How to Send Money to Vietnam from the US the Right Way

Table of Contents

- International Wire Transfer

- Money Transfer Service

- PayPal, Money Orders and Other Options

- Useful Tips to Send Money from US to Vietnam

- Pay attention to exchange rates

- Compare money transfer companies

- Keep an eye on deals and promotions

- Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

Sending money to Vietnam from the US can be a little confusing if you don't know what you're doing. Fortunately, this guide will show you exactly how to do it the right way.

We'll review some of the best ways to send money, as well as some of the most popular methods used in Vietnam. Whether you're looking to send money for personal reasons or for business purposes, this guide has you covered!

International Wire Transfer

When you send money internationally via a wire transfer, there are a few things to consider. You want to make sure the process is safe and reliable as a top most priority. That's why an international wire transfer is one of the best ways to send money from the US to Vietnam.

Here's what makes it one amongst the best methods:

- Safety: When you send money via an international wire transfer, you can rest assured knowing that your money is safe. The process is highly regulated, so you can be sure that your funds will arrive at their destination without any problems.

- Reliability: International wire transfer is a tried and true method of sending money internationally. With a little research, you can find a reputable bank that will send your funds quickly and without any issues.

- Convenience: Sending money via wire transfer is very convenient. You can do it from the comfort of your own home, and in worst cases if your bank does not support online wire transfers, by going into your local bank branch.

- Transfer limits: Banks generally have very high transfer limits, and sometimes no limits, for international wire transfers, so you are able to send larger amounts easily. Even if you bank enforces an upper limit, it will likely still be higher than limits imposed by other channels like money transfer companies and international money order.

There are some disadvantages as well when it comes to sending money via wire transfers via your bank. We list some of the major ones below:

- Inferior exchange rates: Banks generally provide not so good exchange rates on international wire transfers. You can get better prices via other channels.

- High transfer fees: Most banks in the US charge pretty high wire transfer fees. This will have a detrimental impact on your payout, especially for smaller amounts. For example, Well Fargo changes a USD 45 fee for outgoing international wire transfers. So, if you send a smaller amount like USD 100 or USD 200, you literally lose a huge chunk of your money in fees.

- Slower transfer speed: Bank transfers can take days sometimes. Public and bank holidays, involvement of many banks in the end to end transfer process, and processing cut off times are all factors that impact the speed of your transfers.

In a nutshell, there are many pros and cons to using banks for international wire transfers. Depending on your needs, this may be a good option though.

Use international wire transfers for large transfer amounts if you can get a decent exchange rate.

Unless the above conditions are true, you may want to look at other alternatives as well, and compare options to pick what is best for you. In the next section, we present another great option to send money to Vietnam.

Money Transfer Service

There are a number of reasons why money transfer services have become one of the most popular ways to send money from the US to Vietnam. First, they offer a much more convenient and hassle-free way to send money than traditional bank transfers.

Another reason money transfer services are a great option for senders is that they tend to be much cheaper than bank transfers. This is because banks often charge high fees for international money transfers, which can eat into your budget. On the other hand, money transfer companies charge much lower fees, sometimes absolutely 0 fees.

Finally, money transfer services offer much better exchange rates than banks provide, which means you can get more Vietnamese Dong for each US Dollar you send overseas. This is essential when sending large sums of money, as it can make a big difference in the amount of money you end up receiving.

Money transfer companies offer numerous advantages over other ways to send money to Vietnam.

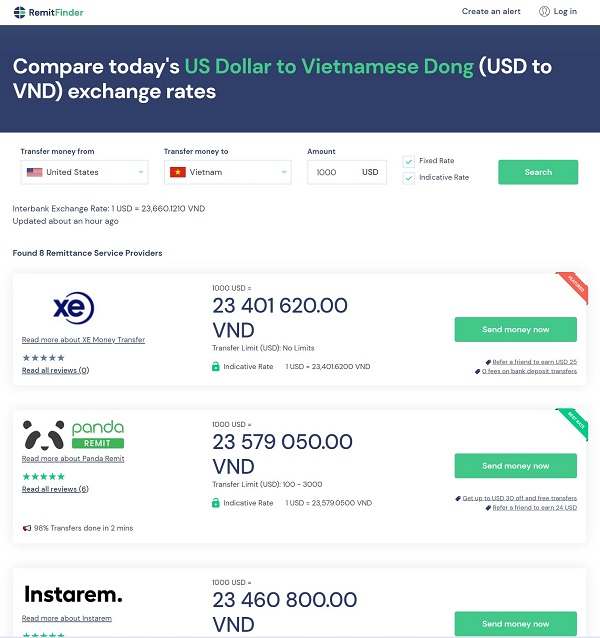

Below is a screenshot showing various money transfer companies that operate in the US-Vietnam money transfer market.

How do you decide which company to go with? We provide some helpful information below.

Which money transfer company should I use to send money from US to Vietnam?

There are many different money transfer companies available, so it is important to compare them before choosing one.

Some factors you may want to consider include fees, exchange rates, and speed of service. Additionally, it is important to choose a service that is secure and reliable, and has a good reputation.

Below, we have compiled a list of some of the most reliable and affordable money transfer services available for sending money from the US to Vietnam. All allow users to send money directly to a bank account or mobile wallet in Vietnam.

We highlight 2-3 key advantages of each company below which may provide helpful to your research when comparing these providers.

XE Money Transfer

The key advantages of using XE Money Transfer include:

- Good exchange rates

- Very low, often 0 fees – If you send more than USD 500, your transfer is always free. For transfers below USD 500, you will have to pay a small fee of USD 3.

- No limit to how much money you can send

Panda Remit

Panda Remit offers the below benefits for sending money to Vietnam:

- Very fast transfers – Most of Panda Remit's money transfers finish within 2 minutes

- Very competitive exchange rates

- Flexible delivery options including mobile wallets

Instarem

Instarem is another great choice to send money from US to Vietnam, and offers the below advantages of using their service:

- Very good exchange rates

- Low, transparent fees

- No transfer limits if paying for your transfer with a bank account

Remitly

Remitly can be a good partner to move your money overseas to Vietnam, and has the below plus points:

- Flexibility to choose between various delivery speeds called Economy and Express – both options come with varying exchange rates and fees and you can pick one or the other based on your needs.

- Higher transfer limits that increase further with membership levels

- Flexible payment method support – For the US, you can use debit cards, credit cards, prepaid cards, bank accounts and Remitly's Passbook Visa card to pay for your money transfers.

Wise

Wise (formerly Transferwise) is another solid money transfer company you cannot go wrong with. Benefits of using Wise include:

- Bank grade security to protect your money and information

- Very transparent and clear pricing structure so you never pay a hidden fee

- Great reviews and feedback from customers

Paysend

The major advantages of using Paysend for international money transfers are as below:

- Low transfer fees – For US transfers, you pay a low flat fee of USD 2 per transfer

- Higher transfer limits possible – Initially, Paysend allows you to send smaller amounts abroad. But you can provide more documentation to get your limit raised or even removed altogether.

- Extremely fast transfers – 70% of Paysend international money transfers finish in 20 seconds!

OFX

OFX is a money transfer specialist that can help you send money from US to Vietnam with the below advantages:

- More than 20 years of experience in the currency exchange business, so you can rest assured you are in good hands

- No transfer fee above AUD 10,000 equivalent transfer amount

- No transfer limits – you can send as much money as you want with OFX

WorldRemit

WorldRemit is our final entry on the list, below are some of the strengths of their money transfer services:

- First 3 transfers are always free – With WorldRemit, your first 3 money transfers come with 0 fee after you sign up and send money with them.

- Fast money transfers – Many WorldRemit money transfers finish instantly, and the rest within 1-2 business days.

- Flexible payment and delivery options – You can choose from many ways to pay for your money transfer as well as how you pay your overseas recipient in Vietnam.

Check out our detailed reviews on these companies to learn a lot more about them. We have analyzed their money transfer services in-depth so you have all the information you need readily available.

- XE Money Transfer detailed review

- Panda Remit detailed review

- Instarem detailed review

- Remitly detailed review

- Wise detailed review

- Paysend detailed review

- OFX detailed review

- WorldRemit detailed review

PayPal, Money Orders and Other Options

There are some additional options to send money to Vietnam from the United States as well. For example, you can use PayPal for international money transfers. But be ready for not so good exchange rates and high fees.

Similarly, you could send an international money order with the US Postal Service (USPS) by visiting a USPS Post Office. But again, the transfer fee is pretty high (almost 50 Dollars) and you can only send up to USD 700 max. Finally, you will likely get sub-optimal exchange rate.

Other options like Cashier's Checks may fulfil traveling needs, but can be easily lost or stolen. Same with cash.

Finally, note that Venmo is not an option given it only works within the US, and not internationally. You cannot, therefore, use Venmo to send money from the US to any other country like Vietnam.

Other options like PayPal, money orders, cashier's checks, etc. for sending money to Vietnam have shortcomings; research well before you use any of them.

In the end, international wire transfers via banks and remittances via money transfer operators stand out as the 2 best options to send money overseas to Vietnam.

Useful Tips to Send Money from US to Vietnam

Below, we have compiled a list of some useful tips that can help you maximize the return on your US money transfers to Vietnam:

Pay attention to exchange rates

Since currency exchange rates fluctuate rapidly like the equities listed on the stock market, you would want to time your international money transfer as best as possible to get a better rate.

You can monitor rates manually, but we recommend using the RemitFinder daily exchange rate alert. It's totally free, and you will receive the latest exchange rate information sent to you every day vs having to search.

Compare money transfer companies

We always recommend to compare various providers to ensure you are getting the best deal available. Even if you have your favorite money transfer company you always send with, it is still better to compare them with others.

You may just get a better return on your transfer elsewhere. If nothing else, you will be able to validate that your usual provider is the best so you have peace of mind that you are not losing out.

Keep an eye on deals and promotions

Another great way to save even more money on your money transfers to Vietnam is to take advantage of ongoing promotions and discounts that companies provide.

For example, at this time, you can utilize some of the below deals from the companies listed on RemitFinder:

- Up to USD 30 off when you send money with Panda Remit

- USD 20 bonus for new customers who sign up with Instarem

- First 3 transfers totally free when you register with WorldRemit

- 10 free money transfers when you create a new account with OFX

- 3 free money transfers for new Paysend customers

Follow these tips and get smarter about your next money transfer from the US to Vietnam. You work hard for your money, so you should always strive to make the most of your international money transfers.

This concludes our guide on all you need to know about how to send money to Vietnam from the US. Hopefully, this article has helped clear some things up for you and armed you with the knowledge necessary to make a decision on which method of transfer is best for your needs.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

Categories

Similar Articles

US Big Beautiful Bill's Impact On Remittances

The Big Beautiful Bill has been passed in the US, and remittances are impacted. Learn how the Bill impacts remittances and what to do if you are affected by the new law.

Bangladesh Remittance Cash Incentive: All You Need To Know

Are you an overseas Bangladeshi resident who sends money home to your loved ones? Read on to learn how to earn an additional 2.5% cash on your international remittances sent to Bangladesh.

How Fintech Is Pushing Banks Out Of The Remittance Business

The fintech revolution is disrupting the international remittance business. Discover how innovative startups are reshaping the international money transfer industry and challenging traditional banks.