The Expert's Guide to Sending Money to France (on the Cheap!)

Table of Contents

- A Guide to the Cheapest Methods of Sending Money to France

- Keep These Things in Mind When Sending Money to France

- Money Transfer Service Options to Send Money to France

- The Most Effective Method of Sending Money to France

- Recommendations for Each Country

- Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

When it comes to sending money to France, there are a lot of options to choose from. You can use a bank, an online payment service, or even a currency exchange service. But which one is the best option for you? And how can you do it on the cheap?

In this article, we will explore all your options and help you find the best way to send money to France!

A Guide to the Cheapest Methods of Sending Money to France

Whether you're an ex-pat living in France or just need to send money there for business purposes, it's important to know how to do so without spending a fortune in fees. The good news is that there are plenty of ways to send money to France cheaply; you just have to know where to look.

Here are the expert-approved methods for sending money to France on the cheap:

Use a foreign exchange specialist

Companies such as OFX and World First specialize in helping people send money overseas. They often offer better exchange rates and lower fees than banks, which can save you a lot of money.

Send cash via post

If you need to send a small amount of cash (less than EUR 100), you can do so by sending it via post. This is a relatively cheap and easy way to do it, although it's not the most secure option.

Use a peer-to-peer payments service

Services such as Wise and CurrencyFair use the latest technology to help you send money overseas quickly and cheaply. They work by matching people who need to send money with those who need to receive it, which means that there are no middlemen (and, thus, lower fees and faster transfers).

Keep These Things in Mind When Sending Money to France

There are four important factors to consider when making an international money transfer to France:

- Transfer fees

- Exchange rates

- Transfer speed

- Security

In the below sections, we will detail all of these so you know how these factors play an important role in executing your money transfer to France in the best possible fashion.

Transfer Fees

When sending money to France, you'll almost certainly have to pay one of three sorts of charges:

- Fixed fee

- Percentage fee

- Combination fee

Read on to understand what these fees are all about.

Fixed Fees

When it comes to sending money to France, one of the best ways to keep your costs down is to choose a provider that charges fixed fees. This way, you'll know exactly how much you're going to pay for your transaction and there won't be any nasty surprises.

Percentage Fees

A percentage fee, as the name suggests, is calculated as a percent of the transfer amount. This may seem scary at first, especially if you are sending a large amount as the percent fee will quickly stack up. But the good news is that most money transfer companies that charge a percent fee have a staggered percentage which decreases as the transfer amount increases. That helps keep the overall fee low.

Combination Fees

The total amount you'll encounter when transferring money to France is the combination fee, which is a mix of a flat fee and a percentage fee. PayPal charges fees for international money transfers made through this method.

There are fixed, percentage or combination fees at play when sending money overseas to France.

Remember that price structures don't always imply that one service is more reasonable or more expensive than another. To get an idea of how much you'll be charged, simply ask your bank or transfer provider for a quote. They should be able to give you an estimate of how much it will cost to send money to France.

The good news is that, as the sender, you will almost always get a much better deal than the recipient. The reason for this is that banks and transfer providers want your business, so they offer very competitive rates to encourage you to use their service.

Exchange Rates

The exchange rate you get for your money transfer to France is one of the biggest factors that will have a major influence on how much money your recipient gets. The good news is that money transfer companies are competing fiercely to win your business. This means that you will generally get very good exchange rates when you send money to France.

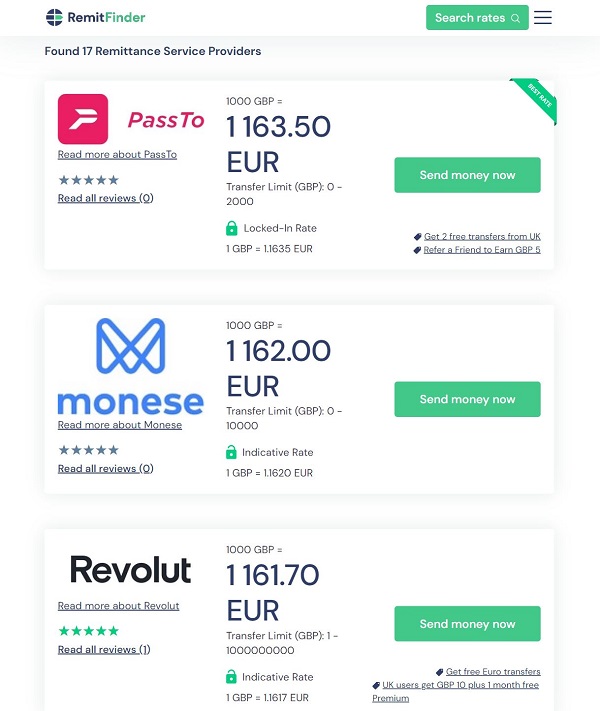

For example, the below image shows the exchange rates from various providers for sending GBP 1000 from UK to France.

Notice how the top 3 providers differ only by a Euro each for the above money transfer scenario!

Money transfer companies compete with each other to win your business; you have many options to send money to France.

To get the best exchange rates, use a money transfer comparison platform like RemitFinder to easily search and compare numerous providers. This way, you can see who provides a better deal and go with them.

Transfer Speed

Another thing you need to take into account is how fast you need the money to arrive in France. The good news is that most international money transfer services can get your money there within a few minutes up to a couple of days. The bad news is that sometimes this speed usually comes at a cost, with some providers charging extra for express service.

Security

Transferring money internationally can be risky. The last thing you want is for your hard-earned cash to disappear into the wrong hands. When sending money to France, make sure you use a reputable and reliable service.

All the solutions for international money transfers listed below are safe and secure. Some of the security features they employ include:

- Data encryption

- Anti-money-laundering (AML) surveillance

- Know your customer (KYC) compliance

- Internet security protocols

- Advanced, real-time warnings for fraud detection and prevention

Make sure to always keep an eye on security so both your money and information are safe with the money transfer company you choose.

Money Transfer Service Options to Send Money to France

There are a variety of options when it comes to sending money from abroad to your French bank account. Let's take a look at each of them, starting with the lowest and working our way up to the most expensive, from internet service providers to traditional banks.

Wise

Expats in France prefer Wise because of their mid-market exchange rates, so let's check how much it costs to deposit USD 1,000 to a French bank account. For sending USD 1,000 to France, Wise will charge you a set price of USD 6.40* fee and provide a 0.9495 EUR exchange rate resulting in a EUR 943.40* payout on the receiving end.

*Exchange Rates and Fees as on June 20, 2022

Wise's percentage fee charge reduces as the size of the transfer increases, eventually lowering to 0.26% for transfers exceeding $1 million. Second, the quantity of fees you pay is determined by the payment method you select:

- Wire transfer

- Debit card

- Credit card

Furthermore, unless you transfer funds after banking hours or on weekends, Wise guarantees that you will receive your funds within hours. Whether you have an Android or iOS app, you can use Wise on your smartphone or PC.

Revolut

Revolut is the perfect solution for anyone looking to send money to France on the cheap. With Revolut, you can transfer money online quickly, easily, and at a low cost. If you're looking for an easy and affordable way to send money to France, look no further than Revolut! It offers a fast and simple online money transfer service that lets you send money to France at a low cost. Plus, with its user-friendly platform, you can make your international money transfer in just a few clicks!

Panda Remit

After Wise and Revolut, Panda Remit is the next cheapest option for sending money to France. At the time of this writing, . Panda Remit is offering free transfers to RemitFinder users – this helps you save even more and maximize your payout in France. One more advantage of Panda Remit is transfer speed. In France, you might have your money in as fast as 2 minutes.

CurrencyFair

CurrencyFair is another great option to send money to France as its way cheaper than banks, and delivers quick transfers.

Furthermore, CurrencyFair provides first 3 transfers for free so you can save some more of your hard earned money. Any money saved on fees only means that your recipient gets more funds in their bank account in France.

Bank Transfers

For transfers up to USD 10,000, avoid banks and instead use Wise or Revolut, which will save you money. Banks, on the other hand, are frequently the best option for larger transactions because they offer fixed fees rather than percentage fees. For expats in France who wish to buy a car, a house, or start a business, banks are the favored method of significant money transfers. Citibank is the cheapest bank in the United States for international money transfers. On all transfers, they impose a flat cost.

Cryptocurrencies

Cryptocurrencies are another way to transfer money overseas to France in a digital format. You can transact online, and then even withdraw crypto at a physical location. There are only five Bitcoin ATMs in France, so you must withdraw your digital assets for cash in Lyon, Mulhouse, or Paris. However, Bitcoin machine operators could charge up to 50% more than regular Bitcoin machine fees, particularly in Paris.

Withdrawals from ATMs

Expats will not be charged withdrawal fees by French banks; however, privately owned ATMs such as Retrait and others charge high costs and should be avoided. The lack of recognizable bank branding will draw your attention to these devices.

Surprisingly, French banks compute Euro withdrawals using the mid-market rate, ensuring that you receive a reasonable amount of money. Keep in mind that your home bank will charge a range of fees on your transactions.

There are many great options to send money to France; compare and pick the best one for your transfer needs.

The Most Effective Method of Sending Money to France

Now that you know which international money transfer service choices are available, you can easily check all the amounts you'd obtain when transferring USD 1,000 or USD 10,000 into Euros from overseas.

Revolut is the cheapest option to send money to France, with the highest Euro yield. Last but not least, bank transfers will provide the smallest amount of Euros to your French bank account.

Below, we provide from country specific recommendations for sending money to France from overseas.

Recommendations for Each Country

United States

When it comes to online payments, Revolut is the most cost-effective option. Whether you're sending USD 1,000 or USD 10,000 or even more, it'll provide you with the most Euros on your French account. There are also no upper limits so even if you need to send a large amount to France, you are not forced to use expensive bank transfers.

United Kingdom

If you have a bank account in the UK, your cheapest bet is to sign up for a PassTo account, link it to your UK bank, and transfer money that way. You'd get EUR 1,165.20^ on the receiving end of a GBP 1,000 transfer, and you'd be able to use PassTo's no-fee transfers for your first 2 money transfers.

^Exchange Rates and Fees as on June 20, 2022

Canada

Xendpay is a great choice for Canadian expats in France. A CAD 1,000 transfer through Xendpay would yield EUR 734.50^^, just over Wise's amount of EUR 729.30^^. As for bank transfers, Scotiabank would be your cheapest choice; it charges CAD 19^^ for international money transfers to France.

^^Exchange Rates and Fees as on June 20, 2022

Other Countries

Below are some helpful links to get you started with sending money to France online from some other popular source countries:

- Send money to France from Germany

- Send money to France from Italy

- Send money to France from Spain

- Send money to France from Australia

- Send money to France from Singapore

Various sending countries have different providers whose services are better than others. Make sure to do research in your country of residence to find best options.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

Categories

Similar Articles

US Big Beautiful Bill's Impact On Remittances

The Big Beautiful Bill has been passed in the US, and remittances are impacted. Learn how the Bill impacts remittances and what to do if you are affected by the new law.

Bangladesh Remittance Cash Incentive: All You Need To Know

Are you an overseas Bangladeshi resident who sends money home to your loved ones? Read on to learn how to earn an additional 2.5% cash on your international remittances sent to Bangladesh.

How Fintech Is Pushing Banks Out Of The Remittance Business

The fintech revolution is disrupting the international remittance business. Discover how innovative startups are reshaping the international money transfer industry and challenging traditional banks.