a good time to check the exchange rate, fees and estimated delivery time. Once you are satisfied, click the Confirm button to initiate the transfer.

- Step 8: Money transfer completed. Once you have confirmed the transfer, e-Pocket will do the currency conversion and send the money to the recipient's bank account. You will receive a confirmation email once the transfer is complete.

That's it! e-Pocket will take it on from here and work on moving your money overseas to your recipient.

You can send money overseas with e-Pocket conveniently in just a few clicks.

How can e-Pocket help me send money?

It is pretty easy to send money with e-Pocket given the streamlined user flow of its product. But just in case you need help or have questions, e-Pocket has resources to help you move forward.

If you need help to send money, e-Pocket will gladly assist you through a phone call. Alternatively, you can also contact e-Pocket online via live chat and someone will assist you with your money transfer.

Do I need a e-Pocket account to receive money?

No, it is not necessary for an overseas recipient to have an e-Pocket account. This is because e-Pocket delivery options include bank transfer, mobile wallet credit and cash pickup - none of these 3 are dependent on the recipient having an e-Pocket account.

Your overseas recipient does not need an e-Pocket account to receive the funds you send to them using e-Pocket.

Does e-Pocket have a mobile app?

e-Pocket does have a mobile app that is available for both Android as well as iOS mobile devices. You can download the e-Pocket mobile app from your respective app store depending on your device operating system.

e-Pocket's mobile app is the best way to use e-Pocket remittance service, so make sure you download the app for your money transfers with e-Pocket.

How do I track my e-Pocket transfer?

You can check the status of your e-Pocket transactions by navigating to your transactions in your account and then clicking on "Transaction Status".

e-Pocket also sends you email notifications anytime your money transfer progresses to the next step in the process.

Can I use e-Pocket for international bank transfers?

Yes, you can use e-Pocket for international bank transfers.

The way you can accomplish this is by choosing both the payment method as well as the delivery method of your transaction as bank transfer. By doing so, the funds will get deducted from your bank account in Australia, and get deposited to your recipient's bank overseas.

In this manner, you effectively simulate an international bank transfer using e-Pocket, but without paying high FX Markups and transfer fees that banks typically charge.

Is e-Pocket online better than sending money in-person in stores?

Yes, you can access e-Pocket online from anywhere, including your mobile phone and can send your money within minutes.

In fact, e-Pocket is an online only company with no physical locations or branches to send money from. This helps e-Pocket reduce its operational costs and hence provide you with better exchange rates and low transfer fees.

Use the e-Pocket website or mobile app to send money online anytime and from anywhere.

Does e-Pocket have a rewards program?

No, currently e-Pocket does not have a long-term rewards program. If that changes, we will update this page. Check back once in a while to see if this information changes in the future.

What customer support options are available with e-Pocket?

In case you need to reach out to the e-Pocket customer support team for help with your money transfer or any general questions, there are quite a few ways to get in touch with them. These include the below:

- Call e-Pocket for personalized over-the-phone customer service at +61-385668869.

- Send a message to e-Pocket support team via live-chat on the mobile app.

- Email the e-Pocket customer support team at support@e-pocket.com.au.

- Fill a web form on the e-Pocket website to raise your question or concern.

There are many easy ways to get in touch with e-Pocket's customer support team.

Whichever way you choose to contact e-Pocket, you can rest assured that someone will respond to your concern and provide assistance as needed.

Can I cancel my e-Pocket transfer?

It is currently not possible to cancel e-Pocket transfers (except for some bank transfers). The reason for this is that e-Pocket transfers your money abroad very quickly.

If you need to discuss cancelation options, make sure you get in touch with e-Pocket's support team as soon as possible.

Finally, as a general best practice, make sure you double-check all the details of your e-Pocket money transfer before sending the money overseas. This will hopefully prevent any issues and you will not need to cancel your transfer.

How do I delete my e-Pocket account?

If you wish to delete your e-Pocket account, you can request deletion through their support team and they will assist in deactivating your account.

Make sure to backup any transactions from the past in case you need to refer to them for any reason in the future.

Additional Information

Legal and Regulatory Compliance

e-Pocket is registered with and regulated by the Australian Transaction Reports and Analysis Centre (AUSTRAC) since 2018.

Helpful Links

e-Pocket's guide to send remittances via their platform

Awards, Prizes and News

2021: Finnies awards finalist

Reviews

Great rates, Will definitely use it again. Their mobile app is super user friendly as well.