Top Money Transfer Companies to Send Money from Singapore

Table of Contents

- Different Ways to Send Money from Singapore

- The Best Money Transfer Companies to Send Money from Singapore

- How to Choose the Best Money Transfer Company

- Most Popular Global Destinations to Send Money from Singapore

- Conclusion

There are many money transfer companies to choose from when sending money from Singapore. It can be difficult to decide which company is right for you, especially if you have never sent money before.

In this article, we present the best money transfer companies that operate in Singapore and discuss what makes them stand out from the competition. We will also provide a brief overview of how each company works and present their pros and cons so you can decide which is best for your needs.

Different Ways to Send Money from Singapore

When you are looking to send money from Singapore, there are a few different ways to do so. You can do an international wire transfer through a bank, use a money transfer service, or even use PayPal.

Even though wire transfers with banks are secure and convenient, the biggest problem you will run into is very high wire transfer fees and low exchange rates. In fact, we did a detailed analysis of the most popular Singapore banks to send international wire transfers, and noticed very high wire transfer fees charged.

PayPal is in the same boat. It's certainly convenient to use PayPal to send money to family and friends and make online purchases, anytime currency conversion is involved, you will likely be worse off. This is because PayPal also charges high fees and also a 3-4% FX Markup to give you a much lower exchange rate.

Both wire transfers and PayPal are costly ways to send money internationally from Singapore.

This leaves money transfer companies as the most economical and best option to send money from Singapore. The good news is that there are so many of them that we are sure you will find at least a few that will match your needs.

The Best Money Transfer Companies to Send Money from Singapore

Singapore is a truly global city nation, and so many people from all over the world go there for studies, work, leisure, living and so on. Given this, sending money from Singapore is a very frequent need that Singaporean expats have.

It is, therefore, no surprise that there are numerous money transfer companies active in Singapore. This is great news for you as more choice means more competition amongst these companies for your business. And more competition generally means better outcomes for the consumer.

Let's check out some of the best money transfer operators you can use to send money overseas from Singapore.

Revolut

Revolut is a financial ecosystem with a ton of financial products and services you can use. It is basically an app where you can save and invest money, do banking, make purchases, and much more.

One of the things you can also do with Revolut is send money overseas. Revolut supports sending money from Singapore to numerous global destinations to you should definitely check them out.

Key benefits of Revolut include the below:

- Very competitive exchange rates that are not too far off the interbank exchange rates. This means your Singapore Dollars can buy more foreign currency.

- Low, transparent fees that do not make a big dent in your pocket.

- Attractive promotion for RemitFinder users whereby you can get an SGD 15 cashback reward as a new user.

- No sending limits, making this a good choice for sending large sums of money abroad.

- Many flexible payment methods to fund your international money transfer.

Instarem

Instarem is a mature fintech company that actually started in Singapore in 2014, and has grown by leaps and bounds since then to become a truly global player in the modern international remittance ecosystem.

Today, Instarem supports money transfers between hundreds of global destinations, and supports numerous major currencies of the world. Despite their massive growth, Instarem continues to have strong focus on Singapore, their original home where they started from.

Key benefits of Instarem are as follows:

- Strong corridor coverage whereby you can send money from Singapore to over 50 global destinations spread across all continents. Plus, the team at Instarem keep adding more countries as part of their ongoing growth.

- Very competitive exchange rates and low transfer fees make Instarem a cost effective way to send money abroad.

- Quick transfers that mostly finish instantly, otherwise within 4 business days.

- Exclusive promotion for RemitFinder users whereby you can earn an SGD 20 bonus on your first transfer from Singapore.

- Many flexible options to pay for your money transfer in Singapore that include PayNow, Bank Transfer, Credit Card & Debit Card.

Panda Remit

Next on our list of the best Singaporean remittance companies is Panda Remit. They started out in Hong Kong in 2018, and have been growing at a rapid pace since then. Panda Remit is owned by Wo Transfer (HK) Limited.

Panda Remit is on a mission to make international remittances accessible to all as well as quick, cheap and easy. They are an online only operator with no physical branches or locations to go to. This helps them cut costs and pass on additional savings to customers.

Major advantages of Panda Remit are as below:

- Highly competitive exchange rates; Panda Remit is regularly in the top few ranks on RemitFinder's money transfer comparison engine.

- 0 fees, especially for new RemitFinder customers who sign up and send money with Panda Remit.

- No money transfer limits which means you can use them for sending larger sums abroad.

- Quick international money transfers with more than 98% transactions clearing within 2 minutes.

- Exclusive cashback promotion for RemitFinder customers whereby you can earn SGD 5 bonus on your first money transfer.

XE Money Transfer

XE, a veteran in the international currency exchange business with an experience of more than 25 years, needs no introduction. No one knows currencies and foreign exchange like XE does, so you can rest assured you are in safe hands.

With more than 60 million app downloads and more than 100,000 customers who have sent money with XE, you get the best of class service that lets you send money between 98 global currencies to more than 130 countries worldwide.

In additional to regular instant international money transfers, you can also book forward contracts and market orders to take advantage of additional flexibility to control the best timing as well as best exchange rates for your remittances.

Major benefits of XE are as below:

- Very competitive exchange rates – XE is regularly a top contender in RemitFinder's comparison for various global corridors.

- Very low transfer fees that are also waived if you send above a minimum threshold. Currently, for Singapore, there is no fee to send money internationally.

- Robust currency and country support – send in up to 98 global currencies to more than 130 countries worldwide with XE.

- No sending limits allow you to send large amounts easily. Couple that with very good exchange rates and 0 fees, and your Singapore Dollars can buy a lot more foreign currency.

- Deep expertise in the international money transfer business with more than 25 years of experience. You know you are dealing with a true specialist when you send money with XE.

Wise (formerly TransferWise)

Wise is a money transfer service that's designed to be simple and transparent. With Wise, you always know exactly what you are paying and there are no hidden fees. You can also hold and convert money in more than 40 currencies.

Wise was created to make it easier and cheaper to send money abroad. To do this, Wise has created its payment network that eliminates the inefficiencies and excessive costs traditionally associated with international payments.

Wise's cost-transparency policy lets you always know what fees you will incur upfront, with no hidden charges. If you need to frequently receive, hold, or exchange currencies, their multi-currency account could benefit individuals and businesses as it offers the real exchange rate for 50+ international currencies in one place.

Key benefits of Wise include:

- Various options for sending money locally as well as internationally with support for numerous global destinations.

- Very competitive exchange rates that are not too far off of the interbank exchange rate. This helps maximize the payout for your overseas recipient.

- Strong focus on safety and security of your money as well as private information. Fully regulated and authorized by the Monetary Authority of Singapore (MAS) as a Payment Institution.

- Wise multi-currency account enables you to hold numerous currencies in a single account, and makes it convenient and easy to make overseas purchases when traveling abroad.

- Excellent customer feedback and ratings on many popular rating and review platforms.

OFX

OFX is one of the leading international money transfer services available. It's efficient, has no fees, and covers a wide range of currencies. OFX is the perfect platform for anyone who needs to transfer money internationally.

There are very low fees and funds can be transferred to 55 different currencies within one working day, making OFX ideal for those who need to send money quickly and without any hassle.

OFX caters to customer needs with services such as 24/7 phone support, personal brokers, and currency management solutions. Although businesses can take advantage of a global currency account with OFX, this service isn't open to personal customers. Nevertheless, they can make online and in-app international payments that go directly into bank accounts.

Major benefits of OFX include the below:

- Send to more than 190 countries in over 55 currencies – this literally would cover almost everywhere you may need to send money to.

- No sending limits that make this an ideal choice for sending large sums of money abroad in a single transaction.

- Relatively fast money transfers that mostly finish in 1-2 business days.

- Exclusive promotion for RemitFinder users whereby your first 10 money transfers are free of cost. This is a great way to save up to AUD 150 since the standard OFX transfer fee is AUD 15 for transfers under AUD 10,000.

- Ability to make direct tax payments to the Australian Taxation Office (ATO) or the Inland Revenue Department (IRD) in New Zealand directly from your OFX account. If you are an Aussie or Kiwi expat in the Singapore, you can take advantage of this.

These are some of the top companies to send money from Singapore. Hopefully you can see their distinct advantages and this can be useful information to have to be able to decide who to go with for your next money transfer.

How to Choose the Best Money Transfer Company

When sending money internationally from Singapore, it is important to get the best exchange rate to maximize the amount of money that arrives at its destination. There are a few factors to consider when looking for the best exchange rate, but the most important one is the money transfer company you choose.

The fees charged by the money transfer service will also affect the payout your overseas recipient will receive. Some money transfer services charge a flat fee, while others charge a percentage of the total amount being sent.

Exchange rates and transfer fees are two of the most important factors to consider when sending money overseas.

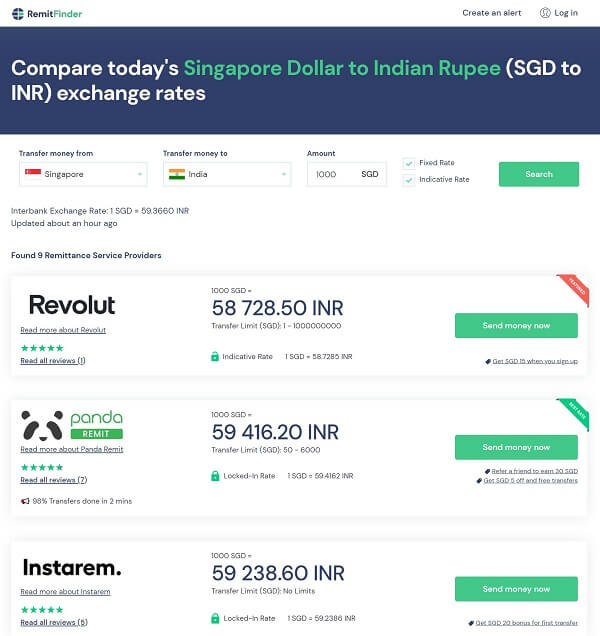

The good news is that there are numerous money transfer companies competing for your business. For example, below is a screenshot of various money transfer companies you could use to send money from Singapore to India.

As you can see, there are numerous money transfer companies with closely matched exchange rates for this popular remittance corridor. You can easily compare their pros and cons and pick the ones that suit your needs the best.

Most Popular Global Destinations to Send Money from Singapore

With so many foreigners and expats living in Singapore, the number of countries remittances are sent to is very large.

That said, below are some of the most popular destinations to send money from Singapore:

- Send money from Singapore to India

- Send money from Singapore to Philippines

- Send money from Singapore to China

- Send money from Singapore to Malaysia

- Send money from Singapore to Indonesia

- Send money from Singapore to Pakistan

- Send money from Singapore to United States

- Send money from Singapore to Canada

- Send money from Singapore to United Kingdom

- Send money from Singapore to Australia

- Send money from Singapore to France

- Send money from Singapore to Germany

For numerous destinations to send money from Singapore, an easy way to compare money transfer companies is to rely on RemitFinder's online money transfer comparison platform.

All you have to do is enter your source and destination countries, and the amount you want to send, and you will be presented with an easy to understand comparison table. This way, you can compare numerous providers side by side.

Not only can you see exchange rates and related information from various remittance service providers, but you can also take advantage of numerous coupons and promotions from these companies.

Finally, you can read detailed review about many money transfer operators to learn more about their services.

Conclusion

There are many good money transfer companies available to send money from Singapore to numerous popular global destinations. Make sure to do your due diligence so you can maximize the value of your Singapore Dollars and put the most money in your recipient's pocket.

Categories

Similar Articles

US Big Beautiful Bill's Impact On Remittances

The Big Beautiful Bill has been passed in the US, and remittances are impacted. Learn how the Bill impacts remittances and what to do if you are affected by the new law.

Bangladesh Remittance Cash Incentive: All You Need To Know

Are you an overseas Bangladeshi resident who sends money home to your loved ones? Read on to learn how to earn an additional 2.5% cash on your international remittances sent to Bangladesh.

How Fintech Is Pushing Banks Out Of The Remittance Business

The fintech revolution is disrupting the international remittance business. Discover how innovative startups are reshaping the international money transfer industry and challenging traditional banks.