How Wise (formerly TransferWise) Works

How Does Wise (formerly TransferWise) Work?

Wise (formerly TransferWise) has become a popular choice to send money home to India, Philippines, Mexico and other destinations. In this blog post, we describe how the Wise peer to peer money transfer system works.

When you transfer money internationally, you may be charged more than you think. There's often an extra fee hidden in the exchange rate. The hidden fee is the difference between the exchange rate offered to you and the actual mid-market rate, which you see on Google. Mid-market rate or the real exchange rate is the rate banks use to buy and sell currency among each other. The catch is that you're being charged a fee that's not ever shown to you, which is also why it is called hidden. RemitFinder has partnered up with Wise who always abolishes the hidden fee in currency conversion.

How can Wise afford to charge only a small fee?

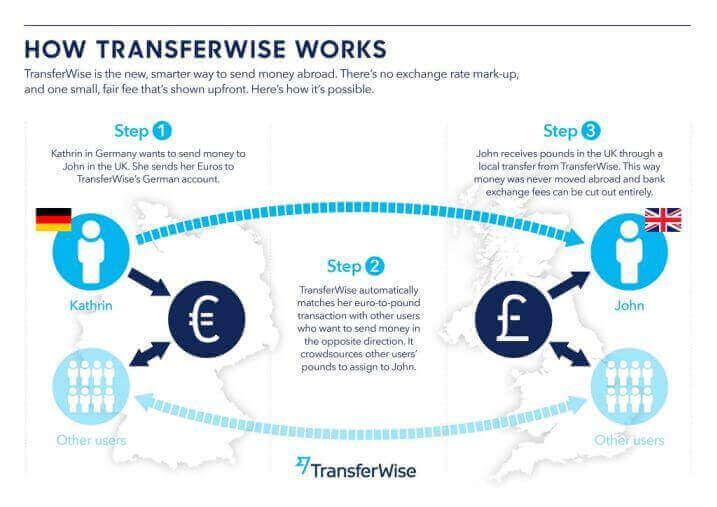

Wise uses a peer-to-peer platform for its service. That means your payment will be matched at the mid-market-rate with one or several other people making an exchange in the other direction or if there is no-one to swap it with the company buys the missing currency from the interbank market. This means Wise is making the transfer cheaper by using free or extremely low-cost local bank account transfers, cutting out extortionate bank charges and offering you the same service - but for less money.

On this graph you can see how the Wise peer-to-peer (P2P) model works. Kathrin sends her money to the Wise EUR account and John gets his money from the GBP account. They are both part of the network of senders that make P2P work as the Euros that Kathrin sent over to the EUR account will be now given to someone else receiving Euros and the Pounds that John got from the GBP account were contributed by another user sending Pounds. P2P is an effective way to transfer money internationally and Wise uses it to benefit their customers by offering low rates.

How can I make a payment?

Wise is available online at Wise.com, or via their Android or iOS Apps. You can fund your transfer using debit or credit cards or via bank transfer. Apple users can also use Apple pay on some routes.

What else should I know?

Wise is used by over a million customers in over 60 countries processing over £800 million per month and rated 9.5/10 with over 30,000 reviews on TrustPilot. The company is also regulated by the UK’s Financial Conduct Authority (FCA). They currently offer 39 currencies with new routes being added frequently.

Their customer service is available around the clock and they can be contacted either by phone, email or webchat.

Categories

Similar Articles

Wise vs Revolut: What Are The Differences?

Both Wise and Revolut have grown massively over the last few years and are popular, established money transfer companies. We delve deep into both to bring you a head-to-head detailed comparison.

How To Save On B2B International Transfer Fees

B2B international payments have been expensive, slow and cumbersome in the past. Are there any new fintech companies that take the hassle out of cross-border business payments?

How To Save Money On Transfers From Europe To India

Are you looking to send money from Europe to India? Check out our guide on how to save money on your international money transfers to India from Europe.