7 Best Financial Apps for Expats Living in Singapore

Table of Contents

If you are an expat living in Singapore, you know that life is very fast paced in this high tech and fast moving city state. Given that, you are probably always looking for ways to save your previous time and money. This definitely applies to your financial life, and it's important to have financial apps that can help you stay organized.

In this article, we present the seven best financial apps for expats living in Singapore. These apps will help you manage your money more efficiently and make sure that you stay on top of your finances.

Why are Financial Apps Useful

When it comes to managing your finances as an expat, several options are available to you. Financial management apps can help you keep track of your spending, budget for upcoming expenses, and even save money on the go.

One possible issue with traveling to a new country is that you might spend more money than you originally budgeted. This can be caused by several things: not having enough knowledge about the area, poor research into the cost of living, or simply because there are too many attractions that look fun.

If you are relocating overseas for a new experience or to enhance your job prospects, keeping track of your current and future finances may be your biggest obstacle.

This is where finance management apps come in. Financial management apps can help you keep track of your spending, budget for upcoming expenses, and even save money on the go.

The best part about these finance apps is that they're simple to use, and help save you time and money. Plus, since they are mobile apps, they are accessible no matter where you are.

Good financial apps can help you stay on top of your finances, spending and budget, and help save and grow your money.

There are several different financial management apps available, each with unique features and benefits. When choosing a financial management app, it's important to find one that fits your individual needs and lifestyle.

In addition, there are also really good money related apps out there that can help you maximize the rewards on your spending, save on international money transfers, and so on.

The Best Financial Apps for Singapore Expats

When it comes to managing your finances and getting the most out of your every single hard earned Singapore Dollar as an expat in Singapore, there are so many options available that you can almost get lost looking at them.

To simplify your choices, we have done the due diligence and picked some of the top apps you could use.

Here are some of the best financial management and money related apps for Singapore expats that can help you save money on purchases and remittances, budget better, and stay on top of your finances:

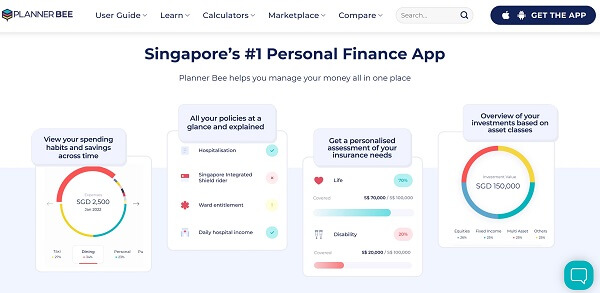

1. Planner Bee

Planner Bee1 is Singapore's number one personal finance app, designed to help users take control of their finances. It offers an easy-to-use platform that lets you track and manage your finances seamlessly. The app provides a full range of features, including budgeting tools, debt tracking and analysis, investment tracking, bank account monitoring and more.

Planner Bee is free to download and use, making it easy for anyone in Singapore to access the tools they need to take control of their finances. With its user-friendly interface and comprehensive range of features, the app can help users save time, money and stress.

Planner Bee has numerous great features around budgeting and spending, and is very popular financial app in Singapore.

Whether you are a beginner or an experienced investor, Planner Bee has something to offer everyone. Start taking control of your finances today with Planner Bee!

Main benefits of Planner Bee include:

- Visualize your spending as well as savings over time to see trends and opportunities to save money.

- Monitor your investments based on asset classes and ascertain how balanced your investment portfolio is.

- Manage all your insurance policies in a single view and never miss any renewal or expiration deadlines.

- Get personalized insurance recommendations based on your coverage needs.

- Create and track budgets and analyze your financial performance.

- Get personalized recommendations from experienced professionals.

- Access educational materials to increase your knowledge of personal finance, and keep up with the latest trends in the financial markets.

2. YouTrip

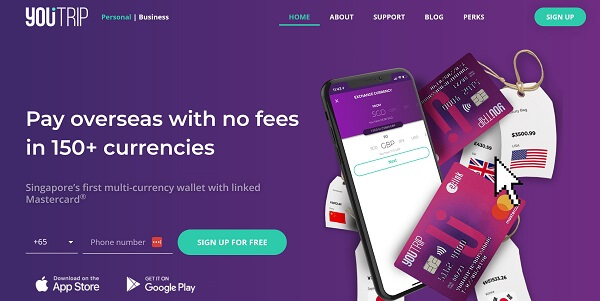

YouTrip2 is a multi-currency mobile wallet available in Singapore, and is the perfect companion for your next overseas adventure. With just a few clicks, you can load up on multiple currencies to use during your travels and save on transaction fees.

YouTrip also gives you access to real-time currency exchange rates so you get the best deals wherever you go. Plus, their easy-to-use app allows you to manage your funds on the go and even check out your past transactions.

YouTrip supports more than 150 global currencies so you can travel anywhere in the world and use it overseas. Your YouTrip mobile wallet comes with a linked Mastercard which you can use anywhere in the world where Mastercard is accepted. This makes overseas shopping a breeze – no need to carry cash or paying exorbitant credit card fees for foreign transactions.

The YouTrip mobile wallet support up to 150 global currencies and is your perfect companion for overseas spending.

Major features of YouTrip include:

- Make purchases online and in-person overseas with your YouTrip Mastercard in more than 150 global currencies.

- Exchange currencies in real-time without hidden fees and save more on your travels with very competitive exchange rates.

- Top up your balance via any Singapore debit card or credit card for convenient payments wherever you go and hold up to SGD 5,000 in your wallet.

- Withdraw cash overseas at any Mastercard, Maestro or Cirrus ATM using your YouTrip Mastercard for a flat fee of SGD 5.

- Track your spending and monitor your transactions in real-time and stay on top of your overseas purchases.

- State-of-the-art encryption technology keeps your money and information safe and secure.

3. RemitFinder

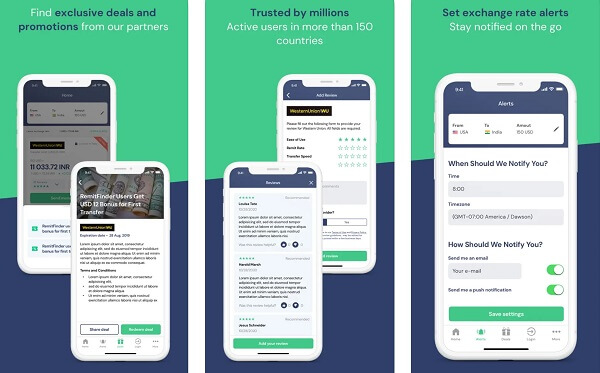

When you want to send money home to your loved ones, it might be challenging to find the best exchange rates due to constantly fluctuating exchange rates and a wide range of money transfer services to choose from. This is where RemitFinder can be helpful.

RemitFinder is an online app that helps you compare the latest remittance exchange rates, so you can get the best value for your money transfer. RemitFinder does the work for you by comparing exchange rates from various providers, so you don't have to search for updated rates manually.

The app also keeps you updated with the latest deals and promotions from numerous money transfer companies. You can rate and review money transfer companies based on your personal experience with them, as well as read reviews written by other customers like you.

RemitFinder is a comprehensive money transfer comparison platform that provides you access to latest exchange rates, deals and related information.

Finally, you can also establish a free, custom exchange rate alert to stay updated with the latest exchange rates.

RemitFinder helps you get the best value for your international money transfers in every possible way.

Key benefits of RemitFinder include:

- Ability to search and compare currency exchange rates from numerous money transfer companies, remittance service providers and banks.

- Accurate and up to date foreign exchange rate information and trends.

- Access to many deals and promotions from remittance companies including exclusive offers and discounts reserved for RemitFinder users.

- Free daily exchange rate alerts for the most up-to-date information on currency exchange rates and deals.

- Access through multiple channels over web and mobile (both iOS and Android).

- Review money transfer companies - share your experience with others and learn from theirs.

4. Wally

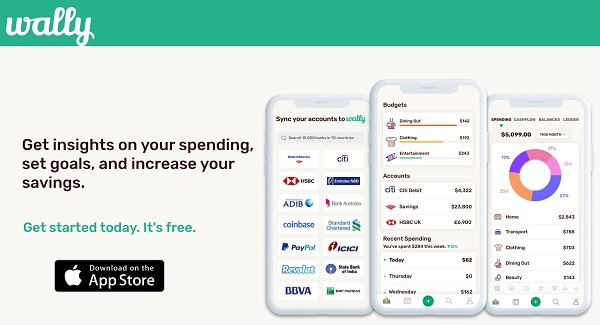

Wally3 is full of features that can help make your life easier, like the ability to integrate your bank accounts and create custom budgets to track your spending. It's simple to understand why Wally is one of the most widely used personal financial budgeting apps on the market today.

The app provides a wide range of financial information displayed through a clear and straightforward layout and divided into digestible chunks. Its integrated receipt-scanning capability makes it simple to enter and track your expenses and serves as a handy place to save essential bills.

You can download and use Wally for free, or upgrade to Wally Gold to get additional features like filtered data export and repeat notifications.

Wally has numerous great features like integrations with your bank as well as built in receipt scanning.

Key benefits of using Wally include:

- Centralizes all your accounts and financial data in a single view to get a holistic view of your finances and spending.

- Flexible and powerful budget tracking based on various categories of spending and purchases.

- Personalized recommendations and insights into spending activity with real time updated as information changes.

- Bill pay reminders and chronologically sorted payments and transactions help you stay on top of your financial calendar.

- Highly recommended by influencers, bloggers and media outlets like Forbes, Economic Times, BBC and more.

- Strong focus on security with data encryption and compliance with standards like PCI, ISO 27001 and GDPR.

5. FavePay

FavePay4 is the ultimate rewards app that you must have if you are a Singapore expat. There are 2 great reasons to use FavePay – first, it rewards you for every single purchase you do, and second, it aggregates all your mobile wallets in a single app that you can use to make cashless purchases online and at stores.

Another advantage of FavePay is that it seamlessly works in Singapore, Malaysia and Indonesia. If you travel frequently between the all these neighboring countries for work or leisure, you can use a single app to make purchases everywhere you go.

With FavePay, you can earn up to 50% cashback on your spending at more than 10,000 shops, stores and restaurants across Singapore, Malaysia and Indonesia.

FavePay is a highly useful rewards app that comes with attractive rewards at thousands of merchants and shops.

Key benefits of using FavePay include:

- Go fully cashless and pay with FavePay everywhere where FavePay is accepted - more than 10,000 locations across Singapore, Malaysia and Indonesia.

- Earn up to 50% cashback for your purchases.

- Include your mobile wallets across Singapore, Malaysia and Indonesia in a single app, and make cashless purchases in all 3 countries.

- Simply scan the FavePay QR Code at thousands of participating locations and make purchases with your mobile phone.

- Enable Face ID or Passcode for enhanced mobile payments security.

- Additional services like FavePay Later, Fave Deals and Fave eCards available.

6. DBS NAV Planner

DBS NAV Planner5 is a one stop financial planning app created by DBS Bank, the largest bank in Singapore. DBS NAV Planner is an essential tool for anyone who wants to get a handle on their finances and grow their wealth.

The app creates a comprehensive overview of your finances by taking data from your DBS/POSB bank accounts and adding other assets and expenses (like CPF, property, investments, insurance and much more). The tool also assesses your financial habits over time to give you personalized tips for improvement.

DBS Nav Planner provides a comprehensive view of your finances by including banking, real estate, investments, insurance and much more in a single app.

Major advantages of DBS NAV Planner include:

- Track, safeguard and confidently increase your wealth in ways that match your personal needs.

- View the full picture of all your finances and investments in one app, even including those that are not handled by DBS Bank – add your income, cash, Central Depository (CDP) account under Singapore Exchange (SGX), CPF savings, property, insurance and investments, and much more.

- Advance your financial goals with advice and insights that are personalized for you.

- Receive customized investment recommendations based on your financial goals, risk tolerance and financial situation.

- Manage insurance policies with ease and get reminders for expiration dates and recommendations for the best coverage.

- Visibility into future projections towards your financial future and recommendations to meet your goals to financial freedom.

7. Hugosave

Hugosave6 is an innovative new way of saving money and helping you reach your financial goals. It is an easy to use platform that allows you to create customized savings plans tailored to your lifestyle and budget.

With Hugosave, you can set up recurring deposits into one or more of our high-yield savings accounts, giving you the power to save for what matters most to you.

The platform also makes it easy to track your financial progress and see how much money you have saved so far. You can even reward yourself with a virtual high-five when you reach certain milestones or stay on track with your plan.

Hugosave makes saving and investing money for your future easy, seamless and fun.

Whether you are saving for a big purchase or just want to start putting money away for the future, Hugosave gives you the power to save smarter and reach your financial goals faster.

Key benefits of using Hugosave include the below:

- Insights on your spending patterns and suggestions on how to reduce your overall spending with smart suggestions.

- Set up your financial goals and track your progress to see how close you are to achieving your goals.

- Automated savings growth by investing with roundup change, one-off deposits and schedules savings.

- Includes Platinum Visa Debit Card that can be used anywhere Visa is accepted for purchases.

- Account is fully safeguarded by DBS Bank, the largest bank in Singapore – this means your funds are always safe even if Hugosave were to become insolvent.

- Buy and sell gold as a commodity with Hugosave Gold Vault service.

Conclusion

Life is extremely fast paced in Singapore, and if you are an expat, you got to worry about much more in a foreign country like settling in, taxation, legal regulations and so on. Anything that can save you time saves you money as your time is your most precious asset.

Relying on the best of breed finance management and money apps will help you stay on top of your finances and save on purchases as well as international money transfers. And the best part is all these apps work on your phone, which means you can use them anytime, anywhere.

Take control of your finances and save money on purchases and remittances with these top 7 apps we have curated for you.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. Planner Bee

2. YouTrip

3. Wally

4. FavePay

5. DBS NAV Planner

6. Hugosave

Categories

Similar Articles

Tax Treatment On Sale Of Property By NRI In India

Are you a Non-Resident Indian (NRI) who needs to sell property in India? Discover the tax implications of property sale in India and ensure that you comply with all legal regulations.

The Ins And Outs Of International Mobile Money Transfers

Mobile money has become a popular way to send money overseas. From fees to security, we delve into the ins and outs of international mobile money transfers. Make the most of your mobile device to send money abroad.

Popular Mobile Wallets In Middle East And Africa

Mobile wallets have significantly improved financial inclusion for residents of Middle East and Africa. Learn about the most popular mobile wallets that people use in this region to participate in the new cashless economy.