5 Ways to Send Money to Thailand from USA without Breaking Your Wallet

Table of Contents

- What to watch out for when sending money to Thailand from the US?

- What are the best ways to send money to Thailand from the US?

- Method #1: International Wire Transfer

- Method #2: Remittance via a Money Transfer Company

- Method #3: Send Money via a Currency Exchange Broker

- Method #4: Multi-Currency Bank Accounts

- Method #5: International Money Orders

- Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

Do you have family or friends in Thailand to whom you need to send money? Maybe you're planning a vacation and need to get your currency converted ahead of time. No matter what the reason, there are plenty of ways to send money to Thailand without breaking the bank.

In this article, we will share key information to look out for when deciding which option to use to send money to Thailand, and share our top 5 picks for actually making your money transfers. Check out all this information below!

What to watch out for when sending money to Thailand from the US?

Before we present the options to send money from the US to Thailand, we want you to be aware of the top areas to keep an eye for when evaluating various choices. Knowledge of these aspects of money transfers will help you evaluate choices against these criteria, and make more informed decisions for your remittance needs.

Below are the key factors to consider for money transfers to Thailand:

Currency Exchange Rates

The exchange rate is one of the most important factors that influence your international money transfer, so it's critical to keep an eye on it. The currency exchange market experiences constant fluctuations like the stock market, so you would want to pay close attention to ever-changing rates.

There are also other considerations related to exchange rates. For example, if you go through your bank to send money to Thailand, you will likely get a poor exchange rate. This is because banks typically mark up the exchange rate by around 3-5%.

On the other hand, foreign exchange companies don't have the same high overhead costs as banks, so they can offer you a much better exchange rate. This can end up saving you a lot of money in the long run.

Money Transfer Fees

The fee your money transfer agent or company charges you to send money overseas with them is called the money transfer fee. Just like the exchange rate, the transfer fee is also a very important factor that will have a direct influence on your bottom line.

Banks and money transfer companies charge varying fees, and you should also calculate how much dent will the fee put into your recipient's final payout.

In general, when you use money transfer companies to send money to Thailand, you won't have to pay extra fees, unlike using a traditional bank. With banks, you'll incur a transfer fee, markup on the exchange rate, and even SWIFT fees. SWIFT stands for Society for Worldwide Interbank Financial Telecommunications, a secure way for banks to send messages about payments.

Foreign exchange companies make their money by making a profit on the exchange rate. On the other hand, as stated above if you were to go through your bank, they would likely charge you a transfer fee that can be quite expensive. In addition, you get a worse exchange rate which further cuts your payout by acting as a hidden fee. All these direct and indirect fees can add up quickly and eat into your profits.

Banks tends to charge high fees and provide poor exchange rates - this lowers the payout on your money transfer.

Money Transfer Speed

The speed of your money transfer may also have a direct impact on the cost effectiveness of your money transfer, and is our next important factor to consider for international money transfers to Thailand.

This is because some money transfer providers will charge you additional or higher fees to move your money to Thailand faster.

That is why using money transfer companies to send money to Thailand could be an advantage since the funds will arrive quickly. Typically, the money will arrive within 1–2 days.

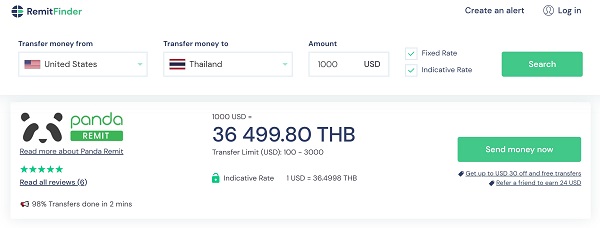

Some companies are able to move money overseas very, very fast – sometimes instantly or within minutes. For example, Panda Remit completes most of their transfers within 2 minutes.

They can, thus, be a great choice for sending money to Thailand if you need to rush funds very quickly to friends and family back home.

On the other hand, if you were to go through your bank, it could take up to a week for the money to arrive. This is because banks have to process the transfer through their systems, which can take a while.

Money Transfer Amount

Finally, the amount of money you send overseas can also have an impact on your final return. This is because the lesser money you send, the more fees the money transfer operator may charge since they still have to incur the fixed cost of moving money overseas.

For example, XE Money Transfer charges USD 3 fee if you send less than USD 500 with them. For transfers above USD 500, you pay 0 fees.

The other implications you need to be aware of sending money to Thailand are as follows:

- While there is no limit on how much money can be transferred to Thailand, transfers of USD 1 million or higher must either be converted into Thai baht immediately or deposited into a foreign currency account in a local bank within 360 days of the transfer.

- If USD 20,000 or more is physically brought into the country, it must be declared.

Large value transfers to Thailand must be converted to Thai Baht or held in a foreign currency account.

Now that we have discussed the top most factors you should consider when sending money from the United States to Thailand, let's look into the best ways to send money next.

What are the best ways to send money to Thailand from the US?

Below are our top 5 picks for sending money transfers internationally from the Unites States to a Thai resident living in Thailand:

Method #1: International Wire Transfer

An international wire transfer is one of the popular ways to send money from the USA to Thailand. This method is very convenient because it can be done via your bank. You already work with you bank for managing your accounts, so it is quick and easy to also send an international wire through your bank.

Most popular US banks have international wire transfer facilities available. There is a lot of variation in their wire transfer fees and limits, so make sure to do your research.

The process is of sending a wire transfer is pretty simple. You will need to have a bank account in the United States that is able to send money internationally via wire transfers. Most banks have simple one page forms to fill to start your transfer request; you can do this online on their website or by visiting your local branch.

You will need to provide recipient information, their Thai bank information, the receiving bank account number in International Bank Account Number (IBAN) format and the amount you want to send. That's it – your bank will do the rest.

Note that most banks charge pretty high fees for sending international wire transfers. Plus, you may not get a great exchange rate either. Hence, wire transfers may not be the most cost-effective way to send money to Thailand from the US.

Additionally, it can take some time for the money to reach the destination bank account. This is because multiple hops may be involved with intermediary banks, and national or regional holidays as well as bank cut off times may introduce further delays.

Wire transfers may not be the most cost-effective way to send money internationally to Thailand, but have advantages like convenience and safety. Plus, you can send large amounts.

That said, wire transfers are safe and convenient, and you can generally send pretty high amounts. For one time transfers for sending large amounts of money, they can be a good choice.

Method #2: Remittance via a Money Transfer Company

An online money transfer service is one of the most affordable ways to send money to Thailand from the USA. When you use an online money transfer service, you are able to avoid the high fees charged by banks and other financial institutions. Additionally, money transfer companies tend to provide much better US Dollar to Thai Baht exchange rates.

Here are some tips when sending money to Thailand from the USA using an online money transfer service:

- Use a reputable money transfer service that offers security and is regulated by major financial institutions like the Financial Crimes Enforcement Network (FinCEN) in the United States.

- Look for competitive exchange rates as the rate you get will have a huge impact on the final payout amount.

- Keep an eye on transfer fees as they will eat out your payout. The lesser, ideally none, fees you pay, the more money your recipient in Thailand will get.

- Look for reliability and good service by checking reviews and ratings from other customers on Trustpilot as well as Google Play Store and Apple App Store if the provider has a mobile app.

By following these tips, you can send money to Thailand from the USA without breaking your budget.

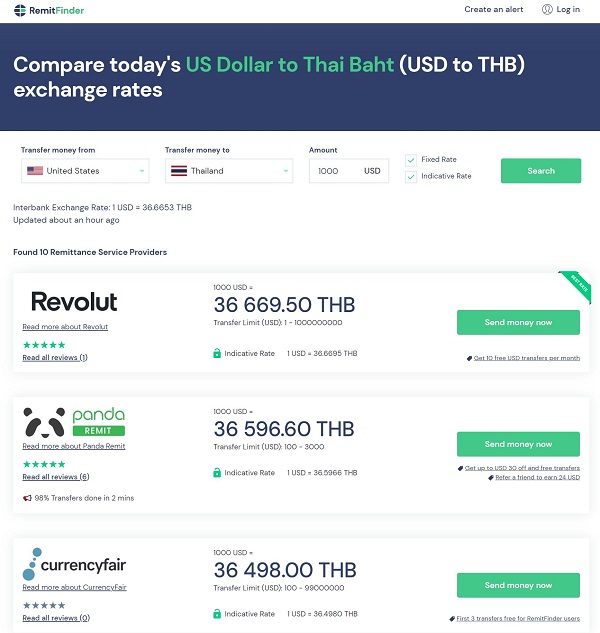

For US to Thailand money transfers, luckily you have many good options to choose from. Below is a screenshot from RemitFinder showing almost a dozen money transfer providers that you can use.

That is a good number of choices for you to explore. You can evaluate these providers on the criteria we touched upon earlier so you can compare their money transfer services and pick the one that suits your needs best.

Another helpful resource is detailed reviews about these providers; we share some examples below:

- Panda Remit detailed review

- Instarem detailed review

- WorldRemit detailed review

- Paysend detailed review

- XE detailed review

- CurrencyFair detailed review

- Ria Money Transfer review

Money transfer companies provide higher rates and lower fees, and can be a great choice to send money to Thailand.

As you can see, with some research, you can arm yourself with useful information and hopefully find an affordable and reliable money transfer service that meets your needs.

Method #3: Send Money via a Currency Exchange Broker

Another good way to send money to Thailand from the US is by using the services of a Currency Exchange Broker. These companies specialize in helping customers send money overseas by providing them with white-glove treatment during the whole process.

Traditionally, FX Brokers used to cater to corporations, businesses and high net worth clients only as the transfer amounts of such clients were higher. But with the advent of the digital era where operating costs have decreased, many brokers are also now working with retail and individual customers.

The biggest advantage of using a broker organization for your money transfers to Thailand is that you will get a dedicated account manager who will work with you personally from start to finish.

Currency exchange brokers will assign a dedicated account manager to you who will help you throughout the money transfer process.

For example, you can rely on currency exchange companies like OFX, TorFX, Venstar Exchange and Regency FX to send money overseas. Their team of dedicated FX traders and money transfer specialists will help you in every step of the process.

Method #4: Multi-Currency Bank Accounts

The fourth good way to send money to Thailand on our list is a multi-currency bank account. Just as the name suggests, a multi-currency bank account behaves like a normal bank account, but with the key difference that you can hold multiple currencies in it.

For the US to Thailand market, both Revolut and Wise (formerly Transferwise) provide options to hold multi-currency accounts with them.

You can, therefore, hold US Dollar and Thai Baht in your account and freely interconvert between them. Generally, companies offering a multi-currency account provide high exchange rates and low fees.

Multi-Currency bank accounts generally have better rates and low fees, and are a good option for frequent travelers.

This can be an attractive option if you go to Thailand often for business or vacation travel. A single account can help you manage your expenses in both countries and currencies.

Method #5: International Money Orders

Finally, you have the option to send international money orders via the US Postal Service (USPS). For this, you simply go to a USPS Post Office and fill a form to send money overseas.

Even though sending a money order may seem convenient, we do not recommend this option due to the below reasons:

- USPS international money orders can be purchased for amounts up to USD 700 only. So, you cannot send higher amounts via this method.

- Money orders come with a high fee of up to USD 49.65. This will cut into your bottom line and reduce your payout.

- You will likely get a poor exchange rate which will further reduce the money that goes into your recipient's pocket.

This concludes our analysis of five ways to send money to Thailand without breaking the bank. All these methods offer a variety of benefits and drawbacks, so be sure to weigh your options before deciding which one is right for you.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

Categories

Similar Articles

US Big Beautiful Bill's Impact On Remittances

The Big Beautiful Bill has been passed in the US, and remittances are impacted. Learn how the Bill impacts remittances and what to do if you are affected by the new law.

Bangladesh Remittance Cash Incentive: All You Need To Know

Are you an overseas Bangladeshi resident who sends money home to your loved ones? Read on to learn how to earn an additional 2.5% cash on your international remittances sent to Bangladesh.

How Fintech Is Pushing Banks Out Of The Remittance Business

The fintech revolution is disrupting the international remittance business. Discover how innovative startups are reshaping the international money transfer industry and challenging traditional banks.