Send Money to India - Compare Money Transfer Remittance Services

Money Transfer to India - Various Remittance Options

In this blog post, we will discuss and compare money transfer operators that provide remittance options to send money to India.

Overseas Indians, also called Non Resident Indians (NRIs) constitute a major chunk of Indian diaspora overseas and make major contributions to host country economies by virtue of their contributions in various fields like Information Technology (IT), Academia, Medical Science, Banking & Finance and numerous other sectors. In addition to strong contributions to their host nation, NRIs also remit their hard earned money back home to India. Based on World Bank reports, below are some figures for remittances sent by NRIs to India.

1975 - USD 430 million

2000 - USD 12.88 billion

2014 - USD 70.39 billion

Source - World Bank Data on Remittances to India

These remittance make strong contributions to the Indian economy. Once again, we cite some numbers from the World Bank - remittances as percentage of GDP in India.

1975 - 0.4%

2000 - 2.7%

2014 - 3.4%

Source - World Bank Data on Remittances as percentage of GDP to India

For a large economy like India, even a 3.4% GDP share is a lot for overseas remittances.

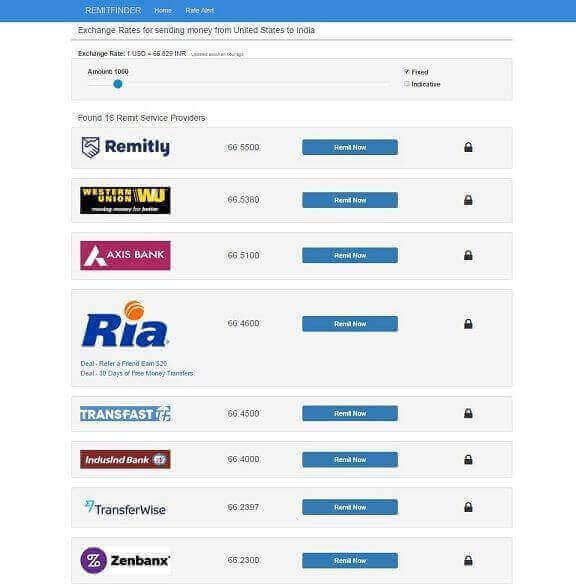

Consequently, the Indian remittance market is full of various global players who want to compete to get your business. For example, see below screenshot for a list of some of the money transfer operators we currently support on RemitFinder. Please note that this list was filtered for a transfer amount of USD 1000, and captures only the providers that provide a guaranteed or fixed exchange rate (a guaranteed or fixed exchange rate means that the rate you are quoted at transaction ordering time is the rate you will get when the transfer operation completes).

A striking observation from this graphic is the small difference in remittance exchange rates provided by these providers. As an example, the difference between the highest rate (1 USD == 66.5500 INR) and the lowest (1 USD == 66.0973 INR) is only 0.4527 INR. There are 8 or so money transfer companies within that minor spread of only 0.4527 INR! With all these banks and providers competing for your business and such small rate differences to choose from, how do you decide which company should you use to send money to India?

In this article, we will compare some of the top providers on various parameters to give you more insight into the choices you have for your money transfers to India. The various criteria we will compare these money transfer companies on will be:-

- Remittance Exchange Rate

- Fees

- Transfer Speed

- Payment Method

- Delivery Method

We chose some of the top money transfer operators that provide a fixed remittance exchange rate for your money transfers. Many other options exist but to keep the scope of this article manageable, we decided not to include companies that provide indicative rates (an indicative rate is a rate quote that you are shown at the time when you order your money transfer; the actual rate you get is determined at transaction clearing time).

Wise (formerly TransferWise)

Wise (formerly TransferWise) pioneered a peer to peer exchange network whereby they match the needs of people sending money back and forth between various countries. This helps Wise manage operating costs better and helps them move money globally faster. From start to finish, your transfer should be completed within 1-4 working days. Wise also offers a variety of payment and delivery methods for your international transfers. But you should be aware that it's not yet possible to pay in US Dollars by debit or credit card. The other noteworthy aspect about Wise is that after a small threshold, fees are a percentage of the amount you send. This may become a problem if you intend to transfer large amounts.

Below we summarize details about this provider for our chosen comparison criteria.

- Remittance Exchange Rate - Mid-Market Rate

- Fees - 0.9% above USD 300, USD 2.7 min

- Transfer Speed - 1-4 days

- Payment Methods - ACH, Wire Transfer

- Delivery Methods - Bank Deposit

- Transfer Limit - USD 3,000/day for ACH, USD 49,999/day for Wire Transfer

Remitly

Remitly has 2 transfer modes to choose from - Economy and Express. Choose Economy for transfers that can wait 3-5 Indian banking days and Express for the fastest transfers. Remitly also encourages you to use your debit card to ensure the fastest delivery to most major banks. Instant transfers are available to Axis Bank, HDFC Bank and more, and on an average, all other banks take up to 4 Indian banking hours. Sending money to India is Free when you send over USD 1,000. If you send below USD 1,000, there is a small USD 3.99 fee. Remitly follows a tiered model to control how much money you can transfer. You can request to be moved into higher tiers if you need to transfer more money. Remitly transfer tiers are captured in the table below.

| Tier Name | 24 Hour Limit | 30 Day Limit | 180 Day Limit |

|---|---|---|---|

| TIER 1 | USD 2,999 | USD 10,000 | USD 18,000 |

| TIER 2 | USD 6,000 | USD 20,000 | USD 36,000 |

| TIER 3 | USD 10,000 | USD 30,000 | USD 60,000 |

Below we summarize details about this provider for our chosen comparison criteria.

- Remittance Exchange Rate - Competitive

- Fees - USD 3.99 under USD 1000, free after, additional 3% charge for credit card transactions

- Transfer Speed - 3-5 days Economy, few hours Express

- Payment Methods - Debit card, Credit card, Bank Account

- Delivery Methods - Bank Deposit

- Transfer Limit - Tiered (see above)

WorldFirst

WorldFirst prides itself with an excellent customer service whereby a dedicated transfer agent gets assigned to every transfer account. So you will have someone to speak with and get assistance from at all times. WorldFirst also allows you to send any amount so can be a great option if you like to transfer large sums of money for scenarios like home or property purchase, etc.

Below we summarize details about this provider for our chosen comparison criteria.

- Remittance Exchange Rate - Competitive

- Fees - USD 10 under USD 10,000, free after

- Transfer Speed - 1-4 days

- Payment Methods - Bank Account, Debit Card

- Delivery Methods - Bank Deposit

- Transfer Limit - Any amount above USD 500

MoneyGram

MoneyGram is a global remittance provider and needs no introduction. One of the key differentiating factors is that you not only have online channel to transfer money, but also a bunch of physical transfer locations operated by MoneyGram agents worldwide. This means that you can walk into a location and pay for your remittance with cash; similarly your recipient or beneficiary can also walk into a MoneyGram agent location in their country and pick up money in cash. This could be a convenience option if you want to send money in minutes. Fees charged by MoneyGram vary depending upon the payment and delivery methods used; below table enumerates these.

| Payment Method | Delivery Method | Transfer Fee |

|---|---|---|

| Bank Account | Cash at Agent | USD 6 |

| Credit Card | Cash at Agent | USD 10 |

| Debit Card | Cash at Agent | USD 10 |

| Bank Account | Bank Deposit | USD 0 |

| Credit Card | Bank Deposit | USD 9.99 |

| Debit Card | Bank Deposit | USD 9.99 |

| Cash at Agent | Cash at Agent | USD 13 |

| Cash at Agent | Bank Deposit | USD 0 |

Below we summarize details about this provider for our chosen comparison criteria.

- Remittance Exchange Rate - Competitive

- Fees - Depends on payment and delivery methods (see above)

- Transfer Speed - Bank account upto 1 day, minutes for Cash Pickup

- Payment Methods - Cash at Agent, Bank Account, Debit Card, Credit Card

- Delivery Methods - Cash Pickup at Agent, Bank Deposit

- Transfer Limit - USD 2,999.00 per online transfer, additional funds from a MoneyGram agent location

TransFast

TransFast provides 2 products you can choose from - Value+ and FastTrack. Both vary in regards to the remittance exchange rate you get, the fee you pay and the time it takes to complete the transfer. We detail the differences in both of these options in the table below.

| Product | Exchange Rate | Transfer Fee | Transfer Speed |

|---|---|---|---|

| Value+ | Higher | Zero | 3 Days |

| FastTrack | High | Starting USD 4.99 | Upto 24 hours |

A key differentiator for TransFast is that you have access to a variety of delivery methods that include Bank Deposit, Cash Pick Up (300,000 global pay points), Home Delivery (limited locations), Cash Card Deposit and Bill Payment - many of these are limited based on location so please ensure you find out which option is available where.

Below we summarize details about this provider for our chosen comparison criteria.

- Remittance Exchange Rate - Competitive

- Fees - USD 0-4.99

- Transfer Speed - 1-3 days

- Payment Methods - Bank Account, Debit Card, Credit Card

- Delivery Methods - Bank Deposit, Cash Pick Up (300,000 global pay points), Home Delivery (limited locations), Cash Card Deposit, Bill Payment

- Transfer Limit - USD 10,000 per month

Ria Money Transfer

Ria Money Transfer is a fast and reliable money transfer operator that operates out of the US and sends money to various countries, including India. One of the best things about Ria Money Transfer is a 0 transfer fee if your payment method is a Bank Account. Ria Money Transfer also specializes in smaller transfer amounts of upto USD 2999.99. Given the 0 transfer fee for Bank Account funded payments, Ria Money Transfer could be a good choice if your need is to send smaller amounts of money frequently.

Below we summarize details about this provider for our chosen comparison criteria.

- Remittance Exchange Rate - Competitive

- Fees - Bank - USD 0, Credit Card - USD 30, Debit Card - USD 6

- Transfer Speed - Upto 4 days

- Payment Methods - Bank Account, Debit Card, Credit Card

- Delivery Methods - Bank Deposit

- Transfer Limit - USD 2999.99 per day, and USD 7,999 per 30 days.

Indus Fast Remit by IndusInd Bank

Indus Fast Remit, an IndusInd Bank service, is a fast, simple, and secure way to send money from US, UK or Canada to recipients in India. One of the best things about IndusInd Bank is that there is 0 transfer fee with the flexibility to send upto USD 30,000 per month (with a USD 10,000 limit per transfer). In this way, IndusInd Bank provides the best of both worlds - no fee with the option to send higher amounts. Other key features of Indus Fast Remit include - secure and easy international money transfer, free transfer to any bank in India, attractive exchange rates, online tracking facility, reminders for future transactions (in US), beneficiary address book, free mobile alerts to beneficiary on the status of money transfer and local helpline number in the US and UK (toll free) for all money transfer queries.

Below we summarize details about this provider for our chosen comparison criteria.

- Remittance Exchange Rate - Competitive

- Fees - USD 0

- Transfer Speed - 5-7 days

- Payment Methods - Bank Account

- Delivery Methods - Bank Deposit, Cheque to a beneficiary

- Transfer Limit - USD 10,000 per transfer, and USD 30,000 per month

Western Union

Western Union is one of the global leaders in money transfers and does not need much introduction. Western Union allows online money transfers of upto USD 3000, and has a Western Union online foreign exchange service called Online FX to send amounts larger than USD 3,000 to your friends and family abroad. Western Union offers numerous payment and delivery method options to customers, including Cash Pickup at an Agent location. This may be a convenient approach if you need to transfer money to your recipient within minutes, especially given the huge agent network that Western Union has all across the globe.

Please see below table for transfer fees and transfer times for various payment and delivery methods offered by Western Union.

| Payment Method | Delivery Method | Transfer Fee | Transfer Speed |

|---|---|---|---|

| Bank Account | Bank Deposit | Zero | 3-4 Days |

| Debit Card | Bank Deposit | Zero | 0-1 days |

| Credit Card | Bank Deposit | Zero | 0-1 days |

| Bank Account | Cash at Agent | USD 6 | 4 days |

| Debit Card | Cash at Agent | USD 10 | Minutes |

| Credit Card | Cash at Agent | USD 10 | Minutes |

| WU Pay | Cash at Agent | USD 6 | 3 days |

Below we summarize details about this provider for our chosen comparison criteria.

- Remittance Exchange Rate - Competitive

- Fees - Various (see above)

- Transfer Speed - Various (see above)

- Payment Methods - Bank Account, Debit Card, Credit Card, WU Pay

- Delivery Methods -Bank Deposit, Cash at Agent

- Transfer Limit - USD 2,999 online, USD 10,000 Online FX, no limit at Agent Location (subject to country limits)

WorldRemit

WorldRemit offers a low fee transfer with various payment and delivery options, including a Mobile Recharge facility. This may be really handy if you want to quickly recharge mobile balances for your loved ones back home. The transfer limit with WorldRemit is USD 2000 so may not be a great option if you need to send large sums of money home.

Below we summarize details about this provider for our chosen comparison criteria.

- Remittance Exchange Rate - Competitive

- Fees - USD 3.99

- Transfer Speed - Bank Deposit - 1-2 days, Cash at Agent - Instant, Mobile Recharge - Instant

- Payment Methods - Debit Card, Credit Card, Bank Account

- Delivery Methods - Bank Deposit, Cash at Agent, Airtime with Mobile Recharge

- Transfer Limit - USD 2000

Below, we summarize all the above information in an easy to compare table format. Hopefully this should help you as a easy comparison reference guide to compare these top money transfer operators.

| Money Transfer Operator | Remittance Exchange Rate | Fees | Transfer Speed | Payment Methods | Delivery Methods | Transfer Limit |

|---|---|---|---|---|---|---|

| Wise (formerly TransferWise) | Mid-Market Rate | 0.9% above USD 300, USD 2.7 min | 1-4 days | ACH, Wire Transfer | Bank Deposit | USD 3,000/day for ACH, USD 49,999/day for Wire Transfer |

| Remitly | Competitive | USD 3.99 under USD 1000, free after, additional 3% charge for credit card | 3-5 days Economy, few hours Express | Debit card, Credit card, Bank Account | Bank Deposit | Tiered (see above) |

| WorldFirst | Competitive | USD 10 under USD 10,000, free after | 1-4 days | Bank Account, Debit Card | Bank Deposit | Any amount above USD 500 |

| MoneyGram | Competitive | Depends on payment and delivery methods (see above) | Bank account upto 1 day, minutes for Cash Pickup | Cash at Agent, Bank Account, Debit card, Credit Card | Cash Pickup at Agent, Bank Deposit | USD 2,999.00 per online transfer, additional funds from a MoneyGram agent location |

| TransFast | Competitive | USD 0-4.99 | 1-3 days | Bank Account, Debit Card, Credit Card | Bank Deposit, Cash Pick Up, Home Delivery (limited), Cash Card Deposit, Bill Payment | USD 10,000 per month |

| Ria Money Transfer | Competitive | Bank - USD 0, Credit Card - USD 30, Debit Card - USD 6 | Upto 4 days | Bank Account, Debit Card, Credit Card | Bank Deposit | USD 2999.99 per day, and USD 7,999 per 30 days |

| IndusInd Bank | Competitive | USD 0 | 5-7 days | Bank Account | Bank Deposit, Cheque to a beneficiary | USD 10,000 per transfer, and USD 30,000 per month |

| Western Union | Competitive | Various (see above) | Various (see above) | Bank Account, Debit Card, Credit Card, WU Pay | Bank Deposit, Cash at Agent | USD 2,999 online, USD 10,000 Online FX, no limit at Agent Location (subject to country limits) |

| WorldRemit | Competitive | USD 3.99 | Bank Deposit - 1-2 days, Cash at Agent - Instant, Mobile Recharge - Instant | Debit Card, Credit Card, Bank Account | Bank Deposit, Cash at Agent, Airtime with Mobile Recharge | USD 2000 |

So, which provider should you use?

The answer is, it depends. As you can see above, there are numerous differences in the operations of all the above money transfer operators. Depending on your needs - whether you are sending small amounts frequently or need to send a large amount for a property purchase, investment, etc, or how much rate/fee balance is right for you, or how urgently you need to send money home - you have plenty of options to choose from. Use the above comparison table as a quick guideline to help you reach the right decision.

We hope you enjoyed reading this post, and happy Sending Money to India!

Categories

Similar Articles

US Big Beautiful Bill's Impact On Remittances

The Big Beautiful Bill has been passed in the US, and remittances are impacted. Learn how the Bill impacts remittances and what to do if you are affected by the new law.

Bangladesh Remittance Cash Incentive: All You Need To Know

Are you an overseas Bangladeshi resident who sends money home to your loved ones? Read on to learn how to earn an additional 2.5% cash on your international remittances sent to Bangladesh.

How Fintech Is Pushing Banks Out Of The Remittance Business

The fintech revolution is disrupting the international remittance business. Discover how innovative startups are reshaping the international money transfer industry and challenging traditional banks.