Top 10 Countries with Highest Received Remittances During the COVID-19 Pandemic

Table of Contents

- Top 10 Receivers of Remittances by Total Amount in 2020

- Conclusion

As the fight against COVID-19 continues in countries worldwide, the recovery of economic activities and labor income remains uncertain. The impact of COVID-19 on remittances has been widely varied and profound. Foreign-born workers in low-paying and customer-facing jobs, many of whom are migrants, have taken the worst hit from the continuing spread of the virus.

Nevertheless, migrants have also played a critical role as economic first responders. Despite facing financial hardship, they have continued to remit funds to their countries of origin to assist loved ones and for other purposes. Worldwide, hundreds of millions of people benefit from these remittances.

Total global migrants' funds transfers for 2020 did fall, but it was better than was projected earlier. In April and May, there was a steep contraction after which a sluggish but partial recovery began. Some countries even received more money from their citizens in the diaspora than in previous years.

Remittances are a lifeline to families and economies alike in many countries. Despite the impact of COVID-19 pandemic on remittance inflows, most parts of the globe saw decent remittance volumes despite the global Coronavirus situation.

Let us now consider the highest recipients of remittance inflows in 2020.

Top 10 Receivers of Remittances by Total Amount in 2020

Mexico, Pakistan, and Bangladesh were unaffected by a decline in Q2 and even had positive growths in Q3. They are among the countries that got the highest amounts for financial flows from the diaspora for last year. Let us take a look at the top ten countries with the highest received-remittances in 2020.

India — the Highest Remittance Beneficiary

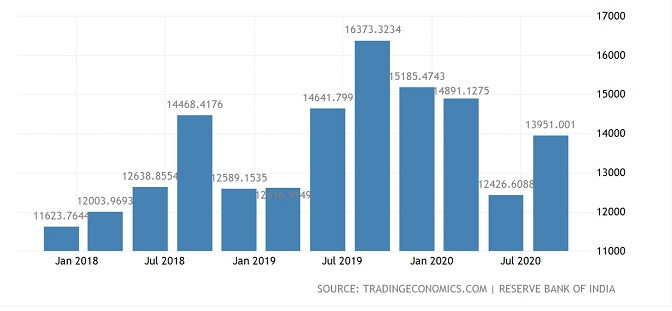

Due to its large diaspora and overseas expatriate population, remittances in India averaged US$10.364 billion within the 2010-2020 period. It reached a new quarterly record of approximately US$16.4 billion in Q3 of 2019. And the Reserve Bank of India said the country got US$ 27.4 billion inbound diaspora payments in the 1st half of 2020.

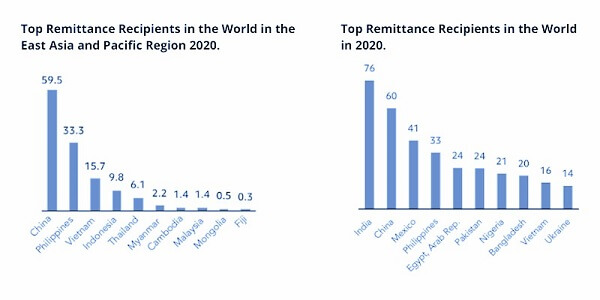

WorldBank estimates that in 2020 India received more than US$76 billion in financial flows from citizens abroad. That is an 8.76% fall compared to more than $83.3 billion received in 2019. Available data places the total sum at approximately US$41.3 billion by the end of Q3 2020.

What is the cost of sending money to India?

On average, the price of remitting $200 on the UAE-India corridor fell to 2.97% ($5.94) in the fourth quarter (Q4) of 2020. Of over 2.7 million Indians living in America, 80% send remittances home. On the US-India corridor, the average cost of remitting $200 rose from 3.15% in Q3 to 3.51% in Q4 of 2020.

China — 2nd Highest Remittance Recipient

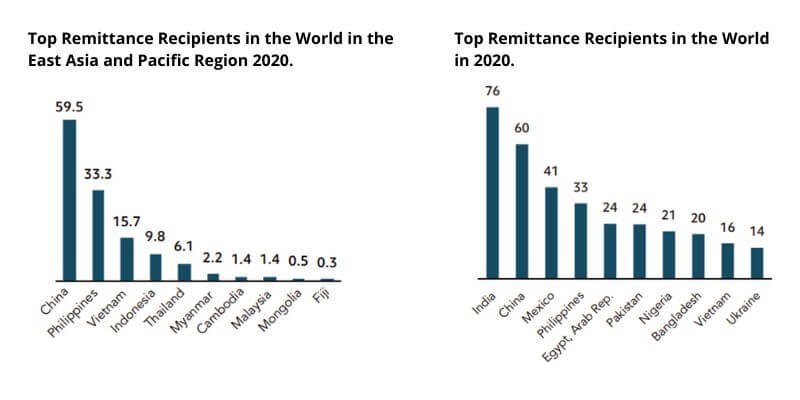

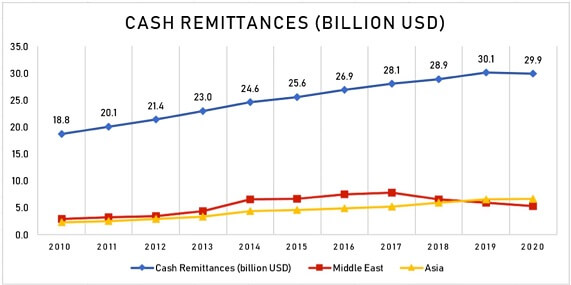

WorldBank estimates that China received around US$60 billion in 2020. That makes the country the highest beneficiary in the region of East Asia and the Pacific, and the 2nd highest globally. Additionally, it represents a 14.29% decrease from an estimated US$70 billion received in 2019.

China is 2nd in terms of the highest beneficiaries of workers funds transfer from the United States after Mexico.

What is the cost of sending money to China?

There was slight increase in the cost of sending money to China during the pandemic. For example, the price of paying US$200 increased from 5.07% in Q3 to 5.19% in Q4 2020 on the US-China corridor.

Mexico — 3rd Highest Receiver Recipient

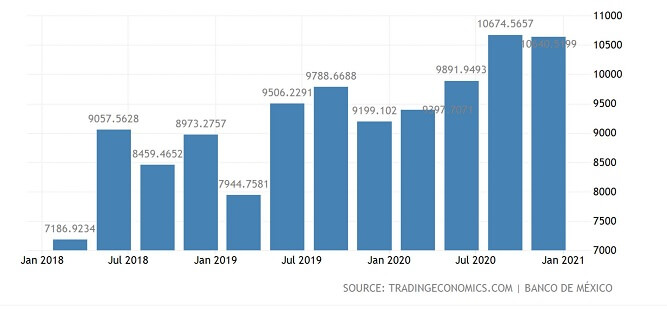

In 2020, Mexican diaspora workers sent a record US$40.606 billion home despite the global financial crisis triggered by coronavirus. The above inflow amounts represent an 11.44% increase from the US$36.438 billion in 2019.

Less than 1% of overseas workers payment inflows arrived in cash or kind, while over 77% arrived via non-banking institutions. Migrants abroad send US$3.266 billion on average between 1980 and 2020. Inflows reached an all-time high of US$10.675 billion in Q3 of 2020.

More than 98% of the total payment inflows in 2020 came from the US. That could be because at least 98% of Mexicans abroad live in the United States. Some of them work in sectors classified as essential, and many benefited from the U.S. government stimulus arrangements.

The country recorded a sharp rise in remittance flows in Q1 of 2020, and its highest remittance contraction of 2% happened in April 2020. Remittances fell to approximately US$10.6 billion in Q4 of 2020 from around US$10.7 billion in Q3 of 2020.

Among other things, the 25% fall of the Mexican peso against the USD and the switch to electronic transfer methods were possible motivations for the rise in inflows.

What is the cost of sending money to Mexico?

As for cost, customers paid 4.18% (or US$8.36) on average to send US$200 in Q3 2020 on the US-Mexico corridor. However, the price dropped to 3.87% in Q4 of 2020.

Philippines — 4th Highest Received Remittances

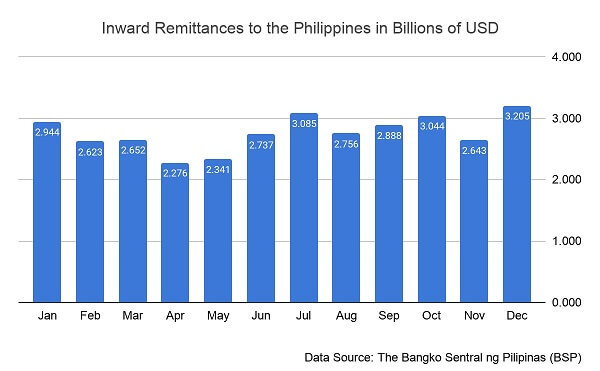

Compared to US$33.467 billion in 2019, Filipinos abroad sent US$33.194 billion home in 2020. That translates to a 0.82% fall despite an estimated 300,000 Overseas Filipinos (OFs) expected to return home for that year. In the end, the country's total remittance contraction for 2020 defied earlier bleak projections of 2% by experts.

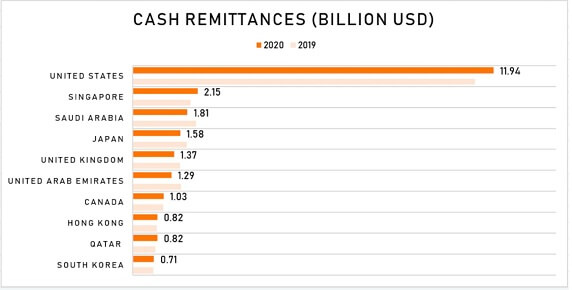

The United States, accounting for approximately 40% in 2020, remains the Philippines primary remittance-source country, followed by Singapore, Saudi Arabia, Japan, and the United Kingdom. Cash transfers from areas in the Middle East and Europe fell, while those from Singapore, Oman, Qatar, the US, Hong Kong and Taiwan increased.

What is the cost of sending money to the Philippines?

The cost of transferring $200 on the US-Philippines corridor rose from 3.64% (or $7.28) in Q3 to 3.83% (or $7.68) in Q4 2020. The Singapore-Philippines remittance corridor is among the cheapest worldwide, with rates falling as low as 2.15% (or $4.30) for sending $200.

Egypt — 5th Highest Remittance Recipient

Egyptian diaspora remitted US$3.3816 billion between 2002 and 2020. Inflows reached a quarterly record high of US$7.869 billion in Q1 2020. Based on WorldBank projections, Egypt, with over US$24.4 billion, received the sixth-largest amount of workers remittances in 2020. That translates to a 7.58% fall from the US$26.4 billion received in 2019.

However, available data suggest that Egypt remittance inflows may exceed projected values. Workers in the diaspora remitted US$ 14.1 billion in the first half of 2020. That amount represents a 7.5% increase from US$ 13.1 billion in the same period in 2019. Inflows rose again to US$ 8.0 billion in Q3 2020, posting a 19.6% year-on-year growth.

It costs around 3.12% or US$6.24 to send US$200 from Jordan to Egypt in Q4 2020.

Pakistan — 6th Largest Recipient of Remittances

Pakistani workers oversea have remitted an average of US$3.1959 billion each quarter between 2002 and 2020. Inflows hit a record high of US$7.147 billion in Q3 of 2020. And the total amount received in 2020 reached US$25.956 billion, exceeding the World Bank projection of US$24.1 billion. That represents a 16.92% increase from $22.2 billion received in the preceding year.

Pakistan registered a steep 36.5% remittance rise in July in comparison to the year before. Inflows from Gulf Cooperation Council (GCC) Countries, especially Saudi Arabia, rose in Q2 and Q3 of 2020, while inflows from the United States fell during the same period.

The rise in remittance flow may is attributable to factors like:

- More people patronizing official payment medium

- The "Haj effect" — where Pakistani abroad remitted monies reserved for Mecca pilgrimage

- The government using tax incentives to attract payment inflows and migrant's savings

What is the cost of sending money to Pakistan?

Pakistan has some of the lowest prices of remitting $200. It costs 2.59% from the United Kingdom, 2.9% from the UAE, 3.28% from Saudi Arabia, and 3.9 from Singapore in Q4 2020.

Nigeria — 7th Highest Received Remittance Flows

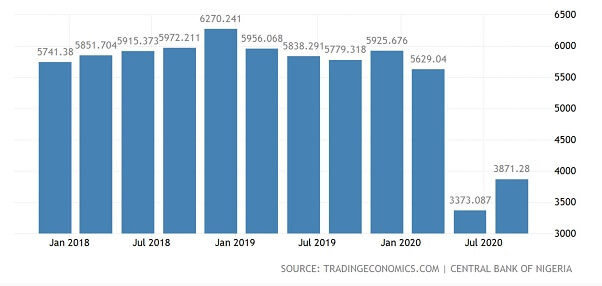

Nigerians abroad have sent a quarterly average of US$5.0986 billion from 2008 until 2020. Inward remittances fell to an all-time low of US$3.3731 billion in Q2 2020 after hitting a record high of US$6.270 billion in Q4 2018.

As per World Bank projections, Nigeria annual remittances were US$21.7 billion in 2020, down 8.82% from US$23.8 billion in 2019. Available data show that inflows rose to US$3.8713 billion in Q3 2020 from US$3.3731 billion in Q2 2020. And by the end of Q3 2020, Nigeria had received US$12.873 billion.

Bangladesh — 8th Largest Received Remittances

Monies sent home by its more than 10 million citizens in the diaspora are a critical stream of foreign exchange for the country. Bangladesh is one of the three nations that defied bleak economic predictions based on the pandemic.

The WorldBank in April predicted a 23% plunge in remittance inflows to Bangladesh in 2020 (to about $14 billion). Asian Development Bank (ADB) also projected that remittance flows to Bangladesh would be among the five worst-hits for developing Asian economies.

Even though remittances did dip between February and April, they recovered in May and continued in an upward path afterwards. The country recorded a massive 53.5% year-on-year (y-o-y) growth of inward remittances in Q3 2020. Then, inflows fell from US$2.0787 billion in November to US$2.0507 billion in December 2020.

And based on data from the Bangladesh Central Bank, more than $21.7 billion was remitted home by Bangladeshi abroad in 2020. That is an 18.4% increase from US$18.33 billion in the preceding year. The highest amounts of payments to Bangladesh are from Saudi Arabia and the UAE.

Probable drivers of the surge in remittance inflows include the following:

- More people began patronizing official remittance channels due to the 2% cash incentive on inflows. Also, restrictions on cross-country travels collapsed the hundi system - an illicit cross-border transaction network

- The massive flooding that engulfed a portion of its land in July

- The "Haj effect"

Vietnam — 9th Largest Received-Remittances

Monies that Vietnamese workers overseas send home are a critical income stream for many households. Around 80% of the over 5 million Vietnamese living and working outside the country are in developed countries. Despite the COVID-19-induced financial crisis, Vietnamese abroad still came through for their dependents during the peak of the pandemic.

The WorldBank estimates Vietnam total remittances for 2020 to exceed US$15.7 billion, a 5% fall from US$16.7 billion in the preceding year. That amount places the country as the 3rd highest beneficiary in the East Asia and Pacific area and 9th worldwide. Vietnam was also among the top recipients in 2018 and 2019, receiving 16 and 16.7 billion USD for each respective year.

Major source countries of Vietnam remittances last year include the United States, Australia and Canada. The cost of remitting US$200 to Vietnam was 4.71% from the United States, 4.74% from Canada, and 6.66% from Australia in Q4 2020.

A likely reason for the resilience of remittances to Vietnam may be more Vietnamese migrants investing at home. For example, by Oct 2020, Vietnamese overseas had investments in more than 360 FDI projects in Vietnam with a total of USD 1.6 billion in registered capital.

Ukraine — 10th Largest Received Remittance

According to WorldBank, Ukraine is the highest beneficiary in the Europe and Central Asia region, but the 10th globally. Ukrainians abroad have sent home US$2.0137 billion on average from 2008 to 2020. Inflows hit a quarterly record high of US$3.220 billion in Q4 2019.

The WorldBank estimates Ukraine inward remittances to exceed US$13.7 billion in 2020, which is a 13% fall from US$15.8 received the previous year. However, available data show that remittances fell to US$2.848 billion in Q2 from US$2.888 billion in Q1 of 2020. Ukrainians in the diaspora sent US$12.121 billion in total for last year.

Since 2016, Poland has replaced Russia as the main remittance source-country to Ukraine.

What is the cost of sending money to Ukraine?

In terms of cost, Ukraine has some of the cheapest and costliest payment corridors. Customers sending US$200 to Ukraine can pay as low as 1% when sending from Russia and as high as 9.1% from the Czech Republic.

Conclusion

Remittances are a valuable source of financing for many nations. They support households without any form of social protection in times of economic difficulty. They also share ideas and information that help to catalyze more extensive reforms in their countries of origin. However, remittances are yet to receive due attention from the appropriate authorities worldwide.

The monies foreign expats send home no doubt contribute to the positive transformation of their birth country's economy. However, migrants also better their host communities by fulfilling labor demand and making a positive net fiscal contribution. Therefore, migration is mutually beneficial for both origin and destination countries.

Furthermore, public authorities should treat payment service providers as essential services. Transfer services should be available at all times. Hence, there should be no regulatory and infrastructure barriers to their operations.

Categories

Similar Articles

US Big Beautiful Bill's Impact On Remittances

The Big Beautiful Bill has been passed in the US, and remittances are impacted. Learn how the Bill impacts remittances and what to do if you are affected by the new law.

Bangladesh Remittance Cash Incentive: All You Need To Know

Are you an overseas Bangladeshi resident who sends money home to your loved ones? Read on to learn how to earn an additional 2.5% cash on your international remittances sent to Bangladesh.

How Fintech Is Pushing Banks Out Of The Remittance Business

The fintech revolution is disrupting the international remittance business. Discover how innovative startups are reshaping the international money transfer industry and challenging traditional banks.