Impact of COVID-19 on Remittance Flows

Table of Contents

- How is COVID-19 affecting migrant's finances & remittances?

- Working hour and labor income losses

- Closed borders limit the movement of workers

- Unstable currency conversion rates discouraged remittance

- How does COVID-19 affect remittances to fragile economies?

- Regional stats on the impact of COVID-19 on remittances

- Europe and Central Asia

- East Asia and Pacific

- The Middle East and North Africa (MENA)

- Sub-Saharan Africa

- South Asia

- Latin America and the Caribbean

- Remittance costs stats by region for sending $200 in 2020

- How does COVID-19 affect players in the remittance industry?

- How to overcome COVID-19-induced challenges in the remittance ecosystem?

- Adopting digital fintech solutions

- Conclusion

COVID-19 is, no doubt, a health crisis. But it has plunged the world into economic turmoil too. It has harmed almost all business sectors with resulting downturns in labor markets around the world.

The resulting loss of employment and labor income has also affected global remittances. Economic activities worldwide are slowly picking up, and jobs are returning. But these indicators are still nowhere near where they were before the current coronavirus struck.

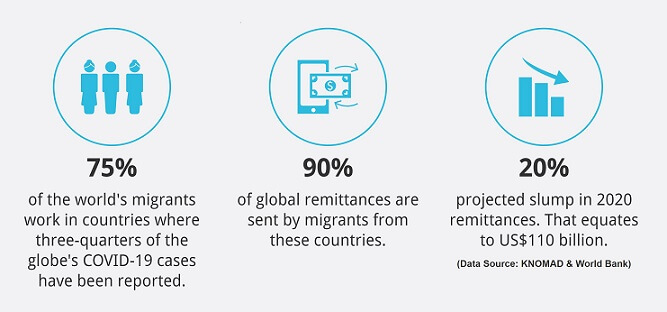

The World Bank (WB) projection for 2020 was a 20% dip in total remittances worldwide. And the situation could get worse with a further 14% fall predicted for 2021. We will now consider how COVID-19 has impacted migrant employees and their dependents, jobs and earnings, and remittance flows.

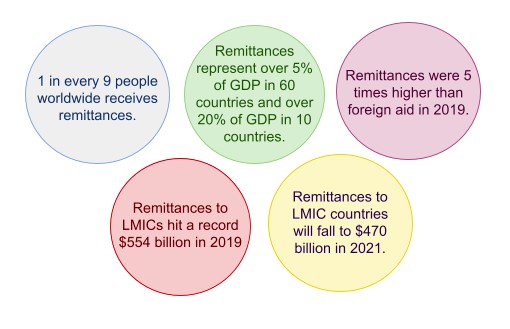

Due to the COVID-19 pandemic, the World Bank projected 20% less remittances worldwide in 2020, and a further downfall of 14% in 2021.

How is COVID-19 affecting migrant's finances & remittances?

Migration creates a source of sustenance and provides earning opportunities. People working abroad often remit money to their birth countries for personal and business purposes. Worldwide, over 800 million people benefit from such remittances. And more than 70% of these monies go for food, healthcare, education, and other basic needs.

Remittances from migrants abroad serve as a critical funding source for several nations too. They augment the revenue base of a country during an economic crisis by increasing consumption and investments.

Working hour and labor income losses

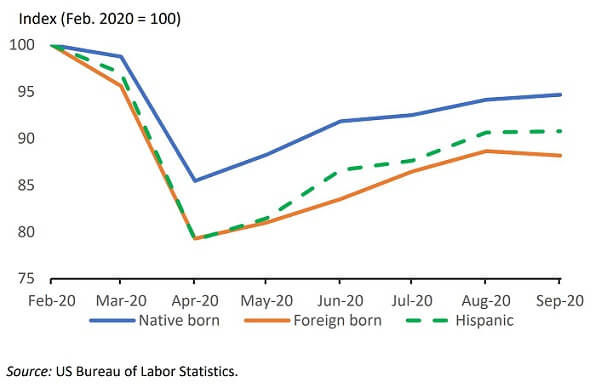

The coronavirus infection and measures to curb its spread left businesses struggling. Giant corporates announced layoffs and stopped their operations in many lands. And the result is 114 million people becoming unemployed in 2020.

The International Labor Organization (ILO) reports that work hours dipped by almost 9% from the pre-crisis values. That translates to a loss of 255 million full-time equivalent jobs amounting to US$3.7 trillion in global labor income.

Women too suffered more job losses from COVID-19 than men. They accounted for close to 60% of total U.S. jobs lost until mid-March 2020. This discrepancy exists because women hold more informal positions that require in-person interactions like in retail or personal care. Therefore, they cannot work online from home and lost their jobs.

Closed borders limit the movement of workers

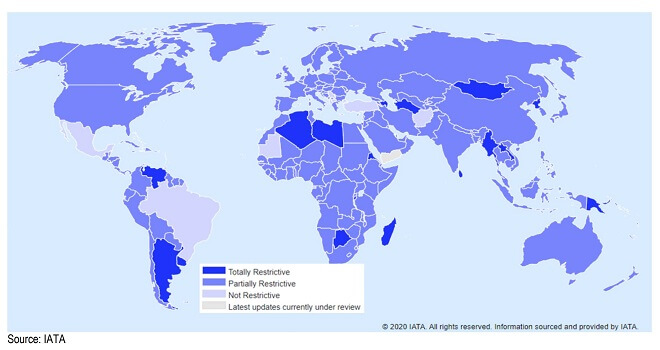

Cross-border migration of professionals is an essential factor in sustaining international trade and economic growth. But as the map below shows, nearly all nations chose to restrict movements.

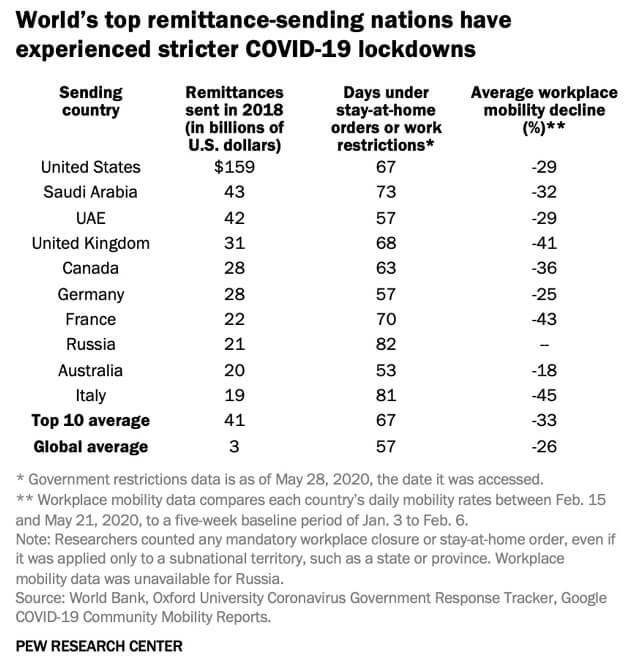

Some countries also ordered lockdowns and border closures to control the spread of COVID-19 virus. The table below shows how much restrictions some of the top remitting countries implemented.

Table Source: PEW RESEARCH CENTER article decline in remittances in 2020 due to COVID-19

As a result of the closures, many professionals could not seek employment overseas, which means less available income to send home. And those abroad already were stranded as they could neither go back home nor get a job in their residing country.

Unstable currency conversion rates discouraged remittance

Turbulences in the capital market and disruptions of financial flows resulted in volatile currency rates. Some migrants whose home country currency became less valuable preferred to postpone homeward payments. Many chose to withhold transfers until they could get better exchange rate offers. And because of that, remittances shrank for some time.

The novel coronavirus has adversely affected both the health and financial wellbeing of professionals abroad and their dependents. Migrants in the health sector and those in client-facing roles were at more risk of getting the virus. Foreign workers in construction, tourism, personal care, industrial, service, and transport sectors who cannot work remotely became unemployed. Furthermore, many were not eligible for government assistance.

Due to declining income or unemployment, many people could not send money to their dependents at home. Also, many payment providers were closed, stalling the payment and receipt of remittances. With little or no financial assistance coming from abroad, families of migrants at home became stranded too.

Less working hours, lockdowns in many countries, limited cross-border movement, and unstable currency exchange rates were some of the factors that contributed to reduced remittances during the COVID-19 crisis.

How does COVID-19 affect remittances to fragile economies?

Financial inflows from migrants working abroad constitute a substantial portion of GDP in several Low-Middle-Income Countries (LMIC). In Haiti and Tonga, cash flow from migrants overseas makes up 23% and 42% of GDP, respectively. Remittances make up 29% of GDP in Tajikistan and Kyrgyzstan (Kyrgyz Republic), 27% in Nepal, and 10% in South Sudan.

Remittances even surpass foreign aid and other sources of financial inflows to many developing and fragile economies.

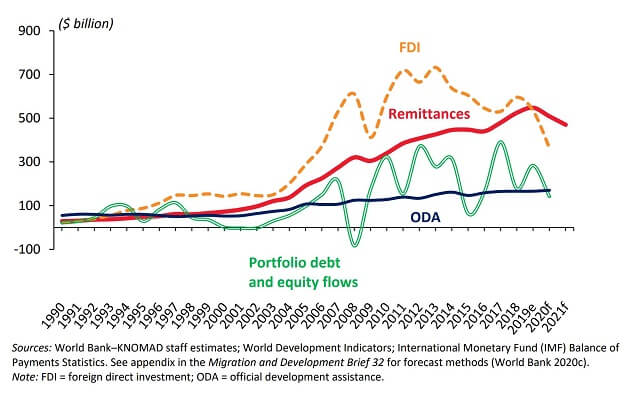

Before the ongoing health crisis, remittance flows to developing economies were on a steady rise. They grew more than 100% from a moderate US$47 billion in 1980 to over US$100 billion by 2000. The amount grew as more people migrated for income opportunities and better payment schemes emerged. And in 2019, more than US$700 billion was sent worldwide. Of that amount, more than US$545 billion went to developing nations.

The financial wellbeing of foreign professionals abroad has a direct implication on cross-border remittances. Unfortunately, many migrants live and work in pandemic-worst-hit economies. Furthermore, the number of global migrants will likely decrease during the pandemic. That is because migration rates slowed while the number of migrants returning to their home nations grew.

World Bank projects that the total international remittances in 2020 will dip below US$575 billion. The downward turn in financial flows is because of the worsening economic situation of migrants arising from the current global health problem. In 2021, LMICs may even see remittances falling lower than $475 billion. The fall in transfer payments will exceed that witnessed during the great recession.

The current global recession has sent an unprecedented 88-115 million humans below the poverty line. And 8 out of every 10 'new poor' people will be from middle-income nations. Helping migrants through the crisis ensures that many people in fragile economies receive assistance.

Countries whose economies depend a lot on remittance inflows suffered heavy losses due to the global health and economic problems caused by the Coronavirus.

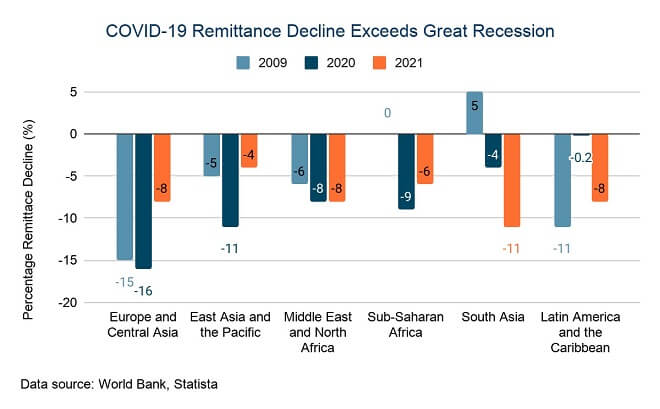

Regional stats on the impact of COVID-19 on remittances

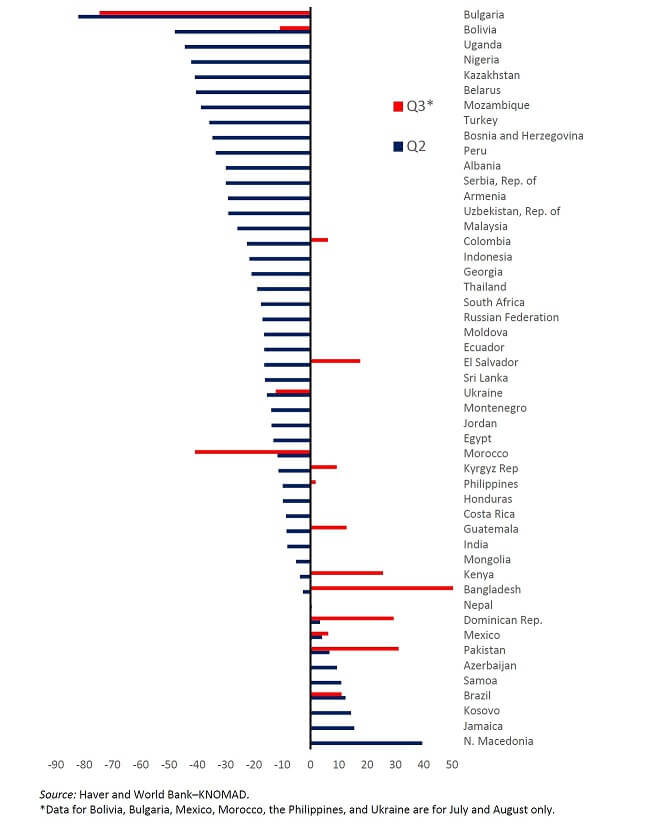

The pandemic triggered an overall reduction in the number as well as the overall sent amount of global remittances. Below chart shows the variations in remittances over Q2 and Q3 of 2020.

Now we will deep dive into regional trends and look at how remittances varied in various countries during the global pandemic.

Europe and Central Asia

Remittance flows here climbed 6% to $65 billion in 2019. Despite initial projections, this region recorded only a 16% contraction (to around US$48 billion). And it is projected to dip 8% more in 2021.

Almost every country in this region will likely record a double-digit fall in remitted funds. Ukraine and Russia got the most inflows but recorded 13% and 16% fall respectively. Tajikistan and Kyrgyzstan got the most inflows as a percentage of GDP.

The global pandemic and crashing oil rates caused cash flows in this region to fall. Furthermore, the devaluation of the Russian currency may have discouraged outbound cash transfers from Russia.

East Asia and Pacific

Before the current health challenge, funds remitted to this region grew above $146 billion in 2019. But they dipped 11% in 2020 to $131 billion and may decline 4% more in 2021. In terms of transfer size, China topped in this region. But Tonga got the most remittance inflows as a GDP contributor.

For the Philippines, a 13% fall in remittance flows was initially projected for 2020. But the country recorded approximately 8% growth between June and July 2020 after dipping by over 19% in May. Overall, flows for the first 11 months of 2020 fell only 0.9% (almost $30 billion) from around $33.5 billion the previous year. Despite the wild swings, the Philippines may see a further 2% contraction in remitted funds for 2020.

The Middle East and North Africa (MENA)

After growing 2.6% in 2019, transfer inflows to this area contracted by approximately 8% to $55 billion in 2020. And it may fall further by 8% in 2021. Egypt and Jordan got the highest amounts of transfers but recorded 9% and 12% fall respectively. Lebanon and Yemen got the most inflows as a percentage of GDP.

Lebanon also saw a 7% contraction, Morocco 5%, and Tunisia 15%. Egypt-bound remittances were large because more workers overseas increased single payment to their relatives at home. However, because of weakening oil revenues and market uncertainty in the Gulf nations, flows may fall eventually.

Sub-Saharan Africa

In 2019, remittances to this region recorded a 0.5% dip to US$48 billion. The pandemic caused 8.8% more contraction in 2020 to US$44 billion. And it may drop a further 5.8% in 2021 to US$41 billion. South Sudan received the most amounts as a portion (35.4%) of GDP.

Nigeria received the largest share of inflows but recorded a fall of over $2 billion compared with 2019. Somalia and Zimbabwe recorded initial declines but recovered later. Kenya has maintained positive remittance inflows, but they may eventually fall in 2021.

The reduction in inflows is an unfavorable development in this region where almost 40% of people live below the poverty line. Aside from the difficulties arising from the coronavirus, floods and swarms of desert locusts have compounded the problems here. Also, crashing oil rates and currency exchange rates affected remittance flows.

South Asia

Migrant financial flows to this region fell in 2020 by about 4% to US$135 billion and could fall further by 11% in 2021. India and Pakistan got the highest inflows while Nepal received the most flows as a share (23%) of GDP.

Remittances in 2020 fell by 9% in both Sri Lank (to US$6.7 billion) and India (to US$76 billion). Despite bleak predictions, flows to Nepal contracted by 12% approximately to US$7.4 billion.

Pakistanis abroad sent home US$14.2 billion between July-December 2020, a 25% rise from the last fiscal year. However, World Bank estimates a 9% growth to US$24 billion for Pakistan in 2020.

Although the initial prediction was a 22% plunge, World Bank now estimates an 8% upsurge for inflows to Bangladesh with US$20 billion in 2020. The country reported massive inflows (53% growth) in the 3rd quarter of 2020. The increase happened after the flooding that engulfed a portion of its territory.

Several other factors contributed to the positive growth in this region. Pakistan made tax exemptions for transactions made through domestic banks starting July 2020. Furthermore, both Bangladeshis and Pakistanis abroad switched to using official routes for remitting funds; the inconveniences of moving physical cash under travel constraints may have encouraged this switch.

Latin America and the Caribbean

This region's remittances were only slightly disturbed by the coronavirus crisis. It fell by only 0.2% to around US$96 billion in 2020, which is way better than the 19.3% initial downfall prediction.

Mexico got the most share - more than US$40 billion - of financial flows from migrants abroad in this region. The country recorded more inflows from migrants in other countries during the pandemic. That could be because over 95% of Mexicans abroad live in the U.S. Some of them were even working in services considered essential. Also, those that qualify got help through the U.S. government stimulus arrangements.

Interestingly, many other states in this area had both negative and positive inflows in 2020. Jamaican migrants sent home fewer amounts of money at first in March and April, but remittances eventually rose. The increase may be from migrant workers receiving support from the authorities in their host countries.

After a steep fall in the preceding two months, the Dominican Republic got 26% more remittances in June 2020 than a year before. In the same month, Honduras and El Salvador recorded a 15% and 10% increase respectively.

Overall in 2020, Guatemala surpassed its historic remittance flow records with total remittances rising by 8% in 2020 to US$11.5 billion. El Salvador saw about a 5% increase to US$5.9 million and Honduras about 4% rise. And flows grew 16% for the Dominican Republic in 2020.

Barring few exceptions, almost all regions of the world saw declines in incoming remittances due to the economic problems created by COVID-19.

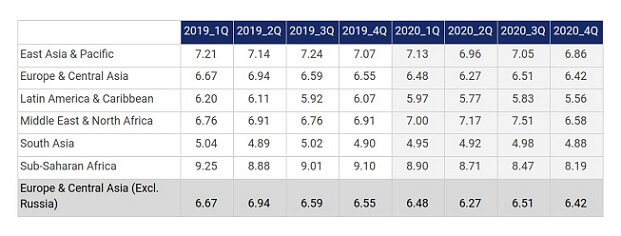

Remittance costs stats by region for sending $200 in 2020

Despite being a means of sustenance for millions worldwide, it still costs migrants a fortune to send monies home. Low-value transfers are costlier than larger payments. On an average, the cost of remitting $200 went down to 6.51% in the 4th quarter (Q4) of 2020. That is still nowhere near the 3% mark of Sustainable Development Goals (SDG) by 2030, a target setup by United Nations Department of Economic and Social Affairs.

Some migrants prefer using informal routes for moving money to their home country because the official channels are too expensive. Migrants lose at least $25 billion every year in remittance fees. Reducing transfer rates will grow the formal economy and increase the net income of benefiting households.

It costs an average of 4.88% to remit $200 to South Asia, which is cheaper than all other regions. But it costs 8.19% on average for sub-Saharan Africa, making it the most expensive payment region.

Banks (the most expensive transfer channel) charge an average of 10.73%. Post Office transfers come next at 8.69% on average. Money Transfer Operators (MTO) are next at 5.56%, and Mobile Money Operators costs the least at 3.08%. Unfortunately, Mobile Operators handle only a tiny fraction (below 1%) of remittances.

How does COVID-19 affect players in the remittance industry?

Apart from the families of migrant employees, the COVID-19-induced financial crisis has also impacted Remittance Service Providers (RSPs). The loss of income made many migrants remit fewer sums or none at all. Hence, the remittance industry recorded reduced revenues.

Before COVID-19, retails agents handled 80% of remittances in cash. But the shut-down order in many states forced these agents to close shop. As a result, many people lost their businesses.

However, there was a boost in digital flows as people turned to digital channels to send financial assistance to their loved ones. And MTOs had to adapt quickly to rising demand for digital money transfer services.

Some payment companies even reported growth. Remitly, for example, had more than 200% growth in customers using digital remittance services. Western Union too got new customers and more than 45% revenue growth in electronic transfers. That said, payment providers are still facing challenges resulting from the pandemic.

How does COVID-19 affect Remittance Service Providers?

Over 90% of the payment services that participated in a survey said the total volume of transactions changed significantly. Below are some COVID-19-related factors that affected transaction volumes.

Health concerns

Health safety concerns continue to be a primary concern for RSPs. Without safety equipment, handling cash and physical interaction with clients at remittance outlets is risky for staff. Furthermore, many agents became ill despite working remotely.

To reduce health risks, RSPs could serve clients through digital channels. But the market does not seem prepared yet to switch to digital technology. In-person customer authentication is still a requirement in many states. Some people don't even have access to digital services. Furthermore, many customers do not have enough knowledge to help them take advantage of available digital payment technologies.

Reduced personnel and working hours

The pandemic has triggered lockdowns and curfews across the globe. Unfortunately, payment companies and their services do not qualify as essential services in many places. As a result, payment agents had to either close down or operate with reduced personnel for limited working hours.

Operating within the limitations mentioned above meant an unreliable network of agents. A payment operator may open to initiate a transfer, but their collection offices in the destination state are closed. That implies more difficult cash-pick-up and in-person transactions.

Problems of liquidity

Many payment providers have had to deal with unpredictable currency conversion rates and interruptions in cash flow. The unstable rates hinder the re-balancing of various cash and electronic accounts. Furthermore, mobility constraints make it harder to access banking services.

Swelling running costs

The health crisis prompted lockdowns which caused job losses. Also, migrants returning to their home countries led to a sudden dip in remittances. The falling financial flows turned the operational costs of transfer services into losses.

Even when operating at minimum capacity, remittance service providers still have to keep paying bills. They pay rent, building maintenance fees, daily running costs, staff salaries, etc. – to name a few. But the lower transaction volumes mean lower profits which is a threat to their survival.

How to overcome COVID-19-induced challenges in the remittance ecosystem?

By taking appropriate measures, we can heavily mitigate and perhaps resolve the numerous pandemic-triggered challenges hindering the global flow of remittances. Below, we will discuss how all concerned parties can collaborate to overcome COVID-19-induced remittance challenges.

Establish favorable policies

A favorable regulatory system will improve remittance flows. Policymakers must:

- Encourage people to use approved channels for international payments.

- Designate payment facilitation as an essential service. That way, RSPs can operate even during curfews or lockdowns. Best of all, it will keep the transfer mediums open so that people abroad can remit funds.

- Establish economic support measures for struggling payment providers and migrants.

- Support the development and scaling up of digital payment channels.

- Digitize wage payments to help reduce physical contact while saving cost and time.

Better regulation

Even though MTOs and mobile operators are the most cost-effective remittance channels, they still face several challenges. Banks deactivate their accounts to be sure that they are following anti-money laundering (AML) policies and rules for combating the financing of terrorism (CFT).

To keep remittances flowing and encourage the use of approved money transfer mediums, regulators could do the following:

- Adopt simpler AML/CFT guidelines and procedures for lower-value payments.

- Simplify the terms, conditions and processes for RSP licensing.

- Make bank services available to payers, receivers, and mobile RSPs during a health crisis.

- Enhance monetary laws and identification schemes to improve the integrity of transactions.

- Set up flexible and inclusive Know-Your-Customer (KYC) procedures for unbanked and undocumented persons. Consider registering a new mobile wallet (digital account), for example. Some places still require a customer to be present physically to provide identifications and signature. Such a rule exposes people to too much health risks during a global epidemic. Accepting e-authentication for users with low-value transactions will simplify this process significantly.

Remittance Service Providers have a part to play too

Payment services could consider relief measures like cutting down on payments costs, waivers for fees, and other special offers. RSPs can invest more in financial and digital education. They could help inform clients about available digital payment systems and how to access them.

COVID-19 impact on remittances can be mitigated to some extent by implementing favorable policies, improving industry regulation, reducing customer friction and streamlining processes to lower costs across the board.

Adopting digital fintech solutions

Since physical and social interactions are reducing, complete digitization appears the way forward for the payment industry. Service providers could help spread digital and financial knowledge to more people in society. They could partner with public institutions to help migrants, as well as recipients, learn about and adopt FinTech services.

Widening the reach of electronic payment channels is also essential. FinTech companies are already devising innovative digital systems for international transactions. Technologies like mobile money are already impacting the industry by fostering more digital inclusion.

A practical example is an arrangement that came into effect after the terrible Harold cyclone struck. UNCDF and UNDP partnered with Vodafone Fiji to allow 2-months free transfers through the M-PAiSA platform.

The monthly volume of transactions jumped from 6,500 (pre-COVID) to 22,000 (in July) during the pandemic. From just over $900,000 before the partnership, transfers increased to over US$3.1 million just in two months.

Why payment services need to go digital

Digitization of remittances will benefit both remittance service companies as well as customers who rely on them to send money abroad. Let us look at why the adoption of electronic solutions for remitting funds is a major step forward.

- It reduces dependence on often risky informal transfer channels based on cash. Digital payment models reduce the incidence of frauds which improves trust and confidence amongst users.

- Digitization, through mobile services, in particular, will foster financial inclusion. It will bring enhanced electronic payment services to well over 1.7 billion unbanked people worldwide.

- It allows for safer operations during a pandemic because of reduced visits to transfer outlets or banks. Less contact means no need to queue up or interact with anyone to complete a transaction.

- Online transfer services provide easy, secure and quick intercountry payments. Electronic payment channels also remove unnecessary intermediaries and commissions, reducing the overall cost of transfers.

Digital fintech solutions and overall digitization of the payments industry will pave the way for faster, easier, cheaper and more secure money transfers.

Conclusion

Remittance flows into low-income fragile states supports households and provides much-needed tax revenue. Plummeting remittances is likely to worsen fiscal and socio-economic pressures on these already-struggling countries.

Even though many payment providers have recorded fewer transfer volumes, the pandemic presents a unique opportunity to develop better digital solutions. Digitization will not only shield remittances and RSPs from the effect of a global pandemic, but it will also ensure fast, simple, cheap (closer to the 3% Sustainable Development Goals [SDG] target) and secure transfers.

Categories

Similar Articles

US Big Beautiful Bill's Impact On Remittances

The Big Beautiful Bill has been passed in the US, and remittances are impacted. Learn how the Bill impacts remittances and what to do if you are affected by the new law.

Bangladesh Remittance Cash Incentive: All You Need To Know

Are you an overseas Bangladeshi resident who sends money home to your loved ones? Read on to learn how to earn an additional 2.5% cash on your international remittances sent to Bangladesh.

How Fintech Is Pushing Banks Out Of The Remittance Business

The fintech revolution is disrupting the international remittance business. Discover how innovative startups are reshaping the international money transfer industry and challenging traditional banks.