Best Banks For Digital Nomads

Table of Contents

- Understanding Digital Nomads And Their Banking Needs

- Factors To Consider When Choosing A Bank For Digital Nomads

- Top Banks for Digital Nomads: Comparison and Review

- 1. Revolut: Awesome for sending and receiving money globally

- 2. Wise: Great for multi-currency spending

- 3. Charles Schwab: Best for digital nomads in North America

- 4. Starling Bank: Best overall UK bank for nomads and expats

- 5. N26: Great online bank for European nomads

- Conclusion: Choosing The Best Bank For Your Digital Nomad Lifestyle

Are you seeking the perfect financial partner to support your digital nomad lifestyle? With so many choices available, it may become a little overwhelming to choose the right bank, financial institution or money app for your needs.

In this article, we cover all the details necessary for determining the optimal financial partner that can support your digital nomadic lifestyle. We will look at the unique needs of digital nomads when it comes to banking and finance, and then present a comparison and review of the top banks tailored to such requirements.

From interest rates to ATM fees and security features, we will dive into various aspects of these institutions so that you can find the best banking partner for your travels.

We will also look at some of the top global banks and financial companies suitable for digital nomads so that you can make an informed decision on which one is right for you.

Understanding Digital Nomads And Their Banking Needs

Digital nomads are a new breed of professionals who work remotely while traveling the world. They are typically freelancers, entrepreneurs, or remote employees who work from their laptops, allowing them to work from anywhere in the world with an internet connection.

This unique lifestyle has become increasingly popular in recent years as technology has made it easier than ever before to work remotely. The Coronavirus pandemic also spurred a shift towards remote work and digital nomadic lifestyles as both employers and employers established a comfort for remote work.

However, this type of lifestyle also brings with it some potential problems when it comes to banking and finance. Digital nomads need a banking solution that is flexible, convenient, and accessible from anywhere in the world. They need a bank to support their frequent travel and international transactions without charging exorbitant fees.

One of the most important factors for digital nomads when choosing a bank is the ability to access their accounts and manage their finances online. The bank should have a user-friendly online platform, mobile banking app, and 24/7 customer support to assist with any issues that may arise.

Another critical consideration is fees. Digital nomads need a bank that offers low or no fees for international transactions, foreign currency conversions, and ATM withdrawals.

They also need a bank that does not charge monthly maintenance fees or minimum balance requirements, as they may not have a fixed income and may need to move funds around frequently.

Finally, digital nomads need a secure and reliable bank with robust fraud protection and the ability to freeze or block their cards if they lose them while traveling.

Factors To Consider When Choosing A Bank For Digital Nomads

When choosing a bank as a digital nomad, several factors should be considered to ensure that the bank or financial institution can meet your unique needs. Here are some of the most important factors to consider when you compare the best banks for a digital nomadic lifestyle.

Online Banking

As a digital nomad, you will likely be managing your finances online, so choosing a bank that offers a robust online banking platform and mobile app is crucial. Look for features like real-time balance updates, bill pay, and the ability to transfer funds between accounts.

Accessibility

When traveling, you need a bank that you can access anywhere in the world. Consider whether the bank has physical locations or partner banks in the countries you plan to visit and whether it has a global ATM network. You will want to avoid banks with high ATM or foreign transaction fees.

Fees and Charges

As a digital nomad, you may be making frequent international transactions, so choosing a bank that offers low or no fees is essential. Look for a bank that does not charge monthly maintenance, overdraft, or ATM fees and offers competitive exchange rates for foreign currency conversions.

Safety and Security

When traveling, there is always a risk of losing your debit or credit card, so choosing a bank with robust fraud protection and the ability to freeze or block your card if necessary is important. Additionally, consider whether the bank offers two-factor authentication or other security measures to protect your account from hackers.

Customer Support

Finally, consider the bank's level of customer support. As a digital nomad, you may need to contact the bank from abroad, so choosing a bank that offers 24/7 customer support via phone, email, or live chat is essential.

From online access to low transaction fees to safety and security, there are a few important considerations that you should consider when choosing the right bank for your needs.

By considering these factors, you can choose a bank or financial institution that can meet your unique needs as a digital nomad and help you manage your finances while traveling the world.

In the following sections, we will review some of the top banks for digital nomads and compare their features and benefits.

Top Banks for Digital Nomads: Comparison and Review

Several banks cater to the unique needs of digital nomads, offering features like low fees, global ATM networks, and robust online banking platforms. Here are some of the top banks for digital nomads, along with review and summary of their top features.

1. Revolut: Awesome for sending and receiving money globally

Revolut is often considered one of the top banks for digital nomads due to its user-friendly interface, low fees, and global presence.

Here are some of the reasons why digital nomads might choose Revolut:

- Low, Transparent Fees: Revolut offers low or no fees for many transactions, such as ATM withdrawals, international transfers, and currency exchange. This makes it an attractive option for digital nomads who must move money between countries and currencies.

- Competitive Exchange Rates: Revolut provides highly competitive exchange rates for sending and receiving money internationally. This helps digital nomads maximize the reach of their money by tapping into great exchange rates on their overseas payments and money transfers.

- Global Presence: Revolut supports over 30 global currencies and supports over 200 countries and regions worldwide. This means that digital nomads can use their Revolut account in many places worldwide without opening new bank accounts in each location.

- User-Friendly Interface: Revolut's app is easy to use, with intuitive features that allow users to manage their money on the go. The app provides real-time notifications of transactions and spending, making it easy for digital nomads to stay on top of their finances.

- Additional Services: In addition to its core services, Revolut offers a range of additional features that may be useful for digital nomads. For example, it offers travel insurance, a budgeting tool, and a virtual card that can be used for online purchases. You can also invest your savings, send gifts online and earn rewards of spending and purchases.

RemitFinder likes Revolut for providing easy, secure, cost-effective and fast ways to send and receive money internationally, thereby making it an attractive choice for digital nomads.

Overall, Revolut can be a good option for digital nomads looking for a simple and cost-effective way to manage their finances while moving. However, it is always a good idea to do your own research and compare different banking options before making a decision.

2. Wise: Great for multi-currency spending

Wise, formerly TransferWise, is not a bank but a fintech company specializing in international money transfers and multi-currency accounts. However, Wise can be an excellent tool for digital nomads who need to manage their finances across borders.

The biggest advantages of Wise include the below:

- Competitive Exchange Rates: One of the main advantages of Wise is that it offers competitive exchange rates for international transfers and currency conversions. This can be especially useful for digital nomads who work remotely and receive payments in different currencies.

- Multi-Currency Account: Another advantage of Wise is that it allows you to hold and manage money in multiple currencies through its multi-currency account. Currently, Wise supports holding funds in up to 50 currencies in parallel. This can be useful for digital nomads who must pay bills or purchase in different countries without incurring additional conversion fees.

- International Debit Card: Wise also offers a debit card that can be used to withdraw money from ATMs and make purchases in up to 50 currencies in more than 175 countries worldwide. This can be a convenient and cost-effective way to access your money while traveling.

- Make International Payments: You can also use Wise's flagship remittance and international money transfer service to send money worldwide at competitive exchange rates and transparent fees.

RemitFinder likes Wise for providing digital nomads a multi-currency account with support for 50 currencies; this helps make overseas purchases like a local with great exchange rates and transparent fees.

Overall, while Wise is not a bank, it can be a valuable tool for digital nomads who need to manage their finances across borders.

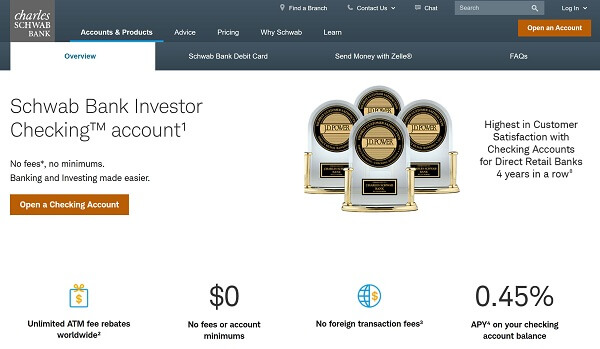

3. Charles Schwab: Best for digital nomads in North America

Charles Schwab is often considered one of the top banks for digital nomads due to its focus on providing online and mobile banking services, its fee structure and travel-friendly features.

Here are some reasons why Charles Schwab is a popular choice for digital nomads in North America:

- No ATM Fees: Charles Schwab does not charge any fees for using ATMs, and it reimburses all ATM fees charged by other banks worldwide. This is especially beneficial for digital nomads who are constantly on the move and need access to cash without worrying about fees.

- No Foreign Transaction Fees: Charles Schwab does not charge any fees for foreign transactions, including purchases and ATM withdrawals. This is a huge advantage for digital nomads who frequently travel abroad and need to make transactions in different currencies.

- High-Yield Checking Account: Charles Schwab offers a high-yield checking account that pays interest on deposits and has no minimum balance requirements or monthly fees. This is an excellent option for digital nomads needing a flexible account to accommodate their changing financial needs.

- Mobile App: Charles Schwab has a mobile app that allows users to manage their accounts, transfer funds, and deposit checks remotely. This is particularly useful for digital nomads who may need access to a physical branch and need to handle their banking on the go.

Charles Schwab is an excellent choice for digital nomads who value convenience, flexibility, and low fees. Its focus on digital banking and travel-friendly features make it a top pick for those constantly moving.

RemitFinder likes Charles Schwab for charging 0 fees on domestic as well as international ATMS, no monthly fees and providing interest on savings as well as full online and mobile banking access.

On the flip side, you will need to be a US resident for tax purposes to be able to open this account. If you travel a lot, it may become hard to meet the minimum stay residency requirements.

4. Starling Bank: Best overall UK bank for nomads and expats

Starling Bank is a mobile bank that offers a range of features that can be useful for digital nomads who need to manage their finances on the go.

One of the key advantages of Starling Bank is that it offers a fully digital banking experience with a mobile app that allows you to manage your accounts and transactions from anywhere in the world. This can be especially useful for digital nomads who need to access their accounts and make transactions while traveling.

Starling Bank also offers a range of features that are specifically designed for international travelers, such as no foreign transaction fees on purchases made abroad and free ATM withdrawals worldwide. This can be a cost-effective way to manage your money while traveling and save you on fees and charges.

Another advantage of Starling Bank is that it offers a range of different account types, including basic accounts with no monthly fees, and premium accounts with additional features such as travel insurance and cashback on purchases. This can allow you to choose the account that best fits your needs and budget as a digital nomad.

Additionally, Starling Bank offers a feature called Spaces, which allows you to set aside money for specific savings goals, such as travel or emergency funds. This tool can be useful for digital nomads who need to save for specific expenses or emergencies.

RemitFinder likes Starling Bank for providing digital nomads with many account types, fully online and mobile banking for 24x7 access and no monthly fees.

Overall, while many different banks and financial services can be useful for digital nomads, Starling Bank is a good option to consider due to its focus on digital banking, international features, flexible account options, and useful savings tools.

5. N26: Great online bank for European nomads

N26 is a mobile bank that offers a range of features that can be useful for digital nomads who travel frequently and need to manage their finances on the go.

One of the key advantages of N26 is that it offers a fully digital banking experience, with a mobile app that allows you to manage your accounts and transactions from anywhere in the world. This can be especially useful for digital nomads who need to access their accounts and make transactions while traveling.

N26 also offers a range of features that are specifically designed for international travelers, such as no foreign transaction fees on purchases made abroad and free ATM withdrawals worldwide. This can be a cost-effective way to manage your money while traveling and can save you money on fees and charges.

Another advantage of N26 is that it offers various account types, including basic accounts with no monthly fees, and premium accounts with additional features such as travel insurance and cashback on purchases. This can allow you to choose the account that best fits your needs and budget as a digital nomad.

RemitFinder likes N26 for providing easy to access and manage online bank account in Europe with a focus on 0 or low transaction fees on overseas purchases and usage.

Overall, while there are many different banks and financial services that can be useful for digital nomads, N26 is a good option to consider due to its focus on digital banking, international features, and flexible account options.

One thing to keep in mind is that N26 has shut down its UK and US operations to focus on its European business. As a result, it is not a good option for you if you primarily live, travel and work in the US or UK.

Conclusion: Choosing The Best Bank For Your Digital Nomad Lifestyle

As a digital nomad, choosing the right bank to manage your finances is an important decision.

Your bank should offer features and services that align with your lifestyle and travel needs, such as no foreign transaction fees, free ATM withdrawals worldwide, and easy access to your accounts from anywhere in the world.

Many banks and financial services are available that cater to digital nomads, each with advantages and disadvantages. Some popular options include Wise, N26, and Starling Bank, which all offer digital banking, international features, and flexible account options.

When choosing a bank, it is important to consider your individual needs and preferences.

For example, if you need to receive payments in multiple currencies, a bank with low fees and competitive exchange rates, such as Wise, may be the best option for you.

Similarly, a premium account from N26 or Starling Bank may be a good fit if you value travel insurance and cashback on purchases.

Ultimately, the best bank for your digital nomad lifestyle will depend on your unique needs and preferences. It is a good idea to do your research, compare different options, and consider factors such as fees, exchange rates, and account features before making a decision.

By choosing the right bank for your digital nomad lifestyle, you can make managing your finances easier, more cost-effective, and more convenient while you travel the world.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

Want to explore by country? Browse all sending countries on our send money from hub.

Categories

Similar Articles

CNAPS Codes Unraveled: Navigating China's Banking Landscape

Discover CNAPS Codes: China’s unique bank identifier for fast, secure transactions. Learn how CNAPS Codes simplify payments across China's banking system.

ABA Routing Numbers In The US: A Comprehensive Guide

Discover what ABA Routing Numbers are, how they work and their importance in US banking transactions like direct deposits, online transactions and wire transfers.

What Is A NUBAN Number And What Is It Used For?

Discover what NUBAN Numbers are and how they streamline bank account identification in Nigeria. Do not miss this essential guide if you transact in any way with the Nigerian banking system.