Best Banks In The UK For Expats And Foreigners

Table of Contents

- Can a Foreigner Open a Bank Account in the UK?

- What Types of Bank Accounts are Available in the UK?

- Current Account

- Savings Account

- Basic Account

- Multi-Currency Account

- Offshore Account

- Other Account Types

- What are the Requirements for Opening a Bank Account in the UK?

- What Types of Banks Operate in the UK?

- What are the Big Four Banks in the UK?

- What are the Best Banks For Foreigners and Expats in the UK?

- Barclays Bank

- Barclays Current Accounts

- Barclays Foreign Currency Current Account

- What are the eligibility criteria for the Barclays Foreign Currency Current Account?

- Which currencies can I hold in my Barclays Foreign Currency Current Account?

- What is the fee for a Barclays Foreign Currency Current Account?

- What are the main benefits of a Barclays Foreign Currency Current Account?

- Is the Barclays Foreign Currency Current Account a good choice for me?

- What is Barclays Bank's SWIFT Code?

- What is Barclays Bank's Sort Code?

- NatWest Bank

- NatWest Current Accounts

- NatWest International Select Account

- What are the eligibility criteria for the NatWest International Select Account?

- Which currencies can I hold in my NatWest International Select Account?

- What is the fee for a NatWest International Select Account?

- What are the main benefits of a NatWest International Select Account?

- Is the NatWest International Select Account a good choice for me?

- NatWest Cash Management Account

- What are the eligibility criteria for the NatWest Cash Management Account?

- Which currencies can I hold in my NatWest Cash Management Account?

- What is the fee for a NatWest Cash Management Account?

- What are the main benefits of a NatWest Cash Management Account?

- What is the interest rate for deposits held in the NatWest Cash Management Account?

- Is the NatWest Cash Management Account a good choice for me?

- Additional NatWest International Savings Accounts

- What is NatWest Bank's SWIFT Code?

- What is NatWest Bank's Sort Code?

- HSBC Bank

- HSBC Bank Accounts

- HSBC Currency Account

- What are the eligibility criteria for the HSBC Currency Account?

- Which currencies can I hold in my HSBC Currency Account?

- What is the fee for an HSBC Currency Account?

- What are the main benefits of an HSBC Currency Account?

- Is the HSBC Currency Account a good choice for me?

- Additional HSBC Accounts

- What is HSBC Bank's UK SWIFT Code in the UK?

- What is HSBC Bank's UK Sort Code?

- Lloyds Bank

- Lloyds Current Bank Accounts

- Lloyds Bank International Current Account

- What are the eligibility criteria for the Lloyds Bank International Current Account?

- Which currencies can I hold in my Lloyds Bank International Current Account?

- What is the fee for a Lloyds Bank International Current Account?

- What are the main benefits of a Lloyds Bank International Current Account?

- Is the Lloyds Bank International Current Account a good choice for me?

- Lloyds Bank Premier International Account

- What is Lloyds Bank's SWIFT Code?

- What is Lloyds Bank's Sort Code?

- Best UK Banks for Expats - Our Recommendations

- Which UK bank is easiest for foreigners to open?

- Which UK bank charges lowest fees?

- Which UK bank is best for international students?

- Which UK bank is best for earning interest on savings?

- Which UK bank is best for traveling overseas?

- Which UK bank supports maximum foreign currencies?

- Tips Before You Open A Bank Account In The UK

- Conclusion

Are you an expat or foreigner in the UK looking for the best bank to open an account with? With so many banking options available in the country, deciding the most suitable one for your needs can take time and effort.

To make your search easier, we have compiled a list of some of the UK's top-rated banks that are geared toward international customers. Many of these banks have robust products and services, offer competitive exchange rates and provide excellent customer service.

From current basic accounts to savings accounts with lucrative perks, these best banks in UK provide extensive services and features tailored to meet your individual banking needs as an expat in the country.

Whether you are looking for an easy account opening process or no hidden fees or free foreign ATM withdrawals or 24/7 customer support, there are many perks at your disposal from these top UK banks. Given this, you will indeed find a bank that can deliver all the services you need when banking as a foreigner in the UK.

Continue reading our article below on some of the best banks in the UK for expats and foreigners to get started on your search for the optimal banking partner.

Can a Foreigner Open a Bank Account in the UK?

If you are a foreigner or expat already living, working or studying in the UK, or planning to go to UK soon, the good news is that most banks will allow you to open a bank account with them.

However, note that most banks will require a UK proof of address to open a bank account with them. If you have a local proof of address in the UK, you are good to go. However, if you do not have a UK address yet, your choices may be limited.

Foreigners and expats can open a bank account in the UK. In some cases, a UK address proof may be required.

Even if you do not have a UK address, there may still be some good online and multi-currency banking options available to you, some of which we will present later in this article.

What Types of Bank Accounts are Available in the UK?

Your banking needs as a foreigner or expat in the UK may vary based on if you are a student, worker, business owner or have a family. The good news is that there are various types of bank accounts that British banks offer to their customers.

Below is a list of various bank account types you can have in the UK.

Current Account

A current account is the most standard and prevalent type of account in the UK, and is meant for everyday use. You can use your current account to get your salary deposited into it, pay bills and make purchases.

A current account generally also comes with additional services and facilities like a credit card, debit card and overdraft protection. Current accounts are generally either free of charge or have nominal fees, whilst more premium options usually come with a heftier price tag for additional features.

If you are in doubt about which type of account to open in the UK, start with a current account. You can never go wrong with a current account.

A current account is a regular checking account meant for everyday use and covers most regular banking needs.

If you are a US resident, you will easily see parallels between the current account in the UK and checking account in the US. Similarly, Australian residents can trace similarities with everyday accounts available in Australia. Similar accounts also exist in Singapore as well.

Savings Account

A savings account, as the name implies, is meant to save money. Savings accounts are a standard banking option all over the world and do not need much introduction. Pretty much all UK banks allow you to open a savings account with them.

Savings accounts generally provide higher interest rates and thereby opportunities to grow your money. In some cases, you may have to maintain minimum balances to earn better interest rates. Additionally, there may also be a limit to the number of transactions you can make using your savings account

Basic Account

A basic account is a trimmed down version of the current account, and would be your choice in case you have poor or insufficient credit history in the UK, or you simply do not meet the requirements for a current account.

Basic accounts offer most of the standard services that current accounts offer like direct deposits, debit cards and bill pay services. However, you may not get access to features like overdraft protection, credit cards or loans.

The good news is that once you establish enough credit history and can successfully pass a credit check, you can easily upgrade from a basic account to a current account.

A basic account is a trimmed down version of a current account and provides less features, and is suitable for expats with insufficient UK credit history.

Multi-Currency Account

Many UK banks also offer setting up a multi-currency account in which you can maintain balances in many currencies in parallel. This is a great option in case you travel frequently for work or leisure.

Multi-currency accounts generally come with better exchange rates and low FX transaction fees. This is because they are specially focused on currency exchange and international payments.

If you travel frequently, you may want to look into a multi-currency account to save on currency conversion fees and get better exchange rates.

The Wise and Revolut multi-currency accounts, respectively, are two good examples of this type of bank account.

Offshore Account

An offshore account is set up outside the UK and can come in handy if you need to make international payments and make investments abroad. Whilst this may be a good option, make sure to consult with legal and tax experts as there may be nuances on how offshore funds will be taxed.

Other Account Types

Finally, there are other accounts like joint accounts, student accounts, business accounts and premium accounts available as well for any specific banking needs or financial circumstances. You should discuss your unique situation with your banker to determine if any of these is more suitable for your requirements.

There are many types of bank accounts available in the UK that cater for various banking and financial needs.

What are the Requirements for Opening a Bank Account in the UK?

The basic requirements for opening a new bank account in the UK include identification, residency and credit checks. Different banks and account types may have specific requirements, but in general, you can expect to be asked for the below information:

- Identification Proof: If you are a foreigner or an expat, you can use your valid passport as identification proof.

- UK Residency Proof: You may be asked for proof of UK residency depending on the bank and the account type. If you do not have this information, you may still be able to open some accounts with certain banks.

- Credit History Check: If you wish to open a current account, you must have enough credit history in the UK to qualify. Otherwise, you might have to settle for a basic account. Once you establish enough credit history, you can always reapply for a current account at that time.

In addition, some banks may also ask for proof of income and a minimum deposit to open certain account types.

What Types of Banks Operate in the UK?

Before we delve into the best banks for expats in the UK, let's also briefly discuss the various types of banks that are active in the country. The following 3 types of banks operate in the UK banking industry.

High Street Banks

High street banks are typical brick and mortar banks with physical branches. In other words, they are traditional banks where you can go to a bank branch or office and work with bank staff physically.

You can, of course, deal with high street banks digitally as well since almost all of them now offer e-banking facilities via their websites as well as mobile apps.

But the term high street bank signifies banks that definitely have physical branches and offer a full gamut of banking and financial products and services like different types of bank accounts, credit cards, loans and mortgages, deposits and investment products.

High street banks are traditional banks with physical branches and provide a wide array of banking and financial services.

Some popular high street banks in the UK include Barclays, Lloyds Bank, Halifax, Bank of Scotland, NatWest and Santander.

Challenger Banks

Challenger banks, sometimes also called online banks, are a recent type of financial institutions that generally operate digitally only without any physical branches. By doing so, they are able to keep their operational costs low. This allows them to fiercely compete with traditional or high street banks.

In this way, these online banks pose a challenge to high street banks, which is why they are called challenger banks.

Another advantage of challenger banks is their reliance of the power of technology and innovation to provide better and faster services whilst keep their costs under control. This further enables them to attract customers who want more than what high street banks can offer.

Challenger banks most operate digitally only and do not have physical branches. This allows them to keep costs low and provide competitive services.

Some popular challenger banks in the UK include Monzo, Revolut, Starling Bank and Atom Bank.

Credit Unions

Credit unions are non-profit financial entities that exist to serve their members' banking and financial needs. They are typically owned by their members and are generally local or regional in nature.

Credit unions usually offer lower fees and more services to their members than high street banks and are popular amongst various communities. They can be a bit limited though due to their local and regional scope and have limited international capabilities as compared to big banks.

International Banks

There are also some global banks in the UK like HSBC that are available to both residents as well as non-residents in the country. These international banks generally have standard services as part of their global operations and can be a good choice if you need to move large sums of money internationally.

You can choose to bank with high street banks, challenger banks, international banks or credit unions in the UK.

Now that we have briefly discussed the types of banks prevalent in the UK, let's look into the best banks for foreigners and expats in the UK. We will also touch upon the best current accounts as well as the best savings accounts in the UK.

What are the Big Four Banks in the UK?

The below 4 major banks are collectively called the Big Four banks in the UK:

- Barclays Bank

- NatWest Bank

- Lloyds Bank

- HSBC Bank

Whilst there are numerous others bank in operation in the UK, these 4 banks are major players with a strong presence in the banking industry in the country.

Barclays, NatWest, Lloyds and HSBC constitute the Big Four banks in the UK.

It is, therefore, no surprise that you will see these Big Four UK Banks in our list of the best UK banks in the following sections of this article.

What are the Best Banks For Foreigners and Expats in the UK?

Foreigners and expats living in the UK often find it difficult to find the best bank that provides services tailored to their needs. Fortunately, several great banks in the UK offer comprehensive banking solutions designed specifically for expats.

The following are some of the best banks in the UK for foreigners and expats that we will cover in the rest of this article:

- Barclays Bank

- NatWest Bank

- HSBC Bank

- Lloyds Bank

For each of these top UK banks, we will present the best accounts suitable for foreigners and expats in the country.

Notice that these are all high-street banking options. We will cover the top challenger or online banks in the UK in another article.

Let's dive in!

Barclays Bank

Barclays is a 330 year old banking and financial institution with headquarters in London. Operating as Barclays UK and Barclays International, the bank offers a wide range of banking and financial products and services for retail as well as corporate customers.

Barclays is one of the Big Four banks in the UK given its history and the magnitude of its assets and operations.

If you are a foreigner or expat in the UK, or planning to move to the UK soon, Barclays may be a good choice for you with quite a few products available1 for newly arriving expats coming to the country.

You can start your Barclays bank account opening process from overseas using the Barclays online banking facility. This will help you save time and prepare in advance. You will have 90 days from that point to open your Barclays bank account in a bank branch once you arrive in UK.

Barclays Current Accounts

If you are able to show proof of UK residency, the following 2 accounts are available for you as an expat:

- Barclays Bank Account

- Barclays Premier Current Account

Both accounts are free of cost but to quality for the Barclays Premier Current Account, you need to earn minimum GBP 75,000 per annum or have a total balance of at least GBP 100,000 in savings with Barclays.

If you cannot establish UK residency, do not have enough credit history or are experiencing financial difficulties, you may be eligible to open a Barclays Basic Account. Check with your nearest Barclays bank to determine eligibility.

You will need to show proof of UK residency for most Barclays bank accounts.

The main advantages of opening a Barclays bank account include the below:

- Pay no monthly fees for Barclays Current and Premier Current bank accounts.

- Access to Barclays online banking for accessing and operating your account anytime and from anywhere.

- Choice of Barclays current accounts, Barclays savings account and other premium account options that suit your banking needs.

- Use the Barclays mobile app to access your account on your mobile device.

- Send international payments to more than 200 countries with no fees for payments send online to non-SEPA countries.

Finally, there are other types of Barclays accounts available for specific needs like some of the below:

- Student Additions Account

- Higher Education Account

- BarclayPlus Children's Account

- Young Person's Account

- Foreign Currency Current Account

Barclays has many types of bank accounts that satisfy various banking needs and scenarios.

Barclays also has a foreign currency account that we will talk about next.

Barclays Foreign Currency Current Account

Since you have another home country as an expat or foreigner in the UK, we want to ensure that you are aware of the Barclays Foreign Currency Current Account2. Read on for more details about this account.

What are the eligibility criteria for the Barclays Foreign Currency Current Account?

If you wish to open a Barclays Foreign Currency Current Account, an important caveat to be aware of is that you must have a Barclays Current Account denominated in British Pounds first.

This means that you must provide identification proof as well as proof of UK residence, both of which are necessary to be able to open a Barclays Current Account.

You must be a UK resident to be able to open a Barclays Foreign Currency Current Account.

Note that having a Barclays Basic Current Account does not establish eligibility to open a Barclays Foreign Currency Current Account.

Additionally, you must be at least 18 years of age to be able to open this account.

Which currencies can I hold in my Barclays Foreign Currency Current Account?

The Barclays Foreign Currency Current Account is a multi-currency account whereby you can maintain balances in 12 currencies in parallel. Supported currencies include the below:

- Australian Dollar (AUD)

- Hong Kong Dollar (HKD)

- New Zealand Dollar (NZD)

- South African Rand (ZAR)

- Canadian Dollar (CAD)

- Danish Krone (DKK)

- Norwegian Krone (NOK)

- Swedish Krona (SEK)

- United States Dollar (USD)

- Euro (EUR)

- Swiss Franc (CHF)

- Japanese Yen (JPY)

With the Barclays Foreign Currency Current Account, you can send and receive foreign currency payments in any of the above supported currencies. Additionally, you get favorable exchange rates when currency conversion is involved.

You can hold up to 12 global currencies in the Barclays Foreign Currency Current Account. This account makes it easy to send and receive international payments.

What is the fee for a Barclays Foreign Currency Current Account?

The good news is that there is no monthly maintenance fee for your Barclays Foreign Currency Current Account. This makes this account a good choice if you do not want to pay any monthly fees.

Outside of that, below are some additional fees3 that may apply to your Barclays Foreign Currency Current Account:

- Sending money in the UK: No fee

- Sending Euro payments within the SEPA region with direct debit: No fee

- Sending international payments via Barclays phone banking or from a branch: GBP 25

- Sending international payments via Barclays online banking: No fee

- Receiving Euro payments via credit transfer: No fee

- Receiving international payments under GBP 100: No fee

- Receiving international payments over GBP 100: GBP 6

There may be other fees associated with your Barclays Foreign Currency Current Account so make sure to check the full fee disclosures before making various types of transactions in your account.

What are the main benefits of a Barclays Foreign Currency Current Account?

If you can establish UK residency to qualify for a Barclays Foreign Currency Current Account, you will be glad to enjoy the many benefit that come with this account. Below we list some of these.

- You can hold up to 12 global currencies in parallel in your account.

- There is no monthly maintenance fee for the Barclays Foreign Currency Current Account. Fees for sending and receiving international payments are also nominal.

- The Barclays Foreign Currency Current Account helps you cover for exchange rate loss when you receive payments in the same currency as your account's currency. This means you get more bang for your buck when you get international payments.

- You can fund your Barclays Foreign Currency Current Account with GBP transfers from your other Barclays accounts as well as deposit foreign currency directly into your account.

- You can withdraw funds either directly into your other Barclays accounts, as cash or as a cheque.

As you can see, there are many benefits to the Barclays Foreign Currency Current Account. The biggest advantage of this account is that you get to hold 12 global currencies in it.

Is the Barclays Foreign Currency Current Account a good choice for me?

The Barclays Foreign Currency Current Account may be a very good choice for you if you do frequent international travel for work or vacation. This is because you can hold 12 currencies in parallel in this account.

Also, there is no monthly maintenance fee for this account, and fees for other banking needs are also pretty low.

Finally, be aware that you must be a UK resident to open a Barclays Foreign Currency Current Account. If you do not have UK residency, you will not be able to open this account.

What is Barclays Bank's SWIFT Code?

If you are planning to receive money into your Barclays account from overseas, you will need to provide your sender with your bank account information as well as Barclays SWIFT Code. This is important as SWIFT Codes are needed to ensure that the funds reach your account correctly.

Barclays SWIFT Code is BUKBGB22.

Note that the above SWIFT Code is for Barclays UK head office. The SWIFT Code for specific Barclays branches across the UK may have 3 additional characters.

What is Barclays Bank's Sort Code?

Sort Codes in the UK are 6 digit numbers used to uniquely identify bank branches for correctly routing funds to bank accounts in those banks.

Barclays Bank branch Sort Codes start with 20. Check with your bank for their exact Sort Code. Alternatively, you can find your bank's Sort Code using the Barclays online banking facility, the Barclays mobile app or by looking at your debit card.

For example, the Sort Code for Barclays head office located at 1 Churchill Place, Canary Wharf, London, E14, 5HP is 200050.

NatWest Bank

NatWest is the commonly used short name of National Westminster Bank, and is one of the Big Four banks in the UK. Founded in 1968 and headquartered in London, NatWest offers a wide range of banking services for both UK residents as well as non-residents.

With an extensive network of more than 900 branches and thousands of ATMs, NatWest is a household name in the UK. The bank caters to the needs of both individual as well as business customers.

If you are an expat in the UK, read on as NatWest has many options for your banking needs.

NatWest Current Accounts

NatWest has many types of current accounts4 which will meet a variety of your banking needs. However, these current accounts can only be opened by UK residents. So, if you are interested in a NatWest current account, you will need to establish UK residency for tax purposes.

You will need to be a UK resident to open a NatWest Current Account.

Here are the main advantages of various NatWest Current Accounts:

- No monthly fees for the Everyday Bank Account.

- Earn rewards for direct debits and spending with a NatWest Reward Account for a monthly cost of GBP 2.

- Student Bank Account making it easier for students to manage their finances and banking needs.

- Child and Teen accounts with options to manage such accounts by parents, and earn interest money held in these accounts.

- Premier Current Accounts that come with extra perks but for a fee.

- Existing NatWest Current Account holders can upgrade their account to NatWest Reward Silver or NatWest Reward Platinum for monthly fee of GBP 10 and GBP 20, respectively.

- NatWest online banking and NatWest mobile app access are standard features of any NatWest account, thereby enabling you to bank 24x7 from anywhere.

- Additionally, you will be able to access thousands of NatWest ATMs across the UK and use your NatWest debit card to make withdrawals.

NatWest is also currently running a promotion whereby you can earn GBP 200 for switching to NatWest from another bank.

These are all great choices, but what if you cannot establish UK residency for tax purposes? Despair not, as there are some good NatWest international bank accounts that may be useful.

NatWest International Select Account

The NatWest International Select Account5 is a great option for you if you are not a UK resident for tax purposes, but are a foreigner or expat in the UK.

You can open your NatWest International Select Account online using the NatWest online banking facility via your mobile app or tablet. The process is simple and easy, and you will be given the option to open both a NatWest International Select Account as well as a NatWest Cash Management Account (more on this account later).

You can open your NatWest International Select Account online using NatWest online banking on your mobile phone.

Note that NatWest international accounts opened online will be based out of Jersey and thus subject to Jersey laws and regulations.

Let's get into more details about the NatWest International Select Account below.

What are the eligibility criteria for the NatWest International Select Account?

Below are the requirements you will need to fulfill to be able to open the NatWest International Select Account:

- You must be minimum 18 years of age.

- You must be a resident of any of the following countries: Austria, Bahrain, Belgium, Bermuda, Canada, China (Expats only), Denmark, Finland, France, Hong Kong, Kuwait, Norway, Oman, Qatar, South Africa, Sweden, Switzerland, United Arab Emirates, United Kingdom (Non-domiciled only) or the United States of America.

- You must meet one of the below financial conditions:

- Deposit at least GBP 25,000 when opening your account

- Setup a salary deposit of at least GBP 40,000 into your account

You do not need to be a UK resident to open a NatWest International Select Account.

Which currencies can I hold in my NatWest International Select Account?

You can hold up to 25 global currencies, including US Dollars (USD), British Pounds (GBP) and Euros (EUR) in your NatWest International Select Account if you also sign up for a NatWest Cash Management Account.

What is the fee for a NatWest International Select Account?

The monthly fee for maintaining a NatWest International Select Account is GBP 8. This account helps you manage your money both in the UK as well as internationally using the NatWest online banking facility or the NatWest mobile banking app.

In addition to the monthly account maintenance fee, below is additional useful information about NatWest International Select Account fees6:

- Direct debits and standing orders fees: GBP 0

- Sending money within the UK, Channel Islands, Isle of Man or Gibraltar in GBP using Faster Payments or digitally: GBP 0

- Sending money within the UK, Channel Islands, Isle of Man or Gibraltar in GBP using CHAPS: GBP 23

- Sending money outside the UK, Channel Islands, Isle of Man or Gibraltar: 0.30% of sending amount subject to GBP 23 minimum and GBP 40 maximum fee (GBP 10 agent charge may also apply in some cases)

- Sending money from outside the UK, Channel Islands, Isle of Man or Gibraltar: GBP 0 fee for payments under GBP 100, and GBP 7.50 for payments above GBP 100

There may be additional fees for other activities, so make sure to check the complete list of fees applicable for your NatWest International Select Account.

What are the main benefits of a NatWest International Select Account?

Below are the main advantages of a NatWest International Select Account:

- You do not need to be a UK resident to open this account. The NatWest International Select Account is, therefore, a great option if you do not have UK residency.

- You can hold up to 25 popular global currencies in your account in parallel if you also open a NatWest Cash Management Account.

- You can make instant transfers of up to GBP 100,000 between your NatWest accounts.

- You get a debit card that can be used at thousands of NatWest ATMs as well as for purchases online and at thousands of merchant locations.

- You can easily lock and unlock your debit card to ensure enhanced security of your money and information.

There are many advantages to having a NatWest International Select Account.

Is the NatWest International Select Account a good choice for me?

The NatWest International Select Account is definitely a very attractive choice for expats and foreigners in the UK. Specifically, the below scenarios are a perfect fit for your banking needs for this account:

- If you do not have UK residency, the NatWest International Select Account is a perfect fit for your needs. Recall that most bank accounts in the UK can only be opened if you have UK residency. In that sense, this is a great option if you are not a UK resident.

- If you travel frequently for work or leisure, the NatWest International Select Account is a great fit as well since you can hold up to 25 global currencies in parallel in this account. This makes interconversion between currencies simple.

- If you need to move funds in and out of your various NatWest accounts seamlessly, the NatWest International Select Account lets you do that with ease. You can quickly make instant transfers of up to GBP 100,000 to and from your NatWest International Select Account.

- You get 24x7 access to NatWest online banking as well as the NatWest mobile app with your NatWest International Select Account. This means you can bank from anywhere, anytime as long as you have internet access.

- Last but not the least, NatWest takes the security of your funds and information very seriously. In that sense, you can rest assured that your money and data is in safe hands with NatWest.

Next, we will look at the NatWest Cash Management Account.

NatWest Cash Management Account

The NatWest Cash Management Account is a good choice if you want to earn some interest on your savings in foreign currencies. Let's look at details of this account below.

What are the eligibility criteria for the NatWest Cash Management Account?

The eligibility criteria for opening a NatWest Cash Management Account are the same as those for opening a NatWest International Select Account with one difference - the minimum age requirement for a NatWest Cash Management Account is 16 years whilst that for the NatWest International Select Account is 18 years.

Rest of the eligibility criteria like residency requirements and account balance are the same for both accounts.

Which currencies can I hold in my NatWest Cash Management Account?

The NatWest Cash Management Account is a multi-currency account using which you can maintain balances in up to 25 of the world's most popular currencies at the same time.

Supported currencies include US Dollars (USD), British Pounds (GBP) and Euros (EUR).

You can hold up to 25 global currencies in your NatWest Cash Management Account.

What is the fee for a NatWest Cash Management Account?

Since the NatWest Cash Management Account is a companion account that goes hand in hand with the NatWest International Select Account, the fees for this account are part of the fees you pay for the NatWest International Select Account.

In other words, there is no separate monthly account maintenance fee for the NatWest Cash Management Account.

For other banking needs, there may be fees involved. Check out our earlier section on fees for the NatWest International Select Account.

What are the main benefits of a NatWest Cash Management Account?

In addition to being able to hold up to 25 currencies in parallel in your NatWest Cash Management Account, the biggest advantage is the ability to earn interest on your savings in foreign currencies.

There are 2 ways you can earn interest on your savings in this account; these are as below:

- NatWest Instant Access Deposit: You can put your money into the Instant Access Deposit pool which leaves it liquid for usage as needed. Plus, you will earn interest on your money. The interest rate is variable and NatWest can change it anytime. If this happens, you will be notified of the change.

- NatWest Fixed Term Deposit: Alternatively, you can allocate your funds into Fixed Deposits for 3, 6, 9 or 12 months and earn interest. In this option, the interest rate is fixed for the term you choose and you cannot withdraw the money before maturity. Once the Fixed Deposit matures, the funds and interest will be credited back into your NatWest Cash Management Account.

You can earn interest on your savings held in your NatWest Cash Management Account using the NatWest Instant Access Deposit or the Fixed Term Deposit options.

What is the interest rate for deposits held in the NatWest Cash Management Account?

The interest rates for savings held in the NatWest Instant Access Deposit or the Fixed Term Deposit options in the NatWest Cash Management Account depends on the currencies in which you hold your funds.

Contact your nearest NatWest branch for finding out the current interest rate on the currency you have your funds in.

Is the NatWest Cash Management Account a good choice for me?

The NatWest Cash Management Account is a great choice if you have savings in foreign currencies that you want to earn interest on.

Earning interest on money is nothing new or fancy, but the NatWest Cash Management Account allows you to do so whilst keeping your money in foreign currencies. This way, you do not need to convert your foreign currency funds into British Pounds.

Finally, the ability to keep 25 currencies in your account at the same time can be a great asset especially if you are a truly global citizen. Instead of opening accounts in various countries for respective currencies, you can simply rely on the NatWest Cash Management Account as your single account and manage your money in multiple currencies.

Additional NatWest International Savings Accounts

In addition to the NatWest Cash Management Account, NatWest has even more international savings accounts available. These are as below:

- NatWest Instant Saver Account: A flexible interest earning account even if you make withdrawals. You can earn an Annual Equivalent Rate (AER) of 1.81% for savings up to GBP 50,000 and 1.87% for those above GBP 50,000. Interest is calculated daily and paid at the end of the month, so you can use your money as you deem fit and still earn interest.

- NatWest Premium Saver Account: An account with higher interest rates if you do not make withdrawals in a month. For example, if you do not make withdrawals from this account, you will earn an AER of 2.22% for balances between GBP 25,000-49,999. If you make withdrawals, the AER will drop to 2.12%.

- NatWest Savings Builder Account: A bonus savings account that rewards you with higher interest rates for growing your savings every month. If you grow your savings by at least GBP 50 per month, you get a higher interest rate. For example, if the GBP 50 savings growth goal is met, you get an AER of 4.07% for balances up to GBP 10,000. If the savings growth goal is not met, the AER will be 1.66%.

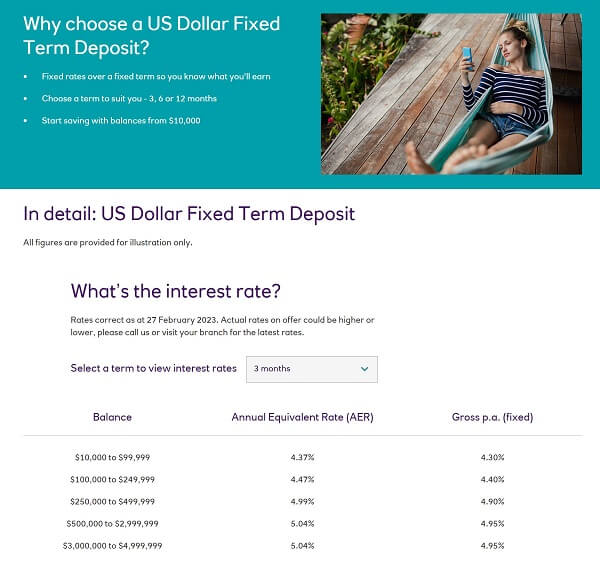

- NatWest US Dollar Fixed Term Deposit Account: A fixed term deposit held in US Dollars to earn interest on savings held in USD. You can open the fixed term deposit for 3, 6, or 12 months, and earn interest for savings starting USD 10,000. For example, the AER for a 3 month deposit for balances between USD 10,000-99,999 is 4.37%. Check out the NatWest US Dollar Fixed Term Deposit Account page7 for a full list of applicable interest rates. This account is a great option for US expats in the UK who want to earn a higher interest rate on their US Dollar savings.

The below screenshot shows the latest interest rates applicable for a 3 month fixed deposit for the US Dollar Fixed Term Deposit with NatWest.

As you can see, there are quite a few choices when it comes to do international banking with NatWest. This is great since you can pick and choose the right account based on your financial situation.

NatWest offers numerous international savings accounts suited for different needs. Check these out to see which ones are the best fit for your requirements.

What is NatWest Bank's SWIFT Code?

If you need to receive funds into your NatWest bank account from abroad, make sure to give your sender the SWIFT Code for NatWest Bank.

NatWest Bank SWIFT Code is NWBKGB2L, or NWBKGB2LXXX if the 11-character version is needed.

What is NatWest Bank's Sort Code?

NatWest Sort Codes vary by branch, so check with your branch office to find out their Sort Code. You can also find this information easily on your account statement or debit card.

For example, the Sort Code for the NatWest branch at London Bridge, Chatham is 515003.

HSBC Bank

HSBC need no introduction. As one of the world's premier financial institutions, HSBC has operations in more than 60 countries across all continents and serve more than 40 million customers.

HSBC UK was created in July 2018 and serves both individual as well as corporate customers by offering a wide array of banking and financial products and services. These include banking, loans, investment and insurance products with a big variety of flavors and choices.

It is, therefore, no surprise that as a foreigner or expat in the UK, HSBC has several good options for you to explore. Let's see what they are below.

HSBC Bank Accounts

You can apply for a few HSBC bank accounts even if you are outside the UK or EU region. In that sense, an HSBC bank account is meant for the global citizen without a strict requirement for UK residency.

You do not need to be a UK resident to open an HSBC bank account in the UK.

Here are the main benefits of an HSBC bank account in the UK if you are a foreigner or expat either living in the UK, or planning to move to UK soon:

- You get a debit card with your HSBC account that can be used to make everyday purchases and cash withdrawals at thousands of HSBC ATMs.

- You get 24x7 access to HSBC online banking as well as the HSBC mobile banking app.

- There is no monthly account maintenance fee just for keeping your HSBC bank account open.

- Your HSBC debit card makes you eligible for umpteen offers and discounts from thousands of merchants and stores.

- You can manage all your HSBC global accounts in one place using HSBC internet banking or the HSBC mobile app.

As an expat of foreigner in the UK, you have 3 HSBC bank account choices8 as below:

- HSBC Bank Account: An everyday bank account for daily banking needs. With this account, you get an ATM withdrawal limit of GBP 300 per day. Also, if you use your debit card overseas to withdraw cash, you will have to pay 2.75% of the transaction amount plus a 2% fee subject to a minimum fee of GBP 1.75 and a maximum fee of GBP 5.

- HSBC Advance Account: An upgraded account with additional features on top of the HSBC Bank Account. For example, your ATM withdrawal limit for an HSBC Advance Account is GBP 500 per day. Like the HSBC Bank Account, you have to pay the same fees for overseas cash withdrawals with your debit card.

- HSBC Premier Account: An elevated banking experience that lets you manage all your global accounts with HSBC in one place. You can also make free transfers between your global accounts if you have an HSBC Premier Account. The daily ATM withdrawal limit for this account is GBP 1,000 and you do not need to pay the 2% fee for overseas cash withdrawals (you still have to pay the 2.75% of the transaction amount). Note that you have to establish eligibility for an HSBC Premier Account via any of the below methods:

- You must be an existing HSBC Premier Account holder in another country, or,

- You must deposit at least GBP 50,000 in savings or investments with HSBC UK within 6 months of your new account opening date, or,

- You must have an income of at least GBP 75,000 per year and have either a mortgage, investment, life insurance or protection product with HSBC UK for at least 6 months from the date of account opening.

These 3 HSBC bank accounts in the UK come with varying degree of features and flexibility. Pick the one that suits your needs the best.

You can choose between the HSBC Bank Account, the HSBC Advance Account or the HSBC Premier Account if you are an expat in the UK.

Finally, note that some account features may not be available if you are not a UK resident. Check with your nearest HSBC branch to find out which exact features your bank account will come with.

Up next, we want to provide you with details and information about another useful HSBC account for expats in the UK - the HSBC Currency Account.

HSBC Currency Account

The HSBC Currency Account9 is HSBC's truly global account that lets you hold numerous currencies at once in the same account. This can be a boon if you work in multiple countries or travel frequently internationally.

Let's take a closer look at the HSBC Currency Account below.

What are the eligibility criteria for the HSBC Currency Account?

If you want to open an HSBC Currency Account, you need to ensure you meet the following conditions:

- You must have an active HSBC current account (the HSBC Basic Bank Account is excluded from the list of allowable current accounts).

- You must be at least 18 years of age.

Also, note that most HSBC current accounts necessitate that you have UK or EU residency. Keep that in mind before you decide to open an HSBC Currency Account.

Which currencies can I hold in my HSBC Currency Account?

You can hold up to 14 currencies in parallel in your HSBC Currency Account. These include the world's most popular currencies as listed below:

- Australian Dollar (AUD)

- Canadian Dollar (CAD)

- Swiss Franc (CHF)

- Chinese Renminbi (CNY)

- Euro (EUR)

- Hong Kong Dollar (HKD)

- Japanese Yen (JPY)

- Norwegian Krone (NOK)

- New Zealand Dollar (NZD)

- Emirate Dirham (AED)

- Swedish Krona (SEK)

- Singapore Dollar (SGD)

- US Dollar (USD)

- South African Rand (ZAR)

You can essentially have a separate account for each currency that you wish to hold. Using this currency specific account, you can manage your money in that currency separately.

You can hold up to 14 currencies in your HSBC Currency Account.

What is the fee for an HSBC Currency Account?

There is no monthly account maintenance fee for your HSBC Currency Account.

Additionally, there is no fee to send money to other HSBC accounts anywhere in the world. If you make payments to non-HSBC accounts, there may be fees involved.

For example, you will need to pay USD 7 for sending US Dollars to a non-HSBC account. Note that if you send Euros within the EU region, there is no fee. Outside the EU, sending Euros to non-HSBC accounts will cost EUR 7.

There is no monthly fee for the HSBC Currency Account. You also do not pay fees for sending money to other HSBC accounts worldwide.

What are the main benefits of an HSBC Currency Account?

There are many advantages to having an HSBC Currency Account; we list some of them below.

- By providing you with the ability to hold 14 currencies, the HSBC Currency Account is a perfect fit if you are a global citizen who deals with multiple currencies.

- You have 24x7 access to your HSBC Currency Account via HSBC online banking as well as the HSBC mobile banking app.

- You get access to live exchange rates when sending money from your HSBC Currency Account.

- You have flexibility in making international payments by sending money right away or scheduling future payments for up to a year. Additionally, you can also setup recurring payments.

- You can easily move money in and out of the HSBC Currency Account from and to your other HSBC accounts denominated in GBP.

- You can send an unlimited amount of money with this account if you do the transaction in a branch. For online transfers, a limit of GBP 50,000 applies.

As you can see, there are many benefits to the HSBC Currency Account, especially if you need to deal with multiple currencies and move money around between them.

Note that the HSBC Currency Account is not an interest earning account. If you have a sizable chunk of money sitting in this account, it will not earn any interest.

Additionally, the HSBC Currency Account does not have overdraft facility. This means that you must ensure that you have enough funds in your account before you setup a payment.

Is the HSBC Currency Account a good choice for me?

The HSBC Currency Account is certainly a very good choice if you need to handle multiple currencies. Below are some scenarios whereby this account can be a great fit for your needs:

- If you work or live in multiple countries and therefore need to deal in multiple currencies, the HSBC Currency Account is something you definitely want to look at in more detail.

- Multiple currencies sometimes necessitate moving money between them which can be difficult. With the HSBC Currency Account, you can do this seamlessly. This makes the HSBC Currency Account an attractive choice if you need to do international transfers.

- If you are concerned about international money transfer fees, you will be glad to know that there are no fees to send payments from the HSBC Currency Account to any HSBC accounts worldwide. Sending money to non-HSBC accounts does come with a fee though.

- If you need to make large payments, the HSBC Currency Account may be a great fit as you can send an unlimited amount of money.

- Last but not the least, if you travel frequently, robust and secure digital banking may be an important need for you to stay on top of your finances 24x7 from anywhere. The HSBC Currency Account lets you do just that with HSBC online banking.

The HSBC Currency Account makes multi-currency handling and international payment hassle free and easily accessible.

Additional HSBC Accounts

Finally, there are quite a few other HSBC bank accounts that may suit your needs. We list some of these below just so you are aware that these are available in case you end up needing them.

- HSBC Basic Bank Account in case you are unable to qualify for any other current accounts.

- HSBC Kinetic Business Account for single business owners and sole traders.

- HSBC Student Bank Account for UK residents who are students.

- HSBC International Student Bank Account for international students who have been studying in the UK for less than 3 years.

- HSBC Graduate Bank Account for new grads to manage their money for up to 2 years after graduation.

- HSBC Childrens Bank Account for ages between 11 and 17 with a debit card and linked savings account.

With so many choices available, the chances that you will be able to find the right HSBC account for your needs are pretty high. Make sure to pick the right account that fits your unique needs.

What is HSBC Bank's UK SWIFT Code in the UK?

If someone needs to send you money from overseas and you wish to receive that into your HSBC UK bank account, you will need to provide them with HSBC's UK SWIFT Code.

The SWIFT Code for HSBC UK is HBUKGB4BXXX.

Make sure you provide them with the above SWIFT Code to correctly receive funds from overseas into your HSBC UK account without any problems.

What is HSBC Bank's UK Sort Code?

Sort Codes are unique identifiers for bank branches in the UK and help route money correctly to the right recipient UK bank account.

Since the Sort Code varies by branch, check with your local HSBC bank branch to find the Sort Code for your branch. Alternatively, you can find the HSBC Sort Code on your debit card, bank statement or by logging into HSBC online banking.

As an example, the Sort Code for the HSBC branch located at 1 Centenary Square,

Birmingham, UK is 401276.

Lloyds Bank

Lloyds Bank is the 4th bank in the Big Four banks in the UK, and has been around for more than 250 years. As the largest retail bank in the UK, Lloyds has thousands of branches and ATMs across the country.

Lloyds caters to the needs of individuals, businesses as well as communities by providing numerous financial products and services to its customers.

Lloyds also caters to the needs of foreigners and expats, which is something we will focus on below. Let's see what they have in store for you if you are an expat in the UK.

Lloyds Current Bank Accounts

Lloyds has a wide variety of current accounts10 that you can open in the UK. Some of these include the below:

- Lloyds Classic Bank Account: A starter account perfect for everyday banking needs.

- Club Lloyds Bank Account: Earn interest on your money and get an annual perk for a monthly fee of GBP 3 which can be waived if you deposit at least GBP 2,000 a month into your account.

- Lloyds Silver Bank Account: Get travel insurance for trips to Europe and UK for GBP 10 monthly fee.

- Club Lloyds Silver Bank Account: Get an annual perk on top of the benefits of the Lloyds Silver Bank Account for an additional GBP 3 monthly fee which can be avoided if you pay at least GBP 2,000 into your account.

- Lloyds Platinum Bank Account: Get travel insurance for trips anywhere in the world and AA Breakdown Family Cover insurance for GBP 12 monthly fee.

- Club Lloyds Platinum Bank Account: All the benefits of the Lloyds Platinum Bank Account plus an annual perk for an additional GBP 3 monthly fee that gets waived if you pay at least GBP 2,000 into your account.

- Various youth and student accounts: Choose between the Lloyds Smart Start Bank Account, the Lloyds Under 19s Bank Account or the Lloyds Student Bank Account based on your needs.

Depending on your needs, you can pick the right account for you.

All Lloyds current bank accounts come with a contactless Visa debit card that you can use at hundreds of thousands of locations that accept Visa as well as for online shopping. Additionally, you get access to Lloyds online banking as well as Lloyds mobile banking using their mobile app.

One thing to keep in mind, though, is that you need to be a UK resident to be able to open any of the above accounts. Lloyds current accounts will not be an option for you, unfortunately, if you cannot establish UK residency.

Lloyds has many current accounts that can suit different needs. You have to be a UK resident to be able to open a Lloyds current account.

You must be wondering if you can bank with Lloyds if you are not a UK resident. The answer is yes!

Lloyds Bank does have an account that you can use even if you are not a UK resident. Let's see what it is below.

Lloyds Bank International Current Account

If you are an expat in the UK with residence in certain eligible countries (more on this below), you may be able to open the Lloyds Bank International Current Account11. This is Lloyd Bank's multi-currency account that may be useful if you need to deal with foreign currencies.

Below is everything you need to know about the Lloyds Bank International Current Account.

What are the eligibility criteria for the Lloyds Bank International Current Account?

You can open the Lloyds Bank International Current Account based on your residency in certain countries. Many countries are allowed but not all.

For example, you can open this account if you are a resident of the UK, Spain, France, UAE, Australia and Singapore. If you are a resident of the US, Canada, Germany or Japan, you are not eligible to open this account.

You can open the Lloyds Bank International Current Account from many countries, but not all. Check if your country is allowed before opening this account.

The good news is that Lloyds Bank has a dedicated page for checking eligibility for international banking12. Make sure to check if your country is supported before you apply for this account.

Which currencies can I hold in my Lloyds Bank International Current Account?

You can hold the following 3 currencies simultaneously in your Lloyds Bank International Current Account:

- British Pound (GBP)

- Euro (EUR)

- US Dollar (USD)

You can make purchases and do spending in all the 3 currencies above, and there is no fee for sending or receiving international money transfers with them.

What is the fee for a Lloyds Bank International Current Account?

The monthly maintenance fee for your Lloyds Bank International Current Account depends on the currency which you hold in your account, and is as below:

- GBP 7.5 for accounts held in British Pounds (GBP)

- EUR 8 for accounts held in Euros (EUR)

- USD 10 for accounts held in US Dollars (USD)

Note that you will pay only one fee above in case you hold more than one currency in your account. The rules for calculating which fee will apply for multi-currency accounts are as below:

- You will pay GBP 7.5 monthly fee if British Pound (GBP) is one of the currencies you hold in your account.

- You will pay USD 10 monthly fee if you hold US Dollar (USD) and Euro (EUR) in your account but not British Pound (GBP).

You will need to pay a monthly maintenance fee for your Lloyds Bank International Current Account.

Also, you do not have to pay the monthly maintenance fee for the first 3 months after you open your new Lloyds Bank International Current Account.

What are the main benefits of a Lloyds Bank International Current Account?

There are several benefits to holding a Lloyds Bank International Current Account. Below, we list the primary advantages of this account.

- You can hold up to 3 popular currencies - GBP, EUR and USD - in this account.

- You do not pay any fees for international payments in the above 3 currencies. Note that correspondent bank charges may still apply.

- You get 24x7 access to Lloyds online banking as well as Lloyds mobile banking.

- You get Visa debit cards in all the 3 supported currencies for easy worldwide use in the currency of your choice.

- You need not be a UK resident to be able to open this account.

In the next section, we discuss if this account could be a good fit for your needs.

Is the Lloyds Bank International Current Account a good choice for me?

The Lloyds Bank International Current Account has many benefits and can be a good choice for your international banking needs. For example:

- If you need to operate your account in GBP, EUR and USD, this account may be a great fit. All 3 currencies are hugely popular and prevalent in many parts of the world, so if you need to handle your money in them, this account may be a perfect match for your requirements.

- If you travel abroad frequently, the Lloyds Visa Debit cards in GBP, EUR and USD can be highly useful to make purchases overseas without incurring currency conversion.

- If you need to send and receive money internationally, you can do so with your Lloyds Bank International Current Account. And the best part is that Lloyds does not charge any fees for sending and receiving money. Note that there may be correspondent bank charged involved.

- If you need on the go access to your money and finances, Lloyds online banking and Lloyds mobile banking can be beneficial to you for round the clock access to your account.

There are many scenarios for which the Lloyds Bank International Current Account may be a great fit.

Lloyds Bank Premier International Account

If the Lloyds Bank International Current Account sparks your interest, you should also be aware of the Lloyds Bank Premier International Account.

On a high level, you pay no monthly fees and enjoy additional benefits with a Lloyds Bank Premier International Account as compared to the Lloyds Bank International Current Account.

However, to be able to qualify for the Lloyds Bank Premier International Account, you must meet the below criteria:

- You must deposit GBP 100,000 with Lloyds to establish eligibility. Plus, these funds must stay in a Lloyds account for at least 6 months after opening your Lloyds Bank Premier International Account.

- Alternatively, you must earn at least GBP 100,000 annually and must save or invest GBP 100,000 with Lloyds within 12 months of opening your account.

The Lloyds Bank Premier International Account is worth exploring as long as you can meet the eligibility criteria.

What is Lloyds Bank's SWIFT Code?

If you intend to receive an overseas payment into your Lloyds Bank account in the UK, you will need to provide the sender with Lloyds Bank SWIFT Code. This will ensure that the incoming funds from abroad reach your Lloyds Bank account without any problems.

Lloyds Bank SWIFT Code is LOYDGB2L.

If your sender's bank asks them for the 11-digit SWIFT Code variation, you can provide them LOYDGB2LXXX as Lloyds Bank's SWIFT Code.

What is Lloyds Bank's Sort Code?

Various Lloyds Bank branches use their own Sort Codes to help route money within the UK banking system. Check with your bank or look at your bank statement or debit card to locate the correct Sort Code for your Lloyds Bank branch.

As an instance, the Sort Code for Lloyds Bank branch located at 88-94 Church Street, Two Brindley Place, Liverpool, UK is 779331.

This concludes our analysis of the top banks in the UK for foreigners and expats. If you are an expat living, studying or working in the UK, or planning to do so, you have hopefully found the information we have presented useful.

That said, our comprehensive analysis has yielded a lot of information which may not be easy to compare and analyze if you are a hurried reader. To further simplify the analysis of the best banks in the UK, we summarize our findings in the rest of this section.

We will also make pertinent recommendations along the way to highlight key features and benefits of the best bank accounts in the UK.

Best UK Banks for Expats - Our Recommendations

In this section, we look at some common banking needs and scenarios that you may find yourself in as a UK expat.

We will make some recommendations for each scenario. These are based on our comprehensive analysis of the best UK banks presented in the earlier parts of this article.

Which UK bank is easiest for foreigners to open?

Many UK banks make it easy for foreigners and expats to do business with them. In some cases, you do not even have to be a UK resident to open a UK bank account.

The NatWest International Select Account stands out as one great option if you are not a UK resident for tax purposes. As a foreigner or expat in the UK, you can open this account as long as you are a resident of any of the following countries: Austria, Bahrain, Belgium, Bermuda, Canada, China (Expats only), Denmark, Finland, France, Hong Kong, Kuwait, Norway, Oman, Qatar, South Africa, Sweden, Switzerland, United Arab Emirates, United Kingdom (Non-domiciled only) or the United States of America.

Another great option for non-UK residents is the Lloyds Bank International Current Account which accepts nationals from many countries that include Spain, France, UAE, Australia and Singapore. Note that if you cannot open this account if you are a resident of the US, Canada, Germany or Japan.

The NatWest International Select Account as well as the Lloyds Bank International Current Account accept non-UK residents from many countries to open these accounts.

In addition to the above 2 good options, you can also apply for many HSBC bank accounts even if you are not a resident of the UK or EU countries.

Finally, you may also be able to open a Barclays Basic Account if you are unable to establish UK residency.

Which UK bank charges lowest fees?

There are quite a few UK banks that do not charge any monthly maintenance fees. We list some of the popular ones below.

- Barclays Current and Premier Current bank accounts

- Barclays Foreign Currency Current Account

- NatWest Everyday Bank Account

- HSBC Currency Account

- Lloyds Bank Premier International Account (you do need to establish eligibility for this account by depositing GBP 100,000 with Lloyds Bank)

There are quite a few UK bank accounts for which you do not have to pay any monthly account maintenance fees or charges.

Note that there may be fees involved for transactions of certain types. Depending on your usage and transactions, you may be charged some fees. Check out our detailed fee summary on the above banks in prior sections.

Which UK bank is best for international students?

Once again, there are a few good accounts available for you if you are a foreigner studying in the UK. Some good choices include:

- Barclays Student Additions Account

- Barclays Higher Education Account

- NatWest Student Bank Account

- HSBC Student Bank Account

- HSBC International Student Bank Account

- HSBC Graduate Bank Account

Check out the details on these bank accounts to see which one might be the best fit for your needs as a foreign student in the UK.

Which UK bank is best for earning interest on savings?

Of all available choices, we recommend the NatWest Cash Management Account if your goal is to earn interest on your savings. The best part of that you can make your money work with this account by keeping your savings in foreign currencies. You do not need to convert your money held in foreign currencies into British Pounds.

To earn interest on your deposits in the NatWest Cash Management Account, you have 2 options to choose from:

- NatWest Instant Access Deposit: If you need flexibility and liquidity of your money, choose this option. The interest is variable and you can access your money anytime.

- NatWest Fixed Term Deposit: If you do not need to tap into your savings, you can choose to create Fixed Deposits for 3, 6, 9 or 12 months and earn interest on your money.

There are even more savings accounts options from NatWest as below:

- NatWest Instant Saver Account

- NatWest Premium Saver Account

- NatWest Savings Builder Account

- NatWest US Dollar Fixed Term Deposit Account

There are many good savings accounts from NatWest that will help you grow your money in foreign currencies as well as British Pounds.

Check out our detailed analysis of various NatWest savings account options earlier in the article.

Which UK bank is best for traveling overseas?

If you travel abroad frequently, we recommend taking a close look at the HSBC Currency Account. First and foremost, you can hold up to 14 popular global currencies in parallel in this account.

Next, you do not need to pay any monthly account maintenance changes for having an HSBC Currency Account. There is also no fee if you send money to other HSBC accounts anywhere across the world. Note that sending money to non-HSBC accounts may entail a fee.

Another good aspect of this account is that there is no limit to the amount of money you can send overseas with this account if you do the transaction in an HSBC branch. However, if you send money online, there is a maximum limit of GBP 50,000.

If you travel abroad often, the HSBC Currency Account may be a perfect fit for your needs both overseas as well as in the UK.

On the flip side, you will not earn any interest on money held in the HSBC Currency Account. Also, this account does not come with an overdraft option. But in our opinion, these are not major issues that can be easily worked around.

Overall, the HSBC Currency Account is a truly powerful account for the global citizen who travels frequently for work and leisure.

Which UK bank supports maximum foreign currencies?

There are several good UK Bank Accounts that allow you to hold numerous currencies in parallel. Some of the best options for these multi-currency accounts in the UK include the below:

- The NatWest Cash Management Account allows you to hold up to 25 currencies.

- The Barclays Foreign Currency Current Account lets you maintain balances in 12 currencies.

- The HSBC Currency Account can also be used to hold up to 14 currencies in parallel.

There are quite a few good multi-currency bank accounts in the UK that you can use to hold funds in many currencies in parallel.

Of all these options, we recommend looking at the NatWest Cash Management Account since it allows you to hold maximum number of currencies and lets you grow your money by earning interest.

You can also opt for additional multi-currency online accounts as those offered by Revolut and Wise, two of the world's premier online financial apps.

Tips Before You Open A Bank Account In The UK

Here are some tips and best practices to follow that will help you easily open a bank account in the UK as a foreigner or expat.

- Gather The Necessary Documents: Before opening a bank account in the UK, you will need to provide your identity proof, such as a passport or national ID card, as well as address proof, like a utility bill or rental agreement.

- Research Different Banks: Different banks offer different features and services so it's important that you do your research and compare all the options before you make a decision. Use our detailed analysis of the best UK accounts to see which accounts may be the best fit for your needs.

- Consider Fees And Charges: Different banks have different fees, charges and interest rates so it is important to consider these before opening a bank account.

- Check Your Credit History: If you have had any past financial problems or debts, then it's important to check your credit report before applying for a bank account. This will help you identify any potential issues preventing you from getting accepted.

- Read Terms And Conditions: Before signing up for a bank account, read all the terms and conditions so that you understand exactly what is expected of you. Make sure to keep all the paperwork as a reference in case you need it later.

- Set Up Online Access: Most banks will offer online access to your account, so make sure you set this up immediately after opening an account. This will allow you to manage your finances quickly and easily from home or on the go. Also check if your bank offers mobile banking and get it set up for 24x7 access.

- Monitor Your Account Regularly: It is important to monitor your bank account and keep an eye on all transactions on an ongoing basis. This will help you avoid any unwanted fees or charges, as well as help you spot potential fraud or identity theft early.

- Ask Questions: If you have any doubts or questions, then make sure to ask the bank for help before signing up for an account. This will ensure that you fully understand everything and are completely happy with your decision.

Following these tips ensures that opening a bank account in the UK is as straightforward and easy as possible. Doing your research before committing to an account will give you peace of mind, knowing you have chosen the best account for your needs.

Conclusion

As an expat or foreigner in the UK, you will have to look at many aspects on your life including banking and finance. Choosing the right bank for your needs will be important so you have peace of mind and can focus on settling and living in the UK.

In this article, we presented a detailed analysis of various bank account types available to you as a UK expat. In addition, we looked at the top UK banks including Barclays Bank, NatWest Bank, Lloyds Bank and HSBC UK Bank. These are all great options and provide numerous banking products and services for expats in the UK.

Check out the respective features of various accounts from the best UK banks to see which one may be the best fit for your unique needs. With so many choices available, we hope that our detailed analysis will help you with your research and narrow down your options.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

References:

1. Barclays Bank new to the UK starting page

2. Barclays Bank Foreign Currency Account

3. Barclays Bank Foreign Currency Account fees

4. NatWest current accounts starting page

5. NatWest International Select Account

6. NatWest International Select Account fees

7. NatWest US Dollar Fixed Term Deposit Account

8. HSBC Bank UK accounts starting page

9. HSBC Bank Currency Account

10. Lloyds Bank current accounts starting page

11. Lloyds Bank International Current Account

12. Lloyds Bank International Current Account eligibility checker

Categories

Similar Articles

CNAPS Codes Unraveled: Navigating China's Banking Landscape

Discover CNAPS Codes: China’s unique bank identifier for fast, secure transactions. Learn how CNAPS Codes simplify payments across China's banking system.

ABA Routing Numbers In The US: A Comprehensive Guide

Discover what ABA Routing Numbers are, how they work and their importance in US banking transactions like direct deposits, online transactions and wire transfers.

What Is A NUBAN Number And What Is It Used For?

Discover what NUBAN Numbers are and how they streamline bank account identification in Nigeria. Do not miss this essential guide if you transact in any way with the Nigerian banking system.