6 Tips to Maximize Your Money Transfers to Mexico

Table of Contents

- What should you focus on when Sending Money to Mexico from the US?

- Tip #1: Determine your needs

- Tip #2: Evaluate the risk

- Tip #3: Calculate the cost

- Tip #4: Pay attention to convenience and ease of use

- Tip #5: Don't forget customer service

- Tip #6: Watch out for deals and promotions

- Conclusion

- Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

With the advancements in technology over the last few years, the world is smaller than ever as money and cargo move at speeds once unimaginable. Just like with physical roads and infrastructures, we have built virtual channels for money to travel around the world.

Since abandoning the gold standard, governments and large banks have promoted themselves as the only reliable party to entrust your money. However, their monopoly over financial legitimacy takes away their incentive to improve services. Therefore, when you send money abroad via your bank, you are looking at long waits, difficult procedures, and high transaction fees.

In this article, we will touch upon why you should abandon your bank to send money to Mexico, and switch over to new fintech companies like Panda Remit.

What should you focus on when Sending Money to Mexico from the US?

Banks are definitely an option to send money from the US to Mexico, but they usually charge high fees and provide a lower exchange rate. This eats into your bottom line, and as a result, your recipient in Mexico will get lesser Pesos for each Dollar you send to them.

If you have been using your bank for international money transfers to Mexico, it may just be time to ditch them and try some new ways to send money abroad. When everyone is taking a plane from the US to Mexico, why would you still try to ride a horse there? 😊

Banks tend to charge high fees and provider lower exchange rates for money transfers to Mexico from the US.

Below is some practical advice that we have for your consideration if you want to maximize your money transfers to Mexico:

Tip #1: Determine your needs

In order to maximize your money's utility, it is important to choose your remittance service wisely. Thanks to market competition and the advancement of modern technology, there are tons of remittance services now to provide an alternative to traditional banks.

You also have access to various deals from money transfer companies depending on the transfer amount, countries involved and other factors. Researching online to find the best money transfer service for your needs is a crucial first step to make the most of your money.

What are the qualities that matter the most to you in a remittance service provider?

If familiarity is the priority, then traditional banks with physical buildings could be a potential choice. Most banks such as BBVA Bancomer, Santander Mexico, and Banamex usually add a markup of around 5% on top of their exchange rates. On top of that, you generally pay high transaction fees. Inferior exchange rates and additional transfer fees could eventually end up costing up to a whopping 20% of the total value of your transfer amount!

You may end up paying up to 20% of your transfer amount with some bank transfers. Fees, bad exchange rates and additional charges could be involved.

If you are trying to truly maximize your remittance experience, online remittance companies such as Panda Remit, XE and Revolut offer more competitive rates and deals that would fit your needs.

Panda Remit, for example, lets you send money to Mexico with 0 transaction fee for any legitimate transaction from the US. There are also additional savings available to you via Panda Remit's deals and promotions – all this makes it stand out as one of the best choices among all the other remittance services available to you.

Tip #2: Evaluate the risk

You may be trying to make your first transaction with an online remittance service and be totally excited about their great offer, but it is crucial to first check their financial background and customer reviews. You want to make sure you watch out for any frequent issues customers report, such as frozen accounts, lost funds, or not being responsive.

Once you have done your due diligence, a good way to start with a new remittance service is by trying it out with a small amount of money at first. This is a very smart idea whereby you can experience the service first hand, but without committing a lot of money. Millions of online reviews cannot be compared to your 1-minute personal experience with a company.

We recommend sending a very small amount with a new money transfer company that you are using for the first time. This will minimize risk while letting you develop firsthand experience.

All said, there are a lot of things to look out for when you investigate if a money transfer company is safe or not. Below, we provide some things to check by taking the example of Panda Remit, a modern fintech startup that is rapidly growing to cater to the global remittance industry.

Here are some ways that Panda Remit ensures the safety of your funds and information:

- Panda Remit relies on Visa/Mastercard 3DSecure to verify customer identity before authorizing the transfer, thus making sure the transaction is legitimate.

- Panda Remit provides a 100% refund guarantee in case the remittance fails to be delivered. Their Symantec SSL Certificate provides a security guarantee of up to USD 1.5 million.

- Panda Remit is Licensed and regulated by over 30 Financial Institutions all over the world, ensuring that your money is handled with care and responsibility.

- All of Panda Remit's cross-border remittance flows are reviewed and regulated by King & Wood Mallesons to ensure they are fully legal and compliant with all rules and regulations.

Thanks to providing a safe and secure environment for customers, in 2021 alone, Panda Remit finished 900,000 remittance transactions successfully with great reviews on the app stores. This fast growth made has the company one of the best online remittance services in the world.

From this section and our analysis so far, you can probably get a pretty good idea of the level of research you need to do before committing to a remittance company. Such research will help you to ensure that your money is handled by a company with a strong financial background.

It takes a lot of time and research to evaluate and compare money transfer companies.

You could do this research manually, provider by provider, and it will certainly work. But a far more efficient way to accomplish this goal is to rely on a remittance comparison platform like RemitFinder. We do the hard work of comparing numerous money transfer companies spanning more than 35,000 global remittance corridors. This way, you save time and money by consuming the results of our comparison software in a single, easy to understand view.

Tip #3: Calculate the cost

What matters most in the international remittance process is how much of the money eventually reaches your overseas recipient. In other words, how much did money transfer company you use charged you and what was your cost?

If you send money through banks, you will likely be charged outgoing fees, flat fees, currency exchange rate markup, and additional incoming transfer fees. That's a lot! So, make sure that you know how much banks will charge you for sending money with them.

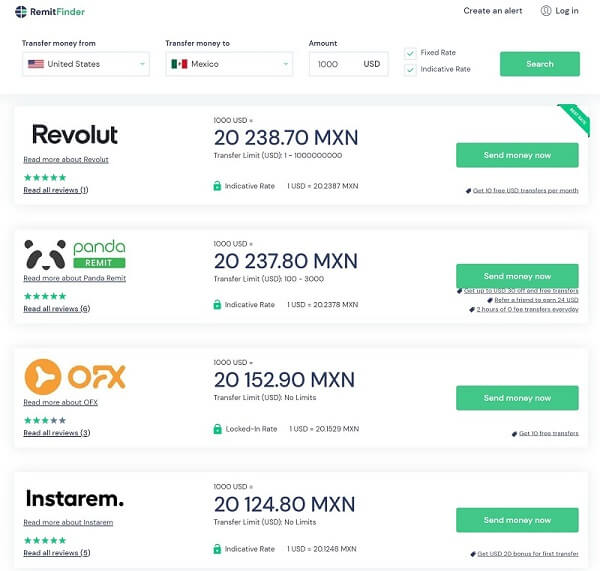

A sure shot way to save money on your transfers is to look up the real-time exchange rate and compare the offerings from various remittance service providers. Such a comparison will tell you from which service you can get the best deal. For example, you can check RemitFinder's page to check the best exchange rates to send money from USA to Mexico.

If you look at the above screenshot from the RemitFinder website from August 09, 2022, you will notice that Panda Remit was offering 20,237.80 MXN for sending 1000 Dollars, one of the best offers out of 10+ services with an exchange rate of 20.2378. At the same time, the mid-market exchange rate for sending 1 USD to Mexico was 20.2890.

Always compare exchange rates from various money transfer companies to see who is giving the best prices.

Using these numbers, we can easily calculate the FX Markup charged by some of the above service providers. To calculate the FX Markup, we take the difference in the exchange rate provided by a company and the mid-market exchange rate, and divide the difference by the mid-market exchange rate.

Below are the FX Markup calculations* for the top 4 providers for sending money from USA to Mexico:

- Revolut: 20.2890 - 20.2387 = 0.0503/20.2890 = ~0.24% FX Markup

- Panda Remit: 20.2890 - 20.2378 = 0.0512/20.2890 = ~0.25% FX Markup

- OFX: 20.2890 - 20.1529 = 0.1361/20.2890 = ~0.67% FX Markup

- Instarem: 20.2890 - 20.1248 = 0.1642/20.2890 = ~0.81% FX Markup

*Exchange rates as on August 09, 2022

*Mid-Market Rate from XE.com

See how we calculate FX Markup

Clearly, Panda Remit is one of the topmost choices here! Both with Panda Remit and Revolut, you pay the minimum FX Markup; this only means that your recipient in Mexico gets more money in their pocket for the same transfer amount you send.

FX Markup is a great way to compare exchange rates and fees from various money transfer companies.

In addition to offering the best rate to their customers, Panda Remit has the technology to track exchange rates in real-time. They are also a customer-oriented remittance service that helps you maximize your money transfer payout. Using Panda Remit instead of Instarem, for example, will save you around 113 MXN, around 2 McDonald's Big Macs in Mexico. As simple as that. Which one would you choose to give the Big Macs to? Your hungry nieces who just got out of school or to financial institutions?

If you have been using banks to send money to Mexico, apply the above simple formula and calculation to their exchange rates, and find out how much more you have been paying them. More of your hard earned money could have gone to your loved ones in Mexico by using a cost-effective service like Panda Remit instead of using banks.

Tip #4: Pay attention to convenience and ease of use

Life is busy, and we all have enough on our plates already. Given that, you do not need another thing to worry about when it comes to choosing the right company to send money internationally with.

Panda Remit's app is available on both the Google Play Store for Android users as well as the Apple App Store for iOS users. Using the mobile app, you can easily achieve international money transfers through your fingertips and track your money in real-time. The Panda Remit app is very user-friendly and straightforward; in case you need help, there are a bunch of videos on YouTube that explain how to use it.

Do not ignore the ease of use of the money transfer service provided by the company you choose.

To send money with the Panda Remit app, all you need to do is fill in all of your information and select the currency you want to send. The app will immediately tell you the rate you will be getting as compared to the mid-market rate. The app also provide a dashboard to track your money after sending it, so you do not need to worry about the ongoing status and progress of the whole money transfer process.

Tip #5: Don't forget customer service

After doing all the research and homework to find the best online remittance service, you would ideally want to stick with your chosen money transfer company. If you can download and use one app, and have it as your designated service while knowing that you can always get the best deal and exchange rate, it will save so much of your precious time and consideration.

Panda Remit is a quality conscious remittance company that consistently offers some of the best rates in the markets they operate in. Over the last few years, Panda Remit has also grown the overall coverage and quality of their customer service.

Easily available, helpful and friendly customer service is important in case you run into problems with your money transfer, or have any questions.

Panda Remit provides 24/7 customer service, making sure that you will always have someone to talk to if you have any questions or run into problems.

Tip #6: Watch out for deals and promotions

When you send money overseas to your family and friends in Mexico, you naturally prefer a money transfer company that will allow you to always have a chance to maximize the recipient's payout, and make the most out of your hard earned money. A great way to do so is by taking advantage of deals, promotions and discounts from remittance providers.

Panda Remit, for example, often offers deals for both new and old customers. At this time, RemitFinder users can take advantage of the below Panda Remit promotions to save even more money when sending money to Mexico from the US:

- Up to USD 30 off and free transfers: Depending on the amount you send, Panda Remit will add coupons to your account that enable you to earn up to USD 30 in free account credits.

- Refer a friend to earn 24 USD: For any friends that you refer to Panda Remit who successfully sign up and send money with them, you each USD 24. Your friend also earns an equal amount!

- 2 hours of 0 fee transfers everyday: For a limited time only, all your Panda Remit money transfers (first as well as repeat) are free if you send money between 1-3 PM EST (same as 10 AM - 12 PM PST). Note that this Panda Remit promotion expires on August 31, 2022.

Deals and promotions are an awesome way to save even more money on your money transfers to Mexico!

Conclusion

In this article, we have touched upon 6 key tips and strategies you want to be aware of when sending money from the US to Mexico. There are many money transfer companies that service this popular corridor. One of them, Panda Remit, checks all of our six boxes, and is a great way to send money to Mexico. Check out Panda Remit now to save on your next money transfer to Mexico!

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

Categories

Similar Articles

US Big Beautiful Bill's Impact On Remittances

The Big Beautiful Bill has been passed in the US, and remittances are impacted. Learn how the Bill impacts remittances and what to do if you are affected by the new law.

Bangladesh Remittance Cash Incentive: All You Need To Know

Are you an overseas Bangladeshi resident who sends money home to your loved ones? Read on to learn how to earn an additional 2.5% cash on your international remittances sent to Bangladesh.

How Fintech Is Pushing Banks Out Of The Remittance Business

The fintech revolution is disrupting the international remittance business. Discover how innovative startups are reshaping the international money transfer industry and challenging traditional banks.