Best Singapore Banks to Send Wire Transfers

Table of Contents

- What to Look for When Choosing a Bank for Wire Transfers?

- Development Bank of Singapore (DBS)

- What are DBS Bank's wire transfer fees?

- What are DBS Bank's wire transfer limits?

- What is DBS Bank's SWIFT Code?

- Oversea-Chinese Banking Corporation (OCBC)

- What are OCBC's wire transfer fees?

- What are OCBC's wire transfer limits?

- What is OCBC's SWIFT Code?

- United Overseas Bank (UOB)

- Maybank Singapore

- What are Maybank's wire transfer fees?

- What are Maybank's wire transfer limits?

- What is Maybanks's SWIFT Code?

- Post Office Savings Bank (POSB)

- CIMB Bank, Singapore

- What are CIMB Bank's wire transfer fees?

- What are CIMB Bank's wire transfer limits?

- What is CIMB Bank's SWIFT Code?

- Best Singapore Banks for Wire Transfers Key Takeaways

- Which Singapore bank has the lowest outgoing wire transfer fees?

- Which Singapore bank has the lowest incoming wire transfer fees?

- Which Singapore bank has the highest wire transfer limit?

- What information do I need to send a wire transfer using a Singapore bank?

- What are Some Tips to Make the Most of Singapore Bank Wire Transfers?

- Tip #1: Compare transfer fees charged by banks

- Tip #2: Consider local alternatives if available

- Tip #3: Upgrade your bank membership

- Tip #4: Always self-serve your wire transfers

- Is a Wire Transfer the Best Way to Send Money from Singapore?

- What are the advantages of wire transfers sent via Singapore banks?

- What are the disadvantages of wire transfers sent via Singapore banks?

- How Do Bank Wire Transfers Compare With Remittances? A Case Study

- Alternatives to Singapore Bank Wire Transfers

- Conclusion

Are you looking for the best Singapore bank to send international wire transfers with? If so, you have come to the right place.

In this article, we will discuss some of the best banks in Singapore that offer international wire transfer services. We will also provide tips on choosing the right bank for your needs.

Whether you're a business owner or an individual looking to send money abroad, read on for our top recommendations to make the most of your international wire transfers from Singapore.

What to Look for When Choosing a Bank for Wire Transfers?

There are many factors to consider when choosing a bank for international wire transfers. Some of the most important ones include the below:

- Wire transfer fees charged by the bank: Some banks charge high fees for international wire transfers, while others offer more competitive rates. Transfer fees are a very important factor that will directly influence the payout your overseas recipient gets. The impact of the fee also depends on the transfer amount. For example, an SGD 30 transfer fee on an SGD 1,000 wire transfer is 3% money lost, whilst the same fee on an SGD 10,000 wire transfer is only 0.3% loss.

When it comes to service fees for international wire transfers and remittance, there are two common types of fee models that banks and overseas money transfer service providers use:- Fixed transfer fee model: Every transaction is charged the same rate. Sometimes this can just be a flat fixed fee regardless of the transfer amount. Alternatively, the amount you need to pay varies depending on the amount of money you're sending. For example, if you're sending SGD 5,000 or less, you'll pay SGD 5. If you're sending SGD 25,000 or less, you'll pay SGD 10. And for any other amounts, you'll pay SGD 35.

- Variable precent based fee model: The variable transfer fee is a percentage of the total amount being transferred. (e.g., 0.125% of the SGD 2,000 being transferred). This may also be tiered whereby the percentages vary based on the transfer amount tiers, much like income tax slab rates.

Wire transfer fees can be fixed or variable (percent based).

- Speed of the transfer: Wire transfers can take anywhere from a few hours to a few days to complete depending on the destination country. Since wire transfers are dependent on banks, they are also subject to national, regional and other bank holidays that may be in effect in both the source as well as the destination country.

- Foreign exchange rate offered by the bank: When sending money internationally, getting the best possible exchange rate is important to avoid losing money on the transaction. In general, banks tend to offer lower rates as compared to money transfer companies. But still, if you want to send a wire transfer with a bank, you should keep an eye on the exchange rate they offer you.

- Customer service offered by the bank: When dealing with large sums of money, it's important to have a bank you can rely on for help and support if needed. Wire transfers can be harder to reverse if something goes wrong, so your bank's customer service can be a key differentiator when things go awry.

There are many factors like fees, exchange rates and speed that you should consider when choosing a bank for an international wire transfer.

Based on these important factors to consider, we have evaluated several Singapore banks to pick the best ones for your consideration. Read on to see what they are!

Development Bank of Singapore (DBS)

DBS Bank Limited, also referred to as DBS, is a worldwide banking and financial services company with its headquarters in Singapore's Marina Bay region in the Marina Bay Financial Centre.

DBS is the top traditional bank for sending and receiving money for online international transactions. Money transfers from Singapore to 16 countries, including Malaysia, India, and others, are free thanks to DBS bank.

Transfers are generally available to these countries within one business day. DBS does have an SGD 10 fee for receiving money transfers and a lower SGD 200,000 transfer cap than other services. However, sending money to various countries is effective with DBS Remit.

There are three ways you can make an international bank transfer with DBS:

- DBS Remit: This is the online remittance service from DBS Bank and enables same-day transfers to countries that include India, the Philippines, Malaysia, Indonesia, China, Hong Kong, the United Kingdom, the United States, Australia, and the Eurozone. DBS Remit was one of the first to introduce the SGD 0 transfer charge and this gained popularity among consumers. Look for the DBS Remit tag on the DBS Bank Digibank Overseas Transfer page to spot transactions with no fees.

- Online using internet banking: DBS Remit is not available in every country, but its internet banking service called DBS Digibank can still be used to send money to other countries.

- Visiting a branch location: To send a telegraphic transfer, fill out the form at the bank and hand it to the teller. The teller will verify your information and process the transfer.

There are many ways you can send money internationally from Singapore with DBS Bank.

If you are receiving an international wire transfer into your DBS Bank account, please let your sender know the following information to ensure a smooth payment delivery:

- Your name as per the records of DBS Bank

- Your DBS bank account number

- Your bank's name and address

- Name and address of bank: 12 Marina Boulevard, DBS Asia Central, Marina Bay Financial Centre Tower 3, Singapore 018982

- DBS Bank SWIFT code: DBSSSGSG

What are DBS Bank's wire transfer fees?

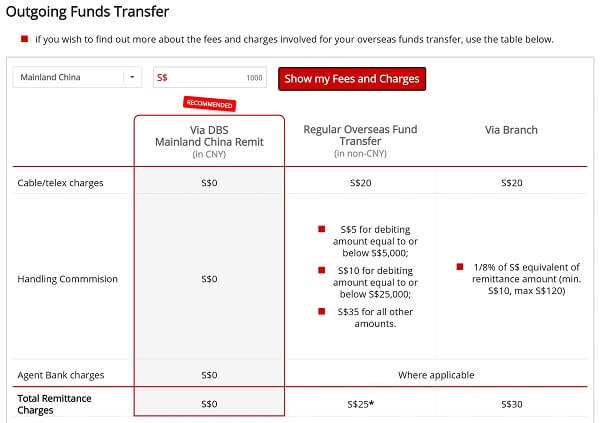

DBS Bank wire transfer fees are as below:

- If you send money internationally using DBS Remit, it is generally free to send money overseas. However, not all countries are supported.

- If you send an overseas funds transfer using DBS Digibank online or the mobile app, the transfer fee is generally anywhere from SGD 25-55 per wire transfer based on the amount you send. The breakdown of the fee is as below:

- Fixed wire transfer fee of SGD 20.

- Handling commission fee of SGD 5 for sending up to SDG 5,000, SGD 10 for up to SGD 25,000 and SGD 35 for higher amounts.

- Additional agent bank fees may also be applicable on a case by case basis.

- If you send your wire transfer in a DBS Bank branch with a banker's assistance, the fee will be anywhere from SGD 30-140, and is calculated as below:

- Fixed wire transfer fee of SGD 20.

- Handling commission fee calculated at 0.125% of the transfer amount subject to a minimum SGD 10 fee and maximum SGD 120 fee.

- Additional agent bank fees may also be applicable on a case by case basis.

- Incoming wire transfers into a DBS Bank account are charged a service fee of SGD 10.

You can expect to pay between SGD 25-55 for online DBS wire transfers, and between SGD 30-140 if you wire in a DBS branch.

DBS Bank provides an online calculator1 that proves very handy to be able to calculate the exact fee you will pay on your international money transfer with them.

All you have to do is choose your destination country and the amount you want to send as part of your intended money transfer, and the above tool will let you know the applicable fees.

Below is an example fee calculation for sending money to China from Singapore for an SGD 1,000 money transfer via DBS Bank:

DBS maintains full transparency about their fee structure. Use the above tool to determine your fees before you plan your money transfer with DBS Bank.

Use DBS Bank's online fee calculator to estimate the wire transfer charges you will need to pay.

What are DBS Bank's wire transfer limits?

You can send anywhere from SGD 500 to SGD 200,000 in a single transaction using DBS Bank's online Digibank website or mobile app.

If you wish to send more than SGD 200,000, you will need to visit a DBS Bank branch and work with a banker to send your money transfer.

There is no limit to the amount of money you can wire overseas with DBS Bank. Online transfers have an upper limit of SGD 200,000 though.

What is DBS Bank's SWIFT Code?

Various DBS Bank branches have different SWIFT Codes, so you'll need to check with your bank to find the correct code for your branch. If you're not sure which branch you need a code for, you can just use the general code, since it will work for all of them.

The generic DBS Bank SWIFT Code is DBSSSGSG.

Oversea-Chinese Banking Corporation (OCBC)

OCBC is a top-rated bank located in 18 countries and regions. It provides different types of saving accounts that are each customized to individual needs, with full incentives and benefits included.

As a full-fledged banking corporation, OCBC also offers international wire transfers that you can take advantage of. We provide some key information about their wire transfer service below.

OCBC in Singapore charges a transfer fee for overseas transfers, which will include a markup in the exchange rate if currency exchange is involved. In addition, recipient or intermediary banks may charge additional fees if your money needs to be sent via SWIFT. When you're considering costs, keep in mind that the upfront fees may not be all the potential expenses involved.

Depending on the country of your recipient's bank, an OCBC international wire transfer can take anywhere from a few hours to four business days.

What are OCBC's wire transfer fees?

OCBC's wire transfer fees2 are a composite of many constituent fees, and can be calculated as below:

- Fixed fee for wire cable charge worth SGD 20

- Wire commission fee worth 0.125% of the transfer amount subject to minimum SGD 10 and maximum SGD 100

- Agent fee may also apply based on the destination currency

With this, you can easily see that you can expect to pay anywhere between SGD 30-120 for sending an international wire transfer with OCBC.

For incoming international wire transfers into an OCBC bank account held in either Singapore Dollars or a foreign currency, OCBC charges a fixed SGD 10 fee.

OCBC's international wire transfer fees range from SGD 30-120. Incoming wire transfer fee is SGD 10.

What are OCBC's wire transfer limits?

OCBC wire transfer sending limits are not published, and vary by the type of account you have with them. Please get in touch with your bank branch to find out your wire transfer limits.

What is OCBC's SWIFT Code?

A SWIFT or BIC Code identifies your specific bank when sending an international payment, ensuring the money arrives at its intended destination.

The OCBC Singapore SWIFT code can be found by logging into online banking or looking at a paper account statement. The necessary details are as below:

- Bank name: Oversea-Chinese Banking Corporation Limited Singapore

- OCBC SWIFT/BIC code for FAST and GIRO payments: OCBCSGSGXXX

- OCBC SWIFT/BIC code for MEPS payments: OCBCSGSG

For quicker processing of your USD payments sent via telegraphic transfers, you may provide the intermediary bank's SWIFT code:

- Bank name: JP Morgan Chase Bank, New York, USA

- SWIFT BIC code: CHASUS33

United Overseas Bank (UOB)

United Overseas Bank (UOB), established in 1935, is the third-largest bank in Singapore and among the most popular in the Asia Pacific region. It provides a wide range of financial services for private and business clients, including international transfers from Singapore to most major world currencies.

Depending on the country, it may take one to five business days for a UOB transfer to reach the intended bank. You can use the UOB website to check exact cutoff times and delivery timelines for various nations.

The UOB international money transfer service is an easy but secure way to send money overseas. This tremendously benefits companies that conduct or need to conduct offshore financial activities. This enables expatriates and overseas workers to send money to their loved ones quickly.

However, this could result in higher fees; each transaction is assessed a percentage of the total transfer amount, and a minimum transfer amount of $200 is required for transfers in Philippine pesos or Indian rupees.

What are UOB's wire transfer fees?

For sending international wire transfers, UOB's wire transfers fees3 comprise of various constituent fees, and are calculated as below:

- You must always pay a fixed cable charge which is SGD 20 for transfers to Malaysia, and SGD 30 for all other countries.

- You will have to pay a wire transfer commission fee of 0.125% of the transfer amount if you send your transfer via a UOB branch or by calling the UOB call center. If you execute your transfer using online banking yourself, the commission is 0.0625% of the transfer amount. These are subject to a minimum SGD 10 fee and a maximum SGD 100 fee.

- You may also have to pay agent charges that can vary based on the destination.

Given the above participant fees, you can expect to pay a total fee between SGD 30-120 for UOB wire transfers to Malaysia, and between SGD 40-130 for transfers to other countries.

For incoming international wire transfers going into a UOB bank account, you have to pay a service charge of SGD 10 per transfer.

International wire transfers sent with UOB will cost between SGD 30-120 for transfers to Malaysia, and between SGD 40-130 for other countries.

What are UOB's wire transfer limits?

There are no limits to how much money you can send with a UOB international wire transfer. Note that you may have to request an increase in default limits that may be placed on all accounts.

What is UOB's SWIFT Code?

To have an incoming remittance in Singapore deposited into your account, the sender must have the following information:

- Your UOB SWIFT code: UOVBSGSG

- Your full name on your UOB account

- Your UOB account number

- UOB Bank name and address: United Overseas Bank Limited, 80 Raffles Place, Singapore 048624

If you would like to receive money in a currency other than SGD, you will need to request that the sender send the payment through specific UOB Nostro agents as indicated on the UOB website.

Maybank Singapore

Maybank Singapore Limited, a subsidiary of the parent Maybank, is based in Singapore and has qualifying full bank privileges. As a result, Maybank provides retail banking services for personal accounts, privileged wealth accounts, premier wealth accounts, and private wealth banker services for SME businesses.

Maybank's exchange rate has a markup from the mid-market rate. While this is typical for most banks and payment services, it might make your total expenses more than anticipated. Always factor in Maybank's additional fee (disguised as a better exchange rate) when budgeting for your overseas payment.

The price you pay for a Maybank overseas transfer depends on the method of payment arrangement that you choose. If you do not set up a G'OUR payment, your recipient may have to pay additional costs due to the SWIFT network's operation (a group of banks working together to process international payments). Even though it is a collaborative effort, each bank involved can take out its fee, which could lead to extra charges and less money overall for your intended recipient.

Maybank offers an opportunity to pay upfront to cover these SWIFT costs. You can do this by setting up the payment in a branch, which unfortunately has a higher fee than online payments. The good news is that you'll only have to make this fixed payment once, and it will be worth it according to the currency you're sending.

Maybank's online international payment service is not available 24/7. The online foreign telegraphic transfer service is only operational from Monday to Friday, 10 am – 6 pm, with the exclusion of public holidays and Federal Territory state holidays.

Keep in mind that you'll need to schedule your transfer for a weekday. The amount of time it will take for the payment to reach its destination varies depending on the country and how quickly the recipient's bank processes payments. In most cases, international payments only take a few business days to go through. However, if there are any public holidays during this period, it could potentially delay the process even further.

What are Maybank's wire transfer fees?

Much like all of the banks we have reviewed earlier, Maybank's international wire transfer fees4 are also composed of individual fees, and are calculated as below:

- Outgoing wire transfer commission fee of 0.125% subject to a minimum of SGD 20 and a maximum of SGD 100.

- Fixed processing fee per transfer that is SGD 20 for wire transfers sent online and SGD 30 for those done in a Maybank branch.

- Finally, agent fees may also apply based on the destination currency chosen.

Keeping the above in mind, you can expect to pay anywhere between SGD 40-120 for online wire transfers and between SGD 50-130 for those completed in a branch.

If you send an international wire transfer with Maybank, you will have to pay fees between SGD 40-120 online transfers and SGD 50-130 in a branch.

What are Maybank's wire transfer limits?

By default, your Maybank account comes with an SGD 3,000 daily limit5 for outgoing international wire transfers.

The good news is that you can increase your daily sending limit to SGD 100,000 using the Maybank Online Banking as long as you use a security token to do so.

What is Maybanks's SWIFT Code?

If you wish to receive international wire transfers into your Maybank account, you will need to provide the sender with some information they will need to send you the funds. The most important information is Maybank's SWIFT Code, which is MBBESGS2.

Maybank's SWIFT Code is MBBESGS2; make sure to provide this information to your sender.

Below is a summary of useful information you should provide to your sender:

- Maybank SWIFT code: MBBESGS2

- Bank name: Maybank Singapore Limited

- Bank address: Battery Road, 2, Maybank Tower, Floor 01, 01, Singapore

- Branch code: RWM

Post Office Savings Bank (POSB)

POSB bank is another great choice to send international wire transfers. Note that since 1998, POSB bank has been part of DBS Bank following an acquisition and merger.

As a result, if you are a POSB customer, you can make use of the same wire transfer information provided earlier for DBS Bank.

CIMB Bank, Singapore

CIMB Bank, Singapore is a subsidiary of the bigger CIMB Group Holdings Berhad, a Malaysian bank based out of Kuala Lumpur. CIMB operates both in the investment banking as well as the retail space with more than a thousand branches across the Association of Southeast Asian Nations (ASEAN) region.

CIMB bank operates as a full scale consumer bank in the financial sectors of Malaysia, Indonesia, Singapore, Thailand, Cambodia and Philippines. It provides a gamut of services to customers just like any regular bank, and also caters to small and medium sized businesses.

It is, therefore, no surprise that CIMB Bank also allows its customers to send international wire transfers from their account. Below are the noteworthy aspects of CIMB's wire transfer services.

What are CIMB Bank's wire transfer fees?

CIMB Bank's international wire transfer fees6 are also structured similar to its competitors, and are a sum of the below constituent fees:

- Flat rate cable charge of SGD 30.

- Wire transfer commission fee charged at 0.125% of the transfer amount with applicable minimum and maximum limits of SGD 10 and SGD 100, respectively.

- Optional agent fees depending on the destination currency.

You can, therefore, expect to pay anywhere between SGD 40-130 for your international wire transfers sent with CIMB Bank.

Incoming international wire transfers coming into a CIMB Bank account in Singapore have their fees waived! That's right – you pay 0 fees for incoming wires regardless of whether the funds are credited as Singapore Dollars or foreign currency.

Expect to pay between SGD 40-130 for outgoing CIMB Bank international wire transfers. Incoming transfers are free.

What are CIMB Bank's wire transfer limits?

CIMB Bank's default international wire transfer limit7 is SGD 3,000 per day. You can get this daily limit raised up to SGD 25,000.

To increase your CIMB Bank outgoing wire transfer sending limit, login into your account, and then navigate to Services --> Change --> Daily Limit. Once there, you can change the daily limits for various services including outgoing wire transfers.

Once you change your daily limit, the new limit applies instantly.

What is CIMB Bank's SWIFT Code?

If you intend to receive incoming international wire transfers into your CIMB Bank account in Singapore, you can provide the following instructions to the sender. These are important to avoid any issues in the transfer and ensure the funds correctly reach your bank account.

For all currencies except GBP, use the following CIMB SWIFT Code and information:

- SWIFT Code: CIBBSGSG

- Bank name: CIMB Bank Berhad, Singapore

- Bank address: 30 Raffles Place, #04-01, Singapore 048622

For incoming GBP wire transfers, use the following CIMB SWIFT Code and information:

- Intermediary bank: Barclays Bank PLC (BARCGB22)

- Sort Code: 20 32 53

- Favoring: CIMB Bank Berhad Singapore (CIBBSGSG)

- Account Number: 20325333053814

- Further Credit To: Beneficiary Full Name as per CIMB Bank's records

- Account Number: Beneficiary Account Number

- Quoting Reference: Reference number (e.g., invoice or membership number)

This concludes our list of the top Singapore banks to send international wire transfers. In the rest of this article, we will analyze the information presented further, and provide additional useful information that may be helpful to make the most of your Singapore Dollars.

In you are interested to learn more, keep reading!

Best Singapore Banks for Wire Transfers Key Takeaways

We have presented a lot of information above and it may be hard to digest it in a single shot. This section summarizes our detailed comparison of the best Singapore banks to send international wire transfers in an easy to digest format.

Which Singapore bank has the lowest outgoing wire transfer fees?

Based on our analysis, various mainstream Singapore banks are pretty much matched on their outgoing international wire transfer fees. All of the banks are charging a combination of cable charges, wire transfer commission fees and agent fees where applicable.

That said, DBS Bank has the lowest fees for outgoing international wire transfers with the range of SGD 25-55. On the other end of the spectrum, CIMB Bank outgoing wire transfer fees are between SGD 40-130.

Keep in mind though that the DBS Bank fee of SDG 25-55 is if you do the international wire transfer yourself using their Digibank service online or via the mobile app. If you send your DBS wire transfer at a bank branch, the fee will be between SGD 30-140.

DBS Bank has the lowest wire transfer fees of SDG 25-55 if you send money yourself using the DBS Digibank online site or mobile app.

Which Singapore bank has the lowest incoming wire transfer fees?

For incoming international wire transfers, most Singapore banks are matched with a standard SGD 10 fee for an incoming transfer into your bank account.

The only exception to this is CIMB Bank whereby your fees are waived and you pay nothing for an incoming international wire transfer regardless of whether it is in SGD or a foreign currency.

CIMB Bank charges 0 fees for incoming wire transfers. Most other banks charge SGD 10 per incoming wire.

Which Singapore bank has the highest wire transfer limit?

When it comes to sending limits for international wire transfers, there is quite a lot of variation amongst the Singapore banks we evaluated.

DBS Bank and UOB have the highest wire transfer limits; you can send an unlimited amount of money with wire transfers with these banks. Be aware that for DBS Bank, you have to go into a branch to send unlimited funds. DBS Digibank online as well as the DBS mobile app have a limit of SGD 200,000.

The only other thing to be aware when it comes to sending limits is that some banks like Maybank and CIMB Bank have low default limits of SGD 3,000. The good news is that you can increase these yourself by changing the settings in your bank account.

You can send an unlimited amount of money with DBS Bank and UOB international wire transfers.

What information do I need to send a wire transfer using a Singapore bank?

In general, you will need the below information to send a wire transfer from your bank in Singapore:

- Recipient's bank name

- Recipient's bank account number

- Recipient's bank SWIFT code or IBAN number. Check out our article on more information about IBANs and related topics.

- Recipient's full name

- Recipient's full address

- The currency and amount of money you wish to send

- The reason for the transfer

What are Some Tips to Make the Most of Singapore Bank Wire Transfers?

We recommend some of the below best practices to try and save money on your international wire transfers sent via Singapore banks:

Tip #1: Compare transfer fees charged by banks

As evidenced by our detailed analysis of the wire transfer services provided by the best Singapore banks, there are variations in the fees charged by all banks. You should definitely compare these fees, and if you need to send wire transfers regularly, you could consider switch to the bank which charges the least transfer fees.

Tip #2: Consider local alternatives if available

Always explore options like mobile wallets and local bank to bank transfers for any domestic wire transfer needs. Of course, this will not work if you need to send international wire transfers, but these options will always be cheaper than even domestic wire transfers with banks.

Tip #3: Upgrade your bank membership

In some cases, banks have different account and membership levels, and if you upgrade to a higher level, some fees may be waived, and certain other rewards may be applied. For example, the incoming wire transfer fee of SGD 10 is waived for DBS Bank Treasures customers.

Tip #4: Always self-serve your wire transfers

Banks have to pay their employees and incur operational expenses to keep their branches running, so every time you walk into a bank branch to do some transaction, you increase the bank's operational cost. In many cases, the bank will simply pass this increased cost to you as a fee.

For example, consider the below variations for DBS Bank wire transfers sent online vs in the branch:

- If you send a wire transfer yourself via the DBS Digibank online or the mobile app, the transfer fee is between SGD 25-55 per wire transfer based on the amount you send.

- On the other hand, if you send your wire transfer in a DBS Bank branch with a banker's assistance, the fee will be anywhere from SGD 30-140.

Always try to send your wire transfers yourself using your bank's online website or mobile app to save on wire transfer fees.

That is a clear example of why you should always send your wire transfer yourself and not rely on a banker in a branch.

It is quick and easy to send international wire transfers yourself using your bank's website or mobile app. In another article, we have covered the steps to send DBS Bank wire transfers using both their Digibank online website as well as mobile app in detail.

Most other banks have very similar wire transfer flows on their app and website. Send your transfer yourself and save on fees you would have to pay if you go to a bank branch to complete your transaction.

Now that we have discussed the ins and outs of the most prominent Singapore banks' wire transfer services in detail, it is time to take a step back and ponder if a wire transfer is the best option to send money overseas from Singapore. Read on if you are interested in this analysis!

Is a Wire Transfer the Best Way to Send Money from Singapore?

In this section, we will analyze if an international wire transfer sent via a Singapore bank is your best bet to send money overseas. Are there other cheaper options to send money from Singapore?

But first, let us summarize the pros and cons of sending international wire transfers via banks in Singapore.

What are the advantages of wire transfers sent via Singapore banks?

Below are the key advantages of sending money overseas from Singapore using bank provided international wire transfer services:

- Security: Wire transfers are time tested banking functionality that has been around for decades. You can rest assured they are secure and safe. Just ensure you keep your own account safe at all times, and the bank should be able to handle your wire transfers safely.

- Ease of Use: Since you already operate your finances with your bank, it is pretty convenient to do yet another transaction type with them i.e., a wire transfer. There is no additional account to open, and you can use your existing bank account to send and receive wires.

- High transfer limits: Most banks have pretty high sending limits in place. Sometimes there are even no limits to how much money you can send with wire transfers. This makes wire transfers a great option for high value transfers needed in cases like moving internationally, paying off a big loan, investing in overseas real estate, etc.

Bank wire transfers are generally safe and convenient. Plus, you can send large amounts overseas.

What are the disadvantages of wire transfers sent via Singapore banks?

Every coin has 2 sides, and Singapore bank wire transfers are no different. Below are the disadvantages of wire transfers for international money transfers out of Singapore:

- Very high transfer fees: As we have seen based on our detailed analysis of wire transfer services provided by Singapore banks, the transfer fees you will have to pay are pretty high. It is not uncommon to end up paying up to SGD 100 for an international wire transfer. Of course, you can follow some best practices to try and reduce the fee as much as possible. But it is still a sizable chunk, and will make a big dent in your overseas recipient's payout, especially for smaller value transfers.

- Low foreign exchange rates: Since international wire transfers typically involve 2 currencies, currency conversion is involved. This means that you are dependent on your bank's exchange rate for your transactions. The bad news is that most banks charge 3-4% FX Markup on their exchange rates. This works like a hidden fee as it lowers the money that will go into your recipient's pocket. Alternatively, you have to pocket this hidden cost as a sender if the recipient needs to be paid a predetermined amount.

- Slow transfer speed: Banks have modernized their systems significantly compared to the 80s and the 90s, but they are still not state of the art when it comes to modern global financial hubs. As a result, many banks still take days to process wire transfers. Also, since you are dependent on at least 2 banks (and sometimes additional intermediary ones), bank holidays can easily add additional delays to your wire transfers. Given this, we do not recommend using wire transfers for urgent situations whereby you may need to rush funds overseas.

- Bank accounts are a must: Since international wire transfers are pretty much bank to bank transfers, both the sender and the recipient must have a bank account. Whilst this may work out most of the times, there are cases where either side may want to use cash. Or you may have to pay someone who doesn't know you well, and therefore, they do not want to share their bank details and instead want a mobile wallet credit.

Wire transfers typically come with high fees and low exchange rates. Additionally, there is a dependency on banks on both sides.

The biggest problem with wire transfers is a reduced payout due to the high transfer fees and lower exchange rates. Both of these factors reduce the mileage of your hard earned money.

Let's embark on a case study to understand this better.

How Do Bank Wire Transfers Compare With Remittances? A Case Study

To see if Singapore bank wire transfers are the best option to send money overseas from Singapore or not, let's compare them with sending remittance with a money transfer specialist.

Here are the parameters and assumptions of our case study:

- We will use DBS Bank Digibank online wire transfer as our candidate since they have the lowest transfer fee amongst all Singapore banks.

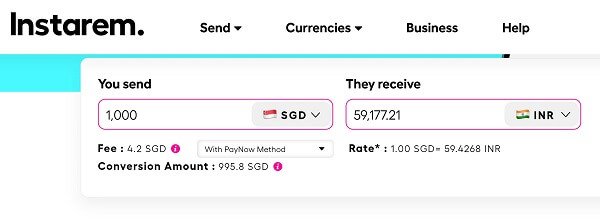

- We will use Instarem, a fintech company specializing in international money transfers, as our money transfer company for this comparison.

- We will assume the bank FX Markup to be 3% - most banks charge 3-4% FX Markup on international currency conversions.

Based on these parameters, we calculated the below values for a Singapore to India money transfer of SGD 1,000.

| Provider | Amount Sent | Interbank FX Rate* | Fee** | FX Rate Applied** | Payout | FX Markup |

|---|---|---|---|---|---|---|

| DBS Bank | SGD 1,000 | 1 SGD = 59.5349 INR | SGD 25 | 1 SGD = 57.7489 INR | 56,305.18 INR | 5.42% |

| Instarem | SGD 1,000 | 1 SGD = 59.5349 INR | SGD 4.2 | 1 SGD= 59.4268 INR | 59,177.21 INR | 0.36% |

*Interbank rate from XE.com

**Rates and fees as of November 24, 2022

See how we calculate FX Markup

Below is a screenshot of the Instarem website with the above transfer parameters.

Below are the key takeaways from this case study:

- Bank wire transfer effective FX Markup ended up being more than 5% due to the high transfer fee involved. This validates the fact that both high transfer fees and lower exchange rates increase the cost of an international money transfer.

- Everything else being the same (i.e., transfer amount and currency pairs), the payout with a money transfer company is INR 2,872.03 higher. This is equivalent to about SGD 48.24 (calculated with the interbank exchange rate).

You will get more money for your SGD international money transfers if you go with a money transfer specialist like Instarem as compared to banks.

This is very interesting as it gives you a deep insight into the pros and cons of bank wire transfers as compared to money transfer specialists. Of course, there are numerous other factors at play here. For example, safety and security, transfer limits, transfer speed, ease of use, customer feedback, and so on.

What are the Alternatives to Singapore Bank Wire Transfers?

Our final section on this comprehensive discussion on Singapore bank wire transfers is to summarize with possible alternatives that can help you save money on your international money transfers from Singapore.

The best alternative to sending bank wire transfers is to rely on money transfer companies that support sending money overseas from Singapore.

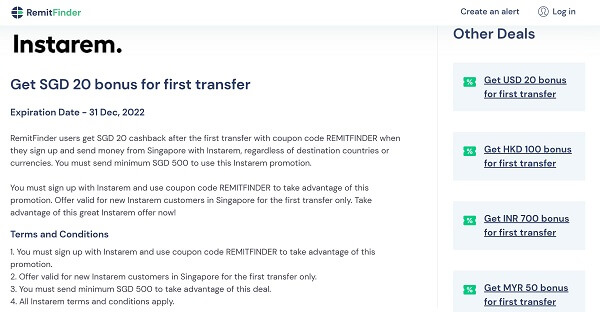

Money transfer specialists provide much better exchange rates and charge massively lower fees as compared to Singapore banks. We saw this in our case study earlier. Many money transfer companies also provide deals and promotions that help you save even more money.

For example, Instarem, our chosen money transfer company for our case study presented earlier, offers an exclusive promotion to RemitFinder customers whereby you can save an additional SGD 20 on your first transfer with Instarem.

Such deals and promotions from money transfer companies help you get even more out of your Singapore Dollar money transfers.

As compared to banks, money transfer companies operate 24x7 so you can send money anytime, and your transaction continues to progress as systems are connected to major global financial hubs. Thus, if you wanted to move money fast overseas, money transfer companies like Instarem can be a great partner to help you.

All money transfer companies listed on RemitFinder are fully regulated and authorized by major global financial watchdog institutions. This means that your money as well as confidential information are safe with them at all times.

Instarem, for example, operates as NIUM Pte Ltd in Singapore, and is regulated by the Monetary Authority of Singapore (MAS) as a Major Payment Institution under License No. PS20200276.

There are umpteen advantages to send money with money transfer companies. You will certainly get higher exchange rates and pay much lower fees as compared to banks.

There are many money transfer companies to choose from when it comes to sending money from Singapore.

You will see a gamut of providers vying for your business – all the way from big banks who have opened up remittance lines of businesses, to established money transfer giants like Western Union and MoneyGram, to smart fintech startups like Instarem and Revolut, to currency conversion veterans like XE and OFX. The list goes on and on.

With so many available choices, how do you decide who to go with? This may seem dauting at first, but is actually not. Simply use RemitFinder's online money transfer comparison engine to compare many money transfer companies side by side.

We evaluate all the strengths and weaknesses of money transfer companies in detail, and present you with in-depth and accurate information so know all you need to. The more information you have, the better decisions you can make.

Conclusion

If you wish to send money overseas from Singapore, there are many well established banks that you can send international wires with. Most Singapore banks charge standard fees and charges, but there are variations.

We presented a detailed evaluation of the top Singapore banks for sending international wire transfers, and compared their services. We also shared our recommendations to help you maximize your bank wire transfers.

Finally, we discussed the pros and cons of wire transfers, and presented alternatives to banks for sending money abroad. Money transfer companies are a great option to send money abroad from Singapore as they provide highly competitive exchange rates and charge low fees.

References:

1. DBS Bank's guide to Overseas Funds Transfer Fees and Charges

2. OCBC Bank's guide to Fees and Charges - Page 11

3. UOB Bank's Outward Remittance Fee Guide

4. Maybank's Outward Remittance Fee's for Singapore

5. Maybank's guide to overseas funds transfers - Page 3

6. CIMB Bank's remittance fees and charges

7. CIMB Bank's outward transfer FAQs

Categories

Similar Articles

CNAPS Codes Unraveled: Navigating China's Banking Landscape

Discover CNAPS Codes: China’s unique bank identifier for fast, secure transactions. Learn how CNAPS Codes simplify payments across China's banking system.

ABA Routing Numbers In The US: A Comprehensive Guide

Discover what ABA Routing Numbers are, how they work and their importance in US banking transactions like direct deposits, online transactions and wire transfers.

What Is A NUBAN Number And What Is It Used For?

Discover what NUBAN Numbers are and how they streamline bank account identification in Nigeria. Do not miss this essential guide if you transact in any way with the Nigerian banking system.