Sending Money Internationally for Free: 5 Tips You Can't Miss

- What are the costs involved in sending money internationally?

- Tips and strategies to minimize or avoid money transfer fees

- Look for companies that offer zero transfer fees

- Consider signing up for new customer offers

- Use promo codes, offers and discounts

- Use a cheaper payment method

- Use a cheaper delivery method

- Conclusion

- Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

There are a lot of different ways to send money internationally. And with so many options, it can be hard to know which is the best for you. Is it possible to make free international money transfers? Yes, it's possible. However, money transfer services are not in the business of giving stuff away for free.

Companies that offer a free service, such as 0 transfer costs, often compensate by placing an FX Markup on the mid-market rate. This margin varies by region and currency, and the costs depend on the firm and destination. It can range from as little as .01% to upwards of 10%, or even more. Because of that, the cost of the markup might exceed the apparent savings of a fee-free transfer, resulting in an overall much expensive transaction.

In this article, we will discuss our top 5 strategies and tips to help you send money overseas in a cost-effective fashion, and sometimes even for free.

What are the costs involved in sending money internationally?

Before we look into ways to save money on international remittances, let us first understand what types of costs are involved in cross border money transfers. Below are the few ways you can get charged for sending money overseas:

Transfer Fees

Money transfer companies often charge a fee as payment for their service to move money overseas. This is called a transfer fee, or a remittance fee, or simply fee.

Transfer fees can be of the following types:

- Fixed Fee: A fixed fee is a set amount of fee that generally does not vary with the transfer amount. For example, a provider may charge you USD 3.99 for any remittance send from the US. Sometimes, fixed fees can be in slabs that vary with the transfer amount. For instance, you may pay a fee of USD 7.99 for a money transfer below USD 1,000, and a fee of USD 2.99 for amounts above USD 1,000.

- Percentage Fee: A percentage fee is calculated as a percent of the transfer amount. Most providers will cap this with a ceiling amount as otherwise large money transfers will become too costly and customers may not choose to send money with them.

- Hybrid Fee: A hybrid fee is a combination of fixed and percent based fees. It is a bit less common, but still, something to be aware of.

Hidden Fees

Sometimes, money transfer companies will offer you a very bad exchange rate that is much lower than the interbank exchange rate or the mid-market exchange rate.

Note that the interbank exchange rate is the rate that big banks and financial institutions use to convert large sums of money from one currency to another amongst them. Typically, the interbank rate is not available to individual retail customers. Also, the exchange rate you typically see on sites like XE, Yahoo Finance and other news sites is the interbank exchange rate.

Inferior exchange rates means the money transfer company is charging a high FX Markup on their rates, and in the end, this hurts you since your overseas recipient gets less money in their pocket. Since the cost of bad exchange rates is not obvious sometimes, it is referred to as a hidden fee.

A great way to see if you are being hit with high hidden fees is to calculate the FX Markup on the exchange rate your money transfer company is quoting you. Good exchange rates tend to come with smaller markups around 1% or so. In the worst cases, you may even see FX Markups as high as 9-10%. This is super expensive, and you should try to find alternate options.

Delivery Charges

In some cases, the destination bank or country may have local laws or procedures whereby your recipient may be charged a fee to receive the amount. These delivery charges tend to be small, but in case you send a small amount of money overseas regularly, they may become a hindrance by lower your recipient's payout every time.

Transfer fees, hidden fees as a result of bad rates and delivery charges are various types of fees involved in international money transfers.

Now that we have discussed various types of fees involved in international money transfers, let's look into ways to avoid them!

Tips and strategies to minimize or avoid money transfer fees

If you're looking for an affordable way to transfer money overseas, here are five tips you shouldn't miss.

Look for companies that offer zero transfer fees

When it comes to finding companies that offer zero transfer fees when sending money internationally, your best bet is to search online. Money transfer companies will certainly advertise free transfers prominently on their site if they offer them.

Another option is to ask around for recommendations. If you know someone who has recently sent money internationally, they may be able to recommend a company that offered them a good rate.

Once you've found a few companies that seem promising, the next step is to research them further. Make sure to read customer reviews to get an idea of their level of service. You should also compare the rates they offer with those of other companies.

One of the best ways to automate this is to rely on a money transfer comparison platform like RemitFinder. We compare numerous remittance service providers side by side so you can easily see their exchange rates, reviews and deals and promotions.

Choosing a company that offers a low transfer fee is only half the battle. You also need to make sure that the company is reputable and that your money will arrive safely. Do your homework before making a decision, and you'll be able to find a great company to work with.

You can also read our in-depth reviews on various companies to learn more about them. We provide a few examples below:

- Revolut in-depth review

- Paysend in-depth review

- WorldRemit in-depth review

- Wise in-depth review

- Instarem in-depth review

- TransferGo in-depth review

There are numerous money transfer companies to choose from - do your research carefully before making a choice.

Consider signing up for new customer offers

When you're a new customer of an online money transfer service, you may be able to take advantage of special offers that often include zero transfer fees. This can save you a significant amount of money, especially if you're sending a large sum of money.

In addition, using an online service can simplify the process and help you avoid any potential problems that might arise from using a traditional bank.

There are a number of online money transfer services that can help you send money internationally for free as a new customer. For example, WorldRemit offers 3 free initial transfers, so you can send money without having to worry about paying high fees at least on your first 3 transactions with them.

Similarly, Paysend also gives 3 free money transfers to new customers who sign up with them and send money.

Many money transfer companies provide free transfers to new users. If you can, take advantage of these offers to save money.

Of course, you may not want to sign up with numerous companies as it will become harder for you to track so many accounts. But if you like 2-3 brands, it might not be a bad idea to sign up with them and take advantage of potential new customer offers.

Use promo codes, offers and discounts

Remittance companies also offer promotions and discounts from time to time. Some of these are ongoing, whilst others are seasonal such as during major holidays or Christmas or New Year.

Anytime you can take advantage of deals and promotions, you should as it helps to reduce your cost and increase the payout that your receiver in the destination country will get.

There are a few ways that you can find a promo code to send money internationally for free. The first way is to search online. You can try searching on Google or another search engine for "promo codes to send money internationally for free". You may also want to check websites of money transfer companies for coupons and promo codes, such as those of WorldRemit or Instarem.

Another way to find a promo code is to contact the company directly. Many companies offer customer support through chat or email, so you can reach out and ask if they have any promo codes available. It never hurts to ask!

The best way, though, is to automate this as you may miss out on deals if you only rely on manual searches. For instance, you can sign up for the RemitFinder daily exchange rate alert. It's totally free of cost, and you get the latest information about deals and promotions in your mobile app or email inbox.

Once you've found a promo code, there are a few things to keep in mind when using it. Make sure to read the terms and conditions of the promo code before using it, so you know what restrictions apply.

Additionally, some promo codes may have expiration dates, so be sure to use them before they expire. And finally, remember that not all companies accept promo codes, so be sure to check with the company first before trying to use one.

Using discounts and promotions is a great way to reduce the cost of your international money transfer, and get a higher return for your money.

Use a cheaper payment method

A payment method is a way to pay for your money transfer with a remittance company. Some popular payment methods include bank transfers, credit or debit cards, cash and local payment methods prevalent in some countries and regions of the world.

Since money transfer companies have to process your incoming payment to access the funds, they charge different fees based on how you fund your transfer with them.

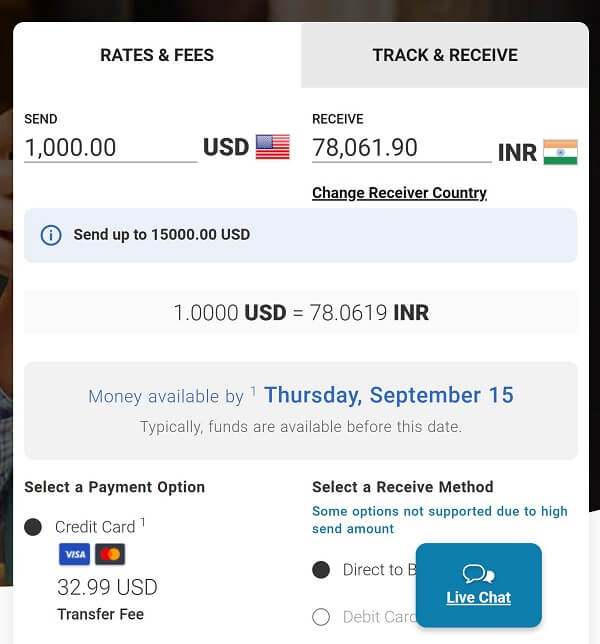

If you pay with a credit card, you will likely have to pay very high transfer fees. For example, MoneyGram charges a USD 32.99 transfer fee^ if you send USD 1,000 from USA to India, and pay with a credit card.

^ Fee as on Sep 12, 2022

What is worse is that most credit card companies treat money transfer payments as cash advance, so may be hit with exorbitant cash advances fees by your credit card company as well.

As a general best practice, try to use a direct bank transfer to pay for your money transfer. This way, the money transfer operator gets funds credited straight into their bank account, and hence they save money on payment processing. They are, therefore, able to pass on the savings to you which results in lower fees. Many companies will charge a very low transfer fee, and sometimes even 0 fee is you pay for your transfer with a bank account.

Another cheaper option is a local payment method if one is available in your country. For example, if you send money with Western Union from Australia, and use POLi to pay for your transfer, your transfer is free.

Finally, always check with your provider to see which payment methods are the cheapest. Most money transfer companies have an online calculator on their site or mobile app that you can use to check this yourself. If that is not an option, you can connect with their customer service to find out.

Pay for your money transfer with bank account or local payment methods to save money. Avoid credit cards.

Use a cheaper delivery method

A delivery method is the way in which you choose to pay your overseas recipient. It is also called a delivery option, and controls how the money transfer company will send money to your receiver.

The most popular delivery methods include bank deposits, card transfers, mobile wallet credits and cash pickups. Some providers may also provide services like door-2-door delivery whereby a local delivery service will deliver the funds to your recipient.

Much like payment methods, delivery methods also differ in cost, and money transfer companies may charge you differently for various delivery methods they support.

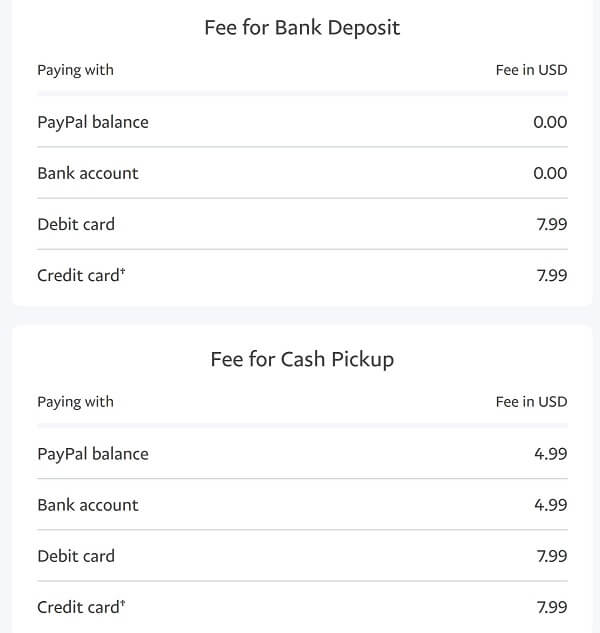

For instance, if you send USD 1000 from USA to Philippines with Xoom, you have to pay different fees for different delivery methods. If you paid for your money transfer with a bank transfer (i.e., the same payment method) but chose different delivery methods, Xoom's fees^^ change as below:

- Debit Card deposits are free

- Bank deposits are also free

- Cash Pickups get charged USD 4.99 fee

- Door 2 Door Delivery gets charged USD 4.99 fee

- Mobile Wallet credits are free

^^ Fees as on Sep 12, 2022

The below screenshot shows some of these variations.

In general, we recommend preferring electronic payment methods like mobile wallets and bank accounts as those involve lesser processing overhead for the money transfer provider. The less expensive it is for the provider to move money, the more savings they can pass on to you in the form of reduced fees.

Rely on electronic delivery methods like bank accounts and digital wallets to save on money transfer cost.

Conclusion

Sending money internationally doesn't have to be expensive. By using one of the methods above, you can send money for free without having to worry about hidden charges. Do your research and compare rates before making a decision, and you'll be sure to find a great deal.

If you're looking to cut down on the cost of sending money internationally, look no further. These five tips will help you get started with your international money transfers in a cost-effective manner.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

Categories

Similar Articles

US Big Beautiful Bill's Impact On Remittances

The Big Beautiful Bill has been passed in the US, and remittances are impacted. Learn how the Bill impacts remittances and what to do if you are affected by the new law.

Bangladesh Remittance Cash Incentive: All You Need To Know

Are you an overseas Bangladeshi resident who sends money home to your loved ones? Read on to learn how to earn an additional 2.5% cash on your international remittances sent to Bangladesh.

How Fintech Is Pushing Banks Out Of The Remittance Business

The fintech revolution is disrupting the international remittance business. Discover how innovative startups are reshaping the international money transfer industry and challenging traditional banks.