The Best Advice You Can Hear about Sending Money to Vietnam from the UK

Table of Contents

- Do Your Research

- Consider Whether You Want Cheaper or Faster

- Know What Payment Methods Are Available to You

- Compare Various Delivery Methods Available to You

- Compare Foreign Exchange Rates

- Look Out for Deals and Promotions

- Conclusion

- Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

Sending money to loved ones in Vietnam doesn't have to be difficult. Here are some tips from expats who have done it before.

Whether you're sending money through a bank or an online service, these tips will help make the process smoother for both you and your recipient. Happy sending!

Do Your Research

There are a number of reasons why it is beneficial to do your research before sending money to Vietnam from the UK. Perhaps the most important reason is that you will be able to find the most competitive exchange rates available. By shopping around and comparing rates from different providers, you can be sure that you are getting the best possible deal on your money transfer.

Another benefit of doing your research is that you will be able to find a provider that offers the services you need. Some providers may offer better customer service or faster turnaround times than others, so it is important to compare your options before making a decision.

Finally, by doing your research ahead of time, you can avoid any potential problems or scams when sending money to Vietnam from the UK. There are a number of reputable providers out there, but there are also some less-than-reputable ones. By taking the time to research your options, you can be sure that you are using a provider that you can trust.

Thorough research on various money transfer companies will help you compare their pros and cons, and decide the best ones that fit your needs.

You can do all this research manually, of course, but that is cumbersome and time consuming. The easier and faster approach is to rely on a money transfer comparison engine like RemitFinder. We compare numerous remittance companies and present easy to digest results to you so you can evaluate their pros and cons.

This way, you can not only save money by choosing the best company that matches your needs, but also save your precious time by taking manually searching every company out of the way.

Plus, we are constantly adding new providers for various remittance corridors. So, whenever we add new remittance companies that support the UK to Vietnam market, you will see them right away.

Consider Whether You Want Cheaper or Faster

When you are looking to send money to Vietnam from the UK, it is important to consider both the rate of exchange and the speed of transfer. There are a number of ways to send money, and each has its own advantages and disadvantages.

Generally, if you want to rush money to Vietnam quickly, you may have to either pay higher than normal transfer fees, or accept a slightly inferior exchange rate.

For example, Remitly offers two transfer speeds called Economy and Express. With the Express option, your money will reach overseas within minutes, but you will get a lower exchange rate. Conversely, with the Economy option, you will get a better rate, but the money will reach your recipient in 3-5 business days.

As exemplified above, you can see how speed and price can be opposing forces that you may have to balance relative to each other.

Money transfer speed and price can sometimes be opposing forces. The faster the speed, the more costly the transfer, and vice-versa.

That said, sometimes you can get the best of both. For example, Panda Remit offers a highly competitive exchange rate when sending money to Vietnam from the UK, and most of their money transfers finish within 2 minutes.

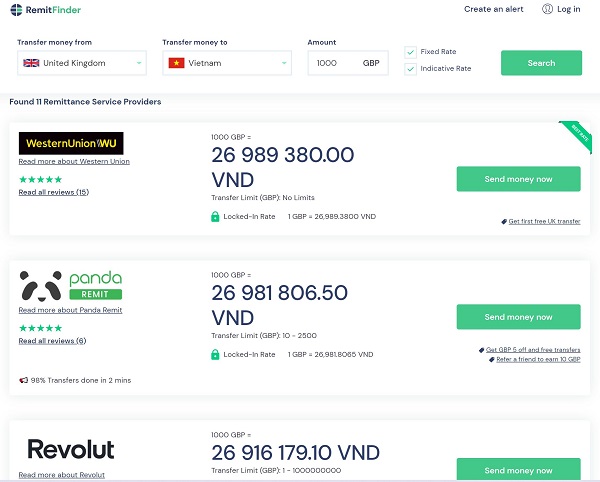

Below is a screenshot of various money transfer companies on RemitFinder for UK to Vietnam money transfers.

As you can see, you have almost a dozen good choices to pick from. You can compare these companies on various spectrums to decide which one is best for your needs.

Know What Payment Methods Are Available to You

There are quite a few things to take into account when sending money to Vietnam from the UK. One of the most important factors is choosing the right payment method. Depending on the amount of money you're sending, and how quickly you need it to arrive, different options will be better suited for your needs.

Bank transfers are usually the best option for larger sums of money as banks specialize in handling larger amounts for decades. Plus, they are convenient as you already deal with your bank all the time.

Paying for your money transfer with credit or debit cards is fast, but there may be fees involved. Especially in the case of credit cards, you may have to pay very high transfer fees. Additionally, your credit card company may treat paying for a money transfer as a cash advance, and you may be charged high cash advance fees. Be cautious and do your research before you use a card as a payment method.

Avoid credit cards to pay for your money transfer as you will get charged high fees. Bank transfers are usually the cheapest option.

Finally, some money transfer operators like Western Union may also accept cash. For this, you will have to go to their office or an agent location to pay for your transfer to Vietnam with cash.

Be sure to compare different options before making a decision, and always double check the transfer fees for your chosen payment method before sending any money.

Compare Various Delivery Methods Available to You

Similar to the discussion on payment methods above, you should also pay attention to the delivery method. A delivery method, also called a delivery option, is how you pay your overseas recipient in Vietnam.

Bank deposits are a time tested and reliable manner to send money directly to your recipient's Vietnamese bank account. But they can be slower as they are subject to bank holidays and processing times.

A popular option is mobile money or digital wallet credit. In this case, you can send money to a mobile wallet that your recipient has overseas. The biggest advantage of this method is that it is very fast. However, not all providers support each delivery method, so check with your money transfer company first if this is an option.

Finally, you can always choose cash pickup as your delivery option. In this case, your recipient will go to an agent location to pick up the funds. This is also a quick way to send money. Just ensure that your recipient follows safety guidelines as cash may be stolen or lost.

Bank deposit, mobile wallet credit and cash pickup are the most popular delivery methods prevalent in Vietnam.

Before you send money, carefully check the transfer fees that your provider charges for various delivery options, and based on your and your recipient's preferences, pick the best one.

Compare Foreign Exchange Rates

When sending money to Vietnam from the UK, it is important to compare foreign exchange rates to get the best deal possible. Currency exchange rate is the most important factor that influences the final payout, so make sure you are getting a competitive rate.

Once you have found a competitive rate, you should also consider the fees charged by the provider. Some providers will charge a flat fee, while others may charge a percentage of the total amount being transferred.

To automate searching for the best exchange rates, you can sign up for the RemitFinder daily exchange rate alert. It costs nothing, and you will receive useful information about the latest exchange rates pushed to you.

Look Out for Deals and Promotions

Many money transfer companies offer deals and promotions from time to time. These are a great way to further save on your cost of sending money, or increase the money that goes into your recipient's pocket.

For sending money to Vietnam from the UK, there are many money transfer companies that have very attractive offers and discounts in place that you can use.

For example, if you sign up with Revolut as a new customer in the UK, you get 3 months free Revolut Premium account membership. Revolut premium members have access to numerous Revolut products and services at discounted prices.

Similarly, if you send money with WorldRemit as a new customer, your first 3 transfers from the UK to Vietnam are totally free.

Deals and promotions offered by money transfer companies help you save more money on your overseas money transfer.

Check out our UK to Vietnam money transfer comparison page for all available promotions offered by various companies.

Conclusion

Sending money from the UK to Vietnam does not have to be hard. Follow our top tips for sending money to Vietnam from the UK, and take the hassle out of your money transfer process.

Hopefully, this has been helpful and you feel more confident in making a money transfer.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

Categories

Similar Articles

US Big Beautiful Bill's Impact On Remittances

The Big Beautiful Bill has been passed in the US, and remittances are impacted. Learn how the Bill impacts remittances and what to do if you are affected by the new law.

Bangladesh Remittance Cash Incentive: All You Need To Know

Are you an overseas Bangladeshi resident who sends money home to your loved ones? Read on to learn how to earn an additional 2.5% cash on your international remittances sent to Bangladesh.

How Fintech Is Pushing Banks Out Of The Remittance Business

The fintech revolution is disrupting the international remittance business. Discover how innovative startups are reshaping the international money transfer industry and challenging traditional banks.