Complete Guide To Venmo Fees And Charges

Table of Contents

- Does Venmo Charge Fees?

- What Are The Fees For Sending Money With Venmo?

- Venmo Credit Card Transactions

- Venmo Instant Transfers

- Venmo Card

- Venmo International Money Transfers

- What Are The Fees For Receiving Money With Venmo?

- What Are The Fees For Venmo Instant Transfer?

- What Are The Fees For Using Venmo Card?

- What Are The Fees For Venmo Business?

- Does Venmo Have Limits And Restrictions?

- Venmo Fees And Charges Summary

- How To Avoid Venmo Fees And Charges?

- Conclusion: Enjoy Venmo's Convenience But Be Aware Of Fees

Venmo is a popular peer-to-peer payment service that allows users to send and receive money easily and quickly. While Venmo is known for its convenience and wide adoption, it is important to understand the different fees associated with using the service.

In this guide, we take a closer look at the fees and charges associated with Venmo, including fees for sending and receiving money, using Venmo Instant Transfer, using the Venmo Card, and using Venmo for business transactions.

We also explore ways to avoid fees and charges and share some useful tips for choosing the right Venmo services and applicable fees for your needs.

Whether you are a frequent Venmo user or just getting started, understanding Venmo fees and charges can help you make informed decisions about your finances and ensure you are getting the most out of this popular payment service.

Does Venmo Charge Fees?

There are a variety of transactions you can do on Venmo, and whilst many of them are free, many others incur a fee1.

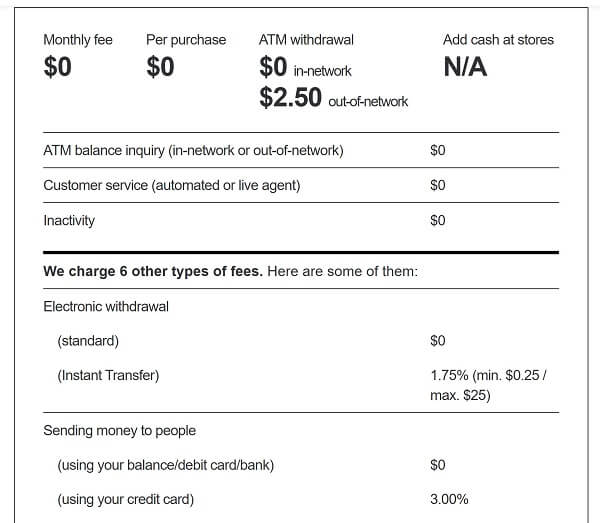

For example, there are no fees for opening and maintaining your Venmo account. Similarly, in-network ATM withdrawals are free, as are balance inquiries and engaging with customer service. Sending and withdrawing money using your Venmo balance or linked bank account or debit card is also free.

On the other hand, activities that will attract fees include out-of-network ATM withdrawals, Venmo Instant Transfers and sending money to others using your credit card.

There are many Venmo transactions that are free and many others that are charged. Information about various Venmo fees and charges will help to maximize value for your money.

The below graphic from Venmo1 shows a high level summary of Venmo fees.

In the rest of this article, we will deep dive into fees associated with various Venmo transactions. We will also touch upon scenarios whereby transactions are free, and best practices on how to avoid fees.

What Are The Fees For Sending Money With Venmo?

When it comes to sending and spending money with Venmo, the good news is that the service is generally very affordable. In fact, Venmo offers free transfers for standard transactions funded by a linked bank account, debit card, or prepaid card.

However, there are some situations where fees and charges may apply. Here are a few things to keep in mind when sending money with Venmo.

Venmo Credit Card Transactions

If you choose to fund a Venmo payment with a credit card, you will be charged a 3% fee. While using your credit card to add money to your Venmo account can be a convenient option if you do not have enough funds in your bank account, it can add up quickly if you are sending frequent payments.

Venmo Instant Transfers

If you need to send money quickly and do not want to wait for a standard transfer to clear, Venmo offers an instant transfer option for a fee of 1.75% of the transfer amount (with a minimum fee of USD 0.25 and a maximum fee of USD 25). This can be useful if you need to send money urgently, but it is important to consider the added cost.

Venmo is generally an affordable way to make payments and send money; be wary of fees and charges though in case you choose to fund your Venmo account with a credit card or choose to send Venmo Instant Transfers.

Venmo Card

If you have a Venmo Card, which is a debit card linked to your Venmo account, there may be fees associated with using the card for purchases or ATM withdrawals. For example, there is USD 2.50 fee for out-of-network ATM withdrawals.

Venmo International Money Transfers

Venmo is primarily used for domestic transactions in the US; currently, it is not possible to send money internationally using Venmo. That said, there are numerous alternatives to Venmo for sending money overseas.

Overall, sending money with Venmo can be an affordable and convenient option, especially for standard transfers funded by a bank account or debit card. However, it is important to know the fees and charges associated with other payment methods, such as credit card transactions.

By understanding these fees and charges, you can make informed decisions about how to send money with Venmo and avoid any unnecessary costs.

What Are The Fees For Receiving Money With Venmo?

When it comes to receiving money with Venmo, the good news is that there are typically no fees or charges associated with standard transactions. If someone sends you money using Venmo and you have a linked bank account, debit card, or prepaid card, you can receive the funds for free.

Receiving money with Venmo is generally free if you have your account linked to a bank account or debit card.

However, there are a few situations where fees and charges may apply when receiving money into your Venmo account. Here are some things to keep in mind.

Venmo Instant Transfer

If you receive money through Venmo and want to transfer the funds to your bank account immediately, you can use Venmo Instant Transfer for a fee of 1.75% of the transfer amount (with a minimum fee of USD 0.25 and a maximum fee of USD 25). This can be a useful option if you need the funds right away, but it is important to consider the added cost.

Venmo Business

If you use Venmo for business purposes, fees and charges may be associated with accepting payments. Venmo charges a 1.9% fee plus a fixed amount of USD 0.10 for each payment received. If the payment was sent using Tap to Pay, then the fee is 2.29% plus a fixed amount of USD 0.09.

Overall, receiving money with Venmo is typically free and straightforward. However, it is important to be aware of the fees and charges associated with Venmo Instant Transfer and Venmo Business, as these can add up quickly if you are not careful.

By understanding these fees and charges, you can make informed decisions about receiving money with Venmo and minimize or avoid fees.

What Are The Fees For Venmo Instant Transfer?

Venmo Instant Transfer is a convenient option that transfers funds from your Venmo account to your bank account instantly.

However, there are fees and charges associated with this service.

When you use Venmo Instant Transfer, you will be charged a fee of 1.75% of the transfer amount, with a minimum fee of USD 0.25 and a maximum fee of USD 25. For example, if you transfer USD 100 using Venmo Instant Transfer, you will be charged a fee of USD 1.75.

It is important to note that the fee is in addition to any other fees or charges that may apply. For example, if you are transferring money from a credit card, you may also be subject to the 3% credit card funding fee. Funding your account using a debit card is free, though.

Venmo Instant Transfers incur a 1.75% transaction fee, subject to a minimum USD 0.25 and a maximum USD 25 charge.

If you need to transfer funds quickly, Venmo Instant Transfer can be a useful option. However, it is important to consider the added cost and compare it to other transfer options. If you can wait a few days for a standard transfer to clear, you can avoid the fee altogether.

What Are The Fees For Using Venmo Card?

The Venmo Card is a debit card linked to your Venmo account, allowing you to use your Venmo balance to make purchases and withdraw cash from ATMs.

While the card itself is free, there are fees and charges associated with using it. Here are some of the fees and charges you may encounter when using your Venmo Card:

- ATM withdrawal Fee: If you use an out-of-network ATM to withdraw cash with your Venmo Card, you will be charged a USD 2.50 fee per transaction. If you use an in-network ATM, there are no fees.

- Overdraft Fee: If you try to make a purchase or withdraw cash with your Venmo Card and do not have enough funds in your account to cover the transaction, you will be charged an overdraft fee either USD 10.00 or 5% of the amount of each cash advance, whichever is greater.

- Late Payment Fee: If you are late on your Venmo Card payment, you may have to pay a late payment penalty of up to USD 41.

- Returned Payment Fee: If your Venmo Card payment does not clear and is returned, you may have to pay a returned payment penalty of up to USD 30.

- Replacement Card Fee: If your Venmo Card is lost or stolen, you can request a replacement card for a fee of USD 4.99.

- International Transaction Fee: If you use your Venmo Card to make purchases outside of the United States, you will not be charged any additional fee for the foreign transaction.

There are various fees and charges associated with the Venmo Card. Be aware of these fees to ensure you know when you will have to incur them and, therefore, how to avoid them.

Awareness of fees applicable to the Venmo Card will help with you decide whether or not to use the Venmo Card for your purchases and cash withdrawals.

What Are The Fees For Venmo Business?

Venmo Business is a service designed for small businesses to accept payments from customers via Venmo.

While using Venmo Business is free, there are fees and charges associated with processing transactions. Here are some of the fees and charges you may encounter when using Venmo Business.

Transaction Fees

When a customer pays for goods or services using Venmo, the business will be charged a transaction fee of 1.9% of the transaction amount plus a fixed amount of USD 0.10. For example, if a customer pays for a USD 100 purchase using Venmo, the business will be charged a transaction fee of USD 2 (USD 1.90 transaction fee + USD 0.10 fixed fee).

Note that if the payment was received using Tap to Pay, the fee is 2.29% plus a fixed amount of USD 0.09. Similar to our example above, if a customer makes a USD 100 purchase using Tap to Pay, the fee will be USD 2.38 (USD 2.29 transaction fee + USD 0.09 fixed fee).

Chargeback Fees

If a customer disputes a transaction and files a chargeback, the business may be charged a fee per chargeback. This fee is in addition to any funds that are returned to the customer.

Instant Transfer Fees

If a business wants to transfer funds from their Venmo account to their bank account instantly, they will be charged a fee of 1.75% of the transfer amount with a minimum fee of USD 0.25 and a maximum fee of USD 25.

Funding Source Fees

If a business funds its Venmo account using a credit card, it may be subject to a funding source fee of 3%.

Venmo Business account offers a lot of convenience but comes with a few fees and charges. Make sure you understand various fees to harness the full power of your Venmo Business account.

Overall, Venmo Business can be a useful tool for small businesses to accept payments from customers. However, it is important to be aware of the fees and charges associated with the service and factor them into your pricing your goods and services.

Does Venmo Have Limits And Restrictions?

While Venmo is a popular and convenient way to send and receive money, there are some limits and restrictions to be aware of.

These Venmo limits and restrictions are designed to prevent fraud and protect users, but they can also impact the fees and charges associated with Venmo transactions. Here are some of the limits and restrictions you may encounter when using Venmo.

Transfer Limits

Venmo sets limits on how much money you can transfer in a given period of time. For personal accounts, the transfer limit is USD 5000 per transaction for verified accounts. For business accounts, the transfer limit is USD 25,000 per week for verified accounts.

If you need to transfer more money than these limits allow, you may need to use a different payment method or contact Venmo support to request a limit increase.

Account Restrictions

Venmo may place restrictions on your account if it detects suspicious activity or violates their terms of service. These restrictions can include limiting your ability to send or receive money, freezing your account, or even closing your account entirely.

Fees For Certain Transactions

While most Venmo transactions are free, there are fees associated with some types of transactions. For example, if you use a credit card to fund your Venmo account, you may be subject to a funding source fee of 3%.

Additionally, if you choose to use Venmo to pay for goods or services abroad, you may be charged a transaction fee of 1.9% of the transaction amount plus a fixed fee of USD 0.10. This increases to 2.29% and USD 0.09 for Tap to Pay purchases.

Payment Holds

Venmo may hold payments for certain transactions to ensure they are legitimate and not fraudulent. For example, if you are a new user or have a history of disputed transactions, Venmo may hold payments for up to 21 days to verify the transaction.

It is important to be aware of these limits and restrictions when using Venmo to avoid unexpected fees or account restrictions. By understanding these limitations, you can use Venmo effectively and minimize your costs while still enjoying the convenience of this popular payment service.

Venmo Fees And Charges Summary

The above sections have covered a lot of information when it comes to Venmo's fees and charges.

Below is a summary of Venmo's fees and charges in a simple and easy to understand table. You can use this as a quick reference for checking various fees you may incur when using Venmo.

Note that the below table is not comprehensive and is supposed to be a handy guide. For a complete and detailed list of Venmo's fees1, check their site or app.

| Venmo Service | Venmo Transaction Type | Venmo Fee |

| Account maintenance | USD 0 | |

| Customer service | USD 0 | |

| Inactive account | USD 0 | |

| ATM Transactions | In-network withdrawal | USD 0 |

| Out-of-network withdrawal | USD 2.50 | |

| ATM balance inquiries | USD 0 | |

| Electronic withdrawal | Standard | USD 0 |

| Instant Transfer | 1.75% (Min USD 0.25, Max USD 25) | |

| Sending money | Using Venmo balance, debit card or bank account | USD 0 |

| Using credit card | 3.00% | |

| Venmo Business - receiving money | Standard payment | 1.9% plus USD 0.10 |

| Tap to Pay payment | 2.29% plus USD 0.09 | |

| Venmo Card | Overdraft | Higher of USD 10.00 or 5% |

| Late payment | Up to USD 41 | |

| Returned payment | Up to USD 30 | |

| Replacement card | USD 4.99 | |

| International transaction | USD 0 |

How To Avoid Venmo Fees And Charges?

While Venmo is generally a free service under certain conditions, fees and charges can quickly add up if you are not careful. Here are some tips for avoiding Venmo fees and charges:

- Link Your Bank Account: Venmo charges a 3% fee when you use a credit card to fund your account, but linking your bank account is free. If you plan on using Venmo frequently, linking your bank account is the best way to avoid fees.

- Use The "Tap to Pay" Option Sparingly: While receiving business payments for goods and services with Venmo is convenient, it comes with an elevated transaction fee of 2.29% plus a fixed amount of USD 0.09. Try to accept other standard payment methods or cash to avoid these fees.

- Be Aware Of Transfer Limits: Venmo limits how much money you can transfer in a given period. If you need to transfer more money than these limits allow, you may need to use a different payment method or contact Venmo support to request a limit increase.

- Avoid Disputed Transactions: Venmo may hold payments for up to 21 days if a transaction is disputed, which can be inconvenient if you need the money sooner. To avoid disputed transactions, make sure you are only sending money to people you know and trust.

- Use Venmo Instant Transfer Sparingly: While Venmo Instant Transfer is a convenient way to get your money faster, it comes with a 1.75% fee of the transfer amount, with a minimum fee of USD 0.25 and a maximum fee of USD 25. If you do not need the money right away, it is better to wait for the standard transfer time, which is usually 1-3 business days.

You can avoid most of the fees and charges associated with Venmo and make the most of this convenient payment service by following some best practices and tips.

Conclusion: Enjoy Venmo's Convenience But Be Aware Of Fees

Choosing the right Venmo services and fees for you depends on your individual needs and preferences.

For example, if you plan on using Venmo frequently, it may be worth linking your bank account to avoid fees associated with using a credit card.

Similarly, if you need to transfer large amounts of money, be aware of Venmo's transfer limits and consider contacting Venmo support to request a limit increase.

When it comes to Venmo's additional services, like Venmo Instant Transfer and the Venmo Card, be sure to weigh the convenience against the associated fees. If you need money right away, Venmo Instant Transfer may be worth the 1.75% fee, but if you can wait a few days, it is better to use the standard transfer time.

Ultimately, the key to making the most of Venmo's services and avoiding unnecessary fees is to be aware of various fees and charges and use the service accordingly. By doing so, you can enjoy the convenience of Venmo without breaking the bank.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. List of Venmo fees and charges

Categories

Similar Articles

Popular Mobile Wallets Across The World

Discover the top mobile wallets transforming how we pay globally. Explore the world of convenient and secure digital transactions. Do not miss this ultimate guide to the most popular mobile wallets across the world!

What Is PayID And How Does It Work?

If you send or receive money in Australia, say goodbye to complex bank details. Use PayID and experience hassle-free payments. PayID has revolutionized the payment experience in Australia – learn all about it.

Complete Guide To Cash App Limits

Cash App is convenient and easy to use, but there are limits you should be aware of. Our comprehensive guide to Cash App limits has all you need to know to maximize the value of your account.