The Frugal Guide to Sending Money to Thailand from the UK

Table of Contents

- The Most Cost-Effective Ways to Send Money to Thailand

- The Not so Frugal Ways to Send Money to Thailand

- Tips and Tricks to Save on Money Transfers to Thailand

- Create accounts with multiple providers

- Use deals and promotions when available

- Stay informed of market trends

- Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

Planning to send money to Thailand from the UK? Here's a guide on how to do it cheaply and easily.

Whether you're sending money for personal or business purposes, these tips will help you save on transfer fees and get your money where it needs to go as quickly as possible. What are you waiting for? Start planning your transfer today!

The Most Cost-Effective Ways to Send Money to Thailand

There are numerous ways to send money to Thailand from overseas, including the UK. Let's see what these are below. For each method, we will focus on cost-effectiveness as this article is all about frugality.

Online Money Transfer Services

There are a number of reasons why using an online money transfer service is one of the most frugal ways to send money from the UK to Thailand.

First, online money transfer services typically have much lower fees than banks or other traditional methods of sending money abroad.

Another reason online money transfer services are more frugal is that they offer competitive exchange rates. This means that you will get more Thai Baht for your Pound when you use an online money transfer service as opposed to a bank or other type of provider. This can make a big difference when sending large sums of money, or if you need to send money on a regular basis.

In fact, bad exchange rates and high transfer fees are the two topmost ways you lose money on your international remittances. Getting better rates and lower fees, therefore, are of prime importance to maximize your recipient's payout.

Money transfer companies generally provide better exchange rates and charge lower transfer fees as compared to banks.

Finally, online money transfer services are very convenient. They can be accessed from anywhere in the world with an internet connection, and they allow you to send money quickly and easily. This means that you can save time and money by using an online service instead of visiting a bank or other type of provider in person.

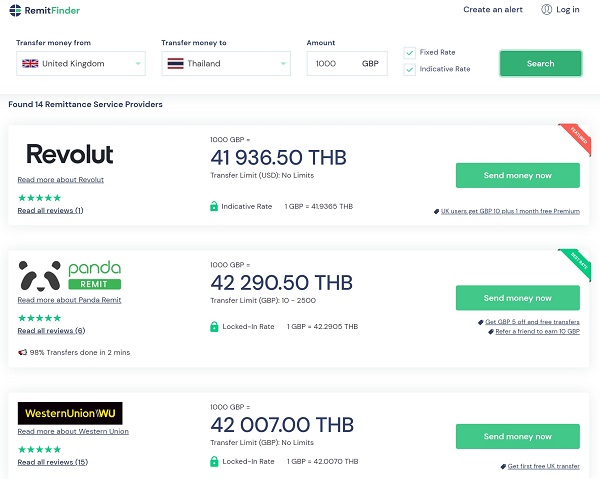

Since there are so many money transfer companies available, we recommend relying on a money transfer comparison engine like RemitFinder. We do all the heavy lifting for you, and present numerous companies for your consideration in an easy to follow one page format. This not only gives you many choices to compare, but also saves you precious time by avoiding having to search manually.

For money transfers to Thailand from the UK, at this time, there are more than a dozen companies listed on RemitFinder. The below screenshot captures how the GBP-THB rates comparison table looks like.

That is a very healthy number of money transfer companies for you to choose from. In fact, the top 5 providers only differ by about 350 THB for a GBP 1000 transfer from the UK to Thailand!

There are lots of spectrums involved in evaluating these companies as the decision to send money abroad with a provider is a very intimate one. You have to consider numerous angles since you are trusting a company with your hard earned money.

This is why we produce very detailed reviews on all these companies so you get to know about numerous aspects of their money transfer services in detail. Below are some examples of such in-depth review:

- Revolut in-depth review

- XE Money Transfer in-depth review

- Panda Remit in-depth review

- Instarem in-depth review

- Remitly in-depth review

- Wise in-depth review

- Paysend in-depth review

- OFX in-depth review

- WorldRemit in-depth review

- Western Union in-depth review

- PassTo in-depth review

- TransferGo in-depth review

Simply click on any provider on the comparison table to check out our detailed review about their remittance services.

Cryptocurrency Wallets

Cryptocurrency wallets are another frugal way to send money to Thailand from the UK. Cryptocurrency is still a young technology, and its adoption is growing every day. More and more businesses are starting to accept cryptocurrency as a payment method, and this trend is only going to continue. This means that sending money to Thailand via cryptocurrency is becoming easier and more convenient.

The main reason why cryptocurrency is a cost-effective way to send money is that generally the fees associated with sending or receiving cryptocurrency tend to be less. This is because the underlying network that powers cryptocurrency, blockchain, is open source and free to use. That said, the cryptocurrency exchange you use will likely charge a transaction fee, but usually it's a small amount.

An additional advantage of this approach is that transactions made using cryptocurrency are very fast. They are often processed within minutes, or even seconds. This is because there is no need for a third party, such as a bank, to verify the transaction.

Finally, cryptocurrency transactions are also very secure. When you send money using cryptocurrency, the transaction is encrypted. This means that it cannot be tampered with or intercepted by anyone.

Cryptocurrencies are a fast and secure way to send money overseas. Make sure merchants and business accept crypto payments before you send money with this approach.

Multi-Currency Bank Accounts

A multi-currency bank account is our next frugal way to send money from UK to Thailand. The way this works is that you have a bank account with a financial institution which allows you to have multiple currencies in it. This way, you can interchange currencies freely from within your account.

Many established financial companies like Revolut and Wise allow customers to open multi-currency bank accounts. You can hold many currencies in these accounts – a major convenience especially if you travel abroad frequently.

The biggest reason why this is a cost-effective option is that you generally get very good exchange rates with these providers. Also, the fee to interconvert currencies between your multi-currency balances tend to be very low, and sometimes even 0.

The reasons multi-currency bank account providers give you these benefits is to try to keep you within their ecosystem vs losing your business.

We recommend exploring multi-currency accounts especially if you go back and forth between countries for business or personal reasons.

Next, we also want to touch upon some expensive or non-cost-effective ways to send money to Thailand so you are aware of these as well.

The Not so Frugal Ways to Send Money to Thailand

In this section, we present some expensive ways to send money to Thailand just so you are aware of them. Information is power, and perhaps you may need to rely on these methods for some special needs, so it's always good to be aware of them as well.

International Wire Transfers

An international wire transfer is a digital bank-to-bank money transfer that you can send using your bank. They are a time-tested and hardened way to move money overseas using banks.

The reason why wire transfers are not a cost-effective way to send money overseas are as below:

- You will pay high wire transfer fees to your bank if you send an international wire with them. For example, most popular US banks charge anywhere from USD 20-50 for sending wire transfers.

- You will get an inferior exchange rate for your wire transfer. This acts like a hidden fee and reduced the return on your money transfer to Thailand.

On the plus side, wire transfers are very secure as banks follow very strict security and safety protocols to protect your money and information. Another big advantage is that you can send large amounts of money to Thailand using this method.

International wire transfers have high fees and bad exchange rates. Be careful of costs involved before you decide to wire money abroad.

PayPal

PayPal is very popular globally, and is a great way to pay merchants, supplies and individuals across the globe. But just like wire transfers, you will get inferior exchange rates and pay high fees. This impacts your bottom line at the end of the day and you spend more British Pounds for the Thai Bahts your recipient gets.

International Money Orders

Most people do not know that your local post office can also send international money orders. While this method of sending funds to Thailand is convenient, it is not cost-effective due to high fees and bad rates involved.

Even though the above methods are not cost-effective, you may still want to consider them on a case by case basis. For example, if you are sending very large amounts, it might be worth to send an international wire. The one-time fee may well be worth it for the peace of mind and security you will get.

Tips and Tricks to Save on Money Transfers to Thailand

Use the below best practices to save on your UK money transfers sent to Thailand:

Create accounts with multiple providers

Since exchange rates change constantly, the ranking of money transfer companies operating in the UK to Thailand space also keeps changing as they move their rates up and down.

This means that if you only use the same company for all your money transfers, you may not get the best return every single time with them. Hence, we recommend using at least 2-3 providers for your money transfers. This way, you can time the market better and send with whoever has the best exchange rates at the time.

Use deals and promotions when available

Pretty much all the money transfer companies we listed earlier in the article have ongoing or seasonal offers and discounts. These usually come in the follow flavors:

- 0 fees for new customers: Panda Remit, Western Union, Pass To, CurrencyFair, Paysend, WorldRemit and TransferGo all offer at least 1 free transfer to new users.

- Cashback for first transfer: Revolut, Panda Remit, Instarem, Xendpay and Skrill Money Transfer provide various cashback amounts for new customers who send money with them.

- Credits for referring friends: Panda Remit, PassTo, XE Money Transfer, WorldRemit and TransferGo all have attractive referral programs whereby you can save even more by referring your friends and family to them.

Take advantage of deals and promotions to further maximize the return on your international money transfers to Thailand.

Many companies even offer combinations of the above, so you can get creative and save additional money on your remittances from UK to Thailand.

Stay informed of market trends

The more information you have, the better decisions you will make. This cannot be truer in the international money transfer market.

Try to stay informed about ongoing economic conditions as they have a direct impact of currency exchange rates and their fluctuations. This way, you can hopefully time your money transfers a bit better and take advantage of higher exchange rates.

Follow these best practices and make the most of your money transfers to Thailand from the UK.

This concludes our frugal guide to sending money from the UK to Thailand. We hope this has been helpful and given you a few ideas on how to save on your transfer costs.

Do You Need To Find the Best Remit Exchange Rate for Sending Money Internationally?

RemitFinder is an online service that helps you track remit exchange rates. By checking and comparing the latest remit exchange rates, you can get the best exchange rate for your money transfers. RemitFinder, thus, helps you to get the best return for your hard-earned money.

Find the cheapest rate to transfer your hard-earned money - visit our site or download the app on Google Play or Apple App Store now.

Categories

Similar Articles

US Big Beautiful Bill's Impact On Remittances

The Big Beautiful Bill has been passed in the US, and remittances are impacted. Learn how the Bill impacts remittances and what to do if you are affected by the new law.

Bangladesh Remittance Cash Incentive: All You Need To Know

Are you an overseas Bangladeshi resident who sends money home to your loved ones? Read on to learn how to earn an additional 2.5% cash on your international remittances sent to Bangladesh.

How Fintech Is Pushing Banks Out Of The Remittance Business

The fintech revolution is disrupting the international remittance business. Discover how innovative startups are reshaping the international money transfer industry and challenging traditional banks.