5 Secrets You Didn't Know about Sending Money to the UK

Table of Contents

- Secret tips and tricks about sending money to the UK

- Secret#1: You Don't Always Need a Bank Account

- Secret#2: You Can Get Better Exchange Rates

- Secret#3: You Don't Have to Pay High Fees

- Secret#4: You Can Send Money for Free in Some Cases

- Secret#5: You Can Get Help If Things Go Wrong

- What are the best money transfer companies to send money to the UK?

- Conclusion

- Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

If you send money to the UK, you may be tempted to think that there is not much depth to the topic of money transfers. After all, the first few choices that come to mind might be your bank or a couple of global money transfer providers.

But believe it or not, there are some secrets about sending money to the UK that even the expert money transfer senders don't always know. In this blog post, we'll share five of them with you.

Whether you're planning to send money abroad for the first time, or you're just looking for ways to save on your next transaction, read on for some helpful tips.

Secret tips and tricks about sending money to the UK

Every year, a lot of people send money to the UK from all over the world. If you are one of them, you would naturally want to maximize the return on your remittances. There are several tips and tricks that can help you save money; below are 5 of our favorite ones:

Secret#1: You Don't Always Need a Bank Account

If you're looking to send money to the UK from another country, you might assume that you need a British bank account. But this isn't always the case. There are now several money transfer providers that offer alternatives to bank-to-bank transfers.

For example, Wise (formerly TransferWise) allows you to send money using your debit or credit card, or even with local payment methods in some countries. This can be a convenient option if you don't have a UK bank account, or if you want to avoid the fees associated with international bank transfers.

The same applies on the recipient side as well. Many people sending money to the UK assume that their recipient must have a local bank account in the UK to be able to receive the money they send to them. But this is simply not true.

Whilst you can always send money to a UK bank account, there are many other ways like card transfers (a specialty of Paysend) as well as mobile money transfers. Many companies also support cash pickup at thousands of agent locations in the UK.

So, if your recipient does not have a bank account, or does not want to share their bank information with you, you can still send money to them using many other delivery options.

Neither you nor your recipient need a bank account to send and receive remittances in the UK.

Secret#2: You Can Get Better Exchange Rates

When you send money abroad, you'll usually need to pay attention to the exchange rate. This is the rate at which one currency is converted into another, and it fluctuates rapidly just like the equities traded on the stock market.

When the exchange rate is favorable, you'll get more pounds for your money. But if it's not so good, you could end up losing out.

The good news is that there are now several ways to get better exchange rates. For example, you can use a service like Revolut, which tends to use high exchange rates that are sometimes very close to the mid-market exchange rate (also called the interbank exchange rate).

The mid-market rate is the exchange rate that big banks use when they trade huge amounts of money with each other. This means that you'll never be worse off than if you'd used your bank. And in many cases, you'll be better off, as Revolut charges a low, transparent fee instead of hidden markups.

The currency exchange rate will have a major impact on how much money your overseas recipient gets in the UK.

The other important aspect of getting better exchange rates is the timing of your international money transfer. You can, of course, manually check exchange rates numerous times a day. By doing so, you may sometimes be able to successfully time your transfer when rates are high. But it's also possible you may not.

A better and easier approach is to rely on RemitFinder's daily exchange rate alert. It's totally free, and you get information about the latest exchange rates and promotions straight into your RemitFinder mobile app or in your email inbox. Let us do the hard work for you so you can save your precious time and money.

Secret#3: You Don't Have to Pay High Fees

When you send money abroad, you'll usually need to pay fees to your bank or transfer provider. These can vary widely, so it's important to compare your options before you make a transfer.

Banks typically charge high fees for international money transfers. They may also add on hidden charges, like markup on the exchange rate. This means that you could end up paying a lot more than you need to.

Banks generally provide lower exchange rates and charge higher transfer fees.

On the other hand, there are now several money transfer providers that charge low, transparent fees. For example, XE Money Transfer charges a fixed fee for each transfer, no matter how much money you're sending. This makes it easy to know exactly how much your transfer will cost, so there are no surprises.

Since the market keeps changing and so do the fees that money transfer companies charge, we strongly recommend that you compare providers when you are ready to execute your money transfer.

By looking at the latest exchange rates, fees and offers from many money transfer companies, you can rest assured that you have all the information you need to make better decisions.

Secret#4: You Can Send Money for Free in Some Cases

Sometimes, it may be possible to send money to the UK for free.

For example, the below scenarios may happen from time to time, or depending on which money transfer provider you use:

- Fee free transfers with some providers: Some companies may let you send money for free to the UK. For example, if you send money to the UK from the United States with XE, you do not pay any transfer fee as long as you send a minimum amount of USD 500.

- First few transfers free for new users: In many cases, remittance providers offer discounts to gain your business. One way they do this is by offering free transfers for new customers. For example, if you send money to the UK with WorldRemit, your first 3 transfers are free.

- Promotions and discounts: Many money transfer operators offer ongoing or season discounts and offers that sometimes include cashbacks or free transfers. For example, at the time of this writing, you can send free transfers to UK with Panda Remit as a new customer.

Keep an eye on all the above types of opportunities for sending free money transfers to the United Kingdom. You work hard for your money, and should avail of any scenarios that help you save even more.

Secret#5: You Can Get Help If Things Go Wrong

If you're sending money abroad, it's important to know what to do if something goes wrong. Fortunately, there are now several ways to get help if your money transfer doesn't go as planned.

First, be sure to contact customer service for the money transfer company you're using. That should always be your first line of defense for any questions or concerns. But if they can't help, there are other options.

For example, the Financial Ombudsman Service is a free service that can help you resolve disputes with financial businesses, like banks and transfer providers. If you've been treated unfairly or you think you've been mis-sold a service or product, you can make a complaint to the Financial Ombudsman Service.

You can also use the European Consumer Center with the European Commission to get help with disputes involving businesses in other European countries. And if you've been the victim of fraud, you can report it to Action Fraud, the UK's national fraud reporting center.

These are our 5 top tips that can hopefully help you save some money on your next UK money transfer.

What are the best money transfer companies to send money to the UK?

The good news is that there are many good choices to send money internationally to the UK.

From currency exchange veterans like XE Money Transfer to mature money transfer operators like Wise, WorldRemit and Instarem to financial ecosystems like Revolut to fintech startups like Panda Remit and CurrencyFair – you have so many good companies to choose from.

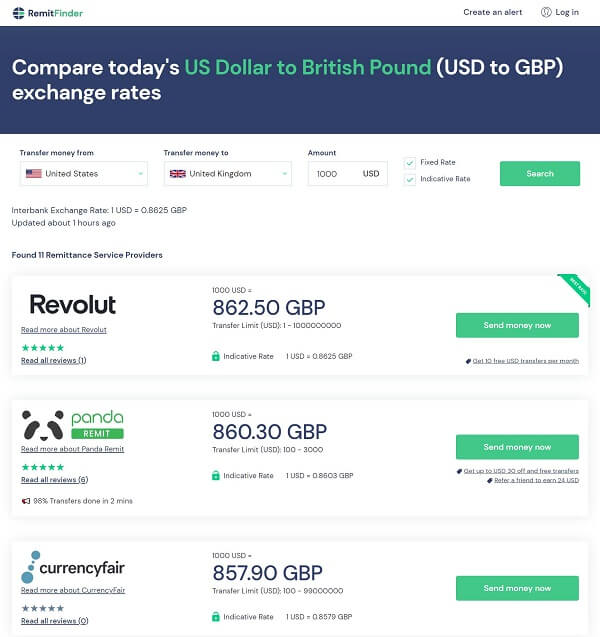

Below is a screenshot of a US to UK money transfer search on RemitFinder showing numerous money transfer companies available for the said remittance corridor.

All these money transfer operators have strengths and weaknesses, and you should do your due diligence on each one of them to see which one suits your needs the best.

To assist you with such research, we review money transfer companies in depth, providing you with maximum facts and information about them. Below are some examples of our detailed reviews about some providers:

Check out our list of money transfer providers to read detailed reviews and learn more about them.

Finally, you can also use the below money transfer comparison pages to get started on your UK money transfers:

- Send money to the UK from USA

- Send money to the UK from Germany

- Send money to the UK from Canada

- Send money to the UK from Australia

- Send money to the UK from France

- Send money to the UK from Spain

- Send money to the UK from Singapore

- Send money to the UK from Switzerland

- Send money to the UK from Japan

- Send money to the UK from New Zealand

For additional countries, simply search for your country combination on RemitFinder and compare various options available.

Conclusion

Sending money abroad to the UK doesn't have to be complicated or expensive. With a bit of planning, you can save yourself time and money. Follow our guidelines presented above and maximize the return on your UK remittances. Plus, if something goes wrong, there are now several ways to get help.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

Categories

Similar Articles

US Big Beautiful Bill's Impact On Remittances

The Big Beautiful Bill has been passed in the US, and remittances are impacted. Learn how the Bill impacts remittances and what to do if you are affected by the new law.

Bangladesh Remittance Cash Incentive: All You Need To Know

Are you an overseas Bangladeshi resident who sends money home to your loved ones? Read on to learn how to earn an additional 2.5% cash on your international remittances sent to Bangladesh.

How Fintech Is Pushing Banks Out Of The Remittance Business

The fintech revolution is disrupting the international remittance business. Discover how innovative startups are reshaping the international money transfer industry and challenging traditional banks.