Best Savings Bank Accounts for Expats in Singapore

Table of Contents

- Can a Foreigner Open a Bank Account in Singapore?

- What are the Best Savings Bank Accounts for Expats in Singapore?

- Development Bank of Singapore (DBS)

- Oversea-Chinese Banking Corporation (OCBC)

- OCBC Global Savings Account

- What are the fees for OCBC Global Savings Account?

- Is OCBC Global Savings Account a good choice for me?

- OCBC 360 Account

- United Overseas Bank (UOB)

- UOB Global Currency Account

- What are the fees for UOB Global Currency Account?

- Is UOB Global Currency Account a good choice for me?

- UOB Global Currency Premium Account

- Maybank Singapore

- Maybank Singapore Dollar Savings Account

- What are the fees for Maybank Singapore Dollar Savings Account?

- Is Maybank Singapore Dollar Savings Account a good choice for me?

- Maybank Master Foreign Currency Account

- CIMB Bank Singapore

- CIMB Foreign Currency Savings Account

- What are the fees for CIMB Foreign Currency Savings Account?

- Is CIMB Foreign Currency Savings Account a good choice for me?

- CIMB Foreign Currency Current Account

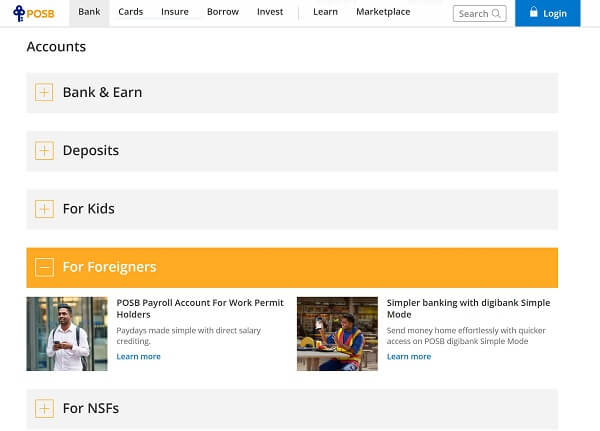

- Post Office Savings Bank (POSB)

- POSB Payroll Account for Work Permit Holders

- What are the fees for POSB Payroll Account for Work Permit Holders?

- Is POSB Payroll Account for Work Permit Holders a good choice for me?

- Simpler Banking with POSB Digibank Simple Mode

- Best Singapore Banks for Expats - Our Recommendations

- Which Singapore bank is best for traveling overseas?

- Which Singapore bank is best for earning interest on savings?

- Which Singapore bank supports maximum foreign currencies?

- Which Singapore bank charges lowest fees?

- Which Singapore bank is best for Singapore Work Permit Holders?

- Conclusion

Are you foreigner settled and living in Singapore and looking for the best savings bank accounts for expats in Singapore? If so, then you have come to the right place.

In this article, we will discuss the different banking options available to you in Singapore and help you choose the account that is best suited for your needs. Whether you are looking for a high-yield savings account or an account with no monthly fees, we have you covered.

Can a Foreigner Open a Bank Account in Singapore?

Foreigners can open a bank account in Singapore. Those on a work visa, student visa, or dependent/long-term visit visa can open an account. If you are a foreigner trying to open a bank account in Singapore, here are the documents you will need:

- Proof of identity, such as passport and visa or national ID card

- Entry permit or employment pass

- Official proof of address (e.g., utility bill or tenancy agreement)

- Reference or introduction letter for some banks if needed

Foreigners can open bank accounts in Singapore as long as they can provide the necessary documents.

What are the Best Savings Bank Accounts for Expats in Singapore?

There are many banks in Singapore, each with its own products and services. How do you know which bank is right for you?

Here are our picks for the best savings bank accounts for expats in Singapore:

- Development Bank of Singapore (DBS)

- Oversea-Chinese Banking Corporation (OCBC)

- United Overseas Bank (UOB)

- Maybank Singapore

- CIMB Bank Singapore

- Post Office Savings Bank (POSB)

In the following sections, we will deep dive into the bank account offerings from these top Singapore banks with a focus on expats and foreigners.

Development Bank of Singapore (DBS)

DBS Bank Limited, more commonly known as DBS, is a Singaporean banking and financial services corporation with its headquarters in the Marina Bay Financial Centre of Marina Bay district in Singapore.

DBS provides several types of accounts, such as current and savings, that can be maintained in both Singapore Dollars (SGD) as well as a foreign currency.

Singapore being a global hub full of immigrants and visitors from all over the world, it is no surprise that DBS has a special program and account dedicated just for expats. Below is a screenshot of the DBS Expat Program1 listed on their home page under the Accounts section.

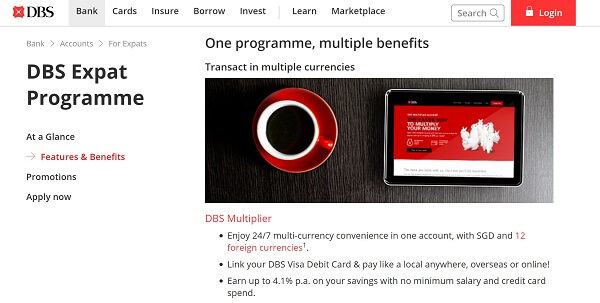

Next, let's look at the best DBS bank account for expats, called the DBS Multiplier Account.

DBS Multiplier Account

The best bank account for foreigners is the DBS Multiplier account, which allows you to have multiple currencies. You can hold Singapore Dollars and 12 other foreign currencies at the same time in your DBS Multiplier account; supported foreign currencies include the below:

- Australian Dollar (AUD)

- Canadian Dollar (CAD)

- Chinese Renminbi (Offshore) (CNH)

- Euro (EUR)

- Hong Kong Dollar (HKD)

- Japanese Yen (JPY)

- New Zealand Dollar (NZD)

- Norwegian Kroner (NOK)

- British Pound (GBP)

- Swedish Kroner (SEK)

- Thai Baht (THB)

- US Dollar (USD)

Your DBS Multiplier account2 can be linked with your DBS Visa Debit Card which allows you to make purchases and withdraw cash in multiple currencies. This way, not only can you enjoy 24/7 multi-currency convenience in one account, but with your DBS Visa Debit Card, you can also pay like a local anywhere overseas or online.

You do not need any initial deposit to open the DBS Multiplier account. Also, no minimum average daily balance is required for first-time account holders with DBS.

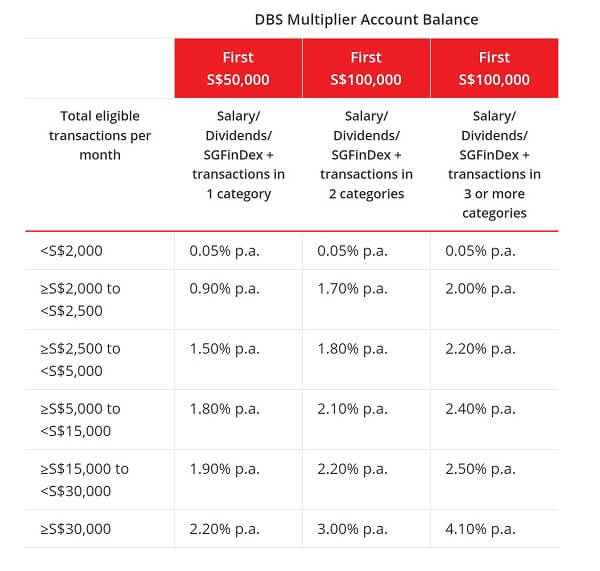

Now the best part - you can also earn up to 4.10% per annum interest on your savings with no minimum salary and credit card spending required. You earn this interest on up to the first SGD 100,000 balance in your account (this limit was recently increased by DBS) plus when you do qualifying transactions per month.

You can earn up to 4.10% annual interest on your first SGD 100,000 savings in your DBS Multiplier Account.

Below is the interest table3 that details this out the applicable interest on your DBS Multiplier account further.

What are the fees for DBS Multiplier Account?

If your average daily balance (ADB) falls below SGD 3,000 (including foreign currency balances when converted to SGD equivalent), you will have to pay a service charge of SGD 5. Further, this service charge is waived if any of the below conditions is met:

- You are under 29 years of age

- Your DBS Multiplier account is your first DBS/POSB account (only online accounts qualify for this condition)

Is DBS Multiplier Account a good choice for me?

If you are an expat living in Singapore, the DBS Multiplier Account is certainly a very good choice given its many advantages. We highly recommend this option due to the below reasons:

- DBS Bank is the largest bank in Singapore and has robust support for all types of monetary, savings, investment and other financial services. Having an account with DBS gives you access to much more that the bank has to offer.

- You get robust support for multiple global currencies that include the Singapore Dollar plus 12 more of the world's most popular currencies. This makes it much easier for you to handle many currencies in a single account.

- Once you link your Multiplier Account with your DBS Visa Debit Card, you can use your Debit Card overseas and make purchases in foreign currencies. This takes the hassle out of carrying cash or having to worry about currency conversion.

- Last but not the least, you can earn an attractive up to 4.10% per annum interest on your savings of up to SGD 100,000 in your account.

The DBS Multiplier Account has comprehensive currency support, and provides ease of use overseas and high interest on your savings.

Oversea-Chinese Banking Corporation (OCBC)

OCBC is among the largest and best banks in Asia Pacific that allows expats living in Singapore to open savings, checking, or foreign currency accounts. OCBC accounts are available for most foreigners who have legal resident status in Singapore.

Below, we present 2 good OCBC bank accounts that are suitable for expats.

OCBC Global Savings Account

The best OCBC bank account for expats is the OCBC Global Savings account4 that allows transactions in eight different currencies that include the below:

- Australian Dollar (AUD)

- Canadian Dollar (CAD)

- Chinese Renminbi (Offshore) (CNH)

- Euro (EUR)

- Hong Kong Dollar (HKD)

- New Zealand Dollar (NZD)

- Sterling Pound (GBP)

- US Dollar (USD)

You can link your OCBC debit card to your Global Savings Account, and if you do so, there are no foreign currency transaction fees when using the OCBC debit card for purchases. Transfers are also funded at competitive rates to get the best value possible.

What are the fees for OCBC Global Savings Account?

There are no fees in case your OCBC Global Savings Account is low on funds.

However, if you want to earn interest, below are the minimum daily balance thresholds for various currencies:

- AUD, CAD, CNH, EUR, GBP, NZD, USD – 5,000

- HKD - 50,000

There are no fees for an OCBC Global Savings Account. You have to maintain minimum balances to earn interest.

Is OCBC Global Savings Account a good choice for me?

The OCBC Global Savings Account is yet another solid bank account suitable for foreigners residing in Singapore; key advantages include:

- Ability to maintain various currencies in one account – Singapore Dollar plus 8 mainstream global currencies.

- No foreign transaction fees if you link your OCBC debit card to your account, and use it to make purchases overseas.

- No monthly service charges or fees if your account balance falls below the average daily balance requirements. You will not earn any interest though if your ADB is below minimum threshold amounts.

The OCBC Global Savings Account allows you to hold 8 foreign currencies, charges 0 foreign transaction fees and no monthly fees if your ADB falls below minimum amounts.

OCBC 360 Account

Another great account for foreigners to use is the OCBC 360 Account. It offers some of the best interest rates, and it's perfect for those who want to save money. With the 360 Account, you can earn interest on your deposited funds. For instance, you can receive bonus interest annually on the first SGD 100,000 of your account balance.

The more you bank with OCBC, the higher your interest rate will be. You can do the below to tap into higher interest rates:

- If you credit your salary, put your savings in your account, and also spend from it, you can earn up to 4.65% per annum on the first SGD 100,000 in your account.

- In addition, if you also use OCBC's insurance and investment products, you can earn up to an additional 3.00% per annum on your savings.

If you use all the aforementioned services with your OCBC 360 Account, you can earn up to a combined 7.65% interest per year on your savings of up to SGD 100,000.

If you are a foreigner and want to open an OCBC account, you need to go to one of their local branches with your EP/S-Pass employment pass/work permit or student pass and passport.

You will also need a minimum initial deposit of SGD 1,000 to open your new OCBC 360 Account.

What are the fees for OCBC 360 Account?

If your average daily balance falls below SGD 3,000, you will be charged an SGD 2 monthly fee. Note that this fee is waived for the first year for new 360 Accounts.

If you like to order a cheque book for your OCBC 360 Account, there is a fee of SGD 10 to do so.

Is OCBC 360 Account a good choice for me?

The OCBC 360 Account is an attractive option if you are a Singaporean expat, and here is why:

- You can earn an aggregate 7.65% interest per year on your savings of up to SGD 100,000 in your OCBC 360 Account if you meet various transaction limits and criteria. This is probably the highest interest rate you will get in Singapore with any bank. That said, be prepared to pretty much use all of OCBC banking and other services to be able to meet the needed minimum thresholds to unlock the 7.65% interest.

- The monthly fee for low average daily balance below the minimum threshold is pretty low at SGD 2. Plus, this fee is waived for the first year of your account.

The OCBC 360 Account provides up to 7.65% interest on savings of up to SGD 100,000 if you are able to meet various criteria. Plus, the monthly fees for low ADB are only SGD 2.

United Overseas Bank (UOB)

United Overseas Bank (UOB) is another good choice for expats living in Singapore. UOB is the third-largest bank in Singapore, and provides many different types of checking and savings accounts. UOB has everything for your personal as well as business needs, including loans, and many other financial products and services.

UOB could be a great option if you're new to Singapore. They offer high-interest rates and other benefits as long as you meet certain minimum requirements, such as paying a specific amount and using your UOB debit or credit card frequently. If you have a job in Singapore, the UOB One account would be perfect for covering everyday expenses and bills; plus, it allows you to earn extra money through interest.

UOB also offers accounts specific for the unique needs of expats; two such popular options are the UOB Global Currency Account and the Global Currency Premium Account. Let's look at them in more detail below.

UOB Global Currency Account

The UOB Global Currency Account5 is specifically tailored to the needs of Singaporean expats, and allows you to hold funds in 10 major foreign currencies as below:

- Australian Dollar (AUD)

- Canadian Dollar (CAD)

- Chinese Renminbi (Offshore) (CNH)

- Euro (EUR)

- Hong Kong Dollar (HKD)

- Japanese Yen (JPY)

- New Zealand Dollar (NZD)

- Swiss Franc (CHF)

- Sterling Pound (GBP)

- US Dollar (USD)

Given this, you can streamline your foreign currency transactions without worrying about currency conversion fees. You will also be able to transfer foreign currencies via telegraphic transfers, cheques, or converting from any of your Singapore Dollar accounts at UOB.

If you hold US Dollar as one of your currencies in your UOB Global Currency Account, you can also take advantage of fast 3 day cheque clearing facility.

One thing to note is that you do need minimum balances to open your UOB Global Currency Account. These initial deposits vary by currencies, and are listed below:

- Australian Dollar – Minimum AUD 1,700

- Canadian Dollar – Minimum CUD 1,700

- Chinese Renminbi (Offshore) – Minimum CNH 5,000

- Euro – Minimum EUR 900

- Hong Kong Dollar – Minimum HKD 7,800

- Japanese Yen – Minimum JPY 150,000

- New Zealand Dollar – Minimum NZD 2,000

- Swiss Franc – Minimum CHF 1,500

- Sterling Pound – Minimum GBP 650

- US Dollar – Minimum USD 1,000

What are the fees for UOB Global Currency Account?

If your average daily balance (ADB) falls below a minimum threshold, you will have to pay a monthly service fee. The ADB and fee amounts vary by currency, and are listed below:

- Australian Dollar – ADB AUD 1,700, Fee AUD 17

- Canadian Dollar – ADB CUD 1,700, Fee CAD 16

- Chinese Renminbi (Offshore) – ADB CNH 5,000, Fee CNH 50

- Euro – ADB EUR 900, Fee EUR 9

- Hong Kong Dollar – ADB HKD 7,800, Fee HKD 80

- Japanese Yen – ADB JPY 150,000, Fee JPY 1,500

- New Zealand Dollar – ADB NZD 2,000, Fee NZD 20

- Swiss Franc – ADB CHF 1,500, Fee CHF 15

- Sterling Pound – ADB GBP 650, Fee GBP 7

- US Dollar – ADB USD 1,000, Fee USD 10

If you close your account in less than 6 months of opening, there is also an early account closure fee of SGD 30.

Is UOB Global Currency Account a good choice for me?

The UOB Global Currency Account is tailor made for foreigners and expats living in Singapore, and affords the below key benefits:

- Flexibility to hold 10 popular global currencies in your account along with Singapore Dollars. This makes interconversion between these currencies easy and seamless.

- Fast 3-day cheque clearing for US Dollar accounts.

- Low minimum average daily thresholds that help avoid paying the monthly fee if ABD falls below specified minimums.

The UOB Global Currency Account allows 10 global currencies and has low ADB minimums to help avoid paying monthly fees for low balances.

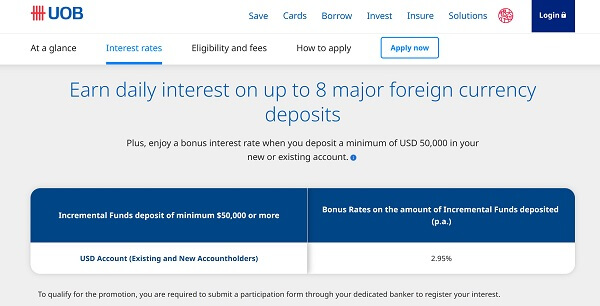

UOB Global Currency Premium Account

The UOB Global Currency Premium Account6 is the next level up from the standard UOB Global Currency Account. The key differences are as below:

- UOB Global Currency Premium Account is interest earning for all currencies, and the current interest rates are as below:

- Japanese Yen – No interest earned

- All other currencies – 0.05% per annum regardless of amount

- The minimum deposits needed to open a UOB Global Currency Premium Account are much higher, and are as below:

- Japanese Yen – Minimum JPY 1,000,000

- All other currencies – Minimum SGD 10,000

There is a promotional interest rate applicable for US Dollar deposits into your UOB Global Currency Premium Account whereby you can earn 2.95% per annum on every incremental deposit of USD 50,000 or more into your account.

What are the fees for UOB Global Currency Premium Account?

There are no fees to maintain your UOB Global Currency Premium Account. This is because you are required to maintain higher average balances in your account – JPY 1,000,000 or SGD 10,000 for other currencies.

The early account closure fee of SGD 30 also applies to the UOB Global Currency Premium Account if you close your account within 6 months of opening.

Is UOB Global Currency Premium Account a good choice for me?

The UOB Global Currency Premium Account is UOB's top tier account for high net worth foreigners and expats in Singapore, and provides the below benefits:

- Your money will earn interest (except for JPY accounts that do not earn interest). This is good news given the high minimum deposit amounts needed to qualify for this account.

- You can earn 2.95% per annum on every incremental deposit of USD 50,000 or more into your account.

- There are no fees charged for this account given the high balances needed to qualify for it.

The UOB Global Currency Premium Account earns interest on your money and there are no fees you have to pay for maintaining this account.

Maybank Singapore

Maybank Singapore is one of the leading banks in Singapore, providing a wide range of banking and financial services to individuals and businesses.

When it comes to expat services, Maybank currently only supports a Maybank Singapore Dollar Savings Account for its Malaysian customers. This allows Malaysians living, working or settled in Singapore to seamless make transactions in both Singapore and Malaysia with the same multi-currency account. Below are more details about this account.

Maybank Singapore Dollar Savings Account

The Maybank Singapore Dollar Savings Account is a unique facility that Maybank provides for its Malaysian customers who may need to make payments in Singapore.

Having this account allows Malaysian residents in Singapore to seamless make transactions in both Singapore and Malaysia in their respective currencies without having to worry about currency conversion and fees.

Here are some additional key points about Maybank Singapore Dollar Savings Account:

- If you open a new Maybank Singapore Dollar Savings Account online, you earn an SGD 20 cash award as well as 3% per annum interest on your savings held in your account.

- Your account comes with a Maybank Platinum Debit Card using which you can make overseas ATM withdrawals free of charge at any Maybank ATMs in Malaysia.

- If you make foreign currency transfers from your Maybank Singapore Dollar Savings Account to your existing Maybank Malaysia Savings/Current Accounts, you will get competitive foreign exchange rates and no currency conversion fee (FX fee waived till December 31, 2022).

What are the fees for Maybank Singapore Dollar Savings Account?

The exact fees for the Maybank Singapore Dollar Savings Account are not available online, but in general, Maybank charges a monthly service fee of SGD 2 if the average daily balance in your account falls below SGD 1,000.

Is Maybank Singapore Dollar Savings Account a good choice for me?

The Maybank Singapore Dollar Savings Account is specially geared towards Malaysian residents in Singapore, and has the following advantages:

- You can interconvert between Singapore Dollars and Malaysian Ringgits seamlessly with this account.

- You can earn 3% interest per annum on your savings held in your account.

- You get SGD 20 bonus for opening a new account online.

The Maybank Singapore Dollar Savings Account provides significant ease of use for Malaysians residing or working in Singapore.

Maybank Master Foreign Currency Account

Maybank does have a more comprehensive Master Foreign Currency Account (MFCA), but unfortunately, it is only available for Maybank Malaysia customers, and not for Maybank Singapore customers.

CIMB Bank Singapore

CIMB Bank is a Malaysian bank that also operates extensively in the Southeast Asian countries including Singapore. It is part of the CIMB Group Holdings Berhad which operates several businesses like CIMB Investment Bank, CIMB Bank, CIMB Islamic, CIMB Niaga, CIMB Securities International and CIMB Thai.

CIMB Bank has a strong presence in Singapore and offers a full range of banking and investment services to customers in the country. With so many expats living in Singapore, it is no surprise that CIMB Bank also offers bank accounts that cater to the needs to foreigners in Singapore. Below, we present CIMB Bank's expat accounts.

CIMB Foreign Currency Savings Account

The CIMB Foreign Currency Savings Account7 is CIMB Bank's best offering for expats living in Singapore, and allows holding the following 5 foreign currencies in parallel:

- Australian Dollar (AUD)

- Euro (EUR)

- Japanese Yen (JPY)

- British Pound (GBP)

- US Dollar (USD)

There is an initial minimum deposit that you must pay when you open your new CIMB Foreign Currency Savings Account. This amount varies based on the currency you use to fund your account, and is as below:

- Australian Dollar – Minimum AUD 1,000

- Euro – Minimum EUR 1,000

- Japanese Yen – Minimum JPY 500,000

- British Pound – Minimum GBP 1,000

- US Dollar – Minimum USD 1,000

You can easily interconvert your foreign currency from and to Singapore Dollars at any time, and CIMB will try to do this conversion at best possible exchange rates.

The other important aspect to be aware of is that your CIMB Foreign Currency Savings Account is non-interest bearing. This means that any funds you have in this account do not earn any interest.

What are the fees for CIMB Foreign Currency Savings Account?

The good news is that there is no service charge or fee if your CIMB Foreign Currency Savings Account balance falls below the minimum foreign currency deposit amount required to open the account.

However, there is an early closure fee if you close your account within 6 months of opening. This fee varies with currency, and is as below:

- Australian Dollar – AUD 20

- Euro - EUR 15

- Japanese Yen – JPY 2,000

- British Pound – GBP 10

- US Dollar – USD 20

The only other thing to be aware of are excess limit fees. If you withdraw more than you have in your account, you will have to pay fees and interest as below:

- AUD and USD – Minimum fixed fee of AUD 10 and USD 10, respectively, plus interest (USD / AUD Prime Rate + 5%) on the overdrawn excess amount

- EUR and GBP – Minimum fixed fee of EUR 7.50 and GBP 5, respectively, plus interest (EUR / GBP Prime Rate + 5%) on the overdrawn excess amount

- JPY – Minimum fixed fee of JPY 1,000, plus interest (JPY Prime Rate + 5%) on the overdrawn excess amount

Given these fees and interest charges you have to pay, be cautious and ensure you never overdraw excess funds from your account.

Is CIMB Foreign Currency Savings Account a good choice for me?

The CIMB Foreign Currency Savings Account can be a good option for Singaporean expats and below are its key strengths:

- You are allowed to hold 5 global currencies in your account in parallel along with Singapore Dollars. This makes interconversion amongst these currencies easier.

- There is no service charge or fee if your average daily balance falls below specified limits.

The CIMB Foreign Currency Savings Account lets you hold 5 foreign currencies, and has 0 fees for low balances. You do not earn any interest on your money though.

CIMB Foreign Currency Current Account

The CIMB Foreign Currency Current Account is a special version of the corresponding Savings account and focuses on a single currency – US Dollar. The main goal of this account is to allow you to pay and transact seamlessly in USD.

This is pretty convenient as the US Dollar is accepted in many countries even though they have their own native currency. So, if you are a frequent traveler with a need to be overseas frequently, the CIMB Foreign Currency Current Account might be a good fit for you.

You need to open this account with a minimum deposit of USD 1,000.

Also, just like its savings account twin, the CIMB Foreign Currency Current Account is also non-interest bearing, and any money you have sitting in this account will not earn any interest.

What are the fees for CIMB Foreign Currency Current Account?

Unlike its savings twin, the CIMB Foreign Currency Current Account does come with a monthly USD 10 fee if you average daily balance falls below USD 1,000.

Additionally, if you lose your account within 6 months of opening, you will have to pay a USD 20 early account closure fee.

Is CIMB Foreign Currency Current Account a good choice for me?

The CIMB Foreign Currency Current Account is a specific US Dollar account that offers the below key advantages:

- This account is held in US Dollars as the only allowed currency. This makes it ideal for overseas use as USD is globally accepted everywhere. So, if you travel a lot, this can be a good option for you.

- A single currency means that you will never have to pay any currency conversion fees or compromise on potentially lower exchange rates.

The CIMB Foreign Currency Current Account allows you to spend and transact easily in US Dollars, and can be a good choice for overseas use.

Post Office Savings Bank (POSB)

Post Office Savings Bank, also referred to as POSB, is the oldest local bank in Singapore still in continuous operation. It is a Singaporean bank that provides consumer banking services. The Post Office Savings Bank was founded on January 1st, 1877, and is currently a division of DBS Bank, which bought the company and its subsidiaries on November 16, 1998.

POSB bank has an extensive history in Singapore, including many notable firsts in the banking industry. It offers various specialized services, such as business, home loans, and mortgages, to meet the needs of its customers.

POSB bank has excellent customer service and low fees, two important factors which have led to the bank being praised by people in Singapore. Most importantly for young adults, the bank offers a fee waiver to 21 years or younger customers.

When it comes to supporting the banking needs of expats, POSB does have one account that foreign workers can use; we present it below.

POSB Payroll Account for Work Permit Holders

If you are a foreign worker in Singapore and hold a work permit, you can sign up for the POSB Payroll Account8 for Work Permit Holders to have your salary direct deposited into this account.

Your POSB Payroll Account also comes with a DBS Visa Debit Card which you can conveniently use at hundreds of thousands online and physical merchants and shops that accept Visa payments.

This way, the POSB Payroll Account helps both you and your employer go cashless, and makes it very convenient to access and use your money.

There is no minimum deposit amount needed to open a new POSB Payroll Account for Work Permit Holders.

What are the fees for POSB Payroll Account for Work Permit Holders?

When it comes to fees, there are a few caveats you need to be aware of for your POSB Payroll Account. These are as below:

- If your average daily balance (ADB) falls below SGD 500, you will have to pay a monthly service fee of SGD 2.

- If you make more than 4 ATM withdrawals in a month, you will have to pay a monthly ATM withdrawal fee of SGD 2.

- If you make a cash withdrawal of less than SGD 2,000 at a DBS/POSB bank branch, you will have to pay a fee of SGD 2 for each such cash withdrawal.

The good news is that all of the above conditions can be easily avoided if you are careful. Keep an eye on your average daily balance and withdrawal activity, and you will not have to pay the fees listed above.

Is POSB Payroll Account for Work Permit Holders a good choice for me?

The POSB Payroll Account is specially designed for Singapore Work Permit Holders and has many key advantages as below:

- It is specifically designed for Singapore Work Permit holders and helps you get your salary directly deposited into your bank account.

- Both you and your employer realize cost savings associated with cashless payments.

- You do not need any minimum balance to open this account.

- The monthly service fee for having low average daily balance is only SGD 2.

The POSB Payroll Account for Work Permit Holders is a great choice to get your salary straight into your account. You do not need a minimum amount to open this account.

Simpler Banking with POSB Digibank Simple Mode

POSB also offers foreigners a useful choice whereby you can enable Simple Mode9 on your POSB Digibank online banking portal or mobile app. This has several advantages that include:

- You can personalize your Digibank home screen based on your needs and usage.

- You can send money home with DBS Remit and take advantage of same day transfers at 0 transfer fees.

- You can top up various accounts and cards anytime.

This concludes our detailed guide on the most popular Singapore banks for foreigners and expats. That was a ton of information, though. We will summarize our findings below by highlight which banks are best for certain scenarios.

Best Singapore Banks for Expats – Our Recommendations

In this final section, we present our recommendations for some scenarios that foreigners and expats may be in based on their financial situation. Our suggestions are based on our detailed evaluation of the most popular Singapore banks for expats.

Which Singapore bank is best for traveling overseas?

If you travel overseas frequently for business or leisure, we recommend looking closely at the DBS Multiplier Account.

This is because you can link your DBS Visa Debit Card with your DBS Multiplier. This basically coverts your DBS Visa Debit Card into a multi-currency debit card. This means that you can make foreign currency purchases and cash withdrawals overseas with your regular DBS Visa Debit Card.

If you are a Singapore expat who travels overseas frequently, the DBS Multiplier Account may be a great fit.

This takes the hassle out of overseas travel as you no longer have to carry cash or deal with currency exchange problems. Just carry your DBS Visa Debit Card with you, and you are all set.

Which Singapore bank is best for earning interest on savings?

If you are a foreigner or expat living in Singapore and want to earn maximum interest on your savings, we suggest opening an OCBC 360 Account since you have the possibility of earning up to 7.65% interest on your savings of up to SGD 100,000.

To be able to get that high interest rate, you would need to ensure that:

- You use your OCBC 360 Account to get your salary direct deposited, put your savings in your account, and also spend from it. All these activities can make you eligible for up to 4.65% per annum on the first SGD 100,000 in your account.

- You also purchase OCBC's other financial products like investments and insurance. These can help unlock further 3.00% per annum interest on your savings.

If you are a Singapore expat who wants to maximize interest on your savings, consider the OCBC 360 Account.

Essentially, the more you use OCBC services linked to your 360 Account, the higher your interest rate will be.

Which Singapore bank supports maximum foreign currencies?

If you wish to have support for numerous currencies in your bank account as a Singaporean expat, we suggest looking at the DBS Multiplier Account and the UOB Global Currency Account.

In addition to the Singapore Dollar, these accounts let you hold multiple foreign currencies in parallel as below:

- DBS Multiplier Account allows 12 global foreign currencies that include Australian Dollar (AUD), Canadian Dollar (CAD), Chinese Renminbi (Offshore) (CNH), Euro (EUR), Hong Kong Dollar (HKD), Japanese Yen (JPY), New Zealand Dollar (NZD), Norwegian Kroner (NOK), British Pound (GBP), Swedish Kroner (SEK), Thai Baht (THB) and US Dollar (USD).

- UOB Global Currency Account allows 10 popular foreign currencies that include Australian Dollar (AUD), Canadian Dollar (CAD), Chinese Renminbi (Offshore) (CNH), Euro (EUR), Hong Kong Dollar (HKD), Japanese Yen (JPY), New Zealand Dollar (NZD), Swiss Franc (CHF), Sterling Pound (GBP) and US Dollar (USD).

If you are a Singapore expat who needs multi-currency support, we suggest the DBS Multiplier Account and the UOB Global Currency Account.

Which Singapore bank charges lowest fees?

If you are a Singapore expat and are concerned about paying fees on your bank account in Singapore, we recommend looking at the below 3 options:

- OCBC Global Savings Account: You do not pay any fees on this account even if your average daily balance runs low.

- UOB Global Currency Premium Account: There are no fees associated with this account. Bear in mind though that you need to meet much higher minimum deposit criteria to qualify for this premium account.

- CIMB Foreign Currency Savings Account: You have to pay no fees for this account, but you also do not earn any interest on your savings held in this account.

If you are a Singapore expat who wants to pay no account fees, look at OCBC Global Savings, UOB Global Currency Premium and CIMB Foreign Currency Savings accounts.

Which Singapore bank is best for Singapore Work Permit Holders?

If you are a Singapore Work Permit Holder, we strongly recommend looking at the POSB Payroll Account for Work Permit Holders.

The biggest advantages of this account are as below:

- Cashless direct deposit of your salary into your account, thus making it easier and cheaper for both you and your employer.

- Access to a DBS Visa Debit Card that can be used freely anywhere where Visa payments are accepted.

- Access to Simple Mode on your POSB Digibank online banking that allows you to send money overseas with DBS Remit on the same day with 0 transfer fees.

- Low monthly fee of SGD 2 in case your average daily balance falls below SGD 500.

If you are a Singapore expat on Work Permit, we recommend the POSB Payroll Account for Work Permit Holders.

Conclusion

If you are an expat in Singapore, finding a bank that offers good savings accounts with competitive interest rates is important. The banks we have listed above offer some of the best deals for expats in Singapore. Be sure to compare the different accounts and choose one that will work best for your needs.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. Portfolio of DBS Bank Accounts

2. Benefits of the DBS Expat Program

3. FAQs for the DBS Multiplier Account for expats

4. OCBC Global Savings Account

5. UOB Global Currency Account

6. UOB Global Currency Premium Account

7. CIMB Foreign Currency Savings Account

8. POSB Payroll Account for Work Permit Holders

9. Simpler Banking with POSB Digibank Simple Mode

Categories

Similar Articles

CNAPS Codes Unraveled: Navigating China's Banking Landscape

Discover CNAPS Codes: China’s unique bank identifier for fast, secure transactions. Learn how CNAPS Codes simplify payments across China's banking system.

ABA Routing Numbers In The US: A Comprehensive Guide

Discover what ABA Routing Numbers are, how they work and their importance in US banking transactions like direct deposits, online transactions and wire transfers.

What Is A NUBAN Number And What Is It Used For?

Discover what NUBAN Numbers are and how they streamline bank account identification in Nigeria. Do not miss this essential guide if you transact in any way with the Nigerian banking system.